Is there a site that compares Medicare plans?

The new Medicare Plan Finder is now available to help you compare 2020 coverage options and shop for plans. The Plan Finder is now mobile-friendly, so you can use it on your smart phone, tablet, and desktop! It will guide you step-by-step through the process of comparing plans.Oct 15, 2019

What is the best way to compare Medicare Advantage plans?

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

What is the difference between the different Medicare Supplement plans?

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What are the 3 ways Medicare Supplement plans are rated?

Medigap Plan Costs Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways: Community-rated: Premiums are the same regardless of age. Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age.Feb 9, 2022

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Should I switch from plan F to plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is plan G as good as plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is the most comprehensive Medicare Supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is Medicare Plan G deductible for 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

Which Medicare plan offers the most supplemental coverage?

Plans C, F and G offer the most supplemental coverage, paying many of your out-of-pocket costs for Medicare-approved services. Consider one of these plans if you are willing to pay a monthly premium that is typically higher in exchange for more covered benefits and lower out-of-pocket costs.

What is Medicare Supplement?

Medicare Supplement insurance plans, also called Medigap plans, provide help with some of the out-of-pocket expenses not paid for by Original Medicare. When you go to the doctor under Original Medicare, you still have expenses to pay. Medicare Supplement insurance plans work with your Medicare Part A (hospital stays) and Medicare Part B ...

What is the difference between Medicare Supplement Plan A and Plan B?

Plans A and B: Lower Benefits, Higher Out-of-Pocket. Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. The Medicare Part A deductible could be one of your largest out-of-pocket expenses if you need to spend time in a hospital.

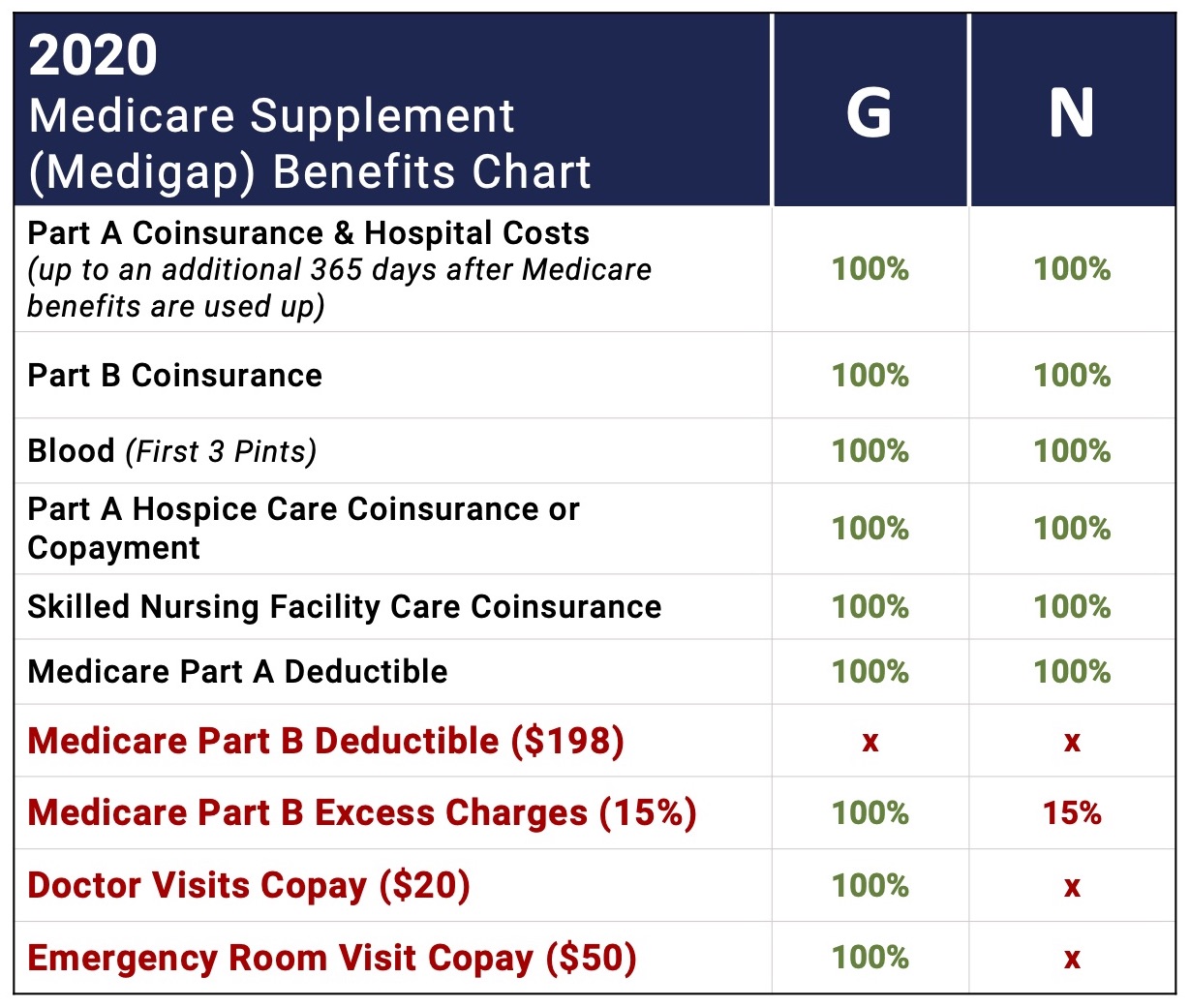

Does Plan N cover Medicare Part B?

Plan N covers the Medicare Part B coinsurance, but you pay copayments for covered doctor office and emergency room visits in exchange for a monthly premium that tends to be more mid-range.

Is AARP an insurer?

These fees are used for the general purposes of AARP. AARP and its affiliates are not in surers. AARP does not employ or endorse agents, brokers or producers. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

What is a K and L plan?

The premiums are typically lower because, for some services, they pay a percentage of the coinsurance instead of the full coinsurance amount. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

How much does Plan N pay for Part B?

1 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in an inpatient admission. 2 Care needed immediately because of an injury or an illness of sudden and unexpected onset.

What is the most popular Medicare Supplement Plan 2021?

Medicare Supplement plan G will certainly be the most popular Medigap plan for 2021 and for great reason. With only one small deductible to pay and then 100% coverage, Plan G makes it easy to budget while getting nearly all of your medical bills paid for.

When is the best time to enroll in Medicare Supplement?

If you are interested in a Medicare Supplement, the best time to enroll is in your Medicare 6-month Medigap open enrollment period. This period lasts for 6 months and begins on the first day your Medicare Part B goes into effect.

How much is Medicare Part B 2020?

In the year 2020, the deductible amount for Medicare Part B was $198. This means you had to pay the first $198 of your medical bills prior to Medicare paying anything. Medicare will then begin paying 80% of your medical bills through Part B. You are responsible for the remaining 20%.

What is Medicare Part B?

Medicare Part B provides you with most of your coverage, particularly for doctor’s bills. This is hopefully what you’ll be using the most of rather than Part A, which is hospitalization.

How long does it take to enroll in Medicare Advantage Plan?

Anyone who wishes to enroll in a Medicare supplement plan and currently has a Medicare advantage plan that is outside the initial 12 months of the plan, must also answer medical questions and go through underwriting.

Does Medicare accept Part B?

There may be times where you need Medicare Part B services but your healthcare provider does not accept Medicare completely. In these cases, you will have to pay Part B excess charges, but that cost can be covered by a couple of the Supplement plans. It should be noted that this is a fairly uncommon expense.

What is Plan N?

Plan N gives you coverage for Part A coinsurance, hospice coinsurance, nursing coinsurance and some of the Part B coinsurance. It covers you for those three pints of blood and for foreign travel costs related to emergency medical care, as well as for the Medicare Part A annual deductible.

How does Medicare Supplement Plan work?

Understanding how Medicare Supplement Plans work can take some time. Here are the basics [2]: Medigap plans cover one person. If your spouse or partner also wants a Medicare Supplement Plan, they must buy a policy of their own. Medigap plans can’t cancel you for health issues.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that aren’t covered in Original Medicare. A Medicare Supplement Plan might (for instance) cover copayments, coinsurance or deductibles you owe under Original Medicare. Medicare Supplement Plans operate as ...

How long does Medicare Supplement last?

This starts the month you turn 65 and enroll in Medicare Part B, and it lasts six months. It also never repeats, so don’t miss it.

What is issue age rated?

Issue-age-rated: Premiums are based on the age you are when you purchase them. Generally, younger people pay lower premiums than older people. This may also be called “entry age-rated.”. Attained-age-rated: Premiums are based on your current age, meaning costs will go up as you get older.

Does Medicare cover vision?

They don’t cover everything. Generally, Medicare Supplement Insurance doesn’t cover dental care, vision care, hearing aids, long-term care, eyeglasses or private-duty nursing. Some plans are no longer available. You can no longer purchase Plans E, H, I and J, but if you purchased one of those plans before June 1, 2010, you can continue with it.

What are the different types of Medicare Supplement Plans?

Depending on where you live, there may be three types of Medicare Supplement plans. This can include community-rated, issue-age-rated or attained-age-rated. In some states, attained-age-rated often ends up being the most cost-effective.

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive supplements. It covers everything except Medicare excess charges. This means it pays both of your deductibles and the 20% that you would normally owe toward all outpatient expenses. Medigap plans C & F are very popular.

Does Plan N cover excess charges?

Plan N offers lower premiums if you are willing to do a bit of cost-sharing. Unlike Plan F or G though, Plan N does not cover excess charges. You’ll want to read up on this and understand what that means before enrolling. For a list of Medicare supplement insurance companies, visit this page.

Does Medicare cover Plan A?

Medigap Plan A offers the most basic of all the Medigap plans. Even still, it will cover the 20% that Medicare doesn’t pay for on outpatient treatments. That’s arguably the most important piece of all Medigap plans. All Medicare insurance carriers must offer Plan A. However, some states do not require companies to offer it to people under age 65 on Medicare disability.

Is Plan G better than Plan F?

It covers everything that Plan F does except for the Part B deductible. Premiums for Plan G are often very competitive, which can often make it a better value than Plan F . When we compare Medicare Supplements between Plan F and G in most states, we often find that Plan G is a better value annually.

Is Medicare Supplement the same as Medigap?

This makes comparing Medicare Supplement plans pretty easy. ( Medicare Supplements and Medigap plans are the same thing) The Centers for Medicare and Medicaid Services updates the Medigap plans comparison chart every year, although most plans do not have benefit changes from year to year. Some Medigap plans will have higher premiums ...

We work with the nation's most trusted insurance providers

"I have been on Medicare for 10 years and this article explained supplemental better to me than anything I have read before. I switched to Plan G and saved $100 a month immediately."

What is Medicare Supplement Insurance?

Medicare Supplement Insurance is a form of private health insurance that helps cover certain Medicare out-of-pocket costs such as deductibles, copayments and coinsurance. Over 14 million Americans had a Medicare Supplement Insurance plan in 2018. 1

Top Questions

MedicareSupplement.com helps you learn about your Medicare coverage options and find a plan, all at once. Our licensed agents can answer your questions and help you find the right Medicare Supplement Insurance plan to fit your needs and budget.

We just need a few details to provide your personalized Medicare Supplement plan comparison

By pressing "Compare plans" above, I consent to receive e-mails, telephone calls, text messages and artificial or pre-recorded messages from TZ Insurance Solutions LLC or its affiliates and third party partners, or their service provider partners on their behalf, regarding their products and services, including Medicare Supplement Insurance plans, Medicare Advantage plans, and/or Prescription Drug Plans, at the e-mail address and telephone number provided above, including my wireless number (if provided) using an automated telephone dialing system.