How much is Medicare increasing?

Nov 12, 2021 · Medicare Open Enrollment and Medicare Savings Programs Medicare Open Enrollment for 2022 began on October 15, 2021, and ends on December 7, 2021. During this time, people eligible for Medicare can compare 2022 coverage options between Original Medicare, and Medicare Advantage, and Part D prescription drug plans.

Why is my Medicare so expensive?

Nov 18, 2021 · Medicare Premiums and Deductibles Announced for 2022 November 18, 2021 Member News The Centers for Medicare & Medicaid Services (CMS) recently announced that the Medicare Part A deductible for inpatient hospital services will increase by $72 in calendar year (CY) 2022 to $1,556.

How much will Medicare cost this year?

Dec 07, 2021 · December 7, 2021 Medicare Premiums to Increase Dramatically in 2022 Medicare Premiums to Increase Dramatically in 2022 Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

When does Medicare increase start?

Sep 30, 2021 · CMS will update the Medicare Plan Finder with the 2022 Medicare health and prescription drug plan information on October 1, 2021. 1-800-MEDICARE is available 24 hours a day, seven days a week to provide help in English and Spanish as …

Are Medicare rates going up for 2022?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

What is the Medicare premium for 2022?

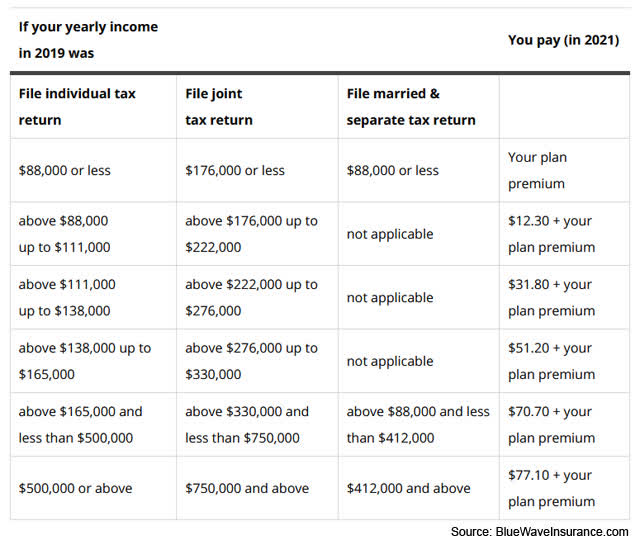

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much will Medicare copay be in 2021?

The copay amounts for people who reach the catastrophic coverage level in 2021 will increase slightly, to $3.70 for generics and $9.20 for brand-name drugs. Medicare beneficiaries with Part D coverage (stand-alone or as part of a Medicare Advantage plan) will have access to insulin with a copay of $35/month in 2021.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

Is Medicare Advantage available for ESRD?

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease (ESRD) unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Is there a donut hole in Medicare?

The Affordable Care Act has closed the donut hole in Medicare Part D. As of 2020, there is no longer a “hole” for brand-name or generic drugs: Enrollees in standard Part D plans pay 25 percent of the cost (after meeting their deductible) until they reach the catastrophic coverage threshold.

What is the maximum deductible for Part D?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans will be $445 in 2021, up from $435 in 2020. And the out-of-pocket threshold (where catastrophic coverage begins) will increase to $6,550 in 2021, up from $6,350 in 2020.

How much is the Part A deductible for 2021?

If the person needs additional inpatient coverage during that same benefit period, there’s a daily coinsurance charge. For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020).