Administration at 1-800-772-1213 to enroll in Medicare or to ask questions about whether you are eligible. You can also visit their web site at www.socialsecurity.gov. The Medicare.gov Web site also has a tool to help you determine if you are eligibile for Medicare and when you can enroll. It is called the Medicare Eligibility Tool.

Full Answer

How do I apply for a Medicare supplement plan?

Jan 01, 2022 · Ways to sign up: Online (at Social Security) – It’s the easiest and fastest way to sign up and get any financial help you may need. (You’ll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

How do I enroll in Medicare?

Dec 12, 2019 · Here's the quick answer: Most people should apply for a Medigap plan within six months of signing up for Part B. Medigap open enrollment begins when you sign up for Medicare Part B (at age 65) and lasts for six months. If you defer Part B coverage past age 65 because of health coverage from your employer, this six-month window would start ...

When can I enroll in a Medicare supplement plan?

Get started with Medicare. Medicare is health insurance for people 65 or older. You’re first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig’s disease). Follow these steps to learn about Medicare ...

Can I buy or Change my Medicare supplement plan outside of enrollment?

Aug 09, 2018 · Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S. If...

How to find out what Medicare plan is available in my area?

Using this handy tool on Medicare.gov, enter your ZIP code (you can answer the other two questions, but they won’t affect the results). The results page will display which plans are available in your area as well as their price ranges.

How many days do you have to enroll in Medigap?

In most of these scenarios, you have 63 days to choose and enroll in a Medigap plan. For a full description of these scenarios, see the table on Medicare.gov.

What is a six month enrollment period?

During your six-month enrollment period, federal law protects you with guaranteed issue rights (sometimes known as Medigap protection s). These rights allow you to purchase any policy available in your area, regardless of your current health. But outside of this window, insurance companies are legally allowed to refuse you a policy, charge more because of your health, or impose waiting periods on your coverage.

How long does Medicare open enrollment last?

When to apply for a Medicare Supplement plan. Medigap open enrollment begins when you sign up for Medicare Part B (at age 65) and lasts for six months. If you defer Part B coverage past age 65 because of health coverage from your employer, this six-month window would start whenever you sign up for Part B.

What does MA mean in Medicare?

You’re enrolled in Medicare Advantage (MA) or have a Medicare SELECT policy, but you move out of the service area or the provider stops covering your area.

Can you keep Medicare and Medigap together?

Be sure to keep your Medicare and Medigap cards together in a safe place. Your Medigap plan will be guaranteed renewable if you apply within your window of guaranteed issue rights. Guaranteed renewable means that as long as you continue to pay your premiums, you’ll keep your plan for as long as you’d like.

Does Medigap guarantee issue rights?

As you can see, Medigap guaranteed issue rights are incredibly valuable. Outside your open enrollment period, there are a few other scenarios where you have these rights as well. Typically these situations apply to you when you lose your existing coverage or after you try out Medicare Advantage.

Medicare basics

Start here. Learn the parts of Medicare, how it works, and what it costs.

Sign up

First, you’ll sign up for Parts A and B. Find out when and how to sign up, and when coverage starts.

What is Medicare Supplement Insurance?

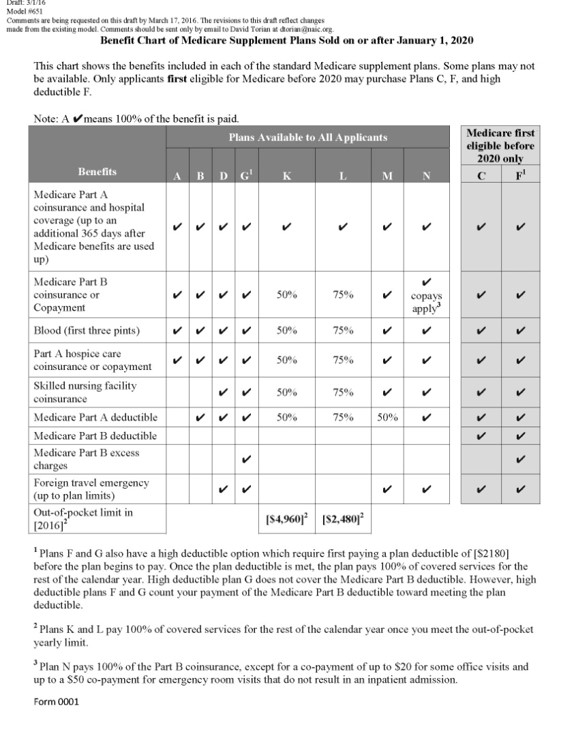

Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S.

What happens if a Medigap policy goes bankrupt?

Your Medigap insurance company goes bankrupt and you lose your coverage , or your Medigap policy coverage otherwise ends through no fault of your own. You leave a Medicare Advantage plan or drop a Medigap policy because the company hasn’t followed the rules, or it misled you.

What happens to Medicare if it ends?

You have Original Medicare and your employer group health plan or union coverage that pays after Medicare pays is ending

How long is the free look period for Medigap?

If you’re within your six-month Medigap Open Enrollment Period and considering a different Medigap plan, you may try a new Medigap policy during a 30-day “free look period.”. During this period, you will have two Medigap plans, and pay the premium for both.

When does Medicare start?

When newly eligible for Medicare, you enter a seven-month Initial Enrollment Period (IEP) which begins three months before your 65th birthday and ends three months after the month of your birthday. If not automatically enrolled in Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance), you may sign up during this period, as well as choose to join a Prescription Drug Plan (Part D) or Medicare Advantage Plan (Part C) with or without prescription drug coverage.

How long does Medicare Supplement open enrollment last?

How can enrollment periods affect my eligibility for Medicare Supplement plans? The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period —for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

How long do you have to wait to get Medicare Supplement?

Keep in mind that even though a Medicare Supplement insurance company cannot reject your enrollment for health reasons, the company is allowed to make you wait up to six months before covering your pre-existing conditions.

How long is a trial period for Medicare Advantage?

Trial rights allow you to join a Medicare Advantage plan for a one-year trial period if you are enrolling in Medicare Part C for the first time. If you’re not happy with the plan, you can return to Original Medicare anytime within the first 12 months.

Can you use Medicare Supplement Plan with Medicare Supplement?

While some beneficiaries may be eligible for both Medicare and Medicaid benefits (also known as “dual eligibles”), Medicaid typically doesn’t work with Medicare Supplement plans. You can only use your Medicare Supplement plan to pay for costs in Original Medicare.

Can you change your Medicare Supplement plan if it goes bankrupt?

For example, if your Medicare Supplement insurance company goes bankrupt or misleads you, you may be able to change Medicare Supplement plans with guaranteed issue.

Can you get Medicare Supplement if you have health issues?

This is when you can get any Medicare Supplement plan that’s available in your area, regardless of any health issues you may have. The insurance company can’t charge you more if you have health problems or deny you coverage because of pre-existing conditions.

Does Medigap cover prescriptions?

Since Medigap plans don’t include prescription drug benefits, if you’re enrolled in Original Medicare and want help with prescription drug costs, you can get this coverage by enrolling in a stand-alone Medicare Prescription Drug Plan.

What is the Medicare eligibility tool?

The Medicare.gov Web site also has a tool to help you determine if you are eligibile for Medicare and when you can enroll. It is called the Medicare Eligibility Tool.

When do you get Medicare if you have Social Security?

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) starting the first day of the month you turn age 65. You will not need to do anything to enroll.

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is coinsurance percentage?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

Can you buy a Medigap policy with a guaranteed issue right?

If you buy a Medigap policy when you have a guaranteed issue right (also called "Medigap protections"), the insurance company can't use a pre-existing condition waiting period.

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.

What is Medicare Supplement Plan?

A Medicare Supplement plan (also known as Medigap) is used for exactly what the name suggests — it supplements the gaps in your original Medicare coverage. This means you must have Medicare Parts A and B in order to get a Medigap plan.

What happens if you don't buy Medigap?

If you don’t buy your Medigap plan during your open enrollment period, you are not guaranteed to be accepted. You will have to answer different questions about your health that may disqualify you for Medicare Supplement insurance outside of your normal enrollment period.

Is Medicare Supplement insurance private?

Because Medicare Supplement insurance is provided by private companies, these health questions and requirements vary per company.

Does Medicare cover medical expenses?

Your regular Medicare plan covers the bulk of your medical costs, but a Medicare Supplement plan can cover some remaining bills, including:

Is it confusing to have Medicare?

Making sure you have the right Medicare coverage can be confusing. Enrollment timing, different plans, and personal requirements can make shopping around for Medicare a hassle.

Does Medicare Allies do annual reviews?

However, Medicare Allies schedules annual reviews with each and every one of our clients to review coverage and shop the market again. If your rates go up or your needs change, this is a great time to discuss your options.

What is the phone number for Medicare Supplement?

Call UnitedHealthcare at 1-866-408-5545 (TTY 711) , weekdays, 7 a.m. to 11 p.m., and Saturday, 9 a.m. to 5 p.m., Eastern Time.

What does OEP mean for Medicare?

During this six-month OEP, you are guaranteed acceptance – meaning you have a right to buy any Medicare supplement plan sold in your state. There may be other situations in which you may be guaranteed acceptance. For example, if you’ve delayed retirement and are enrolling in Medicare beyond your 65th birthday, or if coverage from another Medicare ...

When is the best time to buy a Medicare Supplement Plan?

The best time to buy a Medicare Supplement plan is during your six-month Medigap Open Enrollment Period (OEP). This starts the first day of the month in which you are age 65 or older and enrolled in Part B. During this six-month OEP, you are guaranteed acceptance – meaning you have a right to buy any Medicare supplement plan sold in your state.

Do you have to be an AARP member to enroll in Medicare Supplement Plan?

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Does AARP pay royalty fees?

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, ...

Is AARP an insurer?

These fees are used for the general purposes of AARP. AARP and its affiliates are not in surers. AARP does not employ or endorse agents, brokers or producers. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.