Can I elect Cobra if I am Medicare eligible?

Your previous employer is required to provide you with a COBRA option to continue your health plan for a specified period of time, but enrolling onto a COBRA plan if you are eligible for Medicare may result in your being charged a penalty along with other potential issues.

Is Cobra credible for Medicare?

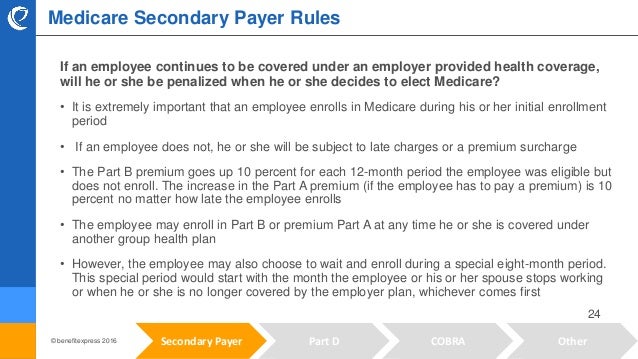

Under current law, COBRA coverage does not count towards creditable prior coverage for Medicare Part B, which means that when your COBRA ends and you decide to sign up for Medicare Part B after the date you originally could have joined, you will face a 10% per year for life penalty on the cost of Part B.

Is Medicaid or COBRA primary?

Medicare is always considered primary when you are no longer working and covered by COBRA. (Joel Mekler is a certified senior adviser. Send him your Medicare questions at [email protected] /)

How does Cobra work with Medicare?

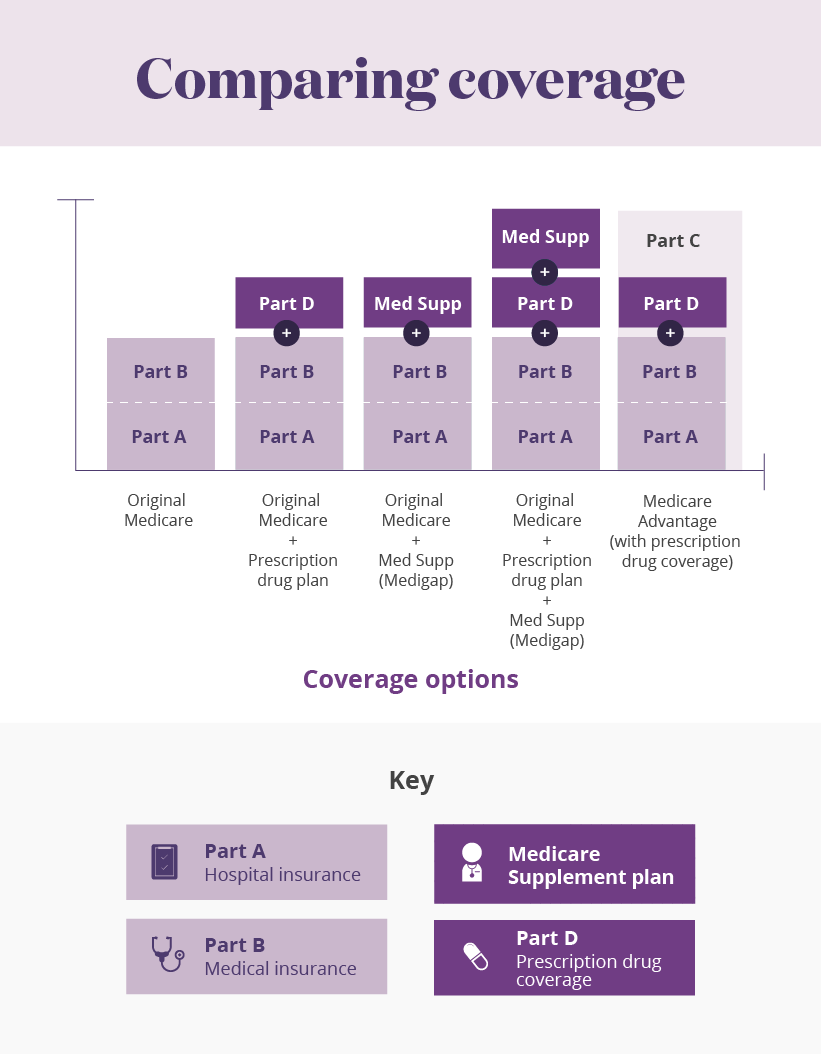

The parts of Medicare are:

- Medicare Part A (hospital insurance). Part A covers stays in the hospital, skilled nursing facilities, and other inpatient care settings.

- Medicare Part B (medical insurance). Part B covers doctor’s visits, ambulance rides, medical equipment, therapies, and other medical services.

- Medicare Part C (Medicare Advantage). ...

- Medicare Part D (drug coverage). ...

How does COBRA and Medicare work together?

If your Medicare benefits (Part A or Part B) become effective on or before the day you elect COBRA coverage, you can continue COBRA coverage as well as having Medicare. This is true even if your Part A benefits begin before you elect COBRA but you don't sign up for Part B until later.

Is Medicare primary or secondary to employer coverage?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

How do you determine which insurance is primary and which is secondary?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer.

Does Medicare recognize COBRA as creditable coverage?

Does COBRA Count as Creditable Coverage for Medicare? To avoid penalties with Medicare, you must have creditable coverage. This means coverage that's at least equivalent to Medicare. COBRA does NOT meet these standards.

Is Medicare always the primary insurance?

If you don't have any other insurance, Medicare will always be your primary insurance. In most cases, when you have multiple forms of insurance, Medicare will still be your primary insurance.

Can you have employer coverage and Medicare at the same time?

Can I have Medicare and employer coverage at the same time? Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

How do I determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.

When two insurance which one is primary?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

How does it work when you have two health insurance policies?

If you have multiple health insurance policies, you'll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance won't pay toward your primary's deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

What happens if I turn 65 while on COBRA?

The risks in electing COBRA at 65 or older include missing Medicare Part B enrollment deadlines and paying premium penalties, having a gap in medical coverage and being responsible for large medical bills you didn't anticipate.

Can you have dual coverage with COBRA?

Each qualified beneficiary has an independent right to elect continuation coverage. This means that if both you and your spouse are entitled to elect continuation coverage, you each can make a different choice.

Is Medicare entitlement A COBRA qualifying event?

Medicare entitlement of the employee is listed as a COBRA qualifying event; however, it is rarely a qualifying event. In situations where it is a qualifying event, it is only a qualifying event for the spouse or children that are covered under the group health plan.

How many employees can you have with Cobra?

In general, COBRA only applies to employers with 20 or more employees. However, some states require insurers covering employers with fewer than 20 employees to let you keep your coverage for a limited time.

How long does Cobra last?

COBRA coverage generally is offered for 18 months (36 months in some cases). Ask the employer's benefits administrator or group health plan about your COBRA rights if you find out your coverage has ended and you don't get a notice, or if you get divorced.

How long do you have to sign up for Part B?

If you’re eligible for Medicare, you don’t qualify for COBRA coverage without having to pay a premium. You have 8 months to sign up for Part B without a penalty, whether or not you choose COBRA.

What is the number to call for Medicare?

If your group health plan coverage was from a state or local government employer, call the Centers for Medicare & Medicaid Services (CMS) at 1-877-267-2323 extension 61565. If your coverage was with the federal government, visit the Office of Personnel Management.

Do you have to tell Cobra if you are divorced?

You or the covered employee needs to tell the plan administrator if you qualify for COBRA because you got divorced or legally separated (court-issued separation decree) from the covered employee, or you were a dependent child or dependent adult child who's no longer a dependent.

Do you have to tell your employer if you qualify for Cobra?

Once the plan administrator is notified, the plan must let you know you have the right to choose COBRA coverage.

What happens if you enroll in Cobra?

This means that if your employees enroll in COBRA instead of Medicare, once COBRA coverage ends, they will have to wait until the next annual enrollment period to enroll in Medicare, and they will have to pay late penalties. The late penalties are not minor, either. For Medicare Part B, for example, the monthly premium goes up 10 percent ...

What is the cobra law?

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, is a federal law that requires employers to offer health care continuation to covered employees, their spouses and their dependents after a qualifying event. Enrollees can be required to pay 102 percent of premium costs, which includes the full premium and a 2 percent administrative fee.

How much does Medicare Part B premium go up?

For Medicare Part B, for example, the monthly premium goes up 10 percent for every 12-month period enrollment was delayed. Enrollees have to pay this penalty for the rest of their lives. If your employees are trying to decide between COBRA and Medicare, make sure they understand that they must enroll in Medicare if they want to avoid expensive ...

How to contact CMS about Medicare?

Your employees can contact the CMS Benefits Coordination & Recovery Center at 1-855-798-2627 with questions about Medicare and COBRA. As always, do your best!

Is Medicare Part A free?

Some younger individuals with certain chronic health conditions may qualify as well. Some of your employees may be disappointed to learn that Medicare is not free, although most enrollees qualify for premium-free Medicare Part A.

Is Medicare a qualifying event?

Yes. Employee enrollment in Medicare is considered a qualifying event under COBRA. Imagine this scenario: One of your employees turns 65 and ages into Medicare, but he’s not ready to retire yet. He keeps working. Now he has two health plan options: his group health plan and Medicare.

Is Cobra the same as Medicare?

If someone is enrolled in both COBRA and Medicare, Medicare is the primary insurance. In other words, Medicare pays first, and COBRA may pay some of the costs not covered by Medicare. Certain benefits are not included in traditional Medicare. For example, dental, vision and hearing benefits are generally excluded from Medicare coverage, ...

When is COBRA primary?

Note: If you are eligible for Medicare due to End-Stage Renal Disease (ESRD), your COBRA coverage is primary during the 30-month coordination period. Be sure to learn about ESRD Medicare rules when making coverage decisions.

Is Medicare Part A or Part B?

If you have Medicare Part A or Part B when you become eligible for COBRA, you must be allowed to enroll in COBRA. Medicare is your primary insurance, and COBRA is secondary. You should keep Medicare because it is responsible for paying the majority of your health care costs.

What is Cobra insurance?

COBRA, which stands for the Consolidated Omnibus Budget Reconciliation Act, helps provide health insurance to employees in certain situations where they may otherwise lose their health coverage for 18 to 36 months . COBRA usually is offered to those who experience a reduction in work hours or lose employment. In this blog we’ll cover all these ...

What happens if you get Cobra before Medicare?

I f you get COBRA first and then become eligible for Medicare, when you turn 65, COBRA will cease providing primary insurance coverage to you. Medicare will become primary, and if you can keep COBRA, it will become your secondary insurer.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long do you have to enroll in Medicare?

Here are some key things about enrollment to keep in mind: 1 You need to enroll in Medicare Part B once you’re eligible 2 You may be able to delay enrolling in Medicare Part D prescription drug coverage without penalty if you can keep COBRA coverage and it includes creditable prescription drug coverage 3 You will have 63 days to enroll in Medicare Part D without penalty once you lose COBRA drug coverage

Can you delay Part D if you lose Cobra?

If you take COBRA and it does provide creditable coverage, then yes, you may be able to delay Part D without penalty. In this case, you will have 63 days after losing COBRA coverage to enroll in Part D without penalty.

Does Cobra pay for Medicare?

If you do decide to take COBRA, do not drop your Medicare plan. Medicare is your primary insurer, and that won’t change when you take COBRA. Medicare will cover some or all health care costs first. COBRA may pay some costs not paid for by Medicare.

Who pays first, Medicare or Cobra?

Who pays first; COBRA, or Medicare? Medicare pays first, except when you have End-Stage Renal Disease. If you have End-Stage Renal Disease, then COBRA pays first. Medicare pays second to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility.

When do you have to enroll in COBRA?

If you’re on COBRA and under 65, you must enroll in Part A and Part B during your Initial Enrollment Period. Your Initial Enrollment Period will begin three months before your 65th birthday. If you don’t join during the seven-month window, you’ll incur penalties.

Can you terminate Cobra insurance?

It’s important to note that your COBRA coverage could be terminated before the maximum period if you become entitled to Medicare after electing to continue coverage.

Can you have cobra and Medicare at the same time?

It’s possible to have COBRA and Medicare coverage at the same time. However, they don’t coordinate the same way as employer coverage and Medicare. When you have COBRA, Medicare usually pays first, and COBRA pays second. However, it’s possible that your group insurance has special rules that will determine the primary payer.

Is Cobra a part of Medicare?

COBRA is NOT creditable coverage for Part B. If you delay enrollment you’ll face life-time penalties. You could choose to have Medicare Part A and B, alongside COBRA. But COBRA wasn’t made for Medicare.

Can you get a special enrollment period with Medicare?

Medicare allows you to qualify for a Special Enrollment Period if you lose your employer’s current health coverage, and you’re Medicare eligible . If you have COBRA when coverage ends, you won’t qualify for a Special Enrollment Period through Medicare.

Is Cobra a creditable insurance?

COBRA is NOT creditable coverage. If you’re Medicare-eligible and have COBRA, you should enroll in Part B. COBRA extends group benefits for a set period of time – up to 18 months. It’s rare for COBRA to be the best option for a Medicare-eligible person. You can usually get better coverage for less money than COBRA.

How to learn more about Medicare?

How to Learn More About Your Medicare Options. Primary insurance isn't too hard to understand; it's just knowing which insurance pays the claim first. Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast.

Is Medicare primary insurance in 2021?

Updated on July 13, 2021. Many beneficiaries wonder if Medicare is primary insurance. But, the answer depends on several factors. While there are times when Medicare becomes secondary insurance, for the most part, it’s primary. Let’s go into further detail about what “primary” means, and when it applies.

Is Medicare a primary or secondary insurance?

Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

Does Medicare pay your claims?

Since the Advantage company pays the claims, that plan is primary. Please note that Medicare WON’T pay your claims when you have an Advantage plan. Medicare doesn’t become secondary to an Advantage plan. So, you’ll rely on the Advantage plan for claim approvals.

Can you use Medicare at a VA hospital?

Medicare and Veterans benefits don’t work together; both are primary. When you go to a VA hospital, Veteran benefits are primary. Then, if you go to a civilian doctor or hospital, Medicare is primary. But, you CAN’T use Veterans benefits at a civilian doctor. Also, you can’t use Medicare benefits at the VA.

Is Medicare a part of tricare?

Medicare is primary to TRICARE. If you have Part A, you need Part B to remain eligible for TRICARE. But, Part D isn’t a requirement. Also, TRICARE covers your prescriptions. Your TRICARE will be similar to a Medigap plan; it covers deductibles and coinsurances.

Medicare vs. COBRA

COBRA is a form of continuation coverage of employer group health insurance.

Can You Have Both COBRA and Medicare?

You can have both COBRA and Medicare coverage at the same time, but only in certain situations.

How Do COBRA and Medicare Work Together?

If you have both Medicare and COBRA coverage, Medicare is always the primary payer — meaning that Medicare pays first for any health care claims, and your COBRA plan pays second. This can save you on out-of-pocket costs.

What is Cobra coverage?

This section provides information about COBRA continuation coverage requirements that apply to state and local government employers that maintain group health plan coverage for their employees. Group health plan coverage for state and local government employees is sometimes referred to as “public sector” COBRA to distinguish it from the requirements that apply to private employers. The landmark COBRA continuation coverage provisions became law in 1986. The law amended the Employee Retirement Income Security Act of 1974 (ERISA), the Internal Revenue Code and the Public Health Service Act (PHS Act) to provide continuation of employer-sponsored group health plan coverage that is terminated for specified reasons. CMS has jurisdiction to interpret and administer the COBRA law as it applies to state and local government (public sector) employers and their group health plans. Individuals who believe their COBRA rights are being violated have a private right of action. The COBRA law only applies to group health plans maintained by employers with 20 or more employees in the prior year. In addition, the law does not apply to plans sponsored by the governments of the District of Columbia or any territory or possession of the United States, certain church-related organizations, or the federal government. (The Federal Employees Health Benefit Program is subject to generally similar requirements to provide temporary continuation of coverage (TCC) under the Federal Employees Health Benefits Amendments Act of 1988.)

What happens after a COBRA election?

the employer ceases to maintain any group health plan. after the COBRA election, an individual obtains coverage with another employer group health plan. after the COBRA election, a beneficiary first becomes entitled to Medicare benefits.

How long does it take for a group health plan to notify the administrator of a second qualifying event?

If a second qualifying event is the death of the covered employee or the covered employee becoming entitled to Medicare benefits, a group health plan may require qualified beneficiaries to notify the plan administrator within 60 days of those events, as well.

How long do you have to notify Medicare plan administrators of a qualifying event?

Employers must notify plan administrators of a qualifying event within 30 days after an employee's death, termination, reduced hours of employment, or entitlement to Medicare (when an employee's Medicare entitlement results in loss of plan coverage for the employee's dependents).

How long does Cobra last?

In most cases, COBRA coverage for the covered employee lasts a maximum of 18 months. However, the following exceptions apply: 29-Month Period (Disability Extension): Special rules apply for certain disabled individuals and family members.

What are the second qualifying events for Medicare?

Second qualifying events may include the death of the covered employee, divorce or legal separation from the covered employee, the covered employee becoming entitled to Medicare benefits (under Part A, Part B or both), or a dependent child ceasing to be eligible for coverage as a dependent under the group health plan.

How long is premium assistance?

Premium assistance was available for up to 15 months, calculated depending on the circumstances. Individuals still receiving 9 months of premium assistance could receive an additional six months of premium assistance (for a total of 15 months coverage).

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).