To enter the Medicare Part B premium along with any other qualified medical expenses Start by clicking on the Federal Taxes tab on the left side of your screen. Selection Deductions & Credits at the top of the screen.

Where do Medicare Part B and d go on a tax return?

Medicare Part B and D go under medical expenses as insurance premiums on a Schedule A (itemized deductions). You have to itemize your deductions in order to deduct them.

How do I Enter my Medicare premiums on my taxes?

First, when you enter your SSA-1099 to report your social security benefits, you'll see entry boxes for the various Medicare types. When you enter your premiums on this page, TurboTax will automatically carry them to the itemized deduction section for inclusion with Medical Expenses.

Are Medicare Part B premiums tax-deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

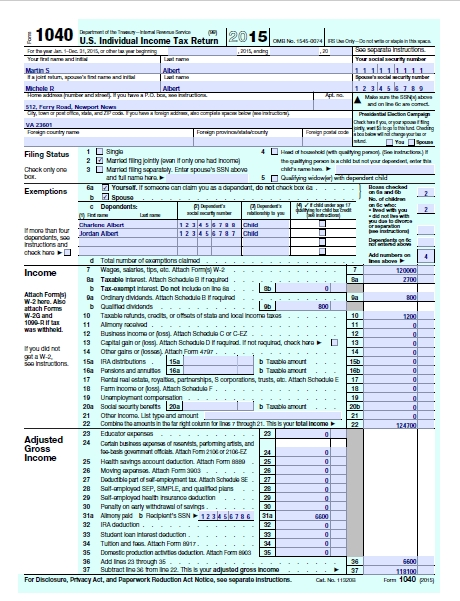

Where do I enter a medical deduction on my 1040 Form?

This deduction will be entered on your Form-1040 in a section separate from your other medical deductions on Form 1040-A. You’ll need to be truly self-employed, with no employees.

Where do I enter 1095b on tax return?

Form 1095-B is not included in your tax return. Please keep a copy of form 1095-B with your tax records for future reference. If you have any questions about your 1095-B form, please contact the issuer of the form.

Where does Medicare go on tax return?

Your Form 1095-B shows your Medicare Part A information, and can be used to verify that you had qualifying health coverage for part of

Does Medicare Part B send a 1095?

If you were enrolled in Medicare: For example, if you were enrolled in the IYC Access Plan and your Medicare Part A and Part B became effective on May 1st, your insurance provider will send you a 1095 form reporting your coverage from January through April.

Do I need my 1095-B to file taxes?

You do not need 1095-B form to file taxes. It is for your records. IRS 1095-B form is your proof of the month(s) during the prior year that you received qualifying health coverage.

Is Medicare Part B premiums tax-deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is the Medicare Part B deductible?

$233Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Do I need a 1095b on Medicare?

coverage is considered to be qualifying health coverage under the Affordable Care Act. If you have Part A, you can ask Medicare to send you an IRS Form 1095-B. In general, you don't need this form to file your federal taxes.

What is the difference between a 1095-B and 1095-C?

Form 1095-B – Individuals who have health coverage outside of the Marketplace will get this form (except for employees of applicable large employers that provide self-insured coverage, who will receive Form 1095-C instead). Form 1095-C - Individuals who work full-time for applicable large employers will get this form.

Are 1095b required for 2021?

You no longer have to file the information from your Form 1095-B on your tax return as the federal mandate for having health insurance ended with 2019 returns. Again, you do not have to file Form 1095-B on your 2021 Tax Return. If you have received a 1095-B from your employer, you can just keep a copy for your records.

Where do I enter my 1095-B on TurboTax?

There is no place to enter the 1095-B in TurboTax. Just file it and forget it.

Are 1095-B required for 2019?

Statements Furnished to Individuals Filers of Form 1095-B must furnish a copy by March 2, 2020, to the person identified as the “responsible individual” on the form for coverage in 2019. However, the IRS will not impose a penalty for failure to furnish a copy of Form 1095-B if certain conditions are met.

What do I do with a 1095-B?

The Form 1095-B is used as proof of Minimum Essential Coverage (MEC) when filing your state and/or federal taxes. It should be kept with your other tax information in the event the Internal Revenue Service (IRS) or Franchise Tax Board (FTB) requires you to provide it as proof of your health care coverage.

What is the standard deduction for Medicare Part B?

As of 2020, the standard deduction is $12,400 for single people and $24,800 for married couples filing jointly . This may mean that it no longer makes sense for some people to claim Medicare Part B premiums and other medical expenses on their taxes, since they'll save more simply taking the standard deduction.

What is the medical deduction for $50,000?

Now, 7.5 percent of $50,000 is $3,750 and your total medical bill for the year exceeds that. You can deduct the amount you paid that’s more than 7.5 percent of your AGI so here, you could deduct $6,000 minus $3,750 , which is $2,250 .

Can you deduct medical expenses on taxes?

The amount of medical expenses you can deduct on your taxes, however, depends on your adjusted gross income. Any medical expense you pay for out of pocket because it's not covered by Medicare or falls under your Medicare annual deductible is included.

Can you deduct Medicare Part C and Part D?

Brought to you by Sapling. In addition to Medicare Part B, you might also pay monthly premiums for Medicare Part C, also known as Medicare Advantage, and Part D for prescription drug coverage. The IRS allows you to deduct any of your out-of-pocket medical expenses, including the premiums you paid for Part C and Part D.

What is medical expense deduction?

A tax deduction – like the well-known medical expense deduction – reduces the amount of money that you have to pay taxes on. Choosing to take the medical expense deduction gives you a write-off that will reduce, but not erase, the taxes that you owe.

Is Medicare Part B tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense. Considering a Medicare Plan?

Can you deduct medical expenses on taxes?

Follow the Rules to Deduct. However, you can only benefit from the medical expense deduction by following specific rules. You’ll need to file your taxes in a certain way, itemizing your deductions instead of choosing the standard deduction. Additionally, your medical expense deductions only begin to count after they surpass 10% ...

Self-employed health insurance deduction for Medicare premiums

Self-employed people (who earn a profit from their self-employment) are allowed to deduct their health insurance premiums on Schedule 1 of the 1040, as an “above the line” deduction — which means it lowers their AGI.

Above-the-line deduction for people who are self-employed

If you’re self-employed, the self-employed health insurance deduction — putting your Medicare premiums on Schedule 1 of your 1040 — is the most direct way to reduce your tax burden. And as noted above, this is an “above-the-line” deduction, which means it reduces your adjusted gross income.

Additional considerations

So, let’s review: You’re self-employed, your business made money (congratulations!), and you’re ready to file. Here are few more things to remember before you get started.

Another alternative: Using your HSA funds to pay Medicare premiums

If you have a health savings account (HSA) , know that you can withdraw tax-free money from the account and use it to pay your premiums for Medicare Parts A, B, C, and D (but not Medigap premiums). This is an alternative to deducting your premiums on your tax return, since you can’t do both.

What is a 1095-B?

The 1095-B Qualifying Health Coverage Notice is a tax form that was developed in response to a provision of the 2010 Affordable Care Act (ACA). The ACA was phased in over several years, and in 2014, everyone was required to have health insurance through the individual mandate provision. If you had Medicare Part A or Medicare Part C, ...

What happens if you don't have Medicare?

If you had Medicare Part A or Medicare Part C, you met the individual mandate. If you didn’t have health insurance coverage, though, you were subject to a penalty fee, which was calculated as a percentage of your income. In 2019, the U.S. Department of Justice and federal appeals courts ruled that the individual mandate was unconstitutional.

When is the ACA decision due?

A decision on that question is due later in 2020.

Do you get a 1095B form if you have Medicare?

Here’s what you need to know about the 1095-B form.

Is Medicare Part A essential?

Medicare Part A and Medicare Part C were considered minimum essential coverage under the ACA. If you have one of these plans, the form was sent to prove compliance with the individual mandate and minimal essential coverage requirements.

How many spaces are there in Schedule B?

Schedule B is divided into the 3 months that make up a quarter of a year. Each month has 31 numbered spaces that correspond to the dates of a typical month. Enter your tax liabilities in the spaces that correspond to the dates you paid wages to your employees, not the date payroll liabilities were accrued or deposits were made.

Why do we need Schedule B?

You’re required to give us the information. We need it to ensure that you’re complying with these laws and to allow us to figure and collect the right amount of tax.

What happens if you file a late 941-X?

If you owe tax and are filing a late Form 941-X, that is, after the due date of the return for the return period in which you discovered the error, you must file an amended Schedule B with Form 941-X. Otherwise, the IRS may assess an "averaged" FTD penalty.

Do employers have to pay Medicare and Social Security taxes?

Federal law also requires employers to pay any liability for the employer share of social security and Medicare taxes. This share of social security and Medicare taxes isn’t withheld from employees. On Schedule B, list your tax liability for each day. Your tax liability is based on the dates wages were paid.

Can you file an amended Schedule B if you have a 941-X?

If you’re filing an amended Schedule B , don’t include the tax increase reported on Form 941-X.

Is Schedule B the same as 941?

Schedule B is filed with Form 941. Therefore, the due date of Schedule B is the same as the due date for the applicable Form 941. In some situations, Schedule B may be filed with Form 941-X. See Form 941-X, later, for details. Don’t file Schedule B as an attachment to Form 944, Employer's ANNUAL Federal Tax Return.

Can you file a Schedule B if you have been assessed an FTD penalty for a quarter?

When completing Schedule B for this situation, only enter the monthly totals. The daily entries aren’t required.