You can use the Medicare Plan Finder on the Medicare website to compare plans in your area. When Can I switch from a Medicare Supplement to a Medicare Advantage Plans? Yes, you can switch from your Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

How to choose the best Medicare supplement plans?

8 rows · Feb 03, 2022 · You can compare Part D plans available where you live and enroll in a Medicare prescription ...

What is the best and cheapest Medicare supplement insurance?

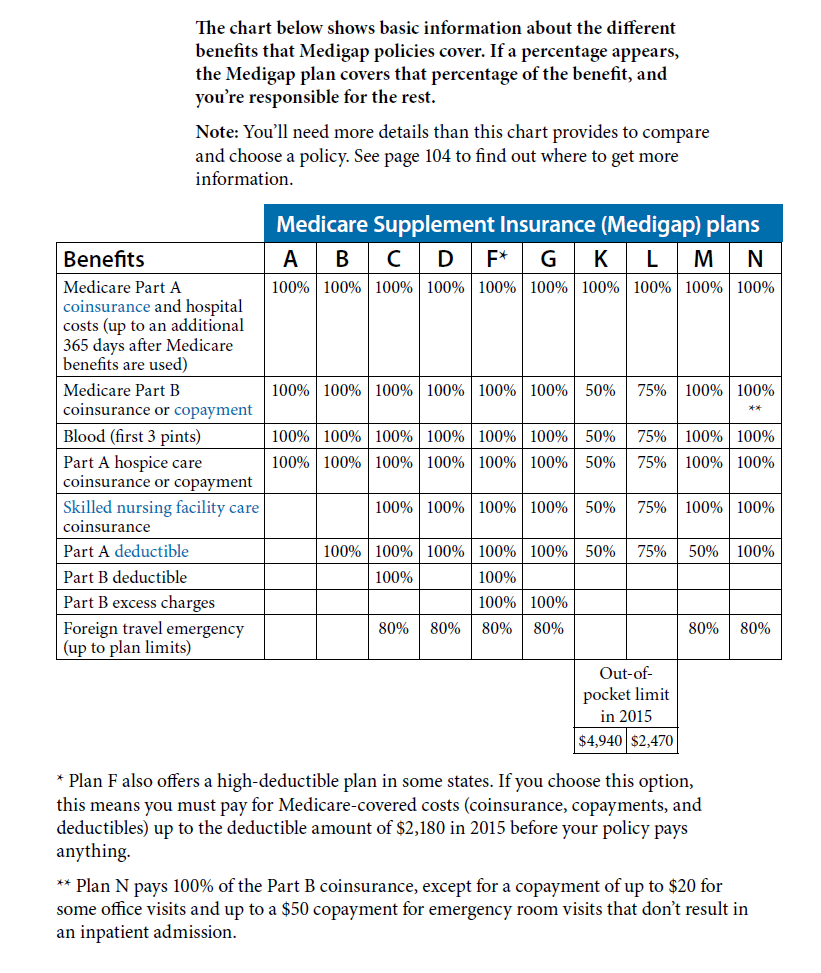

Jun 08, 2021 · Here’s a Medicare Supplement Plan comparison chart to help you see the differences between plans [3]. Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits ...

What is the best way to compare Medicare plans?

How Can I Compare Medicare Supplement Plans? Original Medicare – Part A, hospital insurance, and Part B, doctor insurance – does not cover all costs. You are responsible for deductibles and copayments; copayments are usually set at 20% for Part B services, with Medicare paying 80%. (You are also responsible for the Part B premium, which is ...

How do I compare Medigap plans?

Medicare Supplement Plans Comparison. Our team will compare Medigap plans and rates side-by-side and present you with the top plans for you including prices and financial ratings. Medicare Supplement plans are lettered A – N and each plan covers a different set of the gaps in Medicare. You can compare Medicare Supplement plans side-by-side using the Medicare Supplement …

Is there a site that compares Medicare plans?

The new Medicare Plan Finder is now available to help you compare 2020 coverage options and shop for plans. The Plan Finder is now mobile-friendly, so you can use it on your smart phone, tablet, and desktop! It will guide you step-by-step through the process of comparing plans.Oct 15, 2019

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Do all Medicare supplements pay the same?

Medicare Supplement insurance plans are sold by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare. Different Medicare Supplement insurance plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles.

Which Medigap covers the most?

Policies C and F are the most comprehensive, but they generally cost more. See the Medigap Plan Benefits Chart for a fuller explanation of what each policy covers.

What is the monthly premium for plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Is plan G as good as plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Why does AARP endorse UnitedHealthcare?

What is AARP Medicare Supplement insurance? AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Which Medigap plan has a high deductible option?

Summary: Medicare supplemental (Medigap) Plans F and G can be sold with a high deductible option. Before June 1, 2010, Medigap Plan J could also be sold with a high deductible. The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020.

Can you change Medicare Supplement plans anytime?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

Which Is The Best Medicare Plan?

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. P...

How to Compare Medigap Plans – Benefits

Medicare publishes a booklet each year that includes this Medicare Supplements Plans comparison chart. The Medigap comparison chart allows you to s...

Medigap Plans Comparison Chart

The Medigap Plans comparison chart above compares all of the plans side by side. This allows you to see which ones have the most benefits, and whic...

Shop Rates With Our Free Medigap Plans Comparison Report

Once you determine which Medigap plan feels right for you, you can then shop rates. Boomer Benefits makes this easy our free Medigap rate compariso...

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that aren’t covered in Original Medicare. A Medicare Supplement Plan might (for instance) cover copayments, coinsurance or deductibles you owe under Original Medicare. Medicare Supplement Plans operate as ...

How does Medicare Supplement Plan work?

Understanding how Medicare Supplement Plans work can take some time. Here are the basics [2]: Medigap plans cover one person. If your spouse or partner also wants a Medicare Supplement Plan, they must buy a policy of their own. Medigap plans can’t cancel you for health issues.

How long does Medicare Supplement last?

This starts the month you turn 65 and enroll in Medicare Part B, and it lasts six months. It also never repeats, so don’t miss it.

What is issue age rated?

Issue-age-rated: Premiums are based on the age you are when you purchase them. Generally, younger people pay lower premiums than older people. This may also be called “entry age-rated.”. Attained-age-rated: Premiums are based on your current age, meaning costs will go up as you get older.

Does Medicare cover vision?

They don’t cover everything. Generally, Medicare Supplement Insurance doesn’t cover dental care, vision care, hearing aids, long-term care, eyeglasses or private-duty nursing. Some plans are no longer available. You can no longer purchase Plans E, H, I and J, but if you purchased one of those plans before June 1, 2010, you can continue with it.

Does Medicare Supplement Plan G cover Ohio?

Medicare Supplement Plans operate as additional — not primary — insurance coverage. You must have Medicare Part A and Part B to buy a Medigap plan. These policies are sold by private companies, and the plans are standardized, so Medicare Supplement Plan G in New York will offer the same coverage as Medicare Supplement Plan G in Ohio [1].

How Can I Compare Plans? What Should I Look At?

If you are considering a Medicare Supplement plan, your biggest concern is probably your total cost. That consists of the plan premium and whatever it does not pay. This latter portion is hard to estimate because it depends heavily on your health needs, which are extremely hard to predict.

What About Changing Plans?

Even if you find the ideal plan, you need to be aware that once you have passed your Initial Enrollment Period, you’ll enter the Medicare Supplement Open Enrollment Period, which runs from the first day your Part B coverage is effective and ends six months later. You have guaranteed issue rights during this period.

The Coleman Agency Can Help

If you have any further questions about Medicare Supplement plans, contact The Coleman Agency today. We’re here to find you the Medicare plan that works best for you!

What are the different types of Medicare Supplement Plans?

Depending on where you live, there may be three types of Medicare Supplement plans. This can include community-rated, issue-age-rated or attained-age-rated. In some states, attained-age-rated often ends up being the most cost-effective.

Which Medicare supplement plan requires copays?

When you are learning how to compare Medicare Supplement plans, just remember that Plan N is the one that requires copays from you for doctor and E.R. visits. That’s why the premiums are lower. People interested in the Medigap policies which offer the most affordable rates are usually interested in Plan N.

What is a Medigap Plan B?

Medigap Plan B. Medigap Plan B covers everything that Plan A covers but it also picks up the Medicare Part A hospital deductible. Plan B is a Medigap plan that pays after Medicare pays. Don’t confuse it with Part B, which is part of your Original Medicare benefits that pays for outpatient medical.

What is the difference between Plan F and Plan G?

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. Plan G is only slightly different, so it is also a popular seller. When you compare Plans F and G side by side, you’ll immediately notice that Plan G has only one difference: the Part B deductible.

Does Medicare cover Plan A?

Medigap Plan A offers the most basic of all the Medigap plans. Even still, it will cover the 20% that Medicare doesn’t pay for on outpatient treatments. That’s arguably the most important piece of all Medigap plans. All Medicare insurance carriers must offer Plan A. However, some states do not require companies to offer it to people under age 65 on Medicare disability.

Is Medicare Supplement the same as Medigap?

This makes comparing Medicare Supplement plans pretty easy. ( Medicare Supplements and Medigap plans are the same thing) The Centers for Medicare and Medicaid Services updates the Medigap plans comparison chart every year, although most plans do not have benefit changes from year to year. Some Medigap plans will have higher premiums ...

Does Plan N cover excess charges?

Plan N offers lower premiums if you are willing to do a bit of cost-sharing. Unlike Plan F or G though, Plan N does not cover excess charges. You’ll want to read up on this and understand what that means before enrolling. For a list of Medicare supplement insurance companies, visit this page.

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

Reasons to Consider Changing Your Medicare Supplement Plan

As was mentioned earlier, when Medicare beneficiaries purchase a Medicare Supplement plan, the decision on which plan to purchase is based on the healthcare services you generally need at that time and your budget for purchasing coverage.

Is it Possible to avoid Medical Underwriting outside of the Open Enrollment Period?

The short answer is YES but you must be eligible under one of the following qualifiers:

Can I switch from a Medicare Supplement to a Medicare Advantage Plan?

Yes, you can switch from your Medigap plan to a Medicare Advantage plan between October 15 and December 7, which is the annual enrollment period.