Under the Medicare Part D prescription benefit almost all of your drugs costs will be paid for by Medicare instead of Medicaid. You will get prescription drug coverage from Medicare and pay a small Medicare copayment for each prescription.

Full Answer

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

When is the deadline for Medicare Part D?

Last week, CMS announced proposed rules seeking to increase consumer protections and reduce health care disparities in Medicare Advantage (MA) and Part D, with a strong emphasis on individuals who are dually eligible for Medicare and Medicaid.

Who is eligible for Medicare Part D?

Medicare Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don ...

Who offers Medicare Part D plans?

Based in Orange, California, Alignment Health Plan is the first Medicare Advantage plan to offer the Galleri test as a complement ... according to the American Cancer Society. This is in large part because the majority of cancers are found too late when ...

How do you pay for Part D?

You pay your Part D IRMAA directly to Medicare, not to your plan or employer. You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

Is Part D paid through Social Security?

No. To be enrolled on Part D, you must enroll through one of the prescription drug companies that offers the Medicare Part D plan or directly through Medicare at www.Medicare.gov. You can pay premiums directly to the company, set up a bank draft, or have the monthly premium deducted from your Social Security check.

How are Medicare Part D premiums paid?

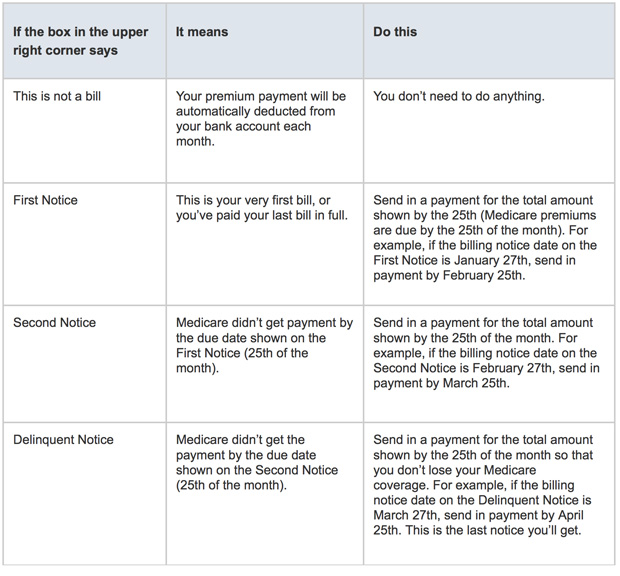

In cases where premiums weren't withheld from your Social Security payment until 1 or 2 months after you enrolled in a Medicare drug plan, you'll get a bill for the months your drug plan's premiums weren't withheld. You'll need to pay your drug plan's monthly premium directly to your plan.

How do you pay Medicare premiums?

4 ways to pay your Medicare premium bill:Pay online through your secure Medicare account (fastest way to pay). ... Sign up for Medicare Easy Pay. ... Pay directly from your savings or checking account through your bank's online bill payment service. ... Mail your payment to Medicare.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is there an out-of-pocket maximum for Medicare Part D?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Is Medicare Part D deductible on taxes?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

How much does Part D cost?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

How many premiums do you have to make for Medigap?

If you join a Medigap policy and a Medicare drug plan offered by the same company, you may need to make 2 separate premium payments for your coverage. Contact your insurance company for more details.

How to stop premium deductions from Social Security?

If you want to stop premium deductions and get billed directly, contact your plan.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you pay extra for a Social Security plan?

The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check. If the amount isn’t taken from your check, you’ll get a bill from Medicare or the Railroad Retirement Board.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

How to compare Medicare plans in zip code?

You’ll want to go to medicare.gov’s Medicare Plan Finder, an online tool that allows you to compare Part D plans available in your ZIP code.

What is the Medicare call center number?

Medicare has a call center that’s open seven days a week, 24 hours a day. The toll-free number is 800-MEDICARE (800-633-4227). You may also contact SHIP. You can find contact information for SHIP in your state at Medicare.gov.

What happens if my Medicare plan is no longer available?

If your plan is no longer available, you will receive a letter from the insurer about the termination. You will then need to pick another plan. However, Medicare officials and experts strongly suggest that you review other available Part D plans — even if you are satisfied with your current plan.

Does Medicare pay for outpatient drugs?

Part D pays for outpatient prescription drugs. But if you go to a doctor’s office or other outpatient facility to receive, for example, chemotherapy, dialysis or other medicines that are injected or given intravenously, Medicare Part B — not Part D — kicks in to pay for those treatments. Part D does cover some self-injected medicines, such as insulin for diabetes.

Does Medicare cover prescription drugs?

No. Most Medicare Advantage plans cover prescription drugs in addition to hospital care and doctor visits. You can see which Medicare Advantage plans include drug coverage at medicare.gov.

Does Medicare pay for cough syrup?

Getty Images. Medicare Part D does not pay for over-the-counter medications like cough syrup or antacids. It also doesn't cover some prescription drugs, such as Viagra when it is used for erectile dysfunction.

Does Part D cover over the counter medications?

Part D does not pay for over-the-counter medications like cough syrup or antacids. It also doesn’t cover some prescription drugs, such as Viagra, when it is used for erectile dysfunction; medicines used to help you grow hair; medicines that help you gain or lose weight; or most prescription vitamins.

What is Medicare Extra Help?

Medicare Extra Help is a program that helps people with limited income and financial resources pay for Medicare Part D costs such as premiums, deductibles and copayments. If you qualify for both Medicaid and Medicare, you automatically qualify for Extra Help. Extra Help is also referred to as the Part D Low-Income Subsidy (LIS).

Can you get Medicare and Medicaid?

If you are eligible for both Medicare and Medicaid, you may also be eligible to join a Dual-eligible Special Needs Plan (D-SNP). This is a certain type of Medicare Advantage plan that offers all of the same coverage as Medicare Part A and Part B along with additional benefits that are tailored to the needs of someone with limited income and resources.

Does Medicaid work with Medicare?

Medicaid works with Medicare in several ways, and Medicaid works particularly close with Medicare Part D.

Can you get Medicare Part D?

Beneficiaries who are eligible for both Medicaid and Medicare can get Part D prescription drug coverage through the Medicare Extra Help program or a Medicare Special Needs Plan. We explain more about each of those programs below.