Full Answer

When does Medicare open enrollment start&end?

Medicare Open Enrollment for 2019 Medicare health and drug plans begins on October 15, 2018, and ends December 7, 2018. Plan costs and covered benefits can change from year to year, so people with Medicare should look at their coverage choices and decide on the options that best fits their health needs.

Are there any changes to Medicare plans for 2019?

Changes to Medicare for 2019 have been announced by the Centers for Medicare & Medicaid Services (CMS). These changes may affect Medicare Advantage, Medicare Supplement (Medigap), and Medicare Prescription Drug Plans in 2019. Find out about these changes before the Annual Election Period (AEP) begins on October 15.

How is CMS Improving Medicare plan selection for 2019?

As the 2019 Medicare Open Enrollment period approaches, CMS is continuing to improve the Medicare.gov website for Medicare plan selection, so beneficiaries can more easily compare options and choose the plan that best fit their needs.

When will I see exact prices for 2019 marketplace coverage?

You’ll see exact prices later when you fill out or update your Marketplace application. See dates and deadlines for 2019 coverage. Get quick tips on how to pick a plan that’s right for you.

How do I get a 2019 Medicare booklet?

You can also call 1-800-MEDICARE (1-800-633-4227) and ask for a replacement card to be sent in the mail. TTY users can call 1-877-486-2048. Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

Are Medicare plans calendar year?

Does Medicare Run on a Calendar Year? Yes, Medicare's deductible resets every calendar year on January 1st. There's a possibility your Part A and/or Part B deductible will increase each year. The government determines if Medicare deductibles will either rise or stay the same annually.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

How do I know if my insurance is on a calendar year?

To find out when your plan year begins, you can check your plan documents or ask your employer. (Note: For individual health insurance policies this 12-month period is called a “policy year”).

Can I change Medicare plans in the middle of the year?

If you're covered by both Medicare and Medicaid, you can switch plans at any time during the year. This applies to Medicare Advantage as well as Medicare Part D.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How much will Medicare premiums increase in 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

What is the annual deductible for Medicare Part B in 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the monthly premium for Medicare Part B in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Will Medicare premiums increase in 2023?

After record rate hike this year, Medicare Part B could see a low premium increase for 2023. While Medicare Part B monthly premiums jumped almost 15% in 2022, unexpected savings on a new, expensive drug may mean a much smaller rise in rates for 2023.

Will Medicare premium go down in 2022?

Medicare Part B Premiums Will Not Be Lowered in 2022.

How much is Medicare Advantage 2019?

The Medicare Advantage average monthly premium continues to steadily decline, and will be the lowest in the last three years. On average, Medicare Advantage premiums in 2019 is estimated to decrease by six percent to $28.00, from an average of $29.81 in 2018.

When is Medicare open enrollment?

Medicare Open Enrollment for 2019 Medicare health and drug plans begins on October 15, 2018, and ends December 7, 2018. Plan costs and covered benefits can change from year to year, so people with Medicare should look at their coverage choices and decide on the options that best fits their health needs.

What percent of Medicare beneficiaries are enrolled in Medicare Advantage?

In addition, Medicare Advantage enrollment is projected to reach a new all-time high with more than 36 percent of Medicare beneficiaries projected to be enrolled in Medicare Advantage in 2019.

What percentage of Medicare Advantage plans will have the same premium?

Nearly 83 percent of Medicare Advantage enrollees remaining in their current plan will have the same or lower premium in 2019. Approximately 46 percent of enrollees in their current plan will have a zero premium. Medicare Advantage will be offering approximately 600 more plans in 2019.

How many supplemental benefits are there in 2019?

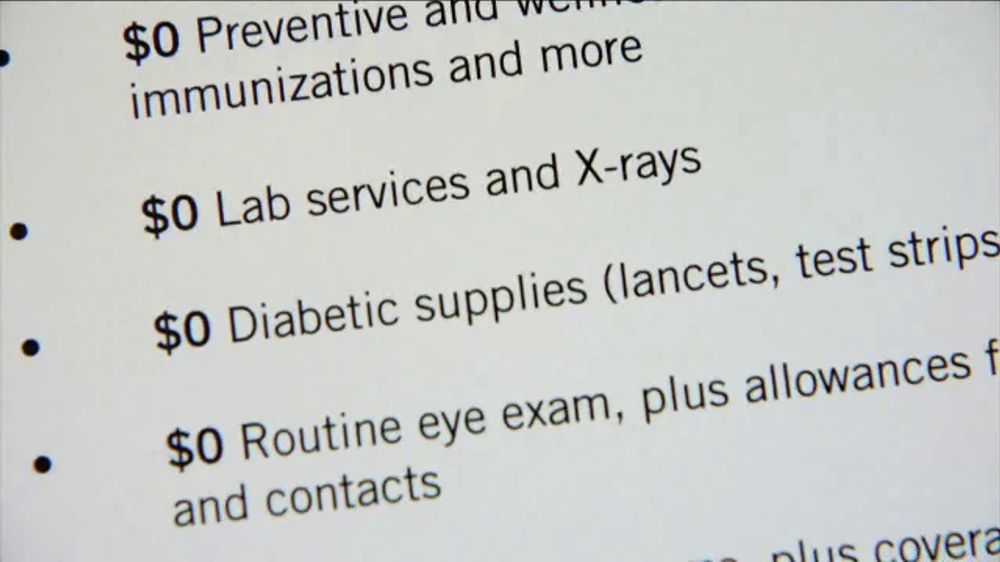

As a result of the new flexibilities on supplemental benefits available for the first time in 2019, about 270 plans are providing nearly 1.5 million enrollees with access to the following new types of benefits: Expanded health related supplemental benefits, such as adult day care services, in-home support services, caregiver support services, ...

Will Medicare premiums increase in 2019?

Medicare Advantage premiums continue to decline while plan choices and benefits increase in 2019. Today, the Centers for Medicare & Medicaid Services (CMS) announced that, on average, Medicare Advantage premiums will decline while plan choices and new benefits increase. In addition, Medicare Advantage enrollment is projected to reach ...

Is CMS extending supplemental benefits in 2020?

The access to new supplemental benefits is a positive start for 2019, and CMS expects continued growth in 2020, as plans take advantage of these new flexibilities to attract new beneficiaries.

When will Medicare Part B be eliminated?

Due to a recent law that prohibits Medigap policies for newly eligible beneficiaries from covering the Medicare Part B deductible after January 1, 2020, two of the most popular Medicare Supplement policy options are being eliminated. Medigap Plan C and Plan F have millions of enrollees, so if you want to retain your coverage but change carriers, you will want to do so before 2020.

What is the intent of the Medicare Advantage and Prescription Drug Benefit Program?

The Centers for Medicare & Medicaid Services finalized 2019 policy updates and changes to Medicare Advantage and the Prescription Drug Benefit Program with the intent “…to improve quality of care and provide more plan choices for MA and Part D enrollees.” There will be changes to Medigap policy offerings, Medicare’s Open Enrollment Period, unnecessary limits in Medicare Advantage plans, dual-eligible passive enrollment, Part D Special Enrollment Periods .

Who is Medicare.net?

Medicare.net is powered by Health Network Group, LLC, which is related to Health Compare Insurance Services, Inc., who is a licensed, authorized agent of: Anthem Blue Cross of California, Anthem Blue Cross of Colorado, Anthem Blue Cross of Connecticut, Anthem Blue Cross of Georgia, Anthem Blue Cross of Indiana, Anthem Blue Cross of Kentucky, Anthem Blue Cross of Maine, Anthem Blue Cross of Missouri, Anthem Blue Cross of New Hampshire, Anthem Blue Cross of Nevada, Anthem Blue Cross of New York, Anthem Blue Cross of Ohio, Anthem Blue Cross of Texas, Anthem Blue Cross of Virginia, Anthem Blue Cross of Wisconsin, Blue Cross Blue Shield of Illinois, Blue Cross Blue Shield of Montana, Blue Cross Blue Shield of New Mexico, Blue Cross Blue Shield of Oklahoma, Capital Blue Cross of Pennsylvania, Highmark of West Virginia, Premera in Washington, Premera in Alaska, and Vibra in Pennsylvania.

How much is BlueMedicare Choice HMO?

BlueMedicare Choice HMO has a $42 monthly premium and primary care visits have $10 copay. Specialists have a $45 copay while inpatient hospital facility services are $290 copay per day for days 1 through 5. Urgent care facilities are $50 copay and emergency room visits have a copay of $90, but this may be waived if you are admitted.

How much does Aetna pay for medical?

Under the Aetna Medicare Choice Plan, if you are between the ages of 65 and 69 in fair health, the monthly premium is $73, and you can expect to pay approximately $3,738 per year for medical costs, including premiums. There is no deductible if you remain in the network, but if you go outside the network you’ll have to meet a $750 deductible before benefits start. There’s an annual cap on your out-of-pocket costs with this plan of $6,700 (for in-network services). In-network primary care physician copays are $5 and 40 percent outside the network. Specialists are $40 in-network and 40 percent outside the network. Inpatient hospital stays cost $220 per day for the first four days. After that, you won’t have to pay a copay for inpatient stays.

How much is United Health Care Sync?

The monthly premium for the UnitedHealthcare Sync PPO plan is $54. Primary care visits have a $15 copay while specialists have a $50 copay. Routine physicals are free, and there’s no annual deductible for medical services. The maximum you’ll pay for in-network services for the year is $5,900. Inpatient hospital stays require a $400 copay per day for days 1 through 4, but there’s no copay for days 5 through 90. Skilled nursing facility costs are also covered.

Is there a premium for BlueMedicare?

There is no premium for BlueMedicare Preferred POS. Primary care office visits have a $0 copay while specialists have a $25 copay. Days 1 through 5 of a hospital stay require a copay of $120 per day, and urgent care facilities have a $25 copay. Emergency room services, both in and out-of-network, are $85 but the fee may be waived if you get admitted.

Is Humana Medicare Advantage?

Humana offers a wide range of insurance products, one of their most prominent being Medicare Advantage. Founded in Kentucky in 1961, the company consistently ranks on lists of top employers in the country, and its commitment to corporate social responsibility sets it apart from industry leaders. In Meomonee Falls, Wisconsin, there are nine Medicare Advantage plans available. We’ve highlighted a few in this section.

What is CMS's plan for 2019?

The policies CMS finalized in April 2018 for Medicare health and drug plans for 2019 advance broader efforts to promote innovation that empowers Medicare Advantage and Part D sponsors with new tools to improve quality of care and provide additional plan choices for Medicare Advantage and Part D enrollees. Through policies adopted through the 2019 Rate Announcement and Call Letter and the final rule, CMS is providing more choices for beneficiaries, a greater number of affordable options, and new benefits to meet their unique health needs.

How many Medicare Advantage plans are there in 2019?

Due to new flexibilities available for the first time in 2019, nearly 270 Medicare Advantage plans will be providing an estimated 1.5 million enrollees new types of supplemental benefits: Expanded health-related supplemental benefits, such as adult day care services, and in-home and caregiver support services; and.

How many Medicare beneficiaries will be enrolled in Medicare Advantage in 2019?

Based on projected enrollment, 36.7% of Medicare beneficiaries will be enrolled in Medicare Advantage in 2019. Medicare Advantage premiums, on average, have steadily declined since 2015 from the actual average premium of $32.91.

What percentage of Medicare beneficiaries will see a decrease in premiums in 2019?

About 26 percent of enrollees staying in current plans will see their premiums decline in 2019. Approximately 46 percent of enrollees in their current plan will have a zero premium in 2019. Access to Medicare Advantage and prescription drug plans will remain nearly universal, with about 99 percent of Medicare beneficiaries having access to ...

How many Medicare beneficiaries are there in 2019?

The data released with the 2019 Medicare Advantage and Part D landscape provides important premium and cost sharing information for Medicare health and drug plans offered in 2019: Enrollment in Medicare Advantage is projected to be at an all-time high in 2019 with 22.6 million Medicare beneficiaries.

How much is Medicare premium per month?

The average monthly premium for a basic Medicare prescription drug plan in 2019 is projected to decrease by $1.09 (3.2 percent decrease) to an estimated $32.50 per month.