If you are eligible, you enter the excess amount on Line 69 of your Form 1040, or Line 41 of Form 1040A. You can't claim the credit if you use Form 1040EZ, and if you owe taxes for the current or past years, the IRS will apply the credit to your past due amounts first and then refund the balance to you. References

How do I include Medicare tax withheld on my taxes?

If you are filing a joint return, include your spouse’s Medicare tax withheld. Also include any uncollected Medicare tax on tips from Form W-2, box 12, code B, and any uncollected Medicare tax on the taxable cost of group-term life insurance over $50,000 (for former employees) fromForm W-2, box 12, code N.

Are Medicare and Social Security tax withholdings supposed to be on 1040?

June 7, 2019 4:34 PM Are you supposed to include medicare and social security tax withholdings on line 13 of 1040-ES or just the federal income tax withholding portion? You would just include the Federal Income Tax that will be withheld from your pay during 2018 to compute this.

How do I report income tax withheld on Form 1040?

Both should be titled, "Federal Income Tax Withheld." The figures in these boxes report how much income tax was withheld from your income over the course of the year. Add up all these amounts and report the total on lines 25a or 25b of your Form 1040.

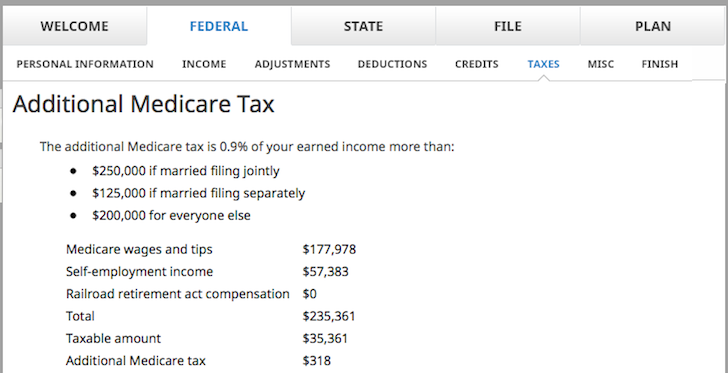

Where do I Find my Medicare wages on my taxes?

Your Medicare wages include your wages and tips from Form W-2, box 5; your tips from Form 4137, line 6; and your wages from Form 8919, line 6. Your self-employment income includes amounts from Schedule SE, Part I, line 6.

What line do you report 1040?

Add up all the amounts that appear on Form 1040 lines 16 through 32. Report the total on line 33. This amount represents your total tax payments throughout the year.

What is the tax withheld from 1099?

Withholding on 1099 Income. Income tax isn't withheld from 1099 income in most cases, but some income sources from which it might be include: 1099-G, box 4: Withholding on unemployment income. 1099-R, box 4: Withholding on retirement income. SSA-1099, box 6: Withholding on Social Security benefits.

What line is the 1040 for 2021?

Updated March 01, 2021. Completing IRS Form 1040 isn't just about tallying up all the sources of income you earned during the year. It records your tax payments as well on lines 25 through 32 of your 2020 tax return. They're totaled on line 33 and applied to your total tax due.

How many times has the 1040 been redesigned?

The 2020 Form 1040 is significantly different from the ones that were used for tax years 2017 and earlier. The IRS has redesigned three times beginning in 2018. 1 All lines and boxes cited here refer to the 2020 version of the form.

How much is Social Security tax in 2020?

The maximum Social Security tax was $8,537.40 per year in 2020, which represents 6.2% of taxable wages up to that year's Social Security wage base: $137,700. Your employer would match this and pay another 6.2%. 6 . You don't have to pay Social Security tax on wages over the wage base, at least for the current year.

Do you have to pay Social Security taxes on wages?

You don't have to pay Social Security tax on wages over the wage base, at least for the current year. Withholding begins again on January 1 of the new year, however. This maximum limit can increase annually, so make sure you get the right number for the year for which you're filing a tax return.

Self-employed health insurance deduction for Medicare premiums

Self-employed people (who earn a profit from their self-employment) are allowed to deduct their health insurance premiums on Schedule 1 of the 1040, as an “above the line” deduction — which means it lowers their AGI.

Above-the-line deduction for people who are self-employed

If you’re self-employed, the self-employed health insurance deduction — putting your Medicare premiums on Schedule 1 of your 1040 — is the most direct way to reduce your tax burden. And as noted above, this is an “above-the-line” deduction, which means it reduces your adjusted gross income.

Additional considerations

So, let’s review: You’re self-employed, your business made money (congratulations!), and you’re ready to file. Here are few more things to remember before you get started.

Another alternative: Using your HSA funds to pay Medicare premiums

If you have a health savings account (HSA) , know that you can withdraw tax-free money from the account and use it to pay your premiums for Medicare Parts A, B, C, and D (but not Medigap premiums). This is an alternative to deducting your premiums on your tax return, since you can’t do both.

How to claim FICA tax refund?

How to Claim a FICA Tax Refund. To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843 . When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed.

What to do if you overpaid for Social Security?

If you have overpaid for any reason, you can submit a request to have those taxes refunded. You must first attempt to claim a Social Security tax refund from your employer . If you can't get a full refund from your employer, you can submit your refund claim to the Internal Revenue Service (IRS) on Form 843.

How much is Social Security taxed in 2020?

If you are an employee, FICA taxes are withheld from your paycheck along with income tax. The Social Security portion of the FICA tax is subject to a cap—$137,700 in 2020, and $142,800 in 2021. This is referred to as the " wage base .".

What is the FICA tax for 2021?

The Social Security and Medicare taxes that are withheld from your paychecks are collectively referred to as the Federal Insurance Contributions Act tax, or "FICA tax.". You pay half of these taxes, and your employer pays half: 7.65% of your salary or wages each for a total of 15.3%. 1.

Do you owe Social Security on income you make?

This is referred to as the " wage base .". You do not owe Social Security tax on income you make over this amount. 1. If you work for yourself rather than an employer, FICA taxes are your self-employment tax. You must make quarterly estimated payments to the IRS for your FICA taxes if you are: Self-employed.

Do non-residents on H visas have to pay FICA taxes?

They typically hold G-visas. Non-residents present in the U.S. on H-visas don't have to pay FICA taxes either.

What line do you include additional Medicare taxes on?

An employee representative subject to RRTA taxes should include the total Additional Medicare Tax paid as reported on line 3 of Form CT-2 (include the total Additional Medicare Tax paid from line 3 of all Forms CT-2 filed for 2020).

What tax is included in joint W-2?

If you are filing a joint return, include your spouse’s Medicare tax withheld. Also include any uncollected Medicare tax on tips from Form W-2, box 12, code B, and any uncollected Medicare tax on the taxable cost of group-term life insurance over $50,000 (for former employees) fromForm W-2, box 12, code N.

What line do you enter wages on 8919?

Enter wages from line 6 of Form 8919, Uncollected Social Security and Medicare Tax on Wages. If you are filing a joint return, also include the amount from line 6 of your spouse's Form 8919.

What line on 4137 is unreported?

Enter unreported tips from line 6 of Form 4137, Social Security and Medicare Tax on Unreported Tip Income. If you are filing a joint return, also include the amount from line 6 of your spouse's Form 4137.

What happens if I don't get my W-2?

Tax topics are available at IRS.gov/TaxTopics. Even if you don't get a Form W-2, you must still figure your Additional Medicare Tax. If you lose your Form W-2 or it is incorrect, ask your employer for a new one. Forms W-2 of U.S. possessions.

Does Ann need to file Form 8959?

Ann, a single filer, has $130,000 in self-employment income and $0 in wages. Ann isn't liable for Additional Medicare Tax and doesn't need to file Form 8959 because her self-employment income is less than the $200,000 threshold for single filers. Example 2.

Is Don liable for Medicare?

However, Don is liable for Additional Medicare Tax on $75,000 of wages ($200,000 in wages minus the $125,000 threshold for a married filing separately return). In addition, the $200,000 of wages reduces the self-employment income threshold to $0 ($125,000 threshold minus the $200,000 of wages).

What to do if you paid too much RRTA?

It should correct the error in your next paycheck. If it doesn't, you can attach Form 843 to your tax return and request a refund from the IRS.

What is the tax rate for a Tier 1 pension?

The Tier 2 pension benefit taxes your first $84,300 of earnings at 4.4 percent, with your employer paying a 12.6 percent rate.

Does the Federal Insurance Contributions Act apply to Social Security?

The Federal Insurance Contributions Act, which defines how money gets taken out of paychecks for Social Security and Medicare, doesn't apply to you. Instead, your paychecks and your retirement and pension are covered by the Railroad Retirement Tax Act, which has tiers of taxes.

Is RRTA taxable?

Tier 1, 2 and 3 of your RRTA tax normally aren't taxable. Like Social Security and Medicare tax, tiers 1 and 3 essentially don't matter when it comes to your taxes -- you pay tax on the income you used to pay your share of the taxes. Tier 2 is also not taxable, much like how your contributions to a workplace 401 (k) aren't taxed.

Why is there no tax withholding on 1099?

You may be wondering why there was no tax withholding on your 1099-NEC form. That's because the payer didn't withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances.

What is backup withholding?

Sometimes the IRS requires withholding from payments to non-employees. This is called backup withholding, and it happens in specific cases, mostly when the payee's tax ID is missing or incorrect. In these cases, the payer receives a notice from the IRS requiring them to begin backup withholding.#N##N#

How is personal income tax determined?

Your personal income taxes are determined by your total adjusted gross income. If your business is a partnership, multiple-member LLC, or corporation, your 1099 income is reported as part of your business income tax return.

What is self employment tax?

For self-employed individuals, these taxes are called self-employment taxes. Self-employment taxes are calculated on the individual's federal income tax return based on the net income from the business, including 1099 income. .

Do you report 1099 income on Schedule C?

If you are a sole proprietor or single-member LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business. When you complete Schedule C, you report all business income and expenses.

Do employers withhold Social Security taxes?

Employers also do not withhold Social Security and Medicare taxes from non-employees. . . Because no taxes are withheld on 1099 income during the year, you may have to pay quarterly estimated taxes on this income. Failing to pay taxes during the year can result in fines and penalties for underpayment.