Full Answer

When will I receive my Medicare Part B reimbursement?

Medicare Part B standard reimbursement for Medicare Part B of $148.50 /month will be issued sometime during the month of April. If you receive your pension via direct deposit, you will see a deposit on your bank statement. If you receive your pension via paper check, you will receive your Medicare Part B reimbursement via paper check.

When are Medicare Part B reimbursement differentials issued?

Those retirees/eligible dependents who are eligible for 2019 Medicare Part B differential reimbursements must submit the Medicare Part B 2019 Reimbursement Differential Request Form , along with required documentation. IRMAA 2020 reimbursements will be issued in October 2021.

Does the city pay for Medicare Part B for retirees?

Medicare Part B Reimbursement The City will reimburse retirees and their eligible dependents for Medicare Part B premiums paid, excluding any penalties. You must be receiving a City pension check and be enrolled as the contract holder for City health benefits in order to receive reimbursement for Part B premiums.

Are you eligible for Medicare Part B reimbursement from CUNY?

If you retired from a full-time position at CUNY and have retiree health insurance coverage from the City of New York, you may be eligible to receive reimbursement for the monthly premium you pay for Medicare Part B. It could save you more than $1,200 a year – or twice that amount if your spouse or domestic partner meets eligibility requirements.

When can I expect my Medicare reimbursement?

Please note that it could take the Social Security Administration (SSA) up to 3 months to process your premium rebate. After that time, you'll see an increase in your check amount.

Where is my Irmaa reimbursement?

IRMAA 2020 reimbursements were issued in October 2021. If you are currently receiving your pension check through Electronic Fund Transfer (EFT) or direct deposit, your reimbursement was deposited directly into your bank account. This is separate from your pension payment.

Is there a reimbursment from Medicare Part B?

If you are a new Medicare Part B enrollee in 2021, you will be reimbursed the standard monthly premium of $148.50 and do not need to provide additional documentation.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

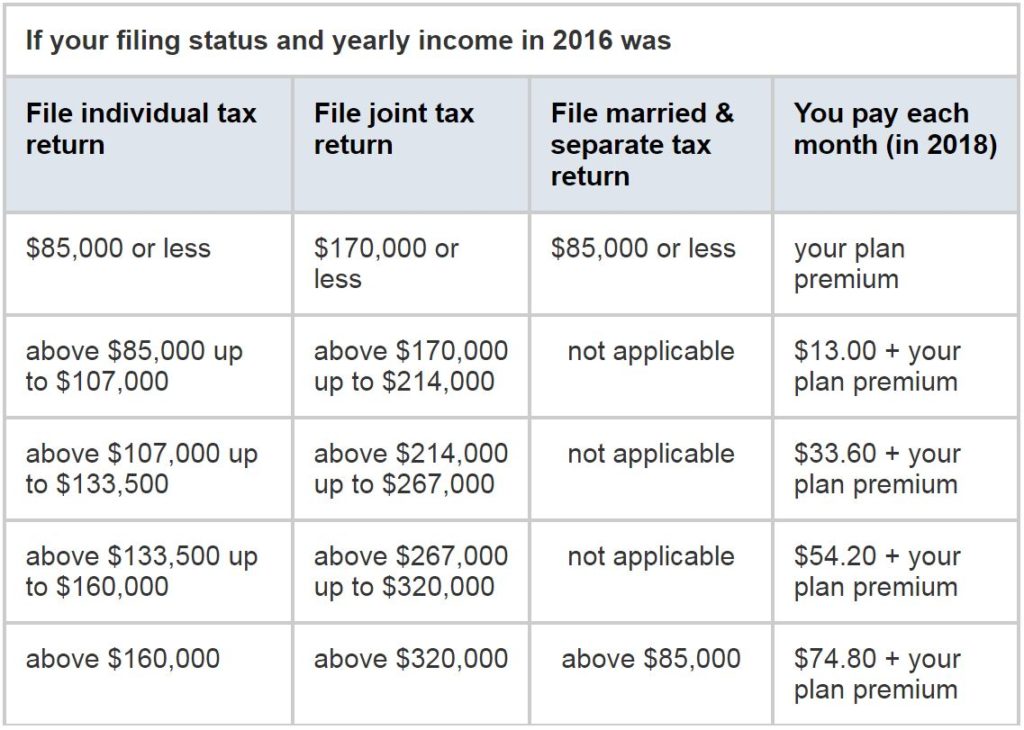

Does NYC reimburse Irmaa?

The NYC Health Benefits Program will reimburse the amount of the Medicare Part B IRMAA increase. The reimbursement claim form and instructions are available in the Forms section of this website.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is retroactive reimbursement of Medicare premium?

If you are enrolled in the QI program, you may receive up to three months of retroactive reimbursement for Part B premiums deducted from your Social Security check. Note that you can only be reimbursed for premiums paid up to three months before your MSP effective date, and within the same year of that effective date.

What is the Medicare Part B payment for 2021?

$148.50 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much is Medicare reimbursement?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill. Not all types of health care providers are reimbursed at the same rate.

How do I get reimbursed for Part B premium?

Submit Medicare Part B premium proof of payment and a completed reimbursement form for each eligible dependent to HealthEquity in one of the following ways: Scan and upload them to healthequity.com. Fax them to 1-801-999-7829. (Be sure to include a cover sheet.)

How do I get Part B reimbursement?

benefit: You must submit an annual benefit verification letter each year from the Social Security Administration which indicates the amount deducted from your monthly Social Security check for Medicare Part B premiums. You must submit this benefit verification letter every year to be reimbursed.

How do I check my Medicare payments?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

When will Medicare Part B be released?

Medicare Part B 2020 reimbursements were issued in April 2021. Please check your bank account/statement (or the mail, if you are receiving a physical check) for your payment. If you already submitted your Medicare Part A & B card to the Health Benefits Program, this payment is automatic and you will receive it annually.

How long does it take to add dependents to NYS health benefits?

Here are some important things that you need to remember: Complete an enrollment form to add new dependents (newborn, adoption, marriage) within 30 days after the event; Notify the NYC Health Benefits Program and your health plan in writing when your address changes;

What if I don't have direct deposit?

If you don’t have EFT or direct deposit, you should have received a check in the mail. If you did not receive your IRMAA reimbursement by December 1, 2020 or if you did receive the reimbursement and you believe the amount is incorrect, you must resubmit the IRMAA 2019 Reimbursement Application .

When will IRMAA 2019 payments be processed?

If you are applying for IRMAA, you will be receiving the differential payment once IRMAA 2019 payments are processed in October 2020. If you were enrolled in Medicare Part B effective after 2016, then you are already receiving the full payment and do not need to complete the Medicare Part B Differential Form. Learn more.

Can I receive a pension check if I don't have EFT?

This is separate from your pension payment. If you don’t have EFT or direct deposit, you should receive a check in the mail.

NYC Health Benefits Program

This is an interactive video. When links are displayed, you may click to jump to those pages on the HBP website.

Medicare Part B Reimbursement

The City reimburses retirees and their eligible dependents for premiums paid for Standard Medicare Part B. The City also provides additional reimbursements for Medicare Part B Differential and IRMAA payments, if you are eligible.

When did Medicare Part B get reimbursed?

Municipal unions first won reimbursement at the bargaining table in 1966 , but a succession of mayors pled poverty and paid only a portion of the premium. In 2001, the City paid just 70%, which was then $384. The return to 100% reimbursement was won ...

What is Medicare Part B?

Medicare Part B is the part of Medicare that covers doctors’ visits, outpatient care and other services not covered by Medicare Part A, which covers hospitalization. In most cases, the Medicare B premium is deducted from your Social Security check. In 2015, most retirees on Medicare will pay a monthly Part B premium of $104.90 per person.

How to request a reduction in IRMAA?

Retirees who have a major life-changing event and whose income has decreased can request a reduction in their IRMAA payments by completing a Medicare IRMAA Life-Changing Event form or scheduling an interview with their local Social Security office.

How much did the City of New York pay in 2001?

In 2001, the City paid just 70%, which was then $384. The return to 100% reimbursement was won through “old-fashioned politicking” by the New York City labor movement, says Irwin Yellowitz, a labor historian and former chair of the PSC Retirees Chapter. By 2000, “it had been an issue that was out there for a very long time,” Yellowitz said.

What unions helped mobilize retirees and other members to send postcards, meet with City Council members and test

New York City unions, including the PSC, the UFT and AFSCME District Council 37, helped mobilize retirees and other members to send postcards, meet with City Council members and testify before the Council on the issue. In 2001 the City Council passed a measure reinstating the full reimbursement and overrode Mayor Rudy Giuliani’s veto of the bill.

Does NYC reimburse Part B?

Reimbursement of your Part B premium is processed by the New York City Health Benefits Program, and you won’t receive reimbursement unless you have submitted notice of your eligibility. You do not need to submit an annual request to receive reimbursement for the standard monthly premium; once you are signed up you will continue to receive this basic reimbursement each year. Retirees in the Teachers’ Retirement System (TRS) with City health coverage must write to the NYC Office of Labor Relations (see below), while retirees in TIAA-CREF or other retirement vehicles in CUNY’s Optional Retirement Program (ORP) must send a form to CUNY.

When does Emblem Health contract go into effect?

The contract would go into effect on July 1, beginning of the City’s fiscal year. What we know at the moment: can stay with your current doctor, if providers accept the new plan.

When will IRMAA be available in 2021?

May 18, 2021 (update): IRMAA application is available on the OLR website, via this link. However, because staff will be returning on a very limited basis in and have a lot of unopened mail they will need to get through, we recommend you wait to submit your IRMAA application.

Does MEA cover out of state?

Only dues paying members are eligible for this benefit and should contact the MEA office to schedule an appointment with legal counsel. Although the program does not cover out of state matters, counsel can refer the member to an out of state attorney, usually at no charge for the initial consultation.

Is Medicare privatized for retirees?

Privatized Medicare Advantage for Retirees. (July 14) The Municipal Labor Committee overwhelmingly approved a transition from the city’s Medicare program for retired employees and their beneficiaries to a privately managed plan that is expected to upgrade benefits in key areas while saving the city $500 million annually in health-care costs.