Is the Medicare Donut Hole really closed?

You may have heard that the coverage gap for Medicare Part D prescription drug coverage, commonly known as the donut hole, closed in 2020. While it’s true that recent changes should reduce costs for many beneficiaries, the coverage gap still exists, and costs for some prescriptions may increase in the gap. Stage 1 — Deductible.

Will Medicare be around when I retire?

Since Medicare pays first after you retire, your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance (Medigap). Retiree coverage isn't the same thing as a Medigap policy but, like a Medigap policy, it usually offers benefits that fill in some of Medicare's gaps in coverage—like Coinsurance and deductibles. Sometimes retiree coverage includes extra benefits, like coverage for extra days in the hospital.

When will you be eligible for Medicare?

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965. These days, fewer people are automatically enrolled in Medicare at age 65 because they draw Social Security benefits after 65. If you do not receive Social Security benefits, you will not auto-enroll in Medicare.

When is donut hole ending?

The Salty Donut will open on the bottom floor of the Dimensional Funds tower in South End with craft doughnuts and coffee ... s double-chocolate gluten-free donuts and “spiked” donut holes. The shop got its start out of a trailer in 2015 before ...

Will the Medicare donut hole ever go away?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

What happens to the donut hole in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What happens when the donut hole ends in 2020?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

Will there be a Medicare donut hole in 2022?

Q: Are there changes in the Medicare Part D prescription drug coverage for 2022? A: Yes. The maximum deductible will be slightly higher, and the upper and lower thresholds for the “donut hole” will change again.

Can you avoid the donut hole?

Purchase your generic drugs and pay the cash price at a pharmacy that does not have your insurance information. Purchase your brand name drugs at another pharmacy and pay the insurance copay. This strategy will reduce your out-of-pocket costs in Stage 2, and often keep you from falling in the Stage 3 donut hole.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

What will the donut hole be in 2022?

$4,430For example, in 2022 the coverage gap — or donut hole — begins once you reach your plans Part D initial coverage limit of $4,430 in prescription costs. While you're in the coverage gap, you'll pay 25% coinsurance for covered generic drugs and 25% coinsurance for covered brand-name drugs.

Did the Affordable Care Act close the donut hole?

The Affordable Care Act is closing the “donut hole” over time, by first providing a one-time $250 check for those that reached the “donut hole” in 2010, then by providing discounts on brand-name drugs for those in the “donut hole” beginning in 2011, and additional savings each year until the coverage gap is closed in ...

How do I get out of the donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

Will Medicare premiums decrease in 2022?

Medicare Part B Premiums Will Not Be Lowered in 2022.

Do all Medicare Part D plans have a donut hole?

All Medicare Part D plans follow the same drug phases. Every prescription coverage plan involves the gap known as the donut hole. Will I enter the donut hole if I receive Extra Help? Those who get Extra Help pay reduced amounts for their prescriptions throughout the year, so they are unlikely to reach the donut hole.

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

How much is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

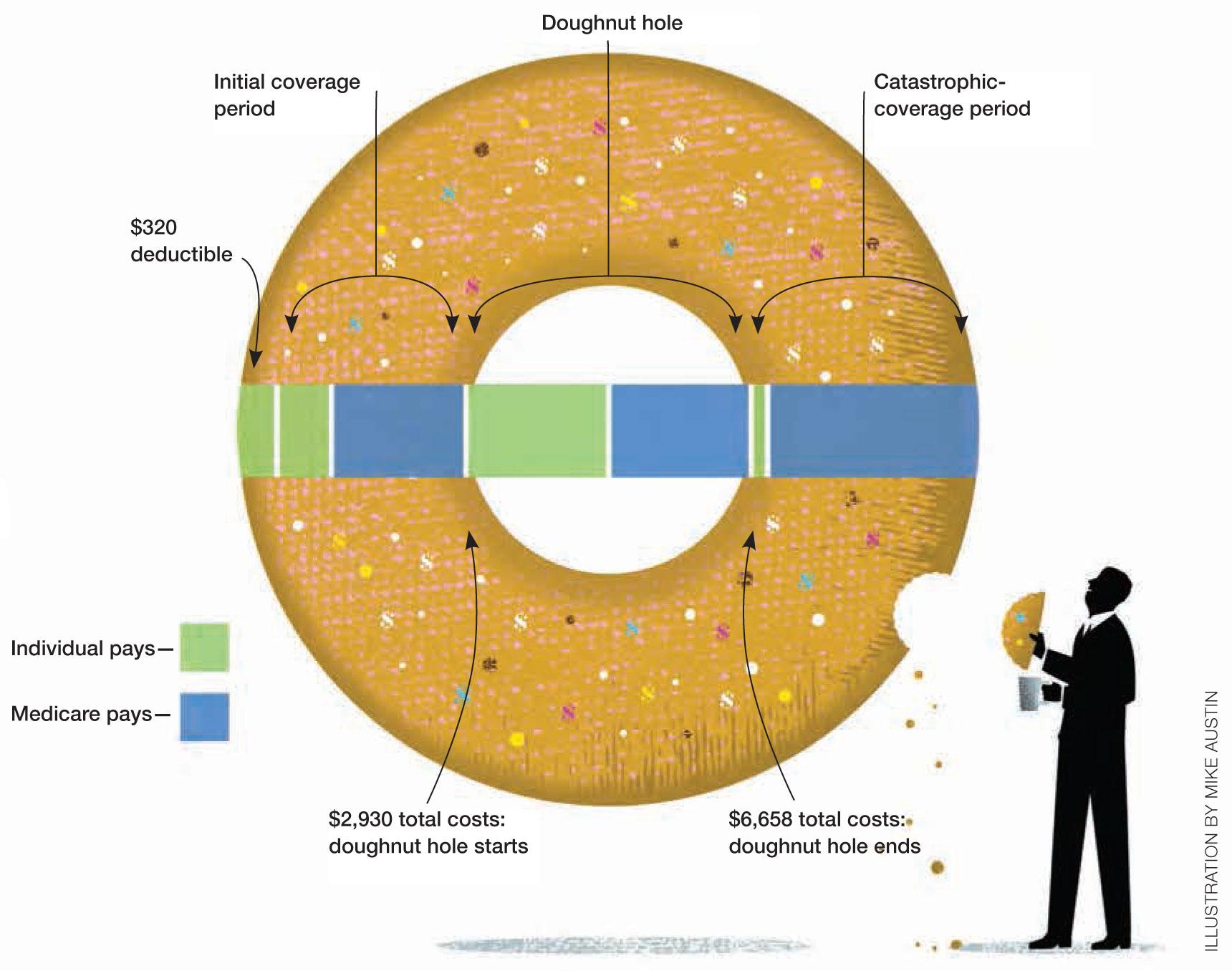

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

How much is a 2021 deductible?

The good news is that once you meet your deductible ( which can be no higher than $445 in 2021 though some plans may offer $0 deductibles) you move to your initial coverage period. If your plan features a $0 deductible, then your coverage starts in this phase.

When does the catastrophic coverage period end for 2021?

Finally, your policy period ends on December 31, ...

When did Medicare Part D start?

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.

AARP In Your State

Visit the AARP state page for information about events, news and resources near you.

Social Security & Medicare

You are leaving AARP.org and going to the website of our trusted provider. The provider’s terms, conditions and policies apply. Please return to AARP.org to learn more about other benefits.

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

What happens if you fall into a donut hole?

Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again. Continue reading as we discuss more about the donut hole and how may it affect how ...

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

What is the minimum copay for 2021?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: 5 percent of a drug’s cost or a small copay. The minimum copay for 2021 has increased a little from 2020: Generic drugs: minimum copay is $3.70, which is up from $3.60 in 2020.

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

How much money do you have to spend to get out of the donut hole?

This is the amount of OOP money that you have to spend before you exit the donut hole. For 2021, the OOP threshold has increased to $6,550. This is up from $6,350 in 2020, meaning that you’ll have to pay more OOP than before in order to get out of the donut hole.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

When did the Affordable Care Act close the donut hole?

Beginning in 2011, the Affordable Care Act (ACA) took measures to close the donut hole, known as the Coverage Gap. Over the last few years, beneficiaries have paid less for drugs. Here's what happened. In 2012, the ACA implemented discounts for the Coverage Gap.

How much is Laura's insulin copayment?

Here's an example. In the Initial Coverage payment stage, Laura's insulin has a $47 copayment. Once she lands in the donut hole, she is responsible for 25%.

What is the gap in Part D?

What Does That Mean? When first implemented in 2006, the Part D drug plan had a gap in coverage. Drug plans did not pay anything toward the cost of drugs in the donut hole so beneficiaries were stuck with the tab for the entire cost. Beginning in 2011, the Affordable Care Act (ACA) took measures to close the donut hole, known as the Coverage Gap.

Do you have to pay for medication in the donut hole?

So, the donut hole has closed for all medications. Many think that means they won’t have to pay for medications once they get to this drug payment stage. But that is not the case. Going forward, drug plan members will pay 25% of the cost for any prescribed medication from the time they meet the deductible until reaching ...

Does closing the donut hole reduce the cost of medication?

Closing the donut hole may or may not reduce costs in the Coverage Gap. Those who end up in that payment stage will still have to pay 25% of the cost of medications. Last updated: 01-02-2020.

Is the donut hole closed for generics?

Now, now the donut hole for generic drugs is also closed. So, the donut hole has closed for all medications. Many think that means they won’t have to pay for medications once they get ...

When did the Medicare donut hole go away?

Did the Medicare Donut Hole Go Away in 2020? The Medicare Donut Hole closed in 2019 for brand name drugs and disappeared in 2020 for generic drugs. Learn how this may affect your Part D costs.

What happened to the Medicare donut hole in 2020?

What happened in the donut hole coverage gap in 2020? The Medicare donut hole coverage gap shrunk to its final cost level in 2020. We'll explain more below about what this means for your coverage. The Medicare donut hole is one of four coverage levels (coverage periods) that are in a Part D prescription drug plan.

What happens when the donut hole goes away in 2020?

What happened when the donut hole went away in 2020? Once you reach the $6,550 threshold in 2021, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastrophic coverage phase, you only pay a small coinsurance or copayment for your covered prescription drugs for the remainder of the year.

How can Medicare help avoid the donut hole?

Medicare beneficiaries may be able to help themselves avoid the donut hole by choosing less expensive generic drugs over brand-name drugs when possible, shopping for prescription drug discounts, buying drugs in bulk through mail-order services and utilizing Medicare Extra Help (see below).

What is the donut hole?

Once you and your prescription drug plan have spent this amount on covered drugs, you enter the coverage gap called the donut hole. Ever since 2020, Medicare Part D plan beneficiaries pay 25 percent of their brand name and generic drug costs while they’re in this coverage gap, or "donut hole.".

What is the maximum deductible for Medicare 2021?

In 2021, the maximum deductible allowed by law is $445 for the year. Some Medicare prescription drug plans have a $0 deductible. After you meet your plan deductible, you enter the initial coverage period.

What is extra help?

Extra Help is an assistance program that helps lower the cost of Part D premiums, deductibles, coinsurance and copayments. There is no coverage gap for Medicare beneficiaries who receive Extra Help.

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

What are the phases of a Part D plan?

Your drug coverage will change throughout the year, depending on how much you spend. If you don’t spend very much on drugs, or you have drug coverage from another source, you may never reach the donut hole phase.

How has the donut hole coverage gap changed?

The ACA began closing the donut hole in 2011, shrinking it little by little each year. The process began with a 50% reduction in brand-name drug prices and a 7% government subsidy on generic drugs within the coverage gap. The subsidies for generic drugs increased each year until 2020.

The bottom line

Even though policymakers say the Medicare Part D donut hole is now fully closed, prescription drug copayments still often increase after the initial coverage phase. To keep your costs down, look for a Part D plan with a formulary that charges less for your medications.

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

How to contact Medicare for copays?

If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770.

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.