Hard copy forms may be available from Intermediaries, Carriers, State Agencies, local Social Security Offices or End Stage Renal Disease Networks that service your State.

How do I access my Medicare Information?

Create an account to access your Medicare information anytime. You can also: Add your prescriptions and pharmacies to help you better compare health and drug plans in your area. Sign up to get your yearly "Medicare & You" handbook and claims statements, called "Medicare Summary Notices," electronically.

How do I get my social security or Medicare tax refunds?

If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement.

How do I get a copy of my Original Medicare claim?

Sign up to get your yearly "Medicare & You" handbook and claims statements, called "Medicare Summary Notices," electronically. View your Original Medicare claims as soon as they're processed. Print a copy of your official Medicare card. See a list of preventive services you're eligible to get in Original Medicare.

Does Medicare provide a 1095-A form?

Since this form applies only to insurance coverage purchased through the Marketplace, Medicare and Medicare Advantage programs do not provide a 1095-A form. What Form Can You Expect with Medicare Coverage?

How do I get my 1099 from Medicare?

Call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. People can reference CMS Product No. 11865 when calling Medicare with questions about this notice.

Where does Medicare go on tax return?

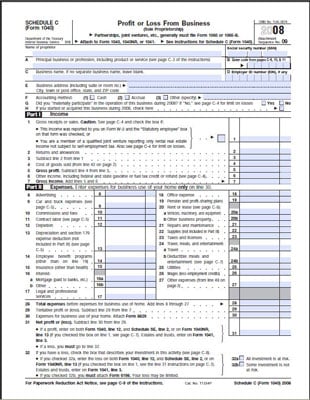

If you're self-employed, the self-employed health insurance deduction — putting your Medicare premiums on Schedule 1 of your 1040 — is the most direct way to reduce your tax burden.

Does Medicare send out 1099 HC?

Are carriers/employers required to mail Forms MA 1099-HC to Medicare subscribers? No.

Where can I find IRS forms?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS).Download them from IRS.gov.Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Where do I get my 1095-B form?

Call 1-800-MEDICARE (1-800-633-4227) to ask for a copy of your IRS Form 1095-B. TTY users can call 1-877-486-2048.

Where does Medicare tax withheld go on 1040 2020?

Line 5a in Part I of Form 1040-SS. Line 5a in Part I of Form 1040-PR. Use Part V to figure the amount of Additional Medicare Tax on wages and RRTA compensation withheld by your employer.

How do I get my 1095-B online?

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2021 application — not your 2022 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

How do I get my 1095-B form from medical?

The family member can contact the responsible county for the deceased's Medi-Cal coverage information and request a reprint of their Form 1095-B. A forwarding address should be given if the Form 1095-B needs to be sent to a different address. To find an office near you please go to the county human services agency .

What is the difference between 1095 C and 1099-HC?

Form 1099-HC is required to complete a Massachusetts state tax return. You can complete the state return without one, but it will not be able to be efiled. You should contact your insurance provider to get a copy of the 1099-HC form before you file. Form 1095 C is an informational document for your federal tax return.

Are IRS forms available 2020?

IRS Income Tax Forms, Schedules, and Publications for Tax Year 2020: January 1 - December 31, 2020. 2020 Tax Returns were able to be e-Filed up until October 15, 2021. Since that date, 2020 Returns can only be mailed in on paper forms.

Are 2021 IRS forms available?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Can you download forms from the IRS?

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center.

Where to file Form 843?

File Form 843 (with attachments) with the IRS office where your employer's Forms 941 returns were filed. You can locate the IRS office where your employer files his Form 941 by going to Where to File Tax Returns.

Do you pay Social Security taxes to one country?

The agreements generally make sure that social security taxes (including self-employment tax) are paid only to one country. You can get more information on the Social Security Administration's Web site.

Do Social Security and Medicare taxes apply to wages?

social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer.

Can you make Social Security payments if no taxes are due?

Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Do you have to deduct taxes on Social Security?

Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

What is a 1095-B form?

The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year.

What is a 1095A?

In short, the 1095-A form is the document provided to people who purchase their health insurance through the government-run healthcare Marketplace. The form includes basic personal information, such as your name, address, and insurance provider. It also lists anyone covered on the insurance policy, such as you, your spouse, and any children.

What is Medicare Advantage?

Original Medicare Part A and Medicare Advantage programs provide minimum essential coverage required by law as defined by the Affordable Care Act. The government provides a slightly different form to individuals with this coverage, which can include Medicare Part A, Medicare Advantage, Medicaid, CHIP, Tricare, and more.

Does the 1095-B cover insurance?

Since the 1095-B form also covers certain employer-sponsored plans, it provides space for other people covered by the insurance plan . These extra spaces typically shouldn’t apply to you or be a source of concern.

Does Medicare provide a 1095-A?

Since this form applies only to insurance coverage purchased through the Marketplace, Medicare and Medicare Advantage programs do not provide a 1095-A form.

Refund of Taxes Withheld in Error

- If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement....

Self-Employment Tax

- Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee. The Internal Revenue Code imposes the self-employment tax on the self-employment income of any U.S. citizen or resident alien who has such self-employment …

International Social Security Agreements

- The United States has entered into social security agreements with foreign countries to coordinate social security coverage and taxation of workers employed for part or all of their working careers in one of the countries. These agreements are commonly referred to as Totalization Agreements. Under these agreements, dual coverage and dual contributions (taxes…

References/Related Topics