Is Medicare funded by taxes?

This money comes from the Medicare Trust Funds. Medicare Trust Funds Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed

Where does FDIC insurance money come from?

Medicare is a Federal program that is managed by the Centers for Medicare & Medicaid Services (CMS). The funds for the program come from a few different sources, with the primary source being FICA payroll taxes. These taxes are in addition to the 6.2% Social Security tax or OASDI tax that you will see withheld from your paycheck.

How does the federal government funds Medicaid?

Sep 10, 2020 · Medicare is funded through two trust funds held by the U.S. Treasury. Funding sources include premiums, payroll and self-employment taxes, trust fund interest, and money authorized by the...

Where does primary support for Medicare Part A come from?

The KFF further reveals that Medicare funding comes from three primary sources: General revenue: This part of Medicare funding comes primarily from federal income taxes that Americans pay. Payroll taxes: Employers who pay payroll taxes also contribute to …

Where do Medicare benefits come from?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries. Other sources include taxes on Social Security benefits, payments from states, and interest.Mar 20, 2015

Is Medicare funded by taxpayers?

Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis.

Is Medicare paid through Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How is Medicare funded by paid taxes?

Most people qualify for premium-free Part A, but those who don't will have premiums that cost up to $499 in 2022. That means Medicare is primarily funded by taxpayers through general federal tax revenue, payroll tax revenue from the Medicare tax, and premiums paid by its beneficiaries.

How is Medicare funded Australia?

Medicare funding The Australian government pays for Medicare through the Medicare levy. Working Australians pay the Medicare levy as part of their income tax. High income earners who don't have an appropriate level of private hospital insurance also pay a Medicare levy surcharge.Dec 10, 2021

How is Medicare funded in Canada?

Canada has a decentralized, universal, publicly funded health system called Canadian Medicare. Health care is funded and administered primarily by the country's 13 provinces and territories. Each has its own insurance plan, and each receives cash assistance from the federal government on a per-capita basis.Jun 5, 2020

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Is Part D premium automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

How much does Medicare take out of my Social Security check?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Is Medicare fully funded?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Who administers funds for Medicare?

CMSThe federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, and the Children's Health Insurance Program (CHIP).

How is Medicare paid for in the US?

Medicare is funded through two trust funds held by the U.S. Treasury. Funding sources include premiums, payroll and self-employment taxes, trust fund interest, and money authorized by the government.Sep 10, 2020

How is Medicare funded?

Medicare is funded through two trust funds held by the U.S. Treasury. Funding sources include premiums, payroll and self-employment taxes, trust fund interest, and money authorized by the government.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How much is Medicare spending in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion. This article looks at the ways in which Medicare is funded. It also discusses changes in Medicare costs.

When was the HI trust fund established?

Taxes paid by employers, employees, and self-employed people provide money for the HI trust fund, which was founded in 1965 . The trust fund also garners the interest earned on its investments, income taxes from some Social Security benefits, and income from Medicare Part A premiums.

What is SMI trust fund?

The SMI trust fund covers the services offered by Medicare Part B, a portion of Part D, and some of the Medicare program’s administrative costs. Medicare Part B includes outpatient services, such as doctor’s visits, lab tests, certain cancer screenings and preventative care, and ambulance transport.

What Is Medicare?

The U.S. government created Medicare to offer health care insurance for retired Americans. Until the Affordable Care Act went into effect, many citizens could only receive health insurance through their employers.

How Is Medicare Funded?

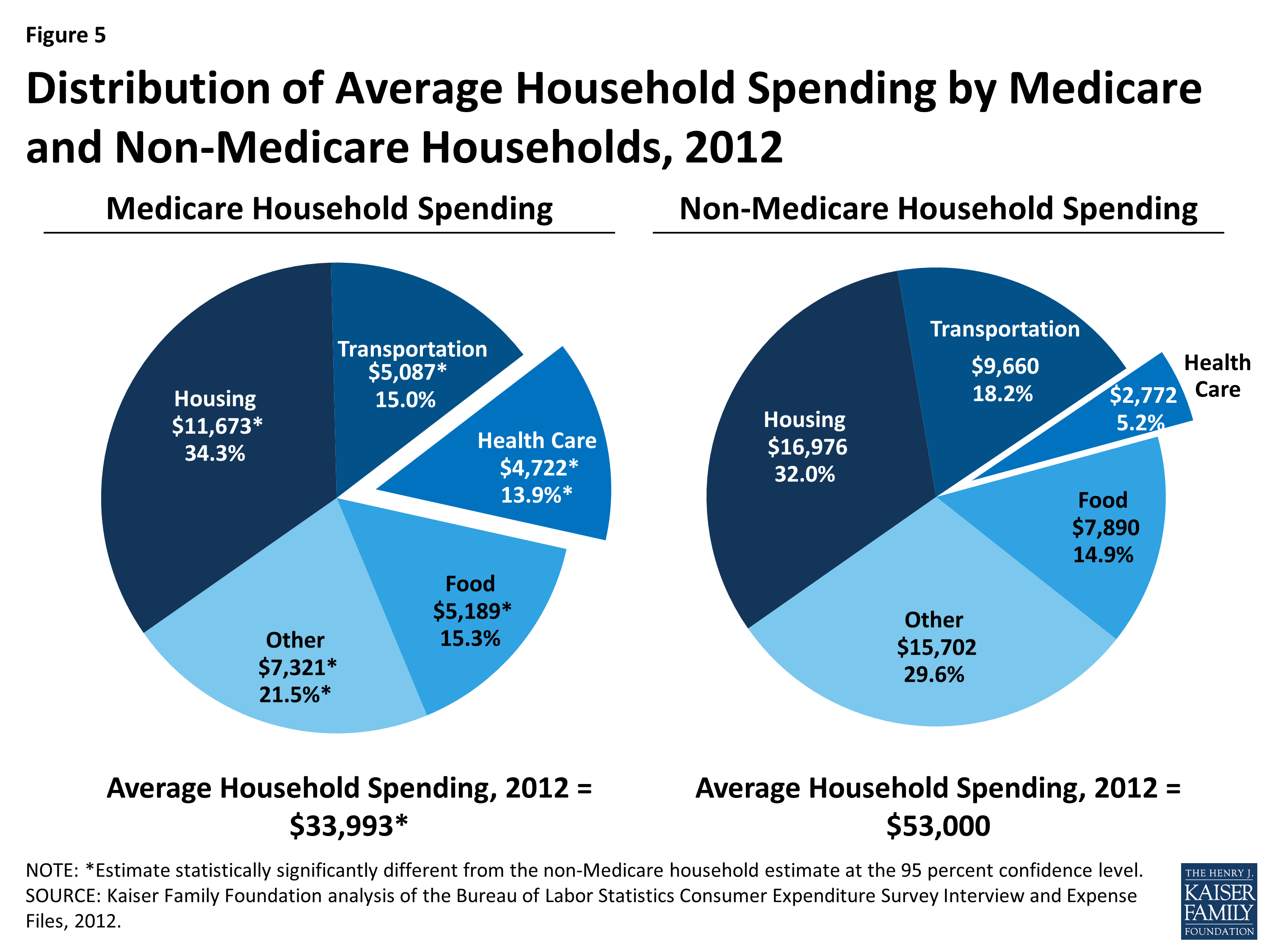

According to the Henry J. Kaiser Family Foundation (KFF), spending on Medicare accounted for 15 percent of the federal budget in 2015. The KFF further reveals that Medicare funding comes from three primary sources:

Will Medicare Funding Run Out?

Many people worry that Medicare funding will run out. However, in its current status, Medicare will be able to fund Part A health care expenses for beneficiaries through 2028. Additionally, the program can adjust for inflation and increase deductions to fund the program well into the 2030 decade.

How Can You Protect Your Financial Future?

Whether you’re enrolling in a Medicare program now or planning to in the future, you can take advantage of supplemental health insurance to make sure that your health care costs remain covered. Americans have plenty of options to protect themselves against health care crises.

How many Americans are covered by Medicare?

Tens of millions of Americans participate in Medicare coverage, and many more expect to take advantage of the program in the future. In order to ensure its continuing viability, it's important to understand where Medicare gets its money.

When will Medicare run out of money?

One concern about Medicare Part A is that the Medicare Hospital Insurance Trust Fund is expected to run out of money in 2030.

Why is Medicare important?

Medicare is a vital program for millions of Americans, many of whom wouldn't be able to afford to pay their healthcare costs without it. Ensuring stable funding for the long run is crucial in order to continuing meeting this need and keeping Medicare financially strong for decades to come.

How much does Medicare pay for self employed?

Self-employed workers pay the full 2.9% themselves. Unlike with Social Security, which imposes a wage base limit above which Social Security payroll taxes are no longer owed, Medicare charges its payroll tax on an unlimited amount of earned income.

Does Medicare cover outpatients?

By contrast, Medicare outpatient and drug coverage don't raise the same concerns, because the government already goes beyond its payroll sources and provides money from general revenue to help fund the vast majority of the other offering. However, increases in those costs will simply translate to greater drains on those resources, and imposing higher premiums on participants will also cause financial hardship to many who rely on Medicare in order to get the healthcare coverage they need.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more ...

Does Medicare cover Social Security?

However, the premiums aren't designed to cover the bulk of the costs of those parts of the Medicare program. Finally, Medicare has a source of funding that Social Security doesn't: the general fund of the U.S. federal budget.

How does Medicare money come from?

The money in the Medicare Trust Funds comes from a variety of sources: 1 The Medicare tax, a payroll tax paid by employers and employees 2 General federal tax revenue, as appropriated by Congress 3 Income taxes paid on Social Security benefits 4 Premiums paid by Medicare beneficiaries 5 Interest earned on the trust fund investments

What is Medicare funded by?

Medicare is funded by federal tax revenue, payroll tax revenue (the Medicare tax), and premiums paid by Medicare beneficiaries. The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised.

How many parts does Medicare have?

There are four parts of Medicare, each of which covers different types of health care expenses. The source of funding for each part of Medicare is different. Technically, Medicare funding comes from the Medicare Trust Funds. Those are two separate funds — the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) ...

When will Medicare run out of money?

The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised. Medicare is a federally run health insurance program that serves seniors and people living with certain disabilities. There are four parts of Medicare, each of which covers different types of health care expenses.

What is the Medicare trust fund?

The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’ s investments.

How much will Medicare pay in 2021?

All workers pay at least 1.45% of their incomes in Medicare taxes. In 2021, Medicare Part B recipients pay monthly premiums of between $148.50 to $504.90. Most people qualify for premium-free Part A, but those who don’t will have premiums worth up to $471.

What is the FICA tax?

There are two FICA taxes: The Hospital Insurance (HI) tax funds Medicare Part A , so it’s commonly known as the Medicare tax.