To drop Part B (or Part A if you have to pay a premium for it), you usually need to send your request in writing and include your signature. Contact Social Security. If you recently got a welcome packet saying you automatically got Medicare Part A and Part B, follow the instructions in your welcome packet, and send your Medicare card back.

Full Answer

How do I decline Medicare Part B?

Or if you’re enrolled automatically because you’re receiving those benefits, you can decline Part B by following the instructions that Social Security sends you in the letter that accompanies your Medicare card and meeting the specified deadline.

Can I disenroll from Medicare Part B?

I’ve had Medicare Part B for several years, but now I’m starting a job that provides health insurance. Can I disenroll from Part B? If so, how? A. Yes, you can opt out of Part B.

How do I contact Social Security about Medicare Part B?

Please contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778) if you have any questions. Note: When completing the forms: State, “I want Part B coverage to begin (MM/YY)” in the remarks section of the CMS-40B form or online application.

Can I get Out of Medicare Part B If I start?

Q. I’ve had Medicare Part B for several years, but now I’m starting a job that provides health insurance. Can I disenroll from Part B? If so, how? A. Yes, you can opt out of Part B.

How do you decline Medicare Part B?

Call the Social Security Administration at 800-772-1213 and ask if you can decline Part B without any penalties. Write down who you spoke with, when you spoke to them and what they said. should write a letter to the Social Security Administration declining Part B.

Can I decline Part A Medicare?

If you qualify for premium-free Medicare Part A, there's little reason not to take it. In fact, if you don't pay a premium for Part A, you cannot refuse or “opt out” of this coverage unless you also give up your Social Security or Railroad Retirement Board benefits.

How do I Unenroll from Medicare?

Call 1-800-MEDICARE (1-800-633-4227). Mail a signed written letter to your plan's mailing address notifying them of your desire to disenroll. Submit a disenrollment request through the plan's website (if such a feature is offered).

What happens when you opt out of Medicare Part B?

Opting out ensures that you don't have to pay Part B premiums or, if you're receiving retirement benefits, have them deducted each month from your Social Security retirement check.

Where do I mail my CMS 1763 form?

Where should Form CMS-1763 be sent? The CMS 1763 form must be completed during or after an interview with a representative from the Social Security Administration. Having filled it out completely, the applicant should submit it to the applicant's local SSA office.

Do I need Medicare Part B if I have Medicaid?

Once you become dual-eligible, most – if not all – of your healthcare costs will be covered. Thus, you are not eligible to enroll in a Medicare Supplement plan. Medicaid covers your Medicare Part A premium (if applicable) and the standard Medicare Part B premium for all eligible enrollees.

Do I have to pay for Medicare Part B?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How do you pay for Medicare if you are not collecting Social Security?

If you don't get benefits from Social Security (or the Railroad Retirement Board), you'll get a premium bill from Medicare. Get a sample of the Medicare bill. An extra amount you pay in addition to your Part D plan premium, if your income is above a certain amount.

What to do if you drop Part B?

If you’re dropping Part B because you can’t afford the premiums, remember that you could save money on your health care costs in other ways. Consider adding a Medicare Advantage or Medigap plan instead of dropping Part B. Call us to learn more about these alternatives to disenrolling in Part B.

What happens if you opt out of Part B?

But beware: if you opt out of Part B without having creditable coverage—that is, employer-sponsored health insurance from your current job that’s as good or better than Medicare—you could face late-enrollment penalties (LEPs) down the line.

What happens if you don't have health insurance?

Without health insurance that’s as good or better than Medicare, you could start racking up late-enrollment penalties the longer you go without coverage. If you decide to re-enroll in Part B later, these penalties could make your premiums (what you pay for coverage) even less affordable.

How to schedule an interview with Social Security?

Call a Licensed Agent: 833-271-5571. You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative.

Is it easy to cancel Medicare Part B?

Disenrolling in Medicare Part B isn’t an easy process because it requires an in-person or phone interview. But this is intentional. Canceling Part B could have negative consequences for your wallet (in the form of late-enrollment penalties) and your health (in the form of a gap in coverage).

Can Medicare tack late enrollment penalties?

If you have a gap in coverage, the Medicare program could tack late-enroll ment penalties onto your Part B premiums if you re-enroll in coverage again later. Avoid this pitfall by working with your human resources department to ensure that your company's insurance is indeed creditable (meaning that it’s as good or better than Medicare Part B). You may need to provide documentation of creditable coverage during your Part B cancellation interview.

Does Medicare Advantage offer rebates?

Consider a Medicare Advantage plan that offers a rebate on your Part B premium. Here's how that works: A Medicare Advantage plan provides the same or better coverage than Part A (hospital insurance) and Part B (medical insurance). To receive this coverage, most enrollees pay a premium for their Medicare Advantage plan in addition to the cost ...

Nobody can force you to sign up for Medicare, but you may face lifelong late enrollment penalties once you do join

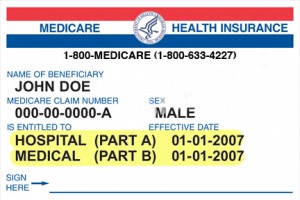

When you turn 65, or are diagnosed with a qualifying disability, you are eligible to sign up for Medicare. Original Medicare is made up of two parts: Part A (hospital insurance) and Part B (medical insurance).

Is Medicare mandatory?

While it’s recommended to enroll in Medicare when you first become eligible, it is not mandatory. If you delay enrollment and have creditable coverage elsewhere, there's no late fees. But, if you do not have creditable coverage and a year or more passes, you will have to pay lifelong late enrollment penalties if you ever do sign up for Medicare.

Why would I delay Medicare coverage?

In most cases, you should only decline Part B if you have group health insurance from an employer you or your spouse is actively working at, and that insurance is primary to Medicare, meaning it pays before Medicare does.

How to opt out of Medicare Part B

If you’ve reviewed your situation and have decided you do not want Part B, you are able to delay or drop the coverage.

What happens when I drop Part B?

If you follow the above steps and delay or drop Part B coverage, this means you are relying on your existing group health plan or private coverage for medical insurance. You will not have to pay Part B premiums (or have them deducted from your Social Security or RRB check).

What if I want to re-enroll in Part B?

If you change your mind, you may re-enroll at a later time. Keep in mind you may have to pay late enrollment penalties if you didn’t have appropriate coverage in place. In some cases you may be able to re-enroll online, though if you have Part A and not part B, you must print, sign and submit new forms.

How to disenroll from Medicare?

To disenroll, you’re required to submit a form (CMS-1763) that must be completed either during a personal interview at a Social Security office or on the phone with a Social Security representative. For an interview, call the Social Security Administration at 1-800-772-1213, or your local office. Medicare insists on an interview to make sure you ...

Can you drop out of Part B?

Medicare insists on an interview to make sure you know the consequences of dropping out of Part B—for example, that you might have to pay a late penalty if you want to re-enroll in the program in the future. However, this is not a problem if you’re leaving Part B to enroll in primary health insurance from an employer.

How to contact Social Security about Part B?

Please contact Social Security at 1-800-772-1213 ( TTY 1-800-325-0778) if you have any questions. Note: When completing the forms: State, “I want Part B coverage to begin (MM/YY)” in the remarks section of the CMS-40B form or online application. If your employer is unable to complete Section B, please complete that portion as best you can on behalf ...

Do you have to leave home to sign up for Medicare Part B?

For many people, signing up for Medicare Part B doesn’t require you to leave the comfort of home. Please visit our Medicare Part B webpage if: You are already enrolled in Medicare Part A. You would like to enroll in Part B during the Special Enrollment Period.