Where do I enter the medical expense deduction on my taxes?

This deduction will be entered on your Form-1040 in a section separate from your other medical deductions on Form 1040-A. You’ll need to be truly self-employed, with no employees. The IRS lists a few additional qualifications that you’ll need to follow, but in general, “it can be one of the largest deductions you have”.

Can I deduct Medicare premiums from my taxes?

They do not impact your self-employment taxes, which include taxes to fund the Medicare and Social Security programs. So you’ll still pay the same amount in self-employment taxes, regardless of whether you deduct your Medicare premiums.

What medical expenses are included in a Medicare deductible?

Any medical expense you pay for out of pocket because it's not covered by Medicare or falls under your Medicare annual deductible is included. To claim any medical expenses at all, your expenses must exceed 7.5 percent of your adjusted gross income.

How much of my medical expenses can I claim on my taxes?

Keep in mind, however, that in order to claim your medical expenses your total bill must be valued at more than 7.5 percent of your adjusted gross income. Are Medicare Premiums Tax Deductible?

Are Medicare Part B premiums deducted from Social Security tax deductible?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Are Medicare withholdings tax deductible?

Is Medicare Tax Deductible? The Medicare taxes are also not deductible from your federal income taxes. There isn't a cap on the amount of earned income subject to the Medicare tax like there is for Social Security, so you won't have too much withheld and won't need to claim a refund.

Can you deduct Medicare premiums on Schedule C?

But now the IRS says that premiums for all forms of Medicare are deductible (Parts A, B, C, and D). You can use this deduction only if you own a business as a sole proprietor, partner in a partnership, limited liability company member, or S corporation shareholder who owns more than 2% of the company stock.

How do I deduct Social Security and Medicare taxes?

FICA Tax Withholding RatesThe Social Security (OASDI) withholding rate is gross pay times 6.2% up to the maximum pay level for that year. ... The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. ... For a total of 7.65% withheld, based on the employee's gross pay.

Where do I deduct Medicare Part B premiums?

If you've established your business as an S corporation, the corporation can either pay your Medicare premiums directly on your behalf (and count them as a business expense) or the corporation can reimburse you for the premiums, with the amount included in your gross wages reported on your W2, and you can then deduct ...

How do you deduct Medicare as a business expense?

As a business owner who falls into the self-employed health insurance deduction category, you could use your Medicare premiums as itemized deductions if:you or your spouse is eligible for health coverage from another employer, or.your business shows a tax loss for the year.

Can you deduct Medicare and supplemental insurance from your taxes?

Yes, your supplemental health insurance is deductible as a medical expense on Schedule A, Itemized Deductions, for Form 1040. You can deduct the amount that exceeds a certain percentage of your adjusted gross income, or AGI, and that depends on your age during the year.

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

Do Medicare premiums reduce taxable income?

Your monthly Medicare premiums are tax deductible. When you add them as an itemized healthcare deduction, you reduce your taxable income.

Are Medicare premiums tax deductible in 2021?

If you are itemizing your taxes because your annual medical costs exceeded 7.5% of your adjusted gross income, you can add your Medicare premiums a...

Can you deduct Medicare premiums from Social Security?

If you are enrolled in both Social Security and Part B Medicare, the Social Security Administration automatically deducts your Medicare premium fro...

Are Medicare Part B premiums deductible?

Yes, you can deduct your Medicare Part B premiums. However, it typically requires you to itemize your deductions instead of opting for the standard...

What insurance premiums are tax deductible?

Premiums for health insurance purchased through Medicare, Marketplace or COBRA are all tax deductible because they are all paid on an after-tax bas...

How much of your Medicare premiums are deductible?

Your unreimbursed medical and dental expenses, including premiums, deductibles, copayments and other Medicare expenses, may be deductible to the extent that they exceed 7.5% of your adjusted gross income.

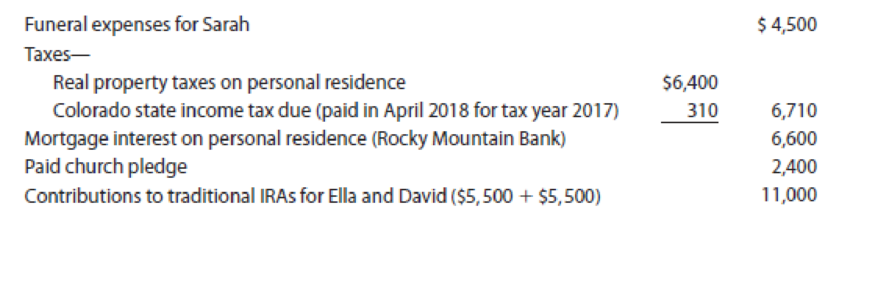

How much can you deduct for long term care insurance?

For tax year 2020, the maximum tax deduction for long-term care premiums for people ages 61 to 70 is $4,350 per person; for age 71 and up, the limit is $5,430.

Is long term care deductible on Medicare?

Other health care expenses may be deductible. Medicare recipients may incur a variety of medical expenses that their insurance does not cover, from long-term care to lodging during a trip to receive medical care. Some of these expenses may be tax deductible, within limits.

What is the standard deduction for Medicare Part B?

As of 2020, the standard deduction is $12,400 for single people and $24,800 for married couples filing jointly . This may mean that it no longer makes sense for some people to claim Medicare Part B premiums and other medical expenses on their taxes, since they'll save more simply taking the standard deduction.

What is the medical deduction for $50,000?

Now, 7.5 percent of $50,000 is $3,750 and your total medical bill for the year exceeds that. You can deduct the amount you paid that’s more than 7.5 percent of your AGI so here, you could deduct $6,000 minus $3,750 , which is $2,250 .

Can you deduct medical expenses on taxes?

The amount of medical expenses you can deduct on your taxes, however, depends on your adjusted gross income. Any medical expense you pay for out of pocket because it's not covered by Medicare or falls under your Medicare annual deductible is included.

Can you deduct Medicare Part C and Part D?

Brought to you by Sapling. In addition to Medicare Part B, you might also pay monthly premiums for Medicare Part C, also known as Medicare Advantage, and Part D for prescription drug coverage. The IRS allows you to deduct any of your out-of-pocket medical expenses, including the premiums you paid for Part C and Part D.

What is a contractual write off?

Contractual write off are those wherein the excess of billed amount over the carrier’s allowed amount is written off.

Can a Medicare provider bill a beneficiary?

A provider is prohibited from billing a Medicare beneficiary for any adjustment (Its a write off) amount identified with a CO group code, but may bill a beneficiary for an adjustment amount identified with a PR group code. Medicare contractors are permitted to use the following group codes:

What is medical expense deduction?

A tax deduction – like the well-known medical expense deduction – reduces the amount of money that you have to pay taxes on. Choosing to take the medical expense deduction gives you a write-off that will reduce, but not erase, the taxes that you owe.

Is Medicare Part B tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense. Considering a Medicare Plan?

Can you deduct medical expenses on taxes?

Follow the Rules to Deduct. However, you can only benefit from the medical expense deduction by following specific rules. You’ll need to file your taxes in a certain way, itemizing your deductions instead of choosing the standard deduction. Additionally, your medical expense deductions only begin to count after they surpass 10% ...