When do you have to pay your Medicare premium?

What else do I need to know about paying my Medicare premium online through my bank?

- You tell the bank your Medicare information to set up this service—make sure your payment is set up correctly so your bill is paid on time.

- Remember: You're responsible for making sure the bank pays the right premium amount at the right time.

- Your statement will show a payment made to "CMS Medicare."

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

How do I Pay my Medicare premium?

Ways to Pay Your Medicare Premium

- Most people don’t receive a bill from Medicare for their Part A and Part B premiums.

- If you do receive a bill (Medicare form CMS-500), you can pay it online through your bank or Medicare Easy Pay.

- You can use your debit or credit card to pay, either online or by mailing your credit card information to Medicare.

How does Medicare calculate my premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How often is Medicare Part A premium due?

How often do Medicare payments come out?

What is Medicare Supplement?

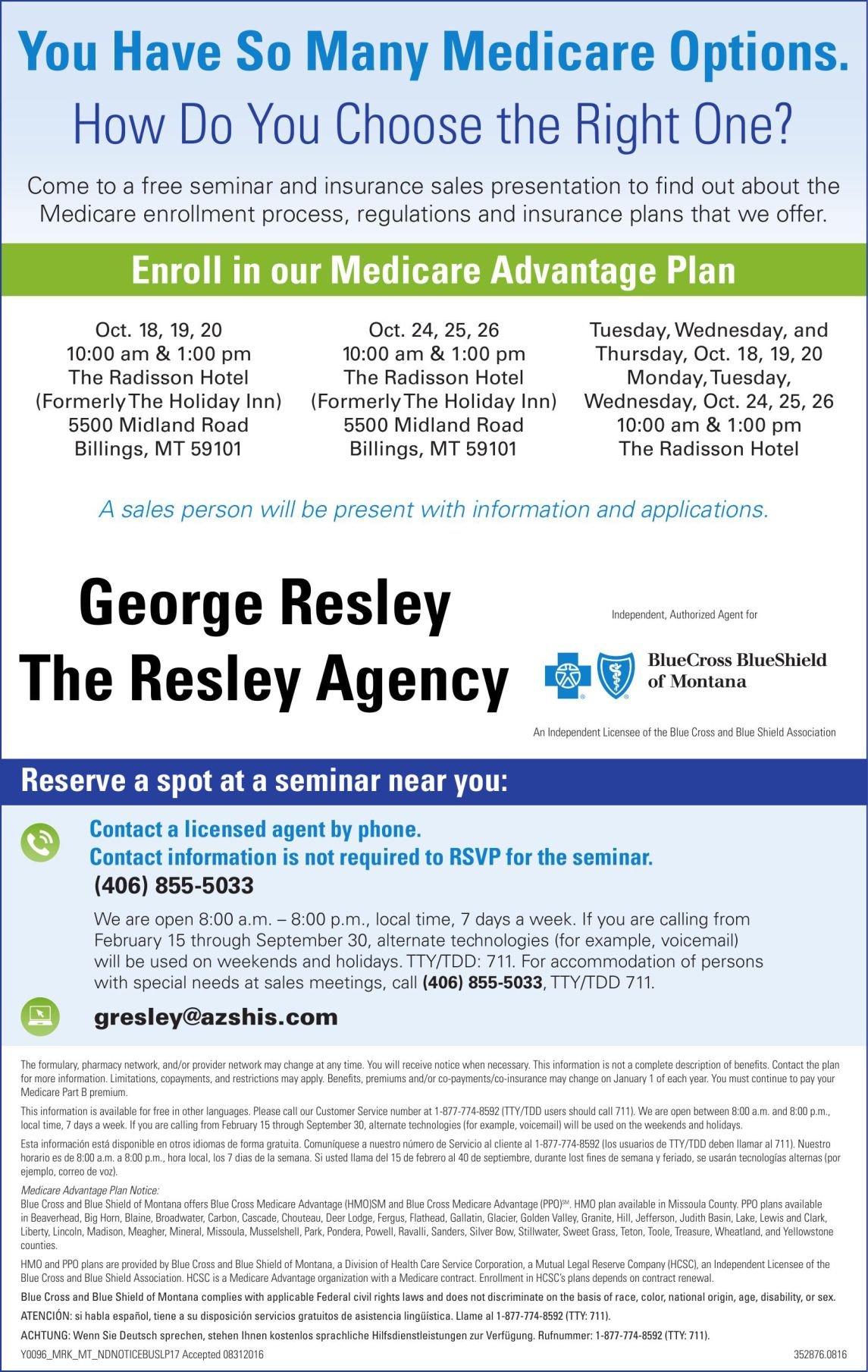

What is Medicare Advantage?

What is the average Part D premium for 2020?

What happens if you are late on Medicare?

How much is Part B insurance in 2021?

See more

About this website

What months are Medicare premiums due?

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of our billing timeline. For your payment to be on time, we must get your payment by the due date on your bill.

Does Medicare start on your birthday or beginning of the month?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

What is the new Medicare premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Why is my first Medicare premium bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

How many months before I turn 65 should I apply for Medicare?

3 monthsGenerally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

What is the best time to apply for Medicare?

A: The best time to enroll is during the open enrollment window around your 65th birthday – preferably in the three months before the month you turn 65, so that you'll have Medicare coverage by the time you turn 65.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Why did my Medicare premium increase for 2022?

The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

Are Medicare premiums deducted a month in advance?

Social Security benefits are paid in arrears, while Medicare premiums are paid in advance, so it's important to recognize the timing of these events. 1. The individual is collecting Social Security benefits for the months of November and December of the year prior to the COLA increase to Medicare.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

How do I find my Medicare premium amount?

Visit Medicare.gov/your-medicare-costs/medicare-costs-at-a-glance to find the information in this chart. If you have questions about your Part B premium, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. If you pay a late enrollment penalty, these amounts may be higher.

CMS Releases 2022 Premiums and Cost-Sharing Information for Medicare ...

The Centers for Medicare & Medicaid Services (CMS) released the 2022 premiums, deductibles and other key information for Medicare Advantage and Part D prescription drug plans in advance of the annual Medicare Open Enrollment to help Medicare enrollees decide on coverage that fits their needs.

CMS Announces 2022 Medicare Part B Premiums | CMS

Today, the Centers for Medicare & Medicaid Services (CMS) released the 2022 Medicare Parts A and B premiums, deductibles, and coinsurance amounts, and the 2022 Part D income-related monthly adjustment amounts.

2022 Medicare Costs.

CMS Product No. 11579 November 2021. You have the right to get Medicare information in an accessible format, like large print, Braille, or audio.

Medicare.gov: the official U.S. government site for Medicare | Medicare

Medicare.gov: the official U.S. government site for Medicare | Medicare

Are Medicare Premiums Deducted From Social Security Payments?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How often is Medicare Part A premium due?

Help with costs. Summary. A person enrolled in original Medicare Part A receives a premium bill every month, and Part B premium bills are due every 3 months. Premium payments are due toward the end of the month. Original Medicare consists of Part A, which is hospitalization insurance, and Part B, which is medical insurance.

How often do Medicare payments come out?

People who do not get SS or RRB benefits will receive bills for their Medicare premiums. Medicare will issue Part A bills monthly and Part B bills every 3 months. There are several ways to pay the premiums, including: through the Medicare account. online through a bank’s bill payment service.

What is Medicare Supplement?

Medicare supplement insurance. Medigap is a Medicare supplement insurance plan that pays 50–100% of the original Medicare (parts A and B) out-of-pocket costs. These plans are available to people enrolled in original Medicare, and there will be a monthly premium to pay. Learn more about how Medigap plans work here.

What is Medicare Advantage?

Medicare Advantage. Instead of enrolling in original Medicare (parts A and B), some people choose to enroll in Part C, or Medicare Advantage. This is an alternative to original Medicare. In that case, a person must pay their Part B premiums in addition to their Medicare Advantage plan costs. Learn more about choosing a Medicare Advantage plan here.

What is the average Part D premium for 2020?

In 2020, the average Part D monthly premium base was $32.74 for people with an income of $87,000 or under. As with Part B, the premiums increase in relation to having an income above a certain amount. People can use this online tool to compare various Part D plans.

What happens if you are late on Medicare?

For original Medicare (parts A and B), Medicare will send a person a First Bill. If they are late with payment, they will get a Second Bill, which includes the past-due premium amount and the premium that is due the following month.

How much is Part B insurance in 2021?

Part B premiums in 2021 are $148.50 per month for people with an income of $88,000 or under. The premiums are higher for individuals with an income that exceeds this amount.

What happens to Medicare premiums once you start?

Once your benefits begin, your premiums will be taken directly out of your monthly payments. You’ll also receive bills directly from your plan’s provider if you have any of the following types of plans: Medicare Part C, also known as Medicare Advantage. Medicare Part D, which is prescription drug coverage.

How long does it take to pay Medicare premiums?

If you enroll in Medicare before you begin collecting Social Security benef it s, your first premium bill may surprise you. It will be due, paid in full, 1 month before your Medicare coverage begins. This bill will typically be for 3 months’ worth of Part B premiums. So, it’s known as a quarterly bill.

What does it mean when you receive a Social Security check in August?

This means that the benefit check you receive is for the previous month. For example, the Social Security benefit check you receive in August is for July benefits. The Medicare premium deducted from that check will also be for July.

How much is Medicare Part B 2021?

Medicare Part B costs. Most people pay the standard Part B premium. In 2021, that amount is $148.50. If the modified adjusted gross income you reported on your taxes from 2 years ago is higher than a certain limit, though, you may need to pay a monthly IRMAA in addition to your premium.

What is Medicare Part D?

Medicare Part D, which is prescription drug coverage. Medigap, also called Medicare supplement insurance. The structure of these bills and their payment period may vary from insurer to insurer. Social Security and RRB benefits are paid in arrears. This means that the benefit check you receive is for the previous month.

How often do you get Medicare payments?

If you have original Medicare and aren’t yet collecting Social Security, you’ll receive a bill from Medicare either monthly or once every 3 months in these cases: If you don’t have premium-free Part A, you’ll receive a monthly bill for your Part A premium.

Do Medicare payments go into advance?

These bills are paid in advance for the coming month or months, depending on the parts of Medicare you’re paying for. If you’re already receiving retirement benefits, your premiums may be automatically deducted from your check. Part C, Part D, and Medigap bills are sent directly from the insurance company that provides your plan.

Medicare typically bills in 3-month increments, if you don't have your premiums automatically deducted from Social Security

Medicare helps pay for a variety of healthcare services, but it isn't free. Beneficiaries are responsible for a variety of Medicare costs, including monthly premiums, deductibles, and coinsurance or copayments.

Who Gets a Medicare Premium Bill?

The Medicare Premium Bill (CMS-500) goes to beneficiaries who pay Medicare directly for their Part A premium, Part B premium, or who owe the Part D Income-Related Monthly Adjustment Amount (IRMAA). Please note that, even if you collect Social Security, if you owe the Part D IRMAA, you must pay the surcharge directly to Medicare.

How Much Should Your Medicare Premium Bill Be?

How much your Medicare premiums cost depends on which parts of Medicare you have and whether you qualify for premium-free Part A.

How Do You Know if You Owe the Income-Related Monthly Adjustment Amount?

Using data from the Internal Revenue Service (IRS), the Social Security Administration (SSA) determines who owes the Income-Related Monthly Adjustment Amount. SSA will notify you if you owe IRMAA. This notification will include information about appealing the IRMAA decision.

Did You Delay Signing Up for Medicare?

If you delayed Medicare enrollment and did not qualify for a Special Enrollment Period (SEP), your monthly premiums may be higher due to late enrollment penalties.

What Is the Medicare Late Enrollment Penalty?

You may owe the late enrollment penalty for Part A, Part B, or Part D – or all three. How much you owe and how it's calculated depends on the part and how long you went without Medicare coverage.

Ways to Pay Your Medicare Premium Bill

Sign up for Medicare Easy Pay, which allows Medicare to automatically deduct your premiums from your personal savings or checking account.

How often is Medicare billed?

Some people with Medicare are billed either monthly or quarterly. If you are billed for Part A or IRMAA Part D, you will be billed monthly. If this box says:

Does Part B include late enrollment penalty?

Current amount due and coverage period for Part A and/or Part B, *If this is the first billing you received, it may also include premiums owed forprevious months not already billed. May also include Part B late enrollment penalty and/or Part B IRMAA amounts if they apply to you.

Does Medicare end if you don't send past due?

The date your Medicare Insurance will end if you do not send the ‘past due amount’ by the date shown. You’ll only see a termination date(s) on a bill that says “Delinquent” at the top.

How often is Medicare Part A premium due?

Help with costs. Summary. A person enrolled in original Medicare Part A receives a premium bill every month, and Part B premium bills are due every 3 months. Premium payments are due toward the end of the month. Original Medicare consists of Part A, which is hospitalization insurance, and Part B, which is medical insurance.

How often do Medicare payments come out?

People who do not get SS or RRB benefits will receive bills for their Medicare premiums. Medicare will issue Part A bills monthly and Part B bills every 3 months. There are several ways to pay the premiums, including: through the Medicare account. online through a bank’s bill payment service.

What is Medicare Supplement?

Medicare supplement insurance. Medigap is a Medicare supplement insurance plan that pays 50–100% of the original Medicare (parts A and B) out-of-pocket costs. These plans are available to people enrolled in original Medicare, and there will be a monthly premium to pay. Learn more about how Medigap plans work here.

What is Medicare Advantage?

Medicare Advantage. Instead of enrolling in original Medicare (parts A and B), some people choose to enroll in Part C, or Medicare Advantage. This is an alternative to original Medicare. In that case, a person must pay their Part B premiums in addition to their Medicare Advantage plan costs. Learn more about choosing a Medicare Advantage plan here.

What is the average Part D premium for 2020?

In 2020, the average Part D monthly premium base was $32.74 for people with an income of $87,000 or under. As with Part B, the premiums increase in relation to having an income above a certain amount. People can use this online tool to compare various Part D plans.

What happens if you are late on Medicare?

For original Medicare (parts A and B), Medicare will send a person a First Bill. If they are late with payment, they will get a Second Bill, which includes the past-due premium amount and the premium that is due the following month.

How much is Part B insurance in 2021?

Part B premiums in 2021 are $148.50 per month for people with an income of $88,000 or under. The premiums are higher for individuals with an income that exceeds this amount.