Full Answer

How do I check the status of my Medicare Part A?

Medicare Part A effective date You can also check the status of your application by visiting or calling a Social Security office. You can ask your pharmacy to check the status of your Medicare Part D enrollment by sending a test claim. You can also call the Member Services department of your Medicare Part D plan.

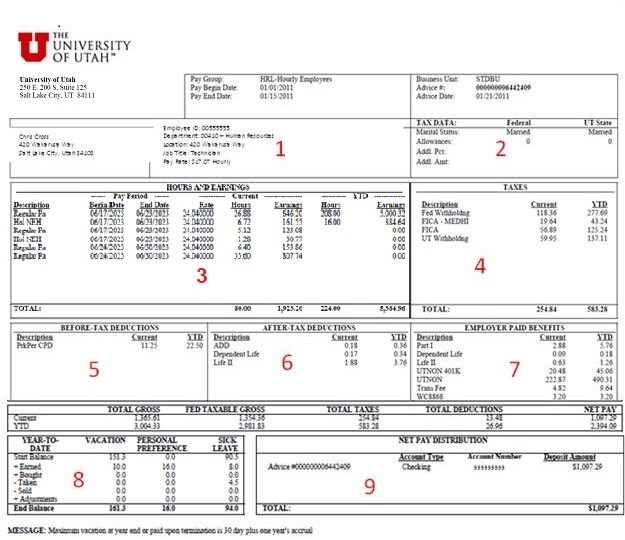

How do I see the Medicare payroll deduction on my paycheck?

There are two ways that you may see the Medicare payroll deduction applied to your paycheck. • If your paycheck is directly deposited into your checking account you will be given a pay statement with all the itemized deductions.

How can I View my Medicare premiums online?

You can use your online MyMedicare account to view your Medicare premium bills, check your payment history and set up Medicare Easy Pay for auto payments. Senior Americans are embracing technology at a rapid rate.

What will I See in the pay section of my paycheck?

What you'll likely see in this section depends on whether you are a salaried or an hourly worker. If you work by the hour, your hourly rate and the number of hours you worked for the pay period will be listed. You may also see overtime hours. If you earn an annual salary, you'll see your salary for the pay period and possibly bonuses.

What is Medicare coming out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Is Medicare always deducted from paycheck?

Medicare provides health insurance for people aged 65 and over, as well as some people with disabilities. Generally, employers are required to withhold Social Security and Medicare taxes from your paycheck in order to pay for these social programs.

When did Medicare start being taken out of paycheck?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it's still below the Social Security tax rate.

What is Medicare tax withheld on w2?

Box 6: Medicare Tax Withheld. This amount represents the total amount withheld from your paycheck for Medicare taxes. The Medicare tax rate is 1.45%, and a matching amount of 1.45% is paid by W&M. Once you earn $200,000 annually, there is an additional . 9% that the employee pays which makes a total of 2.35%.

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Does Medicare tax mean I have insurance?

The Medicare tax is a payroll tax that applies to all earned income and supports your health coverage when you become eligible for Medicare.

How does FICA show on my paycheck?

If you see “FICA” on your pay stub, this is the amount you are contributing to these funds. Some pay stubs will break down your contribution to the two funds separately, and some will not.

Where is FICA on w2?

FICA tax withholding is shown in box 4 for Social Security taxes and in box 6 for Medicare taxes.

Why do I have Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

Where is Box B on W-2?

Box B: This is your employer's unique tax identification number or EIN. Box C: This identifies the name, address, city, state and zip code of your employer. The address may show your company's headquarters rather than its local address.

Why are there two numbers in Box 19 of my W-2?

Box 19: Local income tax withheld. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. Box 20: Locality name. Box 20 contains the two-digit code associated with the tax collection agency serving our area.

What is Box 4 on W-2?

Box 4 — Shows the amount of Social Security tax withheld from your pay.

What Is Included on A Paycheck stub?

Although every company prints paychecks that are unique in their own way, there are some aspects of the employee paycheck that employers must inclu...

Additional Items That May Appear on Your Paycheck Stub

Although not required, the following are items that may appear on your paycheck stub and are useful to money management and relevant to your employ...

Common Abbreviations Used on Paycheck Stubs

1. YTD: Year-to-Date 2. FT or FWT: Federal Tax or Federal Tax Withheld 3. ST or SWT: State Tax or State Tax Withheld 4. SS or SSWT: Social Security...

Exercise Good Money Management Skills: Be Proactive

If you need further explanation on how to read your paycheck stub or if a particular calculation doesn’t seem correct, consult your Human Resources...

How long does it take to see a Medicare claim?

Log into (or create) your secure Medicare account. You’ll usually be able to see a claim within 24 hours after Medicare processes it. A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare.

What is Medicare Part A?

Check the status of a claim. To check the status of. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. or.

What is MSN in Medicare?

The MSN is a notice that people with Original Medicare get in the mail every 3 months. It shows: All your Part A and Part B-covered services or supplies billed to Medicare during a 3-month period. What Medicare paid. The maximum amount you may owe the provider. Learn more about the MSN, and view a sample.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Does Medicare Advantage offer prescription drug coverage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. Check your Explanation of Benefits (EOB). Your Medicare drug plan will mail you an EOB each month you fill a prescription. This notice gives you a summary of your prescription drug claims and costs.

What is the other part of your paycheck called?

But if you find yourself living paycheck to paycheck and need to improve your money management skills, you need to pay close attention to the other perforated portion of your paycheck, called the paycheck stub (also known as the explanation statement.)

What happens if your retirement plan is not calculated correctly?

If a calculation is incorrect, the issue may reappear on every paycheck. Also, you may not be making the best choice for a retirement plan contribution, or losing money if your earnings are not calculated properly. It is ultimately your responsibility to ensure that you are being properly compensated.

What are the items on a pay stub?

Additional Items that May Appear on Your Paycheck Stub 1 Insurance Deductions: Monthly payments for such types of insurance as health (medical and dental), and life insurance. 2 Retirement Plan Contributions: Plans such as 401 (K) or 403 (B) retirement savings plans. 3 Leave Time: Including vacation hours or sick hours. Most employers will detail how many hours have been used to date and how many hours are remaining for the calendar year. 4 Childcare Assistance: If offered by your employer, this amount may appear on each paycheck as a pre-tax benefit. 5 Important Notices: Employers often use a portion of the paycheck stub to communicate important pieces of information to their employees such as wage increases or notifications about tax filings.

How often is a pay period?

A pay period is determined by your employer , but is typically weekly, bi-weekly (every two weeks), semi-monthly (twice per month), or monthly. This figure does not factor in tax withholdings. Net Pay: Includes the amount of income that you actually take home after all withholdings have been applied.

Is childcare assistance a pre-tax benefit?

Childcare Assistance: If offered by your employer, this amount may appear on each paycheck as a pre-tax benefit. Important Notices: Employers often use a portion of the paycheck stub to communicate important pieces of information to their employees such as wage increases or notifications about tax filings.

Is Medicare withholding mandatory?

Medicare: Like Social Security withholdings, Medicare withholdings are also mandatory. Every employee pays 1.45% of their paycheck toward Medicare, and every employer contributes an additional 1.45% on behalf of the employee. Upon eligibility for Social Security, an employee is entitled to coverage for a majority of their medical expenses.

What is included in the earnings section of a paycheck?

The earnings section shows your earnings from the pay period and includes overtime. It also shows pre-tax deductions for different employee benefits that you may receive, such as health insurance and retirement contributions.

How much does a worker contribute to Medicare?

Every worker contributes 1.45% of their gross income to Medicare and every employer pays an additional 1.45% on behalf of each employee.

What taxes are deducted from paycheck?

In a payroll period, the taxes deducted from a paycheck typically include Social Security and Medicare taxes , otherwise known as FICA (Federal Insurance Contributions Act). The following taxes and deductions are what you can expect to see on your paycheck, explained in detail below.

What is withholding on a paycheck?

Withholding refers to the money that your employer is required to take out of your paycheck on your behalf. This includes federal and state income tax payments, Social Security, Unemployment Insurance, and Worker’s Comp.

What deductions are on pay stubs?

Common pay stub deductions include federal and state income tax, as well as Social Security. These federal and state withholdings account for much of the difference between your gross income and net income. There may be other deductions as well, depending on the programs that you sign up for with your employer.

How often do you have to get paychecks in Colorado?

Colorado state law, for example, requires that employees recieve paystubs from their employers at least once a month, which must list gross and net wages, as well as all deductions. Learn more about US paycheck law by state.

How much does each employee contribute to Social Security?

Under federal law, each worker contributes 6.2% of their gross income directly into the Social Security fund, and every employer adds an extra 6.2% for each employee.

How to check my Medicare application?

How to check your Medicare application online. If you applied for Medicare online, you can check the status of your application through your Medicare or Social Security account. You can also visit the Check Enrollment page on Medicare.gov and find information about your enrollment status by entering your: ZIP code. Medicare number.

How to check Medicare Part D enrollment?

date of birth. Medicare Part A effective date. You can also check the status of your application by visiting or calling a Social Security office. You can ask your pharmacy to check the status of your Medicare Part D enrollment by sending a test claim. You can also call the Member Services department ...

How to change Medicare plan when you get it in mail?

When you get your Medicare card in the mail, make sure the information is correct. Contact Social Security if you want to change your plan. There may be fees included in changing plans or adding additional coverage if you didn’t do it when you were eligible.

How long does it take to get a Medicare card?

You’ll receive your card within about 3 weeks from the date you apply for Medicare. You should carry your card with you whenever you’re away from home.

When do you start receiving Medicare benefits?

Your benefits may not start until 3 months after applying, so it’s important to apply 3 months before your 65th birthday to start receiving coverage that day. If you already collect Social Security income benefits or Railroad Retirement Benefits, you will automatically be enrolled in Medicare when you turn 65.

Is Healthline Media a licensed insurance company?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on June 30, 2020.

What to do if you don't receive Medicare?

If you don’t receive these benefits, you’ll need to decide how to pay your Medicare premium bill (in which case, you may need to use Form CMS-500 ). There are several payment options, including sending a check or money order, mailing your credit card information or using your bank’s payment service.

When is Medicare payment due?

You’ll have your payment due on the 25th of the month, so pay early to allow processing time. Whether you prefer making individual payments or enjoy the convenience of automated payment options, Medicare's online portal has you covered.

How often do you get Medicare premiums?

If you only have Medicare Part B and don’t get your Part B premiums deducted from your benefits, you’ll receive a premium bill every three months . If you have to buy Part A or owe Part D income-related monthly adjustment amounts (IRMAA), you’ll get a monthly premium bill.

How long does it take to get your Easy Pay payment?

Complete the online form with your details and submit it. It will take between 6-8 weeks before Easy Pay starts deducting your payments, so remember to make manual payments until you receive confirmation you’re signed up to Easy Pay.

Can you save on Medicare Supplement?

Learn How to Save on Medicare. Medicare Supplement Insurance plans (also called Medigap) can’t cover your Medicare premiums, but they can help make your Medicare spending more predictable by paying for some of your other out-of-pocket costs such as Medicare deductibles, copayments, coinsurance and more.

Does Medicare Easy Pay work?

Medicare Easy Pay is another payment option available to MyMedicare members. This program costs nothing to use, and it automatically deducts premiums from your checking or savings account when they’re due, ensuring you maintain continuous coverage. You’re also able to view your premium payment history online with Easy Pay.