Full Answer

Where do social security and Medicare taxes go?

You can take steps now to protect your income by being strategic about your Medicare coverage and planning ahead for how higher benefits could affect your taxes ... there are some things you should do now. The Social Security Administration will provide ...

Where to get help paying your Medicare costs?

Your Medicare costs

- Get help paying costs. Learn about programs that may help you save money on medical and drug costs.

- Part A costs. Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

- Part B costs. ...

- Costs for Medicare health plans. ...

- Compare procedure costs. ...

- Ways to pay Part A & Part B premiums. ...

- Costs at a glance. ...

Where do Medicaid dollars go?

- Disproportionate Share Hospital (DSH) Payments

- Federal Medical Assistance Percentages (FMAP)

- Enhanced Federal Medical Assistance Percentages (eFMAP)

Where can you go to get a free tax return?

To register and use this service, you need:

- your SSN, date of birth, filing status and mailing address from latest tax return,

- access to your email account,

- your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan, and

- a mobile phone with your name on the account.

Where does the Medicare tax go?

Social Security taxes fund Social Security benefits and the Medicare tax goes to pay for the Medicare Hospital Insurance (HI) that you'll get when you're a senior.

Is Medicare tax a payroll expense?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

Do you include Medicare tax on tax return?

Yes. Individuals will calculate Additional Medicare Tax liability on their individual income tax returns (Form 1040 or 1040-SR),using Form 8959, Additional Medicare Tax. Individuals will also report Additional Medicare Tax withheld by their employers on their individual income tax returns.

What type of tax is Medicare?

The Medicare tax is a payroll tax that applies to all earned income and supports your health coverage when you become eligible for Medicare.

Does Social Security and Medicare count as federal tax?

The Social Security tax is a tax on earned income, and it is separate from federal income taxes. The Social Security tax only applies to earned income, like your wages, salaries and bonuses, but not to unearned income like interest, dividends or capital gains.

Where do you put Medicare tax withheld on 1040?

Line 5a in Part I of Form 1040-SS. Line 5a in Part I of Form 1040-PR. Use Part V to figure the amount of Additional Medicare Tax on wages and RRTA compensation withheld by your employer.

Where does additional Medicare tax go on W-2?

This new tax is calculated on Federal Form 8959 Additional Medicare Tax and that form also reconciles the amount of tax owed against what an employer has already withheld from an employee's paycheck (and so is included as withholding in box 6 of the Form W-2 along with the regular Medicare tax withholding).

What is Medicare tax withheld on W-2?

Box 6: Medicare Tax Withheld. This amount represents the total amount withheld from your paycheck for Medicare taxes. The Medicare tax rate is 1.45%, and a matching amount of 1.45% is paid by W&M. Once you earn $200,000 annually, there is an additional . 9% that the employee pays which makes a total of 2.35%.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

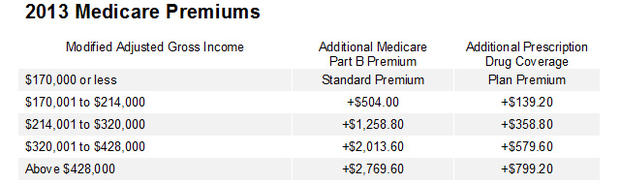

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Why is accrual accounting important for Medicare?

This method is important to the government, as it reconciles expenses to the revenues they generate, thereby helping the government accurately assess the cost of providing Medicare services.

What is accrual basis in Medicare?

The accrual basis of accounting means that you need to recognize (record) revenue when it is earned, not when payment is received.

How to use accrual accounting in QuickBooks?

You begin by entering the date on the bill (or better yet the period to which the bill relates) and then use the “Pay Bills” feature to write the checks when payment is due. Using this method, you have recorded the expense in the period in which it was incurred, thus “realizing” the expense according to the accrual method.

When do you record accrual based expenses?

Accrual-based accounting requires that you record these expenses on the day the payroll period ends (15th and last day of the month) and offset these expenses to a liability account (such as “Wages Payable” and “Payroll Taxes Payable”). When you pay your employees, you would then offset these liabilities.

What does it mean to recognize revenue and expenses?

To “recognize” revenues or expenses simply means to record them in the books. One “realizes” revenues or expenses when they occur, or when you find out about them.

When is revenue recorded in accrual basis?

Under the accrual basis of accounting, revenue is recorded in the period when it is earned, regardless of when it is collected, and expenditures for expense and asset items are recorded in the period in which they are incurred, regardless of when they are paid. Most people are innately familiar with the cash basis of accounting, ...

Do home care executives use accrual accounting?

If you are like many home care executives, you are familiar with the concept of “accrual-based accounting;” however, you may not be as familiar with the essential details. All too often, we find people wondering why they need to use accrual-based accounting. Some wonder what “accrual” is and how it works.

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

Is MAGI the same as AGI?

Most taxpayers will find that their MAGIs are the same as their AGIs, but consult with a tax professional if you're unsure. Your MAGI adds certain deductions back to your AGI. Your AGI appears on line 8b of the 2019 Form 1040. This Form 1040 has been revised from the 2018 version and from previous tax years.

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

What is an expense on an income statement?

A company records an expense on the income statement for the employer matching portion of any Social Security and Medicare taxes, as well as the entire amount of any federal and state unemployment taxes (since they are paid by the company and not the employees).

Is payroll tax a short term liability?

A company also incurs a liability for payroll taxes, which appears as a short-term liability on its balance sheet. This liability is comprised of all the taxes just noted (until they are paid), plus the amount of any Social Security and Medicare taxes that are withheld from the pay of employees.

Can payroll taxes be charged to a single account?

They may be charged to a single payroll taxes account, or charged to a payroll taxes account within each department. If the latter is the case, some part of the taxes will likely be charged to the production department, in which case you have the option of including them in an overhead cost pool, from which they can be allocated to the cost ...

Is Social Security a liability?

Thus, the employee-paid portions of Social Security and Medicare taxes are not an expense to the company ( and so do not appear on the income statement), but they are a liability ...