How much will Medicare cost this year?

Jul 29, 2020 · 2021 Medicare Advantage ratebook and Prescription Drug rate information. 2021 Part D Income-Related Monthly Premium Adjustment. July 29, 2020 announcement of 2021 Part D National Average Monthly Bid Amount, Medicare Part D Base Beneficiary Premium, Part D Regional Low-Income Premium Subsidy Amounts, Medicare Advantage Regional Benchmarks, …

How much will my Medicare premiums be?

Apr 06, 2020 · Outside of the exclusion of organ acquisition costs for kidney transplants from MA ESRD rates (mandated by the 21 st Century Cures Act; discussed below), the methodology proposed in the Advance Notice and finalized in the Rate Announcement for the CY 2021 ESRD rates remains unchanged from the methodology used continuously for the past several years. …

Why is my Medicare so expensive?

1. April 6, 2020. NOTE TO: Medicare Advantage Organizations, Prescription Drug Plan Sponsors, and Other Interested Parties Announcement of Calendar Year (CY) 2021 Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies. In accordance with section 1853(b)(1) of the Social Security Act, we are notifying you of the annual capitation rate for each …

What is the current Medicare premium amount?

The 2021 Medicare Fee Schedule contains the rates that were installed January 1, 2021, unless otherwise noted. Quarterly updates (April, July, and October) will be listed as they become available. Please use the HCPCS Screen in FISS to check the most current rates .

What will Medicare cost seniors in 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Are Medicare rates going down in 2021?

How are Medicare Advantage premiums changing for 2021? According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which is down from about $21/month for 2021, and $23/month in 2020.

Did Medicare rates go up for 2021?

This year's standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer's disease.Jan 10, 2022

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Is Social Security going up 2022?

Cost-of-Living Adjustment (COLA) Information for 2022 Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022.

Will there be an increase in Medicare premiums for 2022?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

What is the top priority of the Trump Administration and CMS?

The health and safety of America’s patients and provider workforce in the face of the Coronavirus Disease 2019 (COVID-19) outbreak is the top priority of the Trump Administration and CMS. We are working around the clock to equip the American healthcare system with maximum flexibility to respond to the 2019 Novel Coronavirus (COVID-19) pandemic. The 2021 Rate Announcement is an example of how CMS is focused on implementing the policies that matter most for ensuring continuous and predictable payments across the health care system and ensure care can be provided where it is needed. While the Rate Announcement does not catalog CMS’ actions related to the COVID-19 outbreak, an overview of CMS’ actions related to the outbreak for MA organizations, PACE organizations, and Part D sponsors can be found at: https://www.cms.gov/files/document/covid-ma-and-part-d.pdf. The agency is also communicating with stakeholders, responding to inquiries through the HPMS system, and developing further guidance on issues related to the COVID-19 outbreak.

Will Medicare cover kidney transplants in 2021?

The 21st Century Cures Act amended the Social Security Act to allow all Medicare-eligible individuals with ESRD to enroll in MA plans beginning January 1, 2021. With this enrollment policy change, the Cures Act also made related payment changes in the MA and FFS programs. Effective January 1, 2021, MA organizations will no longer be responsible for organ acquisition costs for kidney transplants for MA beneficiaries, and such costs will be excluded from MA benchmarks and covered under the FFS program instead. The CY 2021 Advance Notice provided a step-by-step description of the methodology by which CMS will estimate the kidney organ acquisition costs to carve out from MA ESRD and non-ESRD benchmarks, which we are finalizing through the Rate Announcement. PACE organizations will continue to cover organ acquisition costs for kidney transplants and CMS will continue to include the costs for kidney acquisitions in the development of PACE payment rates.

Does Puerto Rico have Medicare?

Puerto Rico. A far greater proportion of Medicare beneficiaries receive benefits through MA in Puerto Rico than in any other state or territory. The policies finalized for 2021 will continue to provide stability for the MA program in the Commonwealth and to Puerto Ricans enrolled in MA plans.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will Medicare update payment policies?

This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022. This proposed rule proposes potentially misvalued codes and other policies affecting the calculation of payment rates. It also proposes to make certain revisions ...

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When is the 2021 Medicare PFS final rule?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

When will CMS accept comments?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: https://www.federalregister.gov/public-inspection.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When is the CY 2020 PFS final rule?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

Reimbursement Rates for Calendar Year 2021

This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect.

AGENCY

Indian Health Service (IHS), Department of Health and Human Services (HHS).

SUMMARY

Notice is provided that the Director of the Indian Health Service has approved the rates for inpatient and outpatient medical care provided by IHS facilities for Calendar Year 2021.

SUPPLEMENTARY INFORMATION

The Director of the Indian Health Service (IHS), under the authority of sections 321 (a) and 322 (b) of the Public Health Service Act ( 42 U.S.C. 248 and 249 (b)), Public Law 83-568 ( 42 U.S.C. 2001 (a)), and the Indian Health Care Improvement Act ( 25 U.S.C. 1601 et seq.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

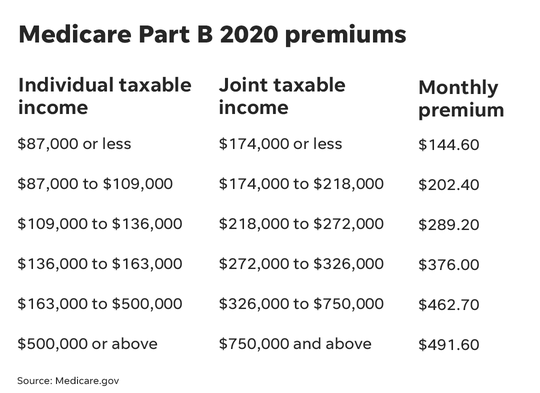

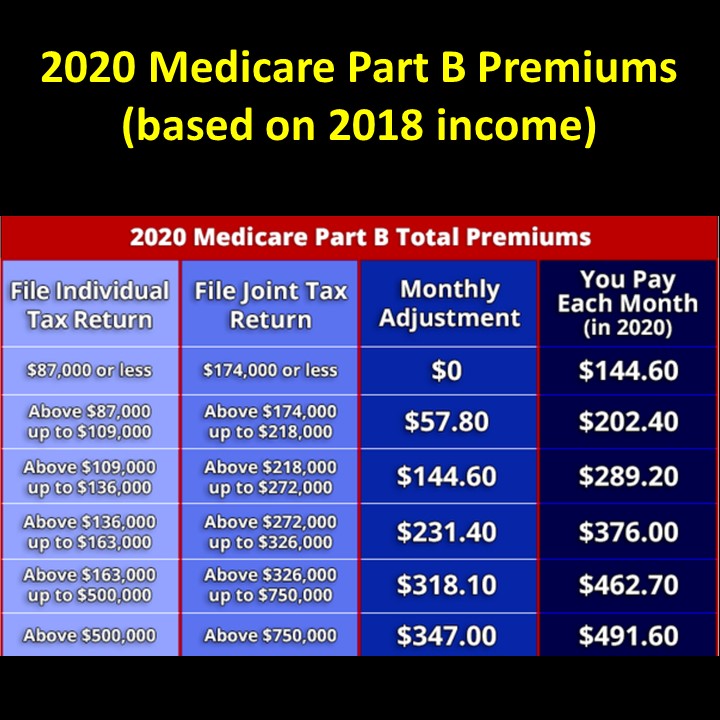

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.