What are the major changes to Medicare for 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.Sep 24, 2021

Is Medicare changing in 2021?

For 2021, the maximum out-of-pocket limit for Medicare Advantage plans increased to $7,550 (plus out-of-pocket costs for prescription drugs), and it's staying at that level for 2022. As usual, most plans will continue to have out-of-pocket caps below the government's maximum.

When should I start looking at Medicare plans?

When your coverage startsIf you sign up:Coverage starts:Before the month you turn 65The month you turn 65The month you turn 65The next month1 month after you turn 652 months after you sign up2 or 3 months after you turn 653 months after you sign up

Are Medicare supplement plans increasing in 2021?

In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020. Plans can also charge additional premiums for such benefits.Jun 21, 2021

What is the Medicare rate for 2021?

1.45%2021-2022 FICA tax rates and limitsEmployee paysEmployer paysMedicare tax1.45%.1.45%.Total7.65%7.65%Additional Medicare tax0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers)1 more row•Jan 13, 2022

What is the standard Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Does Medicare start the beginning of the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

How long in advance should you apply for Medicare?

3 monthsGenerally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

What is the out-of-pocket maximum for Medicare?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

What is the top priority of the Trump Administration and CMS?

The health and safety of America’s patients and provider workforce in the face of the Coronavirus Disease 2019 (COVID-19) outbreak is the top priority of the Trump Administration and CMS. We are working around the clock to equip the American healthcare system with maximum flexibility to respond to the 2019 Novel Coronavirus (COVID-19) pandemic. The 2021 Rate Announcement is an example of how CMS is focused on implementing the policies that matter most for ensuring continuous and predictable payments across the health care system and ensure care can be provided where it is needed. While the Rate Announcement does not catalog CMS’ actions related to the COVID-19 outbreak, an overview of CMS’ actions related to the outbreak for MA organizations, PACE organizations, and Part D sponsors can be found at: https://www.cms.gov/files/document/covid-ma-and-part-d.pdf. The agency is also communicating with stakeholders, responding to inquiries through the HPMS system, and developing further guidance on issues related to the COVID-19 outbreak.

Will Medicare cover kidney transplants in 2021?

The 21st Century Cures Act amended the Social Security Act to allow all Medicare-eligible individuals with ESRD to enroll in MA plans beginning January 1, 2021. With this enrollment policy change, the Cures Act also made related payment changes in the MA and FFS programs. Effective January 1, 2021, MA organizations will no longer be responsible for organ acquisition costs for kidney transplants for MA beneficiaries, and such costs will be excluded from MA benchmarks and covered under the FFS program instead. The CY 2021 Advance Notice provided a step-by-step description of the methodology by which CMS will estimate the kidney organ acquisition costs to carve out from MA ESRD and non-ESRD benchmarks, which we are finalizing through the Rate Announcement. PACE organizations will continue to cover organ acquisition costs for kidney transplants and CMS will continue to include the costs for kidney acquisitions in the development of PACE payment rates.

Does Puerto Rico have Medicare?

Puerto Rico. A far greater proportion of Medicare beneficiaries receive benefits through MA in Puerto Rico than in any other state or territory. The policies finalized for 2021 will continue to provide stability for the MA program in the Commonwealth and to Puerto Ricans enrolled in MA plans.

What is Medicare Advantage Open Enrollment Period?

The Medicare Advantage Open Enrollment Period gives you an opportunity to try out a Medicare Advantage Plan. During this period, you can make one switch to a different Medicare Advantage Plan or you can disenroll from your plan and return to Original Medicare.

Does Medicare cover telehealth?

Medicare for a limited period of time has expanded its coverage of telehealth medical services to respond to the current Public Health Emergency and to help you have medical access from more places (including your home). During this time, you will be able to receive some services through E-visits including common office visits, mental health counseling and preventive health screenings with Original Medicare. This will help ensure you are able to visit with your doctor from your home, without having to go to a doctor’s office or hospital, which puts you and others at risk of exposure to COVID-19.

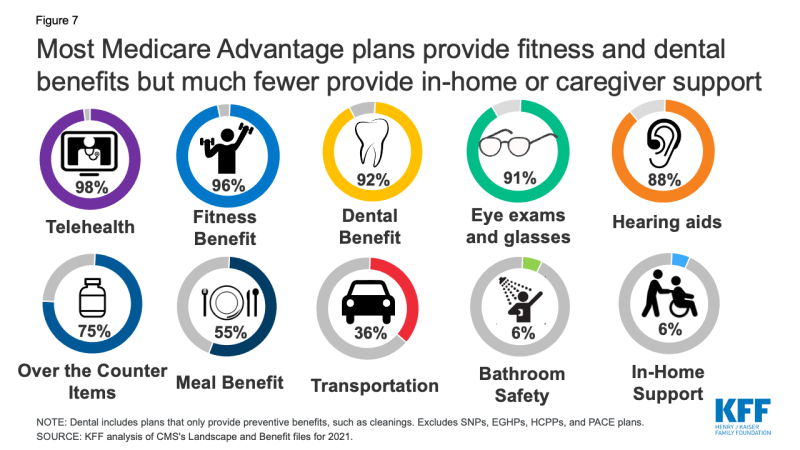

What will Medicare Advantage Plan cover in 2021?

Many advantage plans in 2021 will have Part D prescription drug coverage built into the plan , as well as dental, vision, and hearing coverage also included.

What is Medicare Supplement Plan 2021?

Medicare Supplement Plans 2021. One Medicare option that people also choose, whether they are switching plans or new to Medicare, is one of the Medicare supplement plans in 2021. These are different products than Advantage plans and offer outstanding coverage, especially for those not wanting a network.

How much will Medicare Advantage cost in 2021?

The cost of Medicare Advantage for 2021 isn’t available yet, but you can expect it to be about $14 or so on average. That’s across all the Advantage plans including basic and high coverage ones, so you can definitely find plans that are much cheaper or much more expensive.

When is Medicare open enrollment 2021?

Medicare Open Enrollment 2021. The Medicare enrollment period begins on October 15th and lasts through December 7th. During this time you can: Leave Original Medicare/Medigap and enroll in a Medicare Advantage plan. Change your Medicare Advantage plan to another.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold privately, by companies like Aetna Humana and others. These companies can decide a lot of things about the Advantage plans they sell, such as which ones they will offer, what coverage is provided by the higher end plans and what price they will set.

What is the donut hole in Medicare?

This is a time when the cost of your medications reach a certain level, and you are in what is called a coverage “gap”. Historically when this happened your drug costs would rise dramatically.

Is emergency care covered by Medicare?

Emergency care is covered too, which can include ambulance services and ER visits that are not already covered by the Medicare Part B section of the policy. This is only the basic coverage so for, or what Medicare requires every Advantage plan to include.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

Overview

Medicare plans are generally for those over age 65 but may also be available to those with permanent disabilities or other special circumstances. If you are Medicare eligible, you may choose from the plans below.

Medicare Plans for Calendar Year 2021

Please note: These form (s) are in Adobe Acrobat Reader (PDF) format and are available for downloading and printing.

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is Medicare Plan G?

There are lower coverage plans that allow you to pay less each year. Medicare Plan G will provide you almost complete coverage for your supplemental expenses. It covers you for everything except your Medicare Part B deductible.

What is Plan F insurance?

Plan F is a high coverage plan that gives insurance providers a reason to charge unreasonable amounts for it. That is one of the main reasons that the plan had been delisted.

What is the most expensive Medicare supplement?

Plan F is one of the most expensive supplements from Medicare. That is something that does make sense because the Medicare Supplement Plan F of 2021 is going to be the only supplement plan that is able to cover all of your expenses. Others may end up coming close, but none of them are going to have the same type of coverage. Plan F is a high coverage plan that gives insurance providers a reason to charge unreasonable amounts for it. That is one of the main reasons that the plan had been delisted.

Why is Plan F so popular?

Why Plan F is Well Liked. One of the main reasons that Plan F is so popular is because it provides full coverage. It takes care of all supplemental expenses that you can have. Below are some of the expenses that Plan F covers:

Is Plan N the same as Plan F?

It covers you for everything except your Medicare Part B deductible. Plan N is also a good alternative. It is not as expensive as Plan F, and it will not cover as much. Of all the additional costs, you are only asked to pay deductions from Part B, some co-payments from Part B, and surpluses from Part B yourself.