Why is my Medicare rising?

- Service price and intensity

- Population growth

- Population aging

- Disease prevalence or incidence

- Medical service utilization

Can My Medicare premiums increase?

Your Medicare Supplement Insurance premiums may increase over time, but the amount and timing depend on several factors. Some insurance plans will have increases simply because you're getting older. Medicare Supplement Insurance (Medigap) companies try to limit premium increases to once a year, says Bill Gay, a licensed Medicare insurance agent ...

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

What is the current Medicare premium?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

Why did my Medicare premium increase for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

Is the Medicare premium going up in 2022?

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

At what income level are Medicare premiums increased?

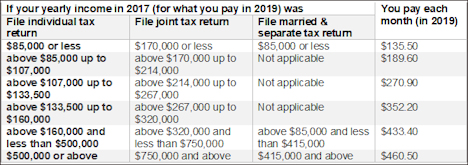

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What will the Medicare Part B premium be in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Will Medicare premiums increase in 2023?

After record rate hike this year, Medicare Part B could see a low premium increase for 2023. While Medicare Part B monthly premiums jumped almost 15% in 2022, unexpected savings on a new, expensive drug may mean a much smaller rise in rates for 2023.

What will Medicare cost in 2023?

CMS finalizes 8.5% rate hike for Medicare Advantage, Part D plans in 2023. The Biden administration finalized an 8.5% increase in rates to Medicare Part D and Medicare Advantage plans, slightly above the 7.98% proposed earlier this year.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

How much will Social Security take out for Medicare in 2022?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Do Medicare premiums change each year based on income?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

What are the Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How often are Medicare premiums adjusted?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

2019 Increase in Medicare Premiums

After staying the same last year, Medicare’s Part B premium will increase slightly in 2019. The premium will increase $1.50 from $134 a month to $135.50.

2019 Increase in Social Security Benefits

The Social Security Administration has announced a 2.8 percent increase in benefits in 2019, the largest increase in the last eight years! The change will put an additional $468 annually in the pocket of the average retired beneficiary.

How much is Medicare Advantage 2019?

The Medicare Advantage average monthly premium continues to steadily decline, and will be the lowest in the last three years. On average, Medicare Advantage premiums in 2019 is estimated to decrease by six percent to $28.00, from an average of $29.81 in 2018.

When is Medicare open enrollment?

Medicare Open Enrollment for 2019 Medicare health and drug plans begins on October 15, 2018, and ends December 7, 2018. Plan costs and covered benefits can change from year to year, so people with Medicare should look at their coverage choices and decide on the options that best fits their health needs.

What percent of Medicare beneficiaries are enrolled in Medicare Advantage?

In addition, Medicare Advantage enrollment is projected to reach a new all-time high with more than 36 percent of Medicare beneficiaries projected to be enrolled in Medicare Advantage in 2019.

What percentage of Medicare Advantage plans will have the same premium?

Nearly 83 percent of Medicare Advantage enrollees remaining in their current plan will have the same or lower premium in 2019. Approximately 46 percent of enrollees in their current plan will have a zero premium. Medicare Advantage will be offering approximately 600 more plans in 2019.

How many supplemental benefits are there in 2019?

As a result of the new flexibilities on supplemental benefits available for the first time in 2019, about 270 plans are providing nearly 1.5 million enrollees with access to the following new types of benefits: Expanded health related supplemental benefits, such as adult day care services, in-home support services, caregiver support services, ...

Will Medicare premiums increase in 2019?

Medicare Advantage premiums continue to decline while plan choices and benefits increase in 2019. Today, the Centers for Medicare & Medicaid Services (CMS) announced that, on average, Medicare Advantage premiums will decline while plan choices and new benefits increase. In addition, Medicare Advantage enrollment is projected to reach ...

Is CMS extending supplemental benefits in 2020?

The access to new supplemental benefits is a positive start for 2019, and CMS expects continued growth in 2020, as plans take advantage of these new flexibilities to attract new beneficiaries.

What is the extra Medicare premium called?

Higher income earners may pay higher Medicare Part B and Part D premiums than the standard amount. This extra amount is called the IRMAA, or the Income-Related Monthly Adjusted Amount.

Do Medicare beneficiaries pay a premium?

Most beneficiaries do not pay a premium for their Medicare Part A (hospital insurance) coverage. But those who do pay a Part A premium saw a slight increase in their monthly cost in 2019.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

When will Medicare stop allowing C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020.