There are many different Medicare Advantage plans with varying cost structures and benefits. Medigap (Medicare Supplement) Medigap fills in the gaps in coverage for Original Medicare, Part A and Part B, by paying the hospitals directly for cost-sharing expenses such as coinsurance, deductibles, and copayments for covered services you receive.

Do Medicare Advantage plans include coinsurance costs?

What do Medicare Advantage Plans cover? Medicare Advantage Plans cover almost all Part A and Part B services. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you’re always covered for

What is a Medicare Advantage a deductible?

Nov 29, 2021 · Many Medicare Advantage plans may also offer prescription drug coverage, as well as coverage for hearing, dental and vision care, which are not typically covered by Original Medicare. While a Medicare Advantage plan will likely include coinsurance costs, a plan could help you save on some of your other out-of-pocket health care costs, which could help offset …

What does a Medicare Advantage plan cover?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2022, the standard Part B premium amount is $170.10 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

What is the typical coinsurance amount for Medicare Part D plans?

May 06, 2021 · Medicare Advantage plans out of pocket cost: Deductibles A deductible is the amount you must pay out of pocket for health care before your plan begins to pay. For example, if your deductible is $1,000, you could pay $1,000 out of pocket before you plan begins to cover your health care costs. Some Medicare Advantage plans have $0 annual deductibles.

Does AARP cover Medicare coinsurance?

Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, and deductibles. Each plan varies in terms of coverage and cost.

Do Medicare Advantage plans cover coinsurance?

Copays and coinsurance Our Medicare Advantage plans use copays for most services. You pay 20 percent coinsurance for most services with Original Medicare.Nov 20, 2017

Does AARP plan a cover Medicare deductible?

AARP Medicare Supplement Plan B Plan B covers each of the benefits offered under Plan A. Additionally, it covers 100% of your Medicare Part A deductible. In 2020, the Part A deductible is $1,408.Jan 4, 2022

How do deductibles work with Medicare?

A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you received outpatient care or services covered by Part B, you would then pay the first $233 to meet your deductible before Medicare would begin covering the remaining cost.

What are the deductibles on Medicare Advantage plans?

Medicare Advantage plans out of pocket costs: deductibles Some Medicare Advantage plans have $0 medical deductibles, $0 prescription drug deductibles, and $0 premiums.

What is the deductible for AARP plan G?

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 (in 2021) that must be met before the plan coverage kicks in.Sep 21, 2021

What is the cost of AARP Medicare Advantage plan?

About 7 out of 10 of AARP's Medicare Advantage plans offer $0 premiums. Of AARP plans that have a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $112.

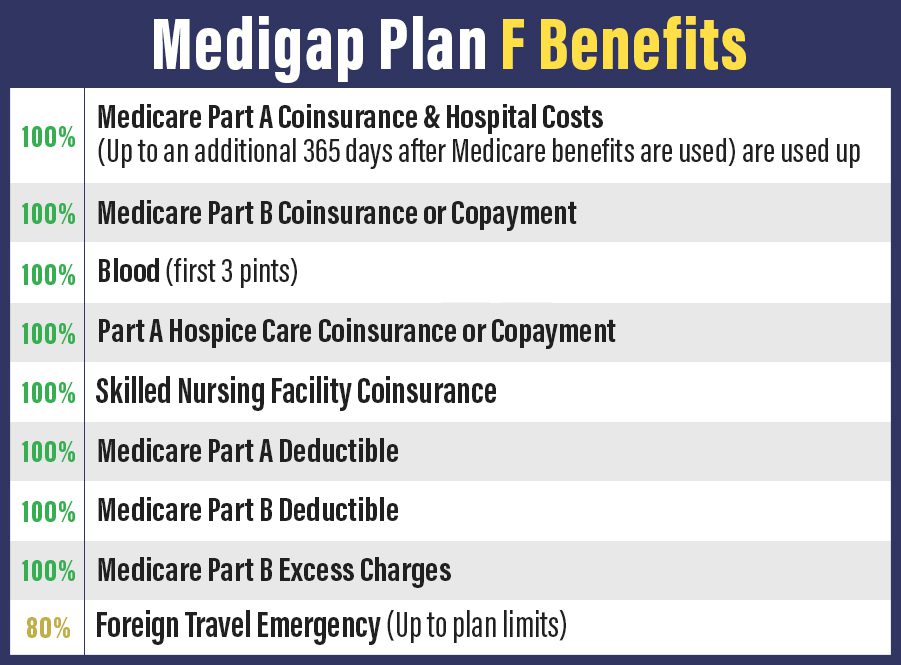

Does plan F cover Medicare deductible?

Overview. Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the Medicare deductible for 2020?

In 2020, the Medicare Part B deductible is $198 per year.

What was the Medicare deductible for 2019?

In 2019, the Medicare Part B deductible is $185 per year.

What counts toward the Medicare Part B deductible?

Basically, any service or item that is covered by Part B counts toward your Part B deductible.

What happens once you reach the deductible?

Once you meet the required Medicare Part B deductible, you will typically be charged a 20 percent coinsurance for all Part B-covered services and i...

Is there a way to avoid paying the Medicare Part B deductible?

There are two ways you may be able to avoid having to pay the Medicare Part B deductible: Medicare Supplement Insurance or a Medicare Advantage plan.

What is coinsurance in Medicare?

Coinsurance is the percentage of a medical bill that you (the Medicare beneficiary) may be responsible for paying after reaching your deductible. Coinsurance is a form of cost-sharing; it's a way for the cost of care to be split between you and your provider. The deductible is the amount you are required to pay in a given year or benefit period ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

Does Medigap cover coinsurance?

In exchange for paying a monthly premium to belong to the plan, a Medigap plan can help cover the cost of your Medicare coinsurance and/or your deductibles. If John from our above example had a Medigap plan that covered his Part B deductible and coinsurance, he may have owed nothing for his doctor’s appointment.

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What happens if you have a Medicare Advantage Plan?

If you have a Medicare Advantage Plan, you have the right to an organization determination to see if a service, drug, or supply is covered. Contact your plan to get one and follow the instructions to file a timely appeal. You also may get plan directed care.

What is Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, ...

What is Medicare health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. under Medicare. If you're not sure whether a service is covered, check with your provider before you get the service.

How much is Medicare Advantage 2021?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2021, the standard Part B premium amount is $148.50 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

Can you get care outside of Medicare?

Care that you get outside of your Medicare health plan's service area for a sudden illness or injury that needs medical care right away but isn’t life threatening. If it’s not safe to wait until you get home to get care from a plan doctor, the health plan must pay for the care. . The plan can choose not to cover the costs of services that aren't.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

What is a deductible for Medicare?

A deductible is the amount you must pay out of pocket for health care before your plan begins to pay. For example, if your deductible is $1,000, you could pay $1,000 out of pocket before you plan begins to cover your health care costs. Some Medicare Advantage plans have $0 annual deductibles.

What is coinsurance and copayment?

Coinsurance and copayment is the amount you pay every time you see a doctor or use a service. Coinsurance is usually a percentage and a copayment is a set dollar amount. For example, you could pay a $15 copayment every time you visit the doctor.

What is Medicare premium?

A premium is the amount you pay monthly or annually to have the plan, whether or not you receive services. Some Medicare Advantage plans have premiums as low as $0 but you must continue to pay your Medicare Part B premium.

Does Medicare Advantage cover hospice?

Medicare Advantage plans must cover everything that Original Medicare (Part A and Part B) cover with the exception of hospice care, which is still covered by Part A. Unlike Original Medicare, Medicare Advantage plans have out of pocket limits, capping what you spend yearly on covered medical services. Medicare Advantage plans may save you money ...

What is the deductible for Medicare?

Each part of Medicare carries its own deductible. The Part A and Part B deductibles are standard for each beneficiary of Original Medicare. The Part C (Medicare Advantage) and Part D (prescription drug plan) deductibles will vary from plan to plan. Some Part C and Part D plans may have a $0 deductible. Some Medicare Advantage plans also feature $0 ...

What is the coinsurance for Medicare Part B?

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent ...

What is the deductible for Part D?

Medicare defines a deductible as: “The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.”.

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible in 2021 is $203 per year, and the Part A deductible is $1,484 per benefit period. Learn more about these costs and what you can expect.

Does Medicare Supplement Insurance cover Part B?

If you enroll in one of these types of plans and pay a monthly premium to belong to the plan, you will not have to pay out of your own pocket for the Medicare Part B deduct ible.

How much is Medicare Part A 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period . Unlike the deductible for Part B that operates on an annual basis, the Part A deductible starts and stops with each benefit period. A benefit period begins the day you are admitted for inpatient care at a hospital or skilled nursing facility, ...

Is Medicare Part C the same as Medigap?

It's important to note that Medicare Part C is a term only used for Medicare Advantage plans, and it's not the same as Medigap Plan C. Medicare Advantage plans provide the same benefits as Medicare Part A and Part B in one plan and serve as an alternative way to get Original Medicare coverage.

What are the costs of Medicare Advantage?

Medicare Advantage plans typically cover medically necessary procedures, office visits, hospitalizations and prescription drugs. Sometimes there can be higher deductibles and other costs for services that are not covered by ...

How many people will be enrolled in Medicare Advantage in 2020?

Enrollment in Medicare Advantage plans has doubled during the last decade, while monthly premiums have decreased. In 2020, 34% of all Medicare beneficiaries are enrolled in a Medicare Advantage plan. Researchers expect this trend to continue.

How much is Medicare Part B 2021?

The standard Medicare Part B premium for 2021 is $148.60, but it can be higher, depending on your income level. Be sure to pay your Medicare Part B and Medicare Advantage premiums on time, so you won’t lose coverage. You could use automatic deductions to avoid missing a payment.

Does Medicare Advantage have a monthly premium?

Medicare. Provide a Valid ZipCode. See Plans. Some Medicare Advantage plans require a monthly premium payment, but others don’t. In fact, more than nine out of 10 beneficiaries (93%) will have access to a Medicare Advantage plan with prescription drug coverage with no monthly premium in 2020.

How much can you pay out of pocket for Medicare?

The average out-of-pocket limit for in-network services in 2019 Medicare Advantage plans was $5,059.

Can Medicare Advantage plan change?

Medicare Advantage plans can change their features, including cost-sharing and in-network doctors, each year. So, the plan that worked well for you this year might not be the best plan for you next year. Depending on the specific changes, you could save money by switching plans.

Who is James Yoo?

About James Yoo. James is a writer and editor for HealthCare.com and its web properties. He is a former newspaper journalist. James has an MA in journalism from Syracuse University and a BA in history from the University of Pennsylvania.

How much is Medicare Part A deductible?

Medicare Part A has a $1,340 deductible each benefit period. Tip: A Medicare Part A benefit period starts when you first go into the hospital or other inpatient facility. It ends when you've been out of the hospital or facility for 60 days in a row.

What is copay in health insurance?

A copay is a fixed amount of money you pay for a certain service. Your health insurance plan pays the rest of the cost. Coinsurance refers to percentages. Our Medicare Advantage plans use copays for most services. You pay 20 percent coinsurance for most services with Original Medicare.

Does Medicare Advantage have an out-of-pocket maximum?

When you reach a certain amount, we pay for most covered services. This is called the out-of-pocket maximum. Original Medicare doesn’t have an out-of-pocket maximum. There's no cap on what you pay out of pocket.

Does Medicare Advantage have a deductible?

Most Medicare Advantage plans have separate medical and pharmacy deductibles. That means that in addition to the $160 medical deductible we used as an example above, you might also have a Part D prescription drug deductible that you’ll need to meet before your plan starts covering your medications.