However, you will still need to confirm this with Medicare prior to any settlement through a request for lien information to the Centers for Medicare and Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Centers for Medicare and Medicaid Services

The Centers for Medicare & Medicaid Services, previously known as the Health Care Financing Administration, is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state government…

How do I find out about Medicare lien claims?

In addition to finding out information about any type of lien claim at your first meeting with the client, be sure to find out if the client receives Medicare benefits. If so, make a copy of their Medicare card, and be sure to copy both sides.

How and when do Medicare liens arise?

A. How and When Medicare Liens Arise Under the Medicare Secondary Payer Act, found at 42 U.S.C. §1395y (b) (MSP), Medicare has a right to be reimbursed for payments it has made for a Medicare beneficiary’s medical treatment when the Medicare beneficiary is compensated for the treated injury by a third-party source.

Who is subject to Medicare’s lien claim?

Persons and entities receiving payment (settlement or bill payment) from a primary payer are also subject to the MSP. They are responsible for satisfying original Medicare‘s lien claim from the money received from the primary payer, if the primary payer failed to satisfy the lien. The Code of Federal Regulations states:

What to do if CMS includes treatment in a lien?

If you feel that CMS is including treatment in the lien that was not related to the workers’ compensation claim, then you can submit a dispute letter to CMS challenging the validity of the charges. This is easier for a Defendant to do in a workers’ compensation claim.

What are Medicare liens?

A Medicare lien results when Medicare makes a “conditional payment” for healthcare, even though a liability claim is in process that could eventually result in payment for the same care, as is the case with many asbestos-related illnesses.

How do I get reimbursed from Medicare?

How to Get Reimbursed From Medicare. To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out.

How do I get a final payment letter from Medicare?

To request a Final CP Amount, go to the Case Information page and select the Calculate Final Conditional Payment Amount action. Click [Continue] to proceed. The Warning - Calculate Final Conditional Payment Amount Can Only Be Selected Once page displays.

What is a CMS demand letter?

The demand letter explains how to resolve the debt, either by repayment or presentation, and documentation of a valid defense. The insurer/TPA is to repay Medicare the lesser of its total primary payment obligation or the amount that Medicare paid.

How do you submit a bill to Medicare?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

Can you negotiate Medicare liens?

This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out. While you can get the lien reduced, paying back Medicare after a settlement is not optional. The only path around a Medicare lien is to negotiate the lien to zero.

Do Medicare benefits have to be repaid?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

Do I have to pay back conditional payments?

If you continue to certify for benefits while we review, you may have to pay back any conditional payments you received if we later find you ineligible.

What is a CMS conditional payment letter?

Conditional Payment Letter (CPL) A CPL provides information on items or services that Medicare paid conditionally and the BCRC has identified as being related to the pending claim.

How is Medicare lien amount calculated?

Formula 1: Step number one: add attorney fees and costs to determine the total procurement cost. Step number two: take the total procurement cost and divide that by the gross settlement amount to determine the ratio. Step number three: multiply the lien amount by the ratio to determine the reduction amount.

What is the Medicare Secondary Payer debt?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare.

What is Medicare lien?

To enforce this right to reimbursement, a “Medicare lien” will attach to judgment or settlement proceeds that are awarded as compensation for the accident. This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out.

How does a lien work in personal injury?

How Medicare Liens Work in Personal Injury Cases. If you are injured in an accident and Medicare pays for some of your treatment, you will be obligated to reimburse Medicare for these payments if you bring a personal injury claim and get financial compensation for the accident. To enforce this right to reimbursement, ...

How much can Medicare fine for reporting?

Additionally, Medicare can fine the “Responsible Reporting Entity,” usually the insurer, up to $1,000 for each day that they are out of compliance with Medicare’s reporting requirements. That is some harsh medicine. It leaves insurance companies stone terrified.

How long does it take for a personal injury claim to be reported to Medicare?

Any settlement or payment must be reported to Medicare within 60 days and their valid lien amount must be paid.

Does Medicare enforce a lien?

Medicare Actively Enforces These Liens. If a Medicare lien is not properly handled and paid off, Medicare is permitted to file against the defendant, the plaintiff, or the plaintiff’s counsel. If Medicare is forced to bring suit against a party to collect its lien, in some situations it is entitled to a civil penalty of two times the amount owed.

Does Medicare have a lien on personal injury settlements?

If a Medicare beneficiary receives a personal injury settlement, they will be required to reimburse Medicare for any payments made on their behalf. To enforce this requirement, the law gives Medicare an automatic priority lien against any settlement proceeds in personal injury cases.

When will an attorney receive a recovery letter?

An attorney will not receive a formal recovery demand letter until there is a final settlement, judgment, award, or other payment reported to Medicare. Once this occurs, a final demand letter will be sent out regarding the Medicare lien amount.

What is a closure letter for Medicare lien?

Once payment of the lien is made to CMS, a closure letter will be issued advising the parties that the lien issue has been resolved.

How old do you have to be to get Medicare?

Most individuals are entitled to Medicare coverage when they reach sixty-five (65) years of age. However, a claimant can become a Medicare beneficiary prior to reaching sixty-five (65) years of age in certain circumstances.

Does an Erisa lien complicate a settlement?

In our last post, we discussed the issues posed by ERISA liens and how the presence of an ERISA lien can complicate a potential settlement. Another similar issue that complicates settlements is the potential presence of a Medicare lien. This applies to workers’ compensation and liability cases.

What is a Medicare lien waiver?

The Medicare lien waiver process is a more involved process than the compromise process. Waiver requests typically focus on the financial position of the injured Medicare beneficiary, who may have higher expenses and/or lower income after sustaining an injury. After settlement occurs and funds are transferred, while the MSP technically still allows the U.S. to pursue the primary payer, when a Medicare beneficiary fails to satisfy a Medicare lien, the Medicare beneficiary is most often considered the debtor and pursued by CMS initially through the BCRC. Attorneys for Medicare beneficiaries can also be caught in the MSP cross hairs. Waiver requests for a Medicare beneficiary are sent to the BCRC. In turn, the BCRC typically asks for a SSA-632 form to be filled out with a variety of financial information about the beneficiary. Waiver determinations may be made by BCRC staff and are usually based on financial hardship.

How long does it take to get Medicare if you are disabled?

a. The first step is to determine whether the injured party is eligible for and/or receiving federal benefits. If not a Medicare beneficiary, then Medicare could not have made any conditional payments that would need to be reimbursed. Sometimes, a settlement will take years to reach. Because a person deemed disabled under SSA’s definition, becomes enrolled in Medicare within two years of receiving Social Security Disability Insurance (SSDI), those who are in the pending application or appeals process for SSDI, are considered to have a reasonable expectation of becoming Medicare enrolled within 30 months. People with end stage diseases like End Stage Renal Disease or ALS have an expedited path to Medicare enrollment separate from the ordinary application SSDI process or via age eligibility.

What cases have CMS been successful in?

For example, CMS was successful in Benson v. Sebelius, 771 F. Supp. 2d 68, 75 (D.D.C. 2011) (Because plaintiff claimed his mother’s medical costs in pursuing his wrongful death action, medical expenses of mother were taken into consideration in calculating and negotiating wrongful death settlement award, and release to landlord where slip and fall occurred included any and all claims and rights including associated medical liens, no error was found when Medicare Appeals Board (in a de novo review) allowed CMS to recover its full medical expenses lien minus its procurement costs from the wrongful death settlement) (citing Mathis v. Leavitt, 554 F.3d 731, 733 (8th Cir.2009) (“Because appellants claimed all damages available under the Missouri wrongful death statute, the settlement, which settled all claims brought, necessarily resolved the claim for medical expenses.”); Cox v. Shalala, 112 F.3d 151, 154–55 (4th Cir.1997) (determining that Medicare was entitled to reimbursement for medical expenses from the proceeds of a wrongful death settlement because the settlement included recovery for decedent’s medical expenses); see also Brown v. Thompson, 374 F.3d 253, 262 (4th Cir.2004) (holding that CMS was entitled to reimbursement from the proceeds of a medical malpractice settlement pursuant to the MSP).

What is the Medicare Secondary Payer Statute?

a. In 1980, the Medicare Secondary Payer Statute (MSP) was enacted. 42 U.S.C. §1395y (b) et seq. is commonly called the MSP Act or MSP Statute and is also referred to as the Medicare Secondary Payer provisions of the Social Security Act (SSA). While it has different statutory references, it is the same law and has parallel sequences of each number and letter after the section 1395y or 1862 as follows: 42 U.S.C. § 1395y (b) = 42 U.S.C. §1862 (b) of the SSA.

What is conditional payment lien?

Because conditional payments are to be reimbursed and there is a direct statutory right providing the U.S. Government with rights of recovery including double damages, Department of Treasury offsets, and other remedies, the industry often refers to conditional payment claims as Medicare liens. We will use this terminology although it could be said that a lien usually needs some other action (such as a filing in a court) before it may be perfected.

What is CMS 411.28?

42 C.F.R. § 411.28 Waiver of recovery and compromise of claims. Pursuant to this regulation, CMS may waive recovery, in whole or in part , if the probability of recovery, or the amount involved, does not warrant pursuit of the claim. It references the general rules applicable to compromise of claims in both subpart F of part 401and under 42 C.F.R. § 405.376, as well as pertinent rules in subpart C of part 405.

Does Medicare pay for secondary payers?

Under the Medicare Secondary Payer Act, found at 42 U.S.C. §1395y (b) (MSP), Medicare has a right to be reimbursed for payments it has made for a Medicare beneficiary’s medical treatment when the Medicare beneficiary is compensated for the treated injury by a third-party source. While Medicare’s rights to recovery under the MSP are so strong that they have been described as a super lien, that does not mean that your client has to always pay the full amount requested by Medicare.

What is the red, white and blue card for Medicare?

All persons who qualify for Medicare receive a Medicare identification card that is red, white and blue. Healthcare that is provided under the red, white and blue card is known as “original” (or “traditional”) Medicare. Persons who opt for a Medicare Advantage healthcare plan will have two cards.

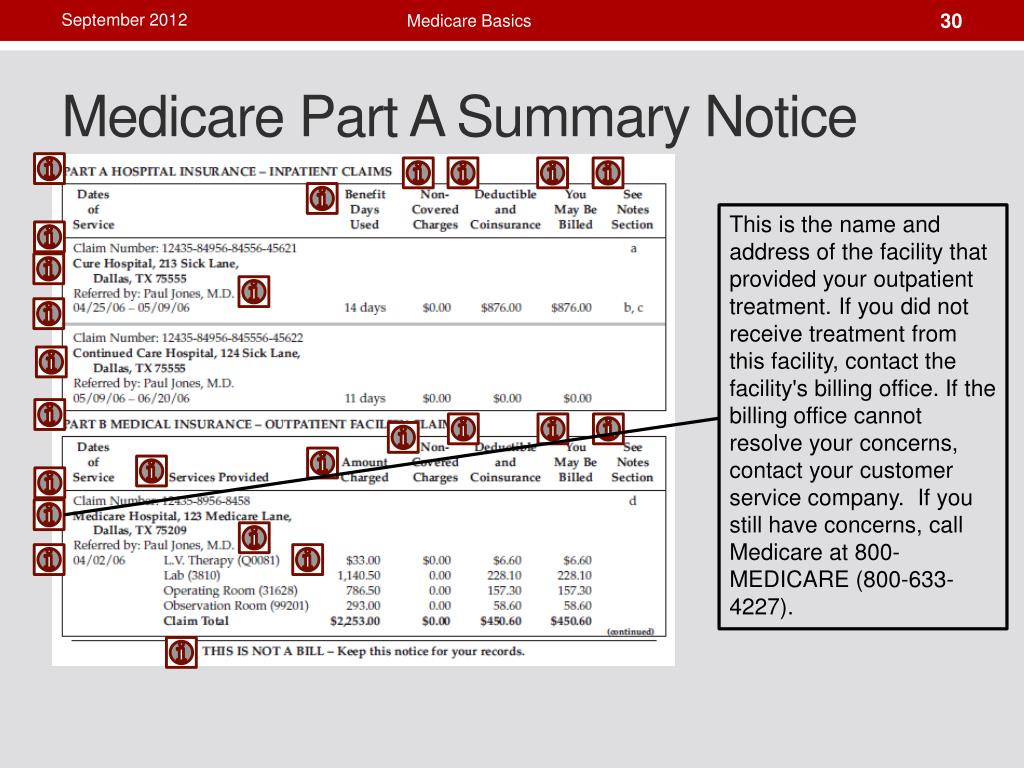

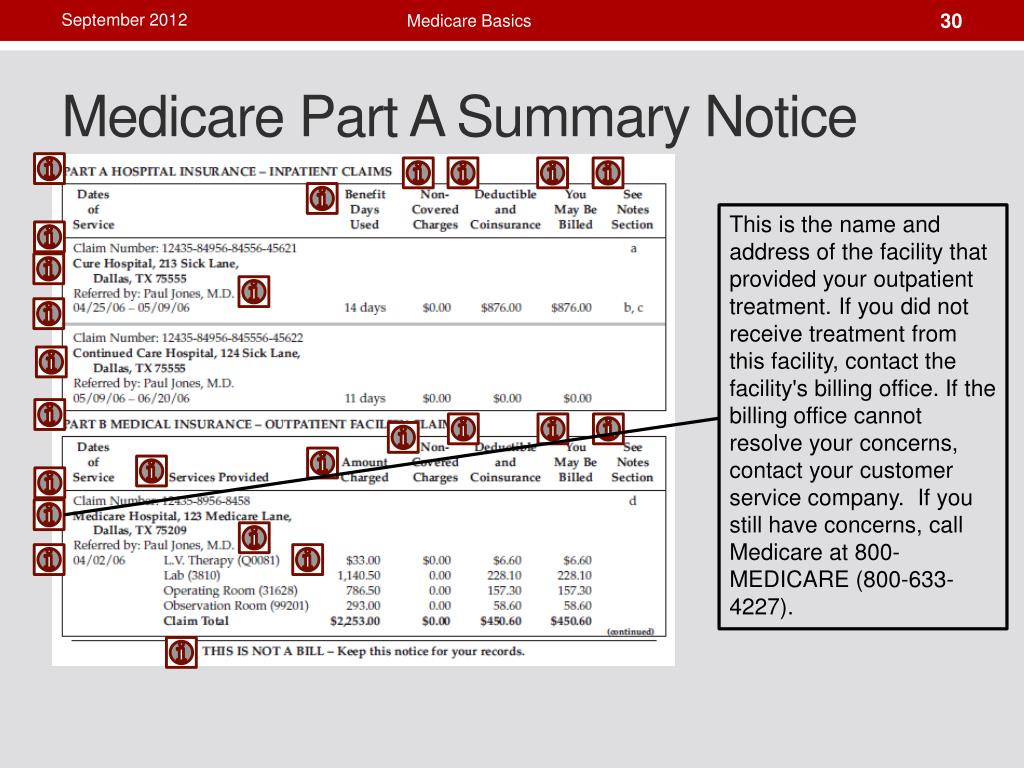

How many parts does Medicare have?

The Medicare Act has four primary parts that allow for Medicare healthcare. (The other parts of the Medicare Act are not discussed in this compendium.) The four parts are: Medicare Part A, for hospitalization, and Part B, for medical doctors and healthcare services, are known as original ( aka traditional) Medicare.

What is a MAO reimbursement claim?

An MAO’s reimbursement claim should be scrutinized to assure it contains both the MAO’s claim for reimbursement and also any second-tier claim for reimbursement, if so allowed under the first-tier and/or second-tier contract. Notice to an MAO of a beneficiary’s third-party tort case.

How much does Medicare pay for hospital days?

Under Part B, original Medicare pays a healthcare provider 80% of the provider’s fee, and the beneficiary is required to pay the 20% balance.

Can a Part D provider issue a prescription card?

A Part D provider may also issue an identification card for the beneficiary to obtain prescription drugs. Both original Medicare and a Medicare Advantage plan have lien claim rights for medical services provided to a Medicare beneficiary for injuries sustained through the fault of a third party.

Is Medicare a secondary payer?

For those payments, Medicare calls itself a “secondary payer,” and it claims the tortfeasor and its insurance carrier are the “primary payers.”. Medicare’s right to recovery is established under the Medicare Secondary Payer Act (MSP). (42 U.S.C. § 1395y.)

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

Who has the right to appeal a demand letter?

This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the right to appeal.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

Who must report a claim to Medicare?

Reporting a Case. Medicare beneficiaries, through their attorney or otherwise, must notify Medicare when a claim is made against an alleged tortfeasor with liability insurance (including self-insurance), no-fault insurance or against Workers’ Compensation (WC). This obligation is fulfilled by reporting the case in the Medicare Secondary Payor ...

When does Medicare focus on the date of last exposure?

When a case involves continued exposure to an environmental hazard, or continued ingestion of a particular substance, Medicare focuses on the date of last exposure or ingestion to determine whether the exposure or ingestion occurred on or after 12/5/1980.

What is a rights and responsibilities letter?

The Rights and Responsibilities letter is mailed to all parties associated with the case. The Rights and Responsibilities letter explains: What happens when the beneficiary has Medicare and files an insurance or workers’ compensation claim; What information is needed from the beneficiary;

Does Medicare cover non-ruptured implants?

For non-ruptured implanted medical devices, Medicare focuses on the date the implant was removed. (Note: The term “exposure” refers to the claimant’s actual physical exposure to the alleged environmental toxin, not the defendant’s legal exposure to liability.)

Does Medicare cover MSP?

Medicare has consistently applied the Medicare Secondary Payer (MSP) provision for liability insurance (including self-insurance) effective 12/5/1980. As a matter of policy, Medicare does not claim a MSP liability insurance based recovery claim against settlements, judgments, awards, or other payments, where the date of incident (DOI) ...

Medicare Liens

- How Medicare Liens Work in Personal Injury Cases

If you are injured in an accident and Medicarepays for some of your treatment, you will be obligated to reimburse Medicare for these payments if you bring a personal injury claim and get financial compensation for the accident. This federal law also unambiguously gives the Medicar… - The Nature of the Medicare Medical Lien

To enforce this right to reimbursement, a “Medicare lien” will attach to judgment or settlement proceeds that are awarded as compensation for the accident. This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out. While you ca…

2021-2022 Medicare Supreme Court Case on Tap

- The case that the U.S. Supreme Court will hear next month to decide on the issue of compensation for future medical expenses and Medicaid liens is Gallardo v. Marstiller. The Supreme Court will decide whether a state Medicaid program can go after a beneficiary’s compensation award for future medical expenses. Right now, federal law clearly permits Medica…

Significance of The Marstiller v. Gallardo Case

- The decision of the Supreme Court in Gallardo will have a major impact on how Medicaid liens are dealt with and how much reimbursement Medicaid can collect from personal injury settlements. If the Supreme Court agrees with the decision of the 11thCircuit and holds that Medicaid reimbursement liens can cover compensation for future medical expenses, state Medicaid agen…

Medical Liens

- In this section, we will look at medical liens in personal injury cases. Medical liens differ from Medicare liens in that they involve regular health insurance as opposed to Medicare. This section explains how the health insurance company may have an interest in your case in some states….and why it is not quite as big of a deal as you may think.