Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare Parts. Medicare is divided into four Parts: A, B, C and D. Part A covers hospital, skilled nursing, and hospice

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

Where does the money for Medicare come from?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds. Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury.

What is Medicare and how does it work?

It also promotes early diagnosis by encouraging better preventive care for all insured people, including and especially seniors. As a social insurance policy on the nation and on individuals, Medicare works on the premise that everyone who pays into the system will reap the benefits of affordable care. Obamacare was built on a similar premise.

What is the history of Medicare?

Like any social program, Medicare traces its roots back far beyond the law that put it into place in the mid-1960s. In the early years of the 20th century, the United States government worked with state governments, lobbyists, union representatives and others to form programs that would later evolve into the various social programs we know today.

What does Original Medicare cover?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How is Medicare funded now?

The Medicare program is primarily funded through a combination of payroll taxes, general revenues and premiums paid by beneficiaries. Other sources of revenues include taxes on Social Security benefits, payments from states and interest on payments and investments.

Is Medicare funded by taxpayers?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

Is Medicare subsidized by the federal government?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury.

Is Medicare provided by Social Security?

Medicare Part A (hospital insurance) You're eligible for Part A at no cost at age 65 if one of the following applies: • You receive or are eligible to receive benefits from Social Security or the Railroad Retirement Board (RRB).

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Who controls Medicare premiums?

The State of California participates in a buy-in agreement with the Centers for Medicare and Medicaid Services (CMS), whereby Medi-Cal automatically pays Medicare Part B premiums for all Medi-Cal beneficiaries who have Medicare Part B entitlement as reported by Social Security Administration (SSA).

Who controls Medicare?

the Centers for Medicare & Medicaid ServicesMedicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Is Medicare funded by private insurance companies?

Medicare is funded through a mix of general revenue and the Medicare levy. The Medicare levy is currently set at 1.5% of taxable income with an additional surcharge of 1% for high-income earners without private health insurance cover.

How is healthcare funded in the US?

There are three main funding sources for health care in the United States: the government, private health insurers and individuals. Between Medicaid, Medicare and the other health care programs it runs, the federal government covers just about half of all medical spending.

How much does Medicare take from Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

What's the difference between Medicare and Social Security?

Social Security offers retirement, disability, and survivors benefits. Medicare provides health insurance. Because these services are often related, you may not know which agency to contact for help.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What is the benefit of Medicare?

One of the primary benefits of Medicare as a social program is that the financial risk is distributed across the working population. This means that the nation as a whole assumes financial risk for factors that might raise someone’s premiums substantially.

How is Medicare funded?

While Medicare is funded primarily through taxes, there are actually several sources of funding. It’s important to understand the financing behind Medicare because the future of the program largely depends on continued funding from individual taxes and other sources. Social programs only succeed in light of their perceived benefit versus the amount of money it takes to sustain them. These programs fail when they lose financial and moral support. In this section, we’ll give you a basic overview of how Medicare is funded so that you’re familiar with its impact on the economy and the healthcare industry as a whole.

How long did it take for Medicare to become law?

However, the path to Medicare wasn’t always smooth sailing. A bill for socialized healthcare was first introduced in 1957, and it took eight years for Medicare to become law. The Johnson administration and lawmakers at the time debated extensively on the concept.

What changes have affected Medicare?

One of the changes that had the biggest impact on Medicare was the decision to include people with certain disabilities as beneficiaries of the program. People with end-stage renal disease (ESRD) or Lou Gehrig’s disease can receive Medicare benefits if they also receive Social Security Disability Insurance.

How much does an employer pay for Medicare?

For people who work for an employer, the employer pays half of the Medicare tax while the worker pays the other half. The Medicare tax rate is 2.9 percent, which means that an employer pays 1.45 percent while the remaining 1.45 percent is deducted from the employee’s wages.

What is Medicare's coverage for speech therapy?

These forms of care help seniors, particularly those with disabilities, to achieve alternate forms of medical treatments.

When did Medicare become law?

A year and a half after he took office, Medicare was signed into law, on July 30, 1965, along with Medicaid. However, the path to Medicare wasn’t always smooth sailing.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What Is Medicare?

The U.S. government created Medicare to offer health care insurance for retired Americans. Until the Affordable Care Act went into effect, many citizens could only receive health insurance through their employers.

How Is Medicare Funded?

According to the Henry J. Kaiser Family Foundation (KFF), spending on Medicare accounted for 15 percent of the federal budget in 2015. The KFF further reveals that Medicare funding comes from three primary sources:

Will Medicare Funding Run Out?

Many people worry that Medicare funding will run out. However, in its current status, Medicare will be able to fund Part A health care expenses for beneficiaries through 2028. Additionally, the program can adjust for inflation and increase deductions to fund the program well into the 2030 decade.

How Can You Protect Your Financial Future?

Whether you’re enrolling in a Medicare program now or planning to in the future, you can take advantage of supplemental health insurance to make sure that your health care costs remain covered. Americans have plenty of options to protect themselves against health care crises.

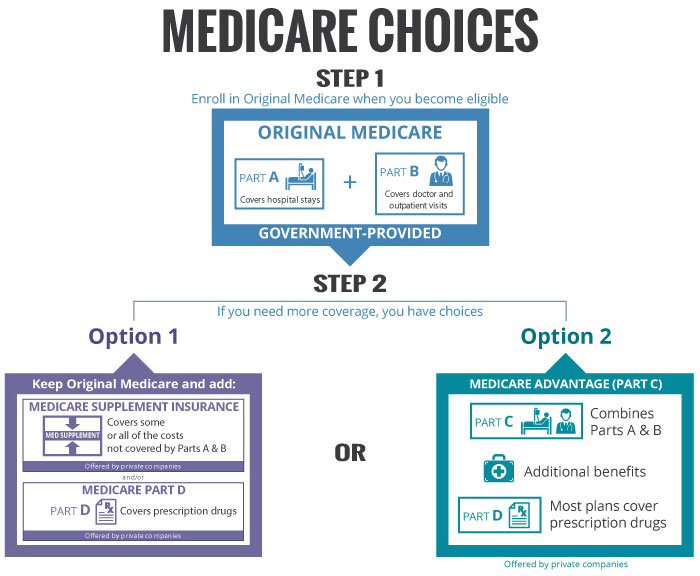

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

Parts of Medicare

Learn the parts of Medicare and what they cover. Get familiar with other terms and the difference between Medicare and Medicaid.

General costs

Discover what cost words mean and what you’ll pay for each part of Medicare.

How Medicare works

Follow 2 steps to set up your Medicare coverage. Find out how Original Medicare and Medicare Advantage work.

Working past 65

Find out what to do if you’re still working & how to get Medicare when you retire.

Why is Medicare important?

Medicare is a vital program for millions of Americans, many of whom wouldn't be able to afford to pay their healthcare costs without it. Ensuring stable funding for the long run is crucial in order to continuing meeting this need and keeping Medicare financially strong for decades to come.

How many Americans are covered by Medicare?

Tens of millions of Americans participate in Medicare coverage, and many more expect to take advantage of the program in the future. In order to ensure its continuing viability, it's important to understand where Medicare gets its money.

What is Medicare Supplemental Medical Insurance Trust Fund?

To some extent, the Medicare Supplemental Medical Insurance Trust Funds provide protection against future shortfalls. Yet because those funds are supported not by payroll taxes but rather from general revenue, the role of the SMI Trust Funds is different from the HI Trust Fund or the Social Security Trust Fund.

How much does Medicare pay for self employed?

Self-employed workers pay the full 2.9% themselves. Unlike with Social Security, which imposes a wage base limit above which Social Security payroll taxes are no longer owed, Medicare charges its payroll tax on an unlimited amount of earned income.

What is the key variable for Medicare?

The key variable for Medicare is the pace at which healthcare costs rise. Recent slowdowns in the growth rate for medical costs have given the program greater long-term viability. Yet in the past, changes in costs have been cyclical in nature.

When will Medicare run out of money?

One concern about Medicare Part A is that the Medicare Hospital Insurance Trust Fund is expected to run out of money in 2030.

Is Medicare going to run out of money in 2030?

One concern about Medicare Part A is that the Medicare Hospital Insurance Trust Fund is expected to run out of money in 2030. A rising number of baby boomers is ramping up the need for healthcare spending from Medicare, and a smaller number of workers means fewer people are coming with money to pay for baby boomers' needs.

How many credits do you need to work to get Medicare?

You’re eligible to enroll in Medicare Part A and pay nothing for your premium if you’re age 65 or older and one of these situations applies: You’ve earned at least 40 Social Security work credits. You earn 4 work credits each year you work and pay taxes.

How much is Medicare Part B in 2021?

Your Part B premiums will be automatically deducted from your total benefit check in this case. You’ll typically pay the standard Part B premium, which is $148.50 in 2021. However, you might have a higher or lower premium amount ...

What is Medicare Part C and Part D?

Medicare Part C and Part D. Medicare Part C (Medicare Advantage) and Medicare Part D (prescription drug coverage) plans are sold by private companies that contract with Medicare. Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services.

Why do people pay less for Part B?

Some people will pay less because the cost increase of the Part B premium is larger than the cost-of-living increase to Social Security benefits. You might also be eligible to receive Part B at a lower cost — or even for free — if you have a limited income.

Can I use my Social Security to pay my Medicare premiums?

Can I use Social Security benefits to pay my Medicare premiums? Your Social Security benefits can be used to pay some of your Medicare premiums . In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits.

Can I deduct healthcare expenses?

Depending on your premiums and other healthcare spending, you might not reach this number. If your spending is less than 7.5 percent of your AGI, you can’t deduct any healthcare expenses, including premiums. However, if your healthcare spending is more than 7.5 percent of your income, you can deduct it.

Does Medicare cover prescription drugs?

Medicare Part D plans cover prescription drugs. Part C and Part D plans are optional. If you do want either part, you’ll also have multiple options at various price points. You can shop for Part C and Part D plans in your area on the Medicare website.