Why was plan F discontinued?

- There are four states that allow beneficiaries to switch to a different Medigap plan. ...

- A few states offer an opportunity once a year. ...

- There are some insurance companies that will allow a policy holder to switch to a different policy the company offers, without medical underwriting.

Is Medigap plan F ending?

Medigap Plan F and Plan C Are Ending for New Medicare Beneficiaries by Rebecca Hambleton | Published December 16, 2020 | Reviewed by John Krahnert Two popular Medigap plan options in the United States won't be available for newly eligible Medicare beneficiaries beginning in 2020.

Will plan F premiums skyrocket?

We don’t know yet how premiums for Plan F will be affected in 2020 but there is a chance that the increases for Plan F will be higher annually after 2020 than the increases on G, so Plan G now is a good buy for your situation. Gary says. October 25, 2017 at 7:59 pm.

Is plan F being discontinued?

Is Plan F Being Discontinued? It is surprising how many agents do not fully understand the changes taking place starting in January. While Plan F is not being discontinued, it will not be available to people who are newly eligible for Medicare after January 1, 2020. First of all, there's no reason to panic.

Is Medicare Plan F being eliminated?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

Will Plan F go away in 2020?

Changes to Medicare Supplement Plan F in 2020 The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles.

Will Plan F be available in 2021?

Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

What is replacing Medicare Plan F?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs.

Can I switch from plan F to plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

Is Medicare Part F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

Does Medicare Plan F cover cataract surgery?

Also good: Plan A, B, D, G, M and N pay 100% of Part B coinsurance, which is your portion of cataract procedure costs. Best plans if you're eligible: Plan C and Plan F pay 100% of the Medicare Part B coinsurance and the Part B deductible.

How much does AARP plan F Cost?

$256Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Will Plan F premiums rise after 2020?

This is good for the long-term rate picture, because insurance companies will still compete for your Plan F business. However, over time we can probably expect Plan F premiums to slowly rise, since the total number of people enrolled will be shrinking annually.

Which Medigap plans are no longer available?

The federal government standardizes all Medigap plans. Medicare Supplement Plan H, Plan I, and Plan J are no longer available. These plans were discontinued when the Medicare Modernization Act of 2003 became a law, introducing Medicare Part D.

Is Plan F guaranteed issue?

Outside of your Medicare Supplement OEP, guaranteed-issue rights are often limited to certain Medicare Supplement insurance plans: A, B, C**, D, F**, G, K, or L. Please note: Not all plans are sold in every state. A high-deductible Plan G might be available in your state.

When Is Plan F Going away?

Both Plan F and Plan C are going away in 2020. However, these Medicare changes in 2020 won’t affect everyone. Some people already on Medicare Plan...

Why Is Plan F Going away?

So what is happening with Plan F? Why is Medicare Plan F being phased out?Well, these changes to Medicare supplement plans are a result of the Medi...

Medicare Plan F 2020 Changes

So is Plan F going away? Yes, BUT only for new people starting in 2020. Here’s how it will go: 1. If you are are on Plan F already when 2020 rolls...

Will Plan F Rates Go Up Faster After 2020?

Some people are worried about this, and it’s certainly possible. Back in 2010, when Medicare discontinued Plans H, I and J, we did some price infla...

What Does 2020 Plan F Change Mean For You?

Here’s our advice about Medicare Plan F going away: 1. Make the best coverage decision for yourself right now. If Plan F feels best to you, it’s st...

What is the deductible for Medicare 2021?

Currently this annual deductible is $203 in 2021. Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, is to make Medicare beneficiaries put a little more “skin in the game.”. You see, people with Plan F have what we call “first dollar” coverage.

How much money do Medicare beneficiaries have to pay out of pocket?

These changes mean that all Medicare beneficiaries will have least $203 in deductible spending out of your own pocket each year.

Is Plan F going away?

So is Plan F going away? Yes, BUT only for new Medicare enrollees starting in 2020. People eligible for Medicare prior to 2020 will continue to have Plan C and F options in the future. Here’s some additional scenarios:

Does Medigap cover Part A?

Medigap plans can still cover the Part A Hospital deductible, but as of 2020, the plans can no longer cover the Part B deductible for new enrollees. Currently this annual deductible is $203 in 2021. Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, ...

What are Medicare Supplement plans?

While Medicare covers most of your healthcare needs, it doesn’t cover everything. You may have to pay out of pocket for deductibles, copays, and coinsurance. If you have chronic conditions or have frequent doctor visits, these charges can rack up.

Why is Medicare Supplement Plan F so popular?

Medicare Supplement Plan F is by far Medicare’s most popular supplemental plan with 57 percent of enrollees purchasing this plan. Plan F offers the most comprehensive coverage for the price, which is generally between $120-140 per month.

Why is it being phased out?

As part of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, Medigap plans that cover the Part B deductible will no longer be sold to new enrollees. The Part B deductible for 2019 is $185; the 2020 Part B deductible has not been announced at the time of this publication.

Important notes

Medigap plans are sold by private insurers, so prices may vary depending on your location, health history, and other factors.

Is Medicare Supplement Plan G a guarantee issue?

After Plan F is phased out in 2020, it is likely to become the most popular choice. However, Plan G is also likely to become the guarantee issue plan of choice for seniors who delayed enrolling in Medicare due to other credible coverage. Although it is not yet clear if this will happen, if it does, it could have an adverse effect on Plan G rates.

Is Medicare Supplement no longer available?

Soon your favorite Medicare Supplement, also known as a Medigap Plan will no longer be available. Congress has passed legislation that prevents companies from covering the Part B Deductible starting January 1, 2020. The change will make Medigap Plan C and the very popular Medigap Plan F unavailable for new sales. The impact on your Medicare Supplement premiums could be devastating.

Is Medicare Plan F going away?

Yes, Plan F is on its way out. For a growing number of new retirees, Plan F won’t be an option in the coming years. But what exactly does this mean for you? We’ll discuss what this popular plan is, why it’s being phased out, who’s still eligible and what options you have without it.

What is Medicare Plan F?

Plan F is one of several types of Medicare Supplement insurance plans. These plans help pay for out-of-pocket costs like coinsurance and copays that Medicare Part A and Part B (aka Original Medicare) can charge.

Why is Medicare Plan F no longer an option for most people?

In short, Medicare Plan F is being phased out because of the first dollar coverage that made it so popular. As federal lawmakers saw it, that kind of coverage has the potential to be overused at the expense of the Medicare program. By requiring a deductible, the insured has a stake in making sure their visit to the doctor justifies the cost.

What about Plan F rate increases?

If you’re eligible to remain on, or enroll in Plan F, it’s worth it to consider the plan’s future.

What is replacing Plan F?

While there’s no specific replacement for Plan F, there are plenty of other options available. Here are a few popular ones:

Have more Medicare questions?

We’re here to support you along the way so you can continue to live a better, healthier life. Learn all about your HealthPartners Medicare plan options.

When will Medicare run out of money?

Medicare has been expected to run out of money for a while now. In the 2019 Medicare Trustees Report, the trustees reported that Medicare Part A is expected to run out of money by 2026.

What is a plan F?

What Is Plan F? Medicare Supplement Plan F is often touted as the "Cadillac" Medigap plan because it boasts the most coverage of any Medicare Supplement. As long as you have a Plan F, doctors and hospitals will never bill you for anything that Medicare Part A and B covers. No copays, no coinsurance, and no deductibles.

How much is Medicare Part B deductible?

The Medicare Part B deductible is the only difference between Plan F and Plan G. That deductible isn't much, either – it's only $185 in 2019 and $198 in 2020. However, that small difference is what caused a lot of discussion and controversy, and it eventually led to Congress passing MACRA in 2015, or the bill that is causing Plan F ...

What to do if you can't pass underwriting to switch companies?

If you can't pass underwriting to switch companies, your agent will help you consider alternative options, such as Medicare Advantage or the Medicare MSA.

Does Medicare need to find ways to save money quickly?

In sum, Medicare needs to find ways to save money quickly and doing away with Medigap plans that provide first-dollar coverage fits the bill. If people stop getting preventive services, it could turn into more expensive treatments later on.

Do you pay more for a Plan F?

Most people appreciate the Plan F because you don't have to deal with reconciling bills from your physicians. Yes, you pay more money for a Plan F, but it takes away all of the headaches associated with doctor's bills.

Do you have to pass medical underwriting to qualify for Medicare Supplement?

There are times when you don't have to pass medical underwriting to qualify for a Medicare Supplement. For example, if you're in a Medicare Advantage plan and you move out of the plan's service area or if your employer group plan is ending. In these situations, you have a 63-day window to choose a Medicare Supplement Plan A, B, C, ...

What plans are available for Medicare after January 1 2020?

For people eligible for Medicare after January 1, 2020, there are other plans available for you. Plans D, G and High-Deductible Plan G (which is a brand new plan option) will still be available to Medicare beneficiaries after January 1, 2020. Among the three, Plan G is the most popular because it’s almost a match in coverage, ...

When does Medicare Part B deductible take effect?

But hang in there, this will not take effect yet until the 1st of January 2020. So you still have some time. And the good thing is that Medicare Part B doesn’t cover the biggest health care costs under Medicare.

What does Plan F pay for?

If you have a Plan F, you pay $0 for hospital stays , doctor visits, lab works, and many more. That is why Plan F has been America’s most popular Medigap plan for decades. However, in 2015, Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) bill.

Which Medicare plan is the most comprehensive?

Among the three, Plan G is the most popular because it’s almost a match in coverage, except for Part B Deductible. Although you must pay the Part B deductible in a Plan G, the premiums can be notably less. After paying the Part B deductible, Plan G works the same as Plan F, making Plan G the most comprehensive plan for newly eligible Medicare ...

Does phasing out Plan F change your insurance?

If you are already enrolled in Plan F, you need not worry about it because you’re still covered by it for as long as you want. Phasing out Plan F won’t change a thing on your coverage. However, some advisers think after 2020 you might find an increase in the rates.

When did the standardized plan options start?

From 1990 (when Congress first standardized plan options) to 2010 there are other parts that have been phased out by the legislative (those are Plans E, H, I, and J). The government stresses that if you have a plan that covers everything, you may go more often than necessary.

Can you change your Medicare Supplement Plan without medical underwriting?

That means they can’t say no due to your medical situation. Those states are California, Connecticut, Missouri, New York, and Oregon.

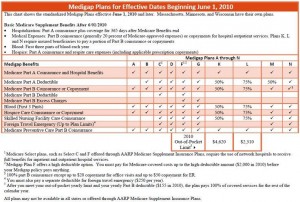

What Are Medicare Supplement Plans?

Why Is Medicare Supplement Plan F So Popular?

- Medicare Supplement Plan F is by far Medicare’s most popular supplemental plan with 57 percent of enrollees purchasing this plan. Plan F offers the most comprehensive coverage for the price, which is generally between $120-140 per month.

Why Is It Being Phased out?

- As part of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, Medigap plans that cover the Part B deductible will no longer be sold to new enrollees. The Part B deductible for 2019 is $185; the 2020 Part B deductible has not been announced at the time of this publication. If you will not be eligible for Part F before it is phased out...

Important Notes

- Medigap plans are sold by private insurers, so prices may vary depending on your location, health history, and other factors.

- Plans are standardacross all states with the exception of Massachusetts, Minnesota, and Wisconsin, which have their own standard plans.

- You may only purchase a Medigap plan if you have Original Medicare(Part A and Part B). It is …

- Medigap plans are sold by private insurers, so prices may vary depending on your location, health history, and other factors.

- Plans are standardacross all states with the exception of Massachusetts, Minnesota, and Wisconsin, which have their own standard plans.

- You may only purchase a Medigap plan if you have Original Medicare(Part A and Part B). It is illegal for an insurance broker to sell you a Medigap plan if you already have a Medicare Advantage plan.

- Medigap plans do not coverroutine dental, vision, or hearing care. However, many Medicare Advantage plans do.