Where does Medicare wages and tips go on 1040?

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes.

Are tips included in Medicare wages?

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

Do you include Medicare tax withheld on 1040?

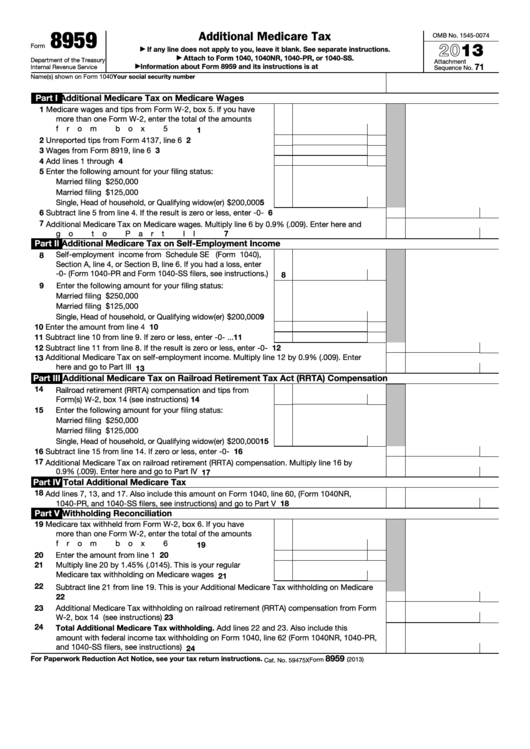

Yes. Individuals will calculate Additional Medicare Tax liability on their individual income tax returns (Form 1040 or 1040-SR),using Form 8959, Additional Medicare Tax. Individuals will also report Additional Medicare Tax withheld by their employers on their individual income tax returns.Jan 18, 2022

What is Box 14 on the W-2 for?

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

How do you account for payroll tips?

Tips reported to the employer by the employee must be included in Box 1 (Wages, tips, other compensation), Box 5 (Medicare wages and tips), and Box 7 (Social Security tips) of the employee's Form W-2, Wage and Tax Statement. Enter the amount of any uncollected Social Security tax and Medicare tax in Box 12 of Form W-2.

How do you account for tips?

The journal entry to recognize tips is to credit a revenue account and debit cash. This entry is usually done every day or week for the cumulative tip amount and not one by one. An account receivable is not normally set up for tips because most businesses know about tip amounts after they are received.

How are Medicare wages and tips calculated?

Medicare Wages and Tips may also be calculated by taking the amount in Box 1 and ADDING all of your TIAA-CREF retirement deductions. Retirement contributions are not taxable for federal income tax, however, they are taxable for Medicare (Medic) tax.

What wages are subject to Medicare tax?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2022, this base is $147,000. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.Mar 15, 2022

Why is Medicare wages and tips higher than wages?

The most common reason relates to 401(k) contributions (W2, Box 12, Code D). They are subject to payroll tax, but not to federal income tax. On many W2s, 401(k)s will explain this difference.Jun 6, 2019

Where do I report Box 14 on my taxes?

Employers use Box 14 on Form W-2 to provide other information to employees. Generally, the amount in Box 14 is for informational purposes only; however, some employers use Box 14 to report amounts that should be entered elsewhere on your return. Note.

What do I put in box 12 on my W-2?

The W-2 box 12 codes are:A – Uncollected Social Security tax or Railroad Retirement Tax Act (RRTA) tax on tips. ... B – Uncollected Medicare tax on tips. ... C – Taxable costs of group-term life insurance over $50,000 (included in W-2 boxes 1,3 (up to Social Security wages base), and box 5); Taxable costs are information only.More items...•Mar 4, 2022

Where is the box 14 code?

Enter the amount from Box 14, Code A will be entered as Net Earnings/Loss from Self-Employment. If any amount has been entered on Line 12 of the K-1 as a Section 179 Deduction, it will automatically pull to this menu.

What is Box 3 in Social Security?

Box 3 shows an employee’s total wages subject to Social Security tax. Do not include the amount of pre-tax deductions that are exempt from Social Security tax in Box 3.

What is box 1 in a tax return?

Box 1: Wages, tips, other compensation. Box 1 reports an employee’s wages, tips, and other compensation. This is the amount you paid the employee during the year that is subject to federal income tax.

What is the wage base for Social Security in 2021?

For 2021, the wage base is $142,800. If you must report Social Security tips (Box 7), the total of Boxes 3 and 7 must be less than $137,700 for 2020 (or $142,800 for 2021, to file in 2022). Important 2020 information: If you provided FFCRA paid sick and/or family leave, include the amount in Box 3.

Who is Jeffrey Joyner?

He studied electrical engineering after a tour of duty in the military, then became a freelance computer programmer for several years before settling on a career as a writer .

Do you have to report tips to Medicare?

The employer includes these tips as income for purposes of calculating and collecting taxes. For those whose income is derived largely from tips, there may be times when the employee's income from hourly wages is less than the amount that needs to be deducted for taxes. This can result in uncollected Medicare taxes.

When do you report tips on W-2?

Tips you received in 2018 that you reported to your employer as required after 2018 but on or before January 10, 2019, are included in the wages shown in box 1 of your 2019 Form W-2. Although these tips were received in 2018, you must report them on your 2019 tax return.

What is an allocation tip?

Allocated tips are those assigned to the taxpayer by the employer in addition to those the taxpayer reported to the employer for the year.

What is Form 4137?

Form 4137 is used to figure and report the social security and Medicare tax owed on tips the taxpayer did not report to the employer, including any allocated tips shown on the taxpayer's W-2 that must be reported as income.

Do you report tips on your taxes?

If you participate in a tip-splitting or tip-pooling arrangement, report only the tips you receive and retain. Do not report on your income tax return any portion of the tips you receive that you pass on to other employees. However, you must report tips you receive from other employees.". Pub. 531 Reporting Tip Income.