To enter or review information from Form SSA-1099, including Medicare Parts B and D premiums: From within your TaxAct® return (Online or Desktop), click on the Federal tab. On smaller devices, click in the upper left-hand corner, then select Federal. Click Social Security Benefits

Full Answer

Do part D payments show up on SSA 1099 form?

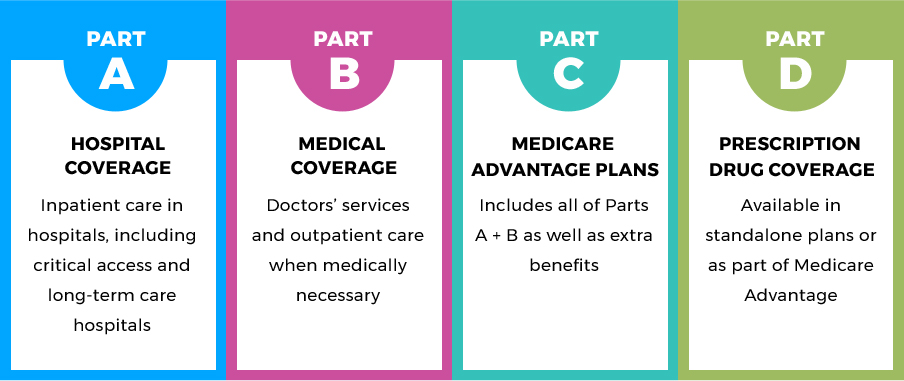

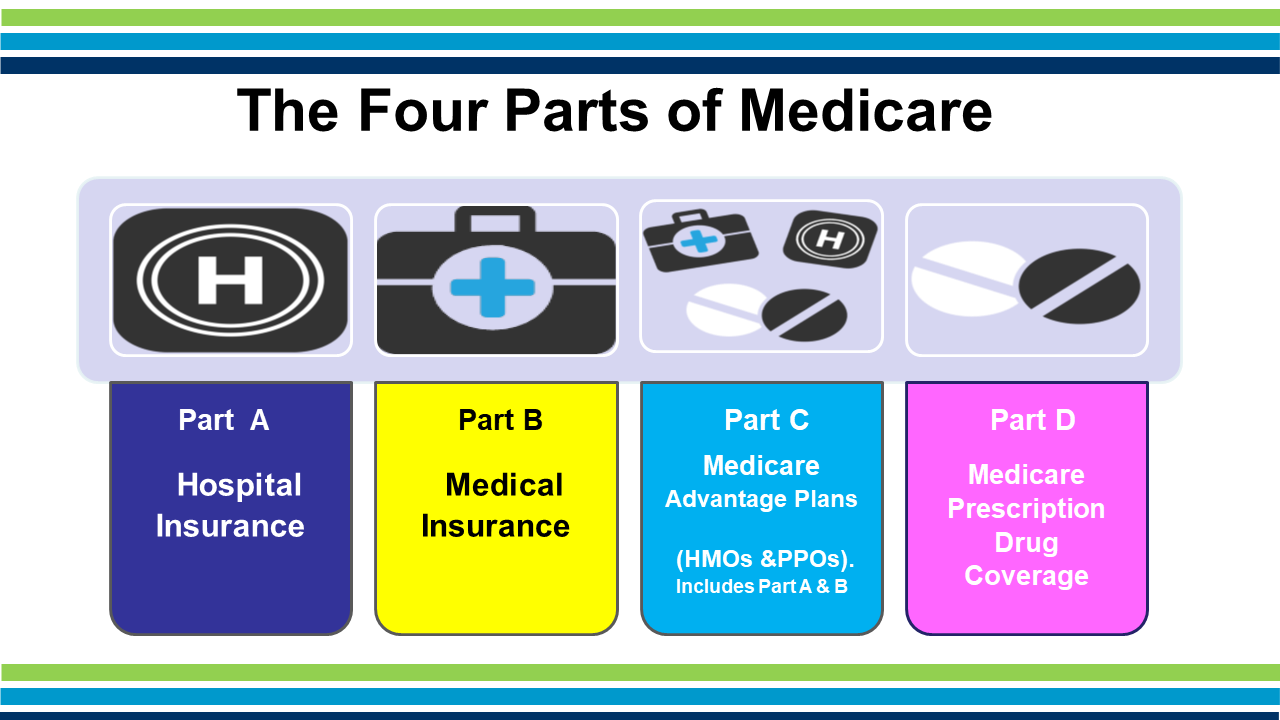

Jun 03, 2019 · Medicare Part B and D go under medical expenses as insurance premiums on a Schedule A (itemized deductions). You have to itemize your deductions in order to deduct them. Your question says you are using, TurboTax Free Edition. You cannot itemize on TurboTax Free. You would need to upgrade to Deluxe or higher.

Where do Medicare Part B and d go on a tax return?

Jun 05, 2019 · I see Part B but not Part D, just some labeled "Nontaxable payments". Also, your part D payments won't show on your SSA-1099 if you are paying some provider separately. Only part D payments deducted from your SSA deposit would show up on the SSA-1099 itself.

Are Medicare Part B premiums deductible on SSA-1099?

To enter or review information from Form SSA-1099, including Medicare Parts B and D premiums: From within your TaxAct® return (Online or Desktop), click on the Federal tab. On smaller devices, click in the upper left-hand corner, then select Federal. Click Social Security Benefits

Where do I enter Medicare Part B premiums on schedule a?

To enter or review information from Form SSA-1099, including Medicare Parts B and D premiums: From within your TaxAct return ( Online or Desktop), click Federal. On smaller devices, click in the upper left-hand corner, then click Federal. Click Social Security Benefits in the Federal Quick Q&A Topics menu, then continue with the interview process to enter all of the appropriate information.

Where do I find Medicare premiums on SSA-1099?

Does form SSA-1099 include Medicare premiums?

Where are Medicare premiums reported?

Are Medicare Part D premiums deducted from Social Security tax-deductible?

Are Medicare Part B premiums taxable income?

Is SSI reported on SSA-1099?

Are Part B premiums deductible?

Can you deduct Medicare premiums on your tax return?

Do health insurance premiums reduce taxable income?

Are Medicare Part B premiums going up in 2021?

What is the standard deduction for 2021 over 65?

Can Medicare premiums be deducted on Schedule C?

Can I join Medicare Part D?

Anyone entitled to Medicare Part A ( whether actually enrolled or not) or who is currently enrolled in Medicare Part B may join Medicare Part D to get help paying prescription drug costs. Enrollment is voluntary except for people who also receive benefits from Medicaid (Medi-Cal in California).

Does Medicare automatically enroll you in Part D?

If you qualify for Medicaid, the government automatically enrolls you in a Medicare Part D plan through which you will receive your prescription drug coverage. For more information about Medicare Part D use the link here.

Does SSA 1099 show part D?

Also, your part D payments won't show on your SSA-1099 if you are paying some provider separately. Only part D payments deducted from your SSA deposit would show up on the SSA-1099 itself.

How to find out if Medicare premiums came out of Social Security?

“It doesn’t exactly pop out at you.” You’ll receive an SSA-1099 from the Social Security Administration which will have a summary of the Medicare premiums that were withheld from your Social Security check during the past year. And keep in mind that if you’re paying premiums directly to an insurance company for Medigap, Medicare Part D, or Medicare Advantage, you should tally up those amounts too. (In some cases, they might be withheld from your Social Security check as well, and will then be reflected on the SSA-1099.)

How much is the standard deduction for 2021?

For 2021, the standard deduction is $12,550 for individuals, $25,100 for married joint filers, and $18,800 for those who file as head of household. Most people come out ahead with the standard deduction, but the best approach will depend on your specific circumstances.

Can I deduct health insurance premiums on 1040?

Self-employed people (who earn a profit from their self-employment) are allowed to deduct their health insurance premiums on Schedule 1 of the 1040, as an “above the line” deduction — which means it lowers their AGI.

Can a S corporation pay Medicare premiums?

If you’ve established your business as an S corporation, the corporation can either pay your Medicare premiums directly on your behalf (and count them as a business expense) or the corporation can reimburse you for the premiums, with the amount included in your gross wages reported on your W2, and you can then deduct it on Schedule 1 of your 1040.

Do you have to be self employed to itemize medical expenses?

So you don’t have to be self-employed to itemize your deductions, including medical expenses – and your Medicare premiums count as medical expenses if you’re itemizing. But if you’re using the itemized deduction approach, you can only deduct medical expenses that exceed a certain amount, as explained below.

Can you deduct Medicare premiums on your taxes?

Some Medicare beneficiaries, however, have the opportunity to deduct their Medicare premiums when they file their taxes. “It’s really simple and it’s often overlooked and it will not happen automatically,” says Mark Steber, Chief Tax Officer at Jackson Hewitt. “It doesn’t make its way to your tax return, your tax software – even your tax professional may not know – so ask about it and see if you qualify.”

Can self employed people deduct Medicare premiums?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

What is the SSA-1099?

But every year during tax season, the Social Security Administration sends out information on Form SSA-1099 to anyone who receives Social Security benefits, and it's important to know what you're supposed to do with this tax form and how it can affect what you owe the IRS. Let's take a closer look at Form SSA-1099 and the key facts you need to know.

How much income is taxed on SSA 1099?

For singles with combined income between $25,000 and $34,000, as much as one-half of your benefits can be subject to income tax, although many will pay lesser amounts. Above $34,000, the maximum amount rises to 85% of the benefits reported on Form SSA-1099.

Why do you need to look at SSA 1099?

The reason why Social Security recipients need to look closely at Form SSA-1099 is that it plays a key role in letting the IRS know whether your benefits will be subject to tax. In particular, the IRS calculates a figure it calls "combined income," which adds up any wage or salary income you have, as well as investment income, business income, ...

How much Social Security is taxed?

If you're single and the number is less than $25,000, then none of your Social Security will get taxed. For joint filers, the threshold number is $32,000. Above those amounts, however, some of your benefits will be added to taxable income. For singles with combined income between $25,000 and $34,000, as much as one-half ...

Why is SSA-1099 important?

Making sure you have the form available when you prepare your tax return is essential in order to avoid mistakes that could lead to an audit.

Does outside income determine tax?

But for future years, keep in mind that your outside income sources help determine taxation. Timing of investment sales that generate taxable gain and retirement account distributions that boost your taxable income can lead to a heavier tax burden on your Social Security benefits as well.

Is it too late to pay taxes on Social Security?

Planning to reduce taxable Social Security income. By the time you get Form SSA-1099, it's usually too late to do anything to reduce the amount of Social Security income that you'll pay tax on.