Form 1095-B will still be produced for all UnitedHealthcare fully insured members and will continue to be made available on member websites, no later than the annual deadline set by the IRS. Members can view and/or download and print a copy of the form at their convenience, if desired.

Does Medicare send out 1095 B?

Medicare is sending a Form 1095-B to people who had Medicare Part A coverage for part of <year>. The Affordable Care Act requires people to have health coverage that meets certain standards, also called qualifying health coverage or minimum essential coverage.

Did not receive 1095 B from Medicare?

Those persons on CHIP, Medicaid, Medicare, Medicare Advantage or Basic Health Program will not receive a 1095-B because those are forms of coverage through the government, so the gov't already knows about the coverage and there is no need for this form to report those types of coverage.

Does Medicare issue 1095 B?

Medicare will send you a Form 1095-B if you received Medicare Part A coverage (including Part A coverage through a Medicare Advantage plan) and any of the following was true for you for the tax year: You were under 65. You enrolled in Part A for the first time. You had Part A for only a portion of the tax year.

Where can I get a copy of my 1095b form?

Form 1095-B. Consumers enrolled in Medicaid, Child Health Plus and Essential Plan (EP) may request a copy of Form 1095-B from the NYS Department of Health. For Medicaid, this includes individuals whose coverage is through Local Departments of Social Services (LDSS), Human Resources Administration (HRA), or NY State of Health. Health plans send the Form 1095-B to consumers who were enrolled in Catastrophic plans, purchased their plan directly from the insurer, or had coverage through the ...

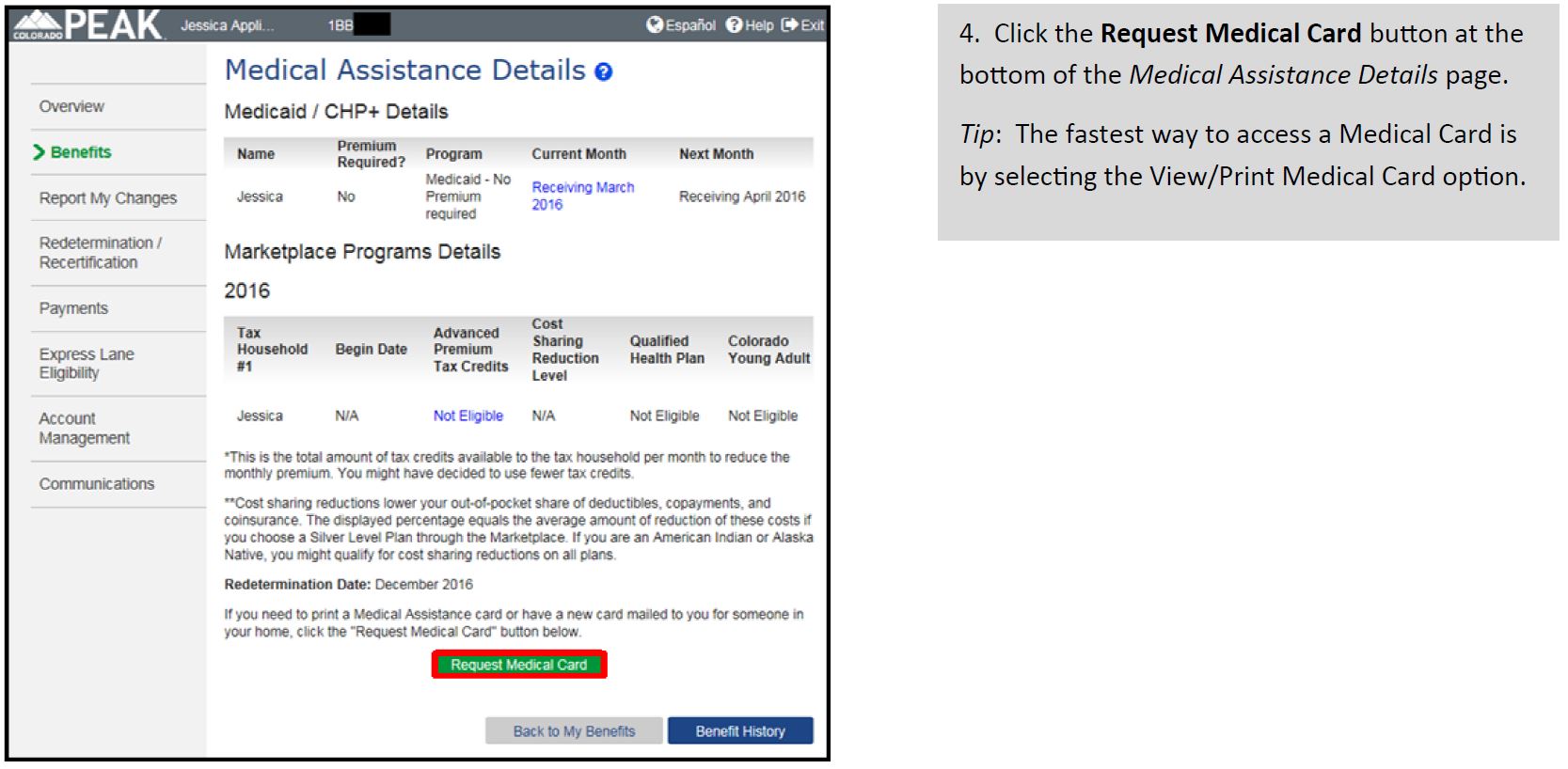

How do I get a copy of my 1095-B form online?

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2021 application — not your 2022 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

Does Medicare Part B send a 1095?

Medicare is sending a Form 1095-B to people who had Medicare Part A coverage for part of

Where is my 1095-B 2020?

If you have had an address change in 2019 or 2020, please call customer care to request a printed copy of the 1095B.

When should I expect my 1095-B?

When will I receive these health care tax forms? The annual deadline for the Marketplace to provide Form 1095-A is January 31. The deadline for insurers, other coverage providers and certain employers to provide Forms 1095-B and 1095-C to individuals is January 31.

How do I get my 1099 from Medicare?

Still have questions? If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online, call our toll-free number at 1-800-772-1213 or visit your Social Security office.

Do Medicare members receive a 1095?

If you were enrolled in Medicare: For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

How do I get a copy of my 1095-B from Medicare?

Medicare. Call 1-800-MEDICARE (1-800-633-4227) to ask for a copy of your IRS Form 1095-B.

What do I do if I didn't get my 1095-B?

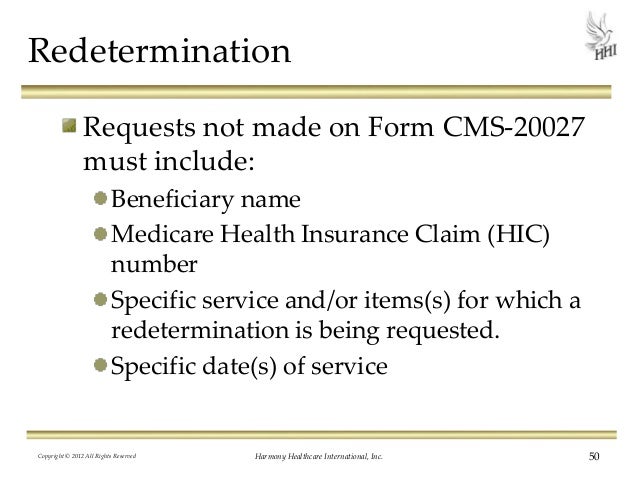

If you do not receive a Form 1095-B and you would like a Form 1095-B for your records, you should contact your eligibility worker at your county human services agency to determine why and request a reprint.

What happens if I don't file my 1095-B?

Good news the 1095-B does not need to be filed! You don't need your form 1095-B to file your tax return. TurboTax will ask you questions about your health coverage but your form 1095-B isn't needed. Just keep the form for your files.

Are 1095-B required for 2021?

You no longer have to file the information from your Form 1095-B on your tax return as the federal mandate for having health insurance ended with 2019 returns. Again, you do not have to file Form 1095-B on your 2021 Tax Return. If you have received a 1095-B from your employer, you can just keep a copy for your records.

Do I need my 1095-B to file taxes?

You do not need 1095-B form to file taxes. It is for your records. IRS 1095-B form is your proof of the month(s) during the prior year that you received qualifying health coverage.

Who is responsible for sending 1095 forms?

Under federal regulations, it is the responsibility of insurance "providers" to send out 1095-B forms. But there's a vitally important distinction between "sponsors" of health coverage and "providers." A sponsor is whoever arranges the health coverage.

Form 1095-A

Form 1095-B

- Form 1095-B is sent out by health insurance carriers, government-sponsored plans such as Medicare, Medicaid, and CHIP, and self-insured small employers (large employers, including those that are self-insured, send out Form 1095-C instead). This form is mailed to the IRS and to the insured member. If you buy your own coverage outside the exchange, y...

Form 1095-C

- Form 1095-C is sent out by large employers who are required to offer health insurance coverage as a provision of the ACA. This applies to employers with 50 or more full-time equivalent employees (ie, Applicable Large Employers). Form 1095-C is sent to the IRS and to full-time employees (30+ hours per week). It’s provided to all employees who were eligible to enroll in the …

Which Form Will You receive?

- Most people will only receive one of those three forms. But there are some circumstances where you might receive more than one. For example, if you work for a large company and have access to coverage from your employer, but you opted to buy coverage in the exchange instead, you’d receive Forms 1095-A and 1095-C. The 1095-C would indicate that you were offered employer-s…

When Will My Form 1095 arrive?

- For 2016 coverage and beyond, the deadline for exchanges, health insurers, and employers to send out the forms is January 31 of the following year. But every year thus far, the IRS has granted a deadline extension for the distribution of Form 1095-B and 1095-C. The deadline to distribute 2021 forms was pushed to March 2, 2022, and the IRS has proposed making this extension per…

Forms 8962

- Most Americans don’t have to do anything on their tax returns pertaining to health insurance (for 2014 through 2018 tax years, most people were able to simply check the box for “full-year health care coverage” on their tax return and carry on; that box is no longer part of the federal tax return, as there’s no longer a federal penalty for being uninsured, although it is part of the state tax retur…