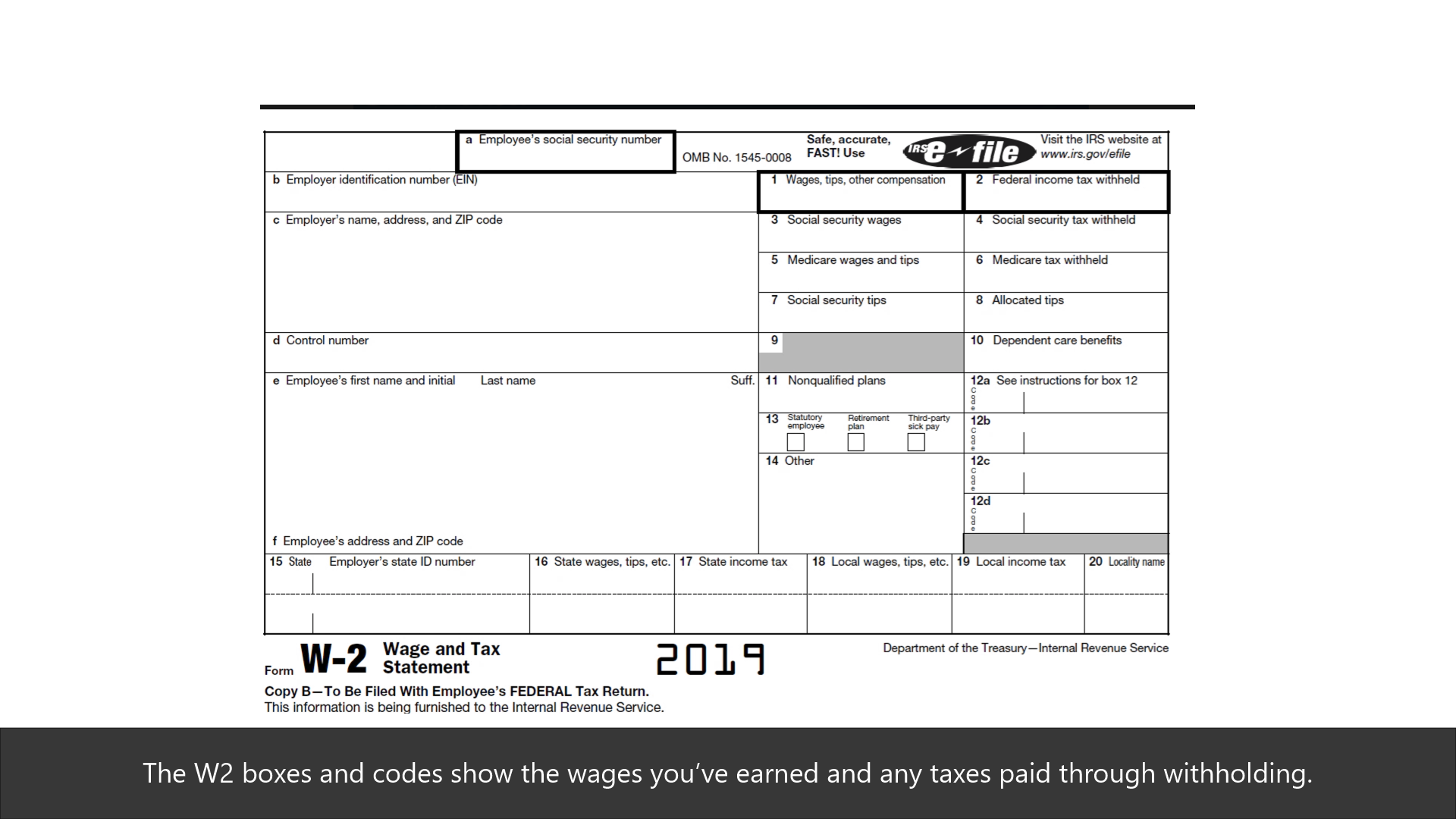

The box most likely to be accurate, would be the Medicare Wages amount. Box 1 will show your total earnings minus any money contributed towards pre-tax salary plans etc. So you would need to add these in to get a total figure. Remember as well; that total income earned, will include all earned income, in addition and including, this W-2.

What's the difference between a W-2 and a total salary?

What you see on your W-2 is your taxable income, not your total salary. What's more, the amount shown in Box 1 for "wages, tips and other compensation" may be different than the amount in Box 3 for "Social Security wages" or the amount in Box 5 for "Medicare wages," and all three sums may be less than what you actually earned in 2015.

How is Medicare tax withholding calculated on a W-2?

The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form. These matching numbers show that the Medicare tax is based on 100% of an employee’s earnings.

What are Medicare W-2 wages and tips?

The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form.

What is the Medicare tax on wages?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax. The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2

Where on my W-2 is my total income?

Box 1Box 1 shows your total taxable wages, tips, prizes and other compensation, as well as any taxable fringe benefits.

What is the difference between wages and Medicare wages on W-2?

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

What does Medicare wages mean on W-2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form.

Are Medicare wages the same as gross wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

Where can I find my gross income?

Line 8b on Form 1040 and 1040-SR (on tax year 2019 form) Line 7 on Form 1040 (on tax year 2018 form)

What is a Medicare wage?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax.

How do you calculate 2019 earned income?

On Form 1040, find Line 1 on the middle of the first page. If you were NOT self-employed, and only received pay from your employer(s), that's your 2019 earned income.

Why is wages different than Medicare wages?

The most common questions relate to why W-2 Wages differ from your final pay stub for the year, and why Federal and State Wages per your W-2 differ from Social Security and Medicare Wages per the W-2. The short answer is that the differences relate to what wage amounts are taxable in each case.

How do you read a W-2 earnings summary?

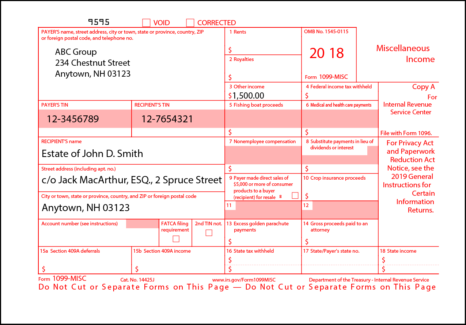

How do I read a W-2?Box A: Your Social Security number, which the IRS uses to identify you.Box B: The employer identification number, or EIN, which the IRS uses to identify your employer.Box C: Your employer's name, address and ZIP code.Box D: ... Box E: Your legal name.Box F: Your address and ZIP code.More items...•

Are Medicare wages taxable?

Retirement contributions are not taxable for federal income tax, however, they are taxable for Medicare (Medic) tax. This is the amount of Medicare tax withheld from your wages during the calendar year.

What is Medicare tips on W-2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding.

What is Medicare tax?

Medicare taxes go toward the Medicare program—a federal health insurance program for Americans who are older than 65 or have certain disabilities and diseases. The funds taken from Medicare taxes cover three areas.

What is the Medicare tax rate for 2020?

If you are self-employed, the 2020 Medicare tax rate is 2.9% on the first $137,700 of your yearly earnings.

How much do employers have to match for Medicare?

An employer is also required to match 1.45% of an employee’s withholding for Medicare wages and tips. For example, if an employee makes $2,000 during their pay period, that employee would have $29 withheld from their paycheck, and their employer would match that contribution with an additional $29 paid toward Medicare.

Is Medicare taxed on wages?

Almost all wages earned by an employee in the United States are subject to the Medicare tax. How much an individual is taxed will depend on their yearly earnings. However, certain pretax deductions are exempt from the FICA tax, which includes Social Security and Medicare taxes.

What to call if your W-2 does not match Social Security?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2, call Central Payroll, 617-495-8500, option 4 for assistance.

What to call if your W-2 does not match Box 1?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 1 Federal Wages and Box 16 State Wages on your W-2, call Central Payroll, 617-495-8500, option 4, for assistance.

What is the Social Security base for 2019?

The Social Security Wage Base for 2019 was $132,900. To determine Social Security and Medicare taxable wages on your W-2, again begin with the Gross Pay YTD from your final pay stub and make the following adjustments if applicable:

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

Can you deduct retirement from paycheck?

In many cases, you can elect to have a portion deducted from your paycheck for this purpose. Many employers offer certain types of retirement plans, depending on the length of time an employee has been with an organization (known as vesting) and the type of organization (company, nonprofit, or government agency).

Do self employed people pay Medicare?

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes. 6 .

Is there a limit on Medicare tax?

4 . Unlike the Social Security tax, there is no income limit on the Medicare tax.

What is the most important thing to know about W-2?

Your W-2 gives a lot of information, but the most important is that it shows your total income and your salary as taxable wages. If you have pretax deductions or nontaxable wages, these are not included in your taxable wages. To determine your total salary from your W-2, look at your taxable wages and then consider any nontaxable wages ...

Why are Medicare and Social Security taxes called FICA?

Both Social Security and Medicare taxes are commonly called FICA taxes because they are collected under the authority of the Federal Insurance Contributions Act. Your taxable wages for those two taxes might be the same, or they might differ because Social Security has an annual wage limit and Medicare has none.

Do salaried employees pay federal taxes?

As a salaried employee, you are required to pay federal income tax, Social Security tax, Medicare tax, and, if applicable, state and local income tax. Knowing how to calculate your W-2 wages can help you to know your total salary and taxable income.

What is the box 1 wage for 2015?

If you earned less than $118,500 in 2015, expect your Box 1 wages to be less than Box 3 and 5 wages, says Wang, since you can shelter more of your earnings from federal taxes than you can Social Security and Medicare taxes.

Is it a good idea to have W-2s less than your salary?

Not to worry. “It’s actually a good thing to have your W-2 wages be less than your salary as this means you’ll owe less taxes,” says CPA Amy Wang, senior technical manager for the American Institute of Certified Public Accountants. What you see on your W-2 is your taxable income, not your total salary. What’s more, the amount shown in Box 1 ...

What is the information on a W-2?

The information on your W-2 helps determine your taxable income and shows the amount of tax you’ve already paid through withholding.

What is a W-2 summary?

A W-2 earnings summary is one of the most common tax documents employees receive. Knowing how to read a W-2 can help you better understand your income and file your taxes each year.

What is the box 2 of a tax return?

Box 2: The amount of federal income tax the employer withheld from your wages for the tax year. Box 3: The total wages paid that are subject to Social Security tax. Because certain income may be subject to Social Security tax but not income tax, don’t be alarmed if it’s higher than Box 1.

How long does it take to get a corrected W-2?

Ask to initiate a Form W-2 complaint. The IRS will send your employer a letter requesting that it provide you a corrected W-2 within 10 days. The IRS will also send you instructions for using Form 4852 so you can file on time. The deadline for filing federal income taxes is usually April 15 for most filers.

What to do if your W-2 is incorrect?

If you received a W-2 from your employer, but it’s incorrect, contact your employer immediately to make corrections so you can file on time. If it refuses to make corrections or are taking too long, call the IRS at 1-800-829-1040 or make an appointment to visit an IRS Taxpayer Assistance Center. Ask to initiate a Form W-2 complaint.

How to get a copy of W-2 if you don't have it?

Start by calling your employer. Verify that it has your correct mailing address. If it hasn’t sent your W-2 — or if it has sent it to a wrong address — you can ask it to send you a copy. If you don’t have any luck dealing with your employer, you can call the IRS for help at 1-800-829-1040.

What happens if you lose your W-2?

If you lose it, issuing a new one can take time and may delay your ability to file taxes on time. If your W-2 falls into the wrong hands or gets stolen, the information on it could be used by identity thieves. Always store your W-2s in a safe and secure location.

What line on W-2 is the total of all W-2s?

You should include this amount on the wages line of your return. If you have more than one Form W-2, or you are married and your spouse also has one or more W-2s, the total of all forms’ Box 1 will be shown on Form 1040, line 1. Box 2 — Shows the total federal income tax withheld from your paycheck for the tax year.

Is it hard to complete W-2?

Completing taxes can be tricky. And while information like that found in W-2 boxes seem simple to complete at first, Form W-2 codes could be hard to complete and interpret on your own.

Do you report tips on W-2?

On Form 4137, you’ll figure the Social Security and Medicare tax owed on the allocated tips shown on your W-2 (s).