Although most Americans become eligible for Medicare at age 65, you are under no obligation to sign up for Medicare when you turn 65. Enrollment in Medicare is entirely voluntary. You are not required to enroll at age 65 or any other time.

Will I be automatically enrolled in Medicare at 65?

Feb 01, 2021 · Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But it’s important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

How to enroll in Medicare if you are turning 65?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer. If you have COBRA coverage: Sign up for Medicare when you turn 65 to avoid gaps in coverage and a monthly Part B late enrollment penalty. If you have COBRA before signing up for Medicare, …

Can you keep Medicaid after turning 65?

Enrollment in Medicare is entirely voluntary. You are not required to enroll at age 65 or any other time. It is highly advisable, however, for most people to enroll in Medicare when they turn 65. Here are some of the reasons: Signing up for Medicare during your Initial Enrollment Period eliminates late enrollment penalties you may have to pay if you enroll in Medicare later.

How can you get Medicare before age 65?

Medicare will not force you to sign up at 65, and you’ll get a special enrollment period to sign up later as long as you have a group health plan and work for an employer with 20 or more people. It’s generally advisable to stop HSA contributions six months prior to signing up for Medicare if you’re enrolling after age 65 because retroactive coverage is automatic in that situation.

Are you automatically signed up for Medicare when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Signing up for Medicare during your Initial Enrollment Period eliminates late enrollment penalties you may have to pay if you enroll in Medicare later

These penalties include the Medicare Part B late enrollment penalty and the Medicare Part D late enrollment penalty. If you enroll in Part B or Part D at any time following your Medicare Initial Enrollment Period, you may have to pay these penalties as long as you have Part B or Part D coverage.

If you let your Medicare Initial Enrollment Period pass without enrolling in Medicare, you will miss your Medigap Open Enrollment Period

Although you will have the opportunity to apply for Medigap coverage if you enroll in Medicare after age 65, you will not have another Medigap Open Enrollment opportunity. During your Medigap Open Enrollment Period, there are no medical underwriting considerations and you are able to enroll in any Medigap plan sold in your state.

Medicare insurance is compatible with most other types of health insurance you may already have

If you have private health insurance, you do not need to cancel your current plan in order to enroll in Medicare. If you are satisfied with your current private health plan and want to continue with it, enrolling in Medicare will not decrease your current health benefits.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

What happens if you lose your health insurance?

Additionally, if you lose your health insurance through your employer or choose to just go without, you’ll face penalties for not enrolling in Medicare Part B. No one likes penalties, so make sure you’re covered at all times.

What are the jobs of older people?

The most common jobs of older workers, according to the Bureau of Labor Statistics, include management, office and administrative support, and sales. If this might be you, there’s a good chance that you’re still getting some kind of health insurance through your employer.

Does Medicare cover 80% of medical expenses?

Note: Medicare on its own only covers about 80% of your Medicare-approved expenses.

Is Medicare Part A free?

Original Medicare is made up of 2 main parts: Part A (your hospital insurance) and Part B (your medical insurance). As long as you’ve worked at least 10 years and paid Medicare taxes, Medicare Part A is actually free to have, meaning that you don’t have a monthly premium to pay. There’s really no downside to having Part A when you turn 65.

What happens if you don't sign up for Medicare?

Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage. It’s therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability.

How long can you delay Medicare?

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops (whichever happens first), without incurring any late penalties if you enroll later. When the employer-tied coverage ends, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare.

Can you sell a Medigap policy?

Insurance companies are prohibited from refusing to sell you a Medigap policy or charge higher premiums based on your health or preexisting medical conditions, if you buy the policy within six months of enrolling in Part B. Outside of that six-month window, except in very limited circumstances, they can do both.

Can you delay Medicare enrollment?

You can’t delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA — by definition, these do not count as active employment. Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

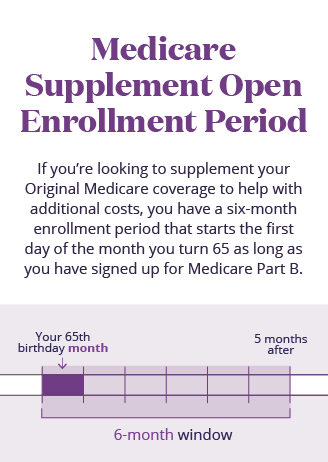

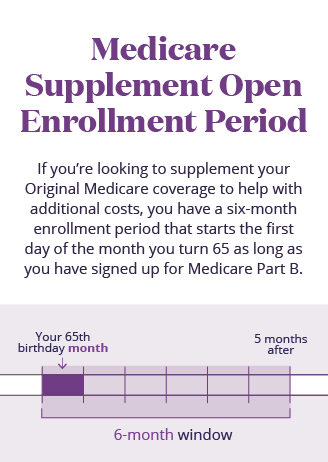

What is Medicare Supplement insurance?

Medicare Supplement insurance – this coverage may help pay your Medicare Part A and Part B costs, like copayments, coinsurance, and deductibles. You need Part A and Part B to qualify. Usually the best time to enroll is during your Medicare Supplement Open Enrollment Period.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) – this program gives you an alternative way to get your Medicare Part A and Part B benefits (many plans also include prescription drug benefits too). You need Part A and Part B to qualify, and then the plan (instead of the government) manages those benefits for you.

When does IEP start?

So if your 65th birthday is in November, your IEP runs from August through February. Your IEP is different if you’re not yet 65, but you qualify for Medicare by disability.

What is a stand alone Medicare plan?

Stand-alone Medicare prescription drug plan (Medicare Part D) – you might want this type of plan if you need prescription drug coverage. You need Part A or Part B to qualify. If you don’t enroll during your Medicare Initial Enrollment Period (IEP), you might have to wait to sign up.

Is Medicare Part A premium free?

Enroll in Medicare Part A as soon as they’re eligible. Even if your employer plan has hospital coverage, Part A is premium-free for most people. If your employer plan has hospital coverage, and you have a hospital stay, your plan and Medicare Part A will coordinate benefits to work out payment of your hospital costs.

Is Medicare Part A or B?

You might be automatically enrolled in Medicare Part A and Part B (Original Medicare). But if you want to sign up for other Medicare coverage, right about when you’re first eligible for Medicare might be a good time to enroll. If you’re not already getting Social Security retirement benefits when you turn 65, you generally won’t be automatically ...