Original Medicare — sometimes referred to as “traditional” Medicare — is administered by the federal government. It is divided into two parts: Part A (hospital insurance) and Part B (medical insurance). Medicare Part A Medicare Part A covers hospital care, including, skilled nursing facilities, hospice

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

What is the difference between Medicare Part an and Part B?

May 22, 2018 · Medicare Part A, or Medicare hospital coverage, is one of the four parts of Medicare, the government’s health insurance program for older adults.

Does Medicare Part A have a premium?

The different parts of Medicare help cover specific services: Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is covered by Medicare Part?

Medicare Part A . Part A (hospital coverage) covers things like inpatient hospital stays, home health care and some skilled nursing facility care. Together, Medicare Parts A and B are called Original Medicare. Medicare Part B. Part B (medical coverage) covers things like doctor visits, outpatient services, X-rays and lab tests, and preventive screenings. Medicare Part C . Part C is …

Do I have to pay for Medicare Part?

Federal Hospital Insurance Trust Fund. finances Medicare Part A. payroll taxes shared equally by employers and employees (2.9% split in half or 1.45% each) how the Federal Hospital Insurance Trust Fund is financed. people who are self-employed. who would have to pay all 2.9% of payroll taxes on their own.

What is Part A Medicare?

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

What is Medicare Part A quizlet?

Medicare Part A. Medicare Part A includes inpatient hospital coverage, skilled nursing care, nursing home care, and hospice care. It is the plan in which you're automatically enrolled when you apply for Medicare. The Part A plan is your hospital insurance plan.

What is the difference between Medicare Part A?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

What is original Medicare Part A?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). out-of-pocket costs.

What is Medicare describe Parts A and B of Medicare quizlet?

Medicare Part A covers hospitalization, post-hospital extended care, and home health care of patients 65 years and older. Medicare Part B provides coverage for outpatient services. Medicare Part C is a policy that permits private health insurance companies to provide Medicare benefits to patients.

What does Medicare Part A pay for quizlet?

Part A. (HOSPITAL INSURANCE) COVERS INPATIENT CARE AT A HOSPITAL, SKILLED NURSING FACILITY AND HOSPICE ALSO COVERS SERVICES LIKE LAB TESTS, SURGERY, DOCTORS VISITS, AND HOME HEALTH CARE.

What is the difference between Medicare Part A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

How are Medicare and Medicare different?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

What are the differences between Medicare Part A and Medicare Part B quizlet?

Medicare Part A pays for care in hospitals, skilled nursing facilities, and home health care; Medicare Part B pays for physician, diagnostic, and treatment services; Medicare C, also called Medicare Advantage, pays for hospital, physician, and, in some cases, prescription medications; Medicare Part D is a prescription ...

Is Original Medicare Part A and B?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

What is not covered under Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What does Medicare Part A cover?

As a Medicare Part A beneficiary, you will receive coverage for hospital expenses that are critical to your inpatient care, such as a semi-private room, meals, nursing services, medications that are part of your inpatient treatment, and any other services and supplies from the hospital.

When do you enroll in Medicare Part A?

Initial Enrollment in Medicare Part A. If you turn 65 and are already receiving Social Security retirement benefits or benefits from the Railroad Retirement Board (RRB), enrollment in Medicare Part A is usually automatic. Medicare Part A benefits begin the first day of the month you turn 65. If your birthday is on the first day ...

How long does a skilled nursing facility stay in a hospital?

To qualify for SNF care, the hospital stay must be a minimum of three days, beginning on the day you are formally admitted as an inpatient.

What is hospice care?

In hospice care, the focus is on palliative care, not curing your disease. The goal is to relieve pain and make the patient as comfortable as possible. To qualify for Medicare-covered hospice care, you must meet all of the following conditions: You must be enrolled in Medicare Part A.

How old do you have to be to qualify for Medicare?

Eligibility for Medicare Part A. In general, you are eligible for Medicare Part A if: You are age 65 or older and a U.S. citizen or permanent legal resident of at least five years in a row. You are already receiving retirement benefits.

When will Medicare cards arrive?

Your red, white, and blue Medicare card will arrive about three months before your 65th birthday. If you do not qualify for Social Security retirement benefits or benefits from the Railroad Retirement Board (RRB) then you must enroll in Medicare Part A manually during your Initial Enrollment Period (IEP).

Does Medicare cover home care?

Medicare Part A does not cover 24-hour home care, meals, or homemaker services if they are unrelated to your treatment. It also does not cover personal care services, such as help with bathing and dressing, if this is the only care that you need.

What is Medicare for?

Medicare is the federal health insurance program for: 1 People who are 65 or older 2 Certain younger people with disabilities 3 People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

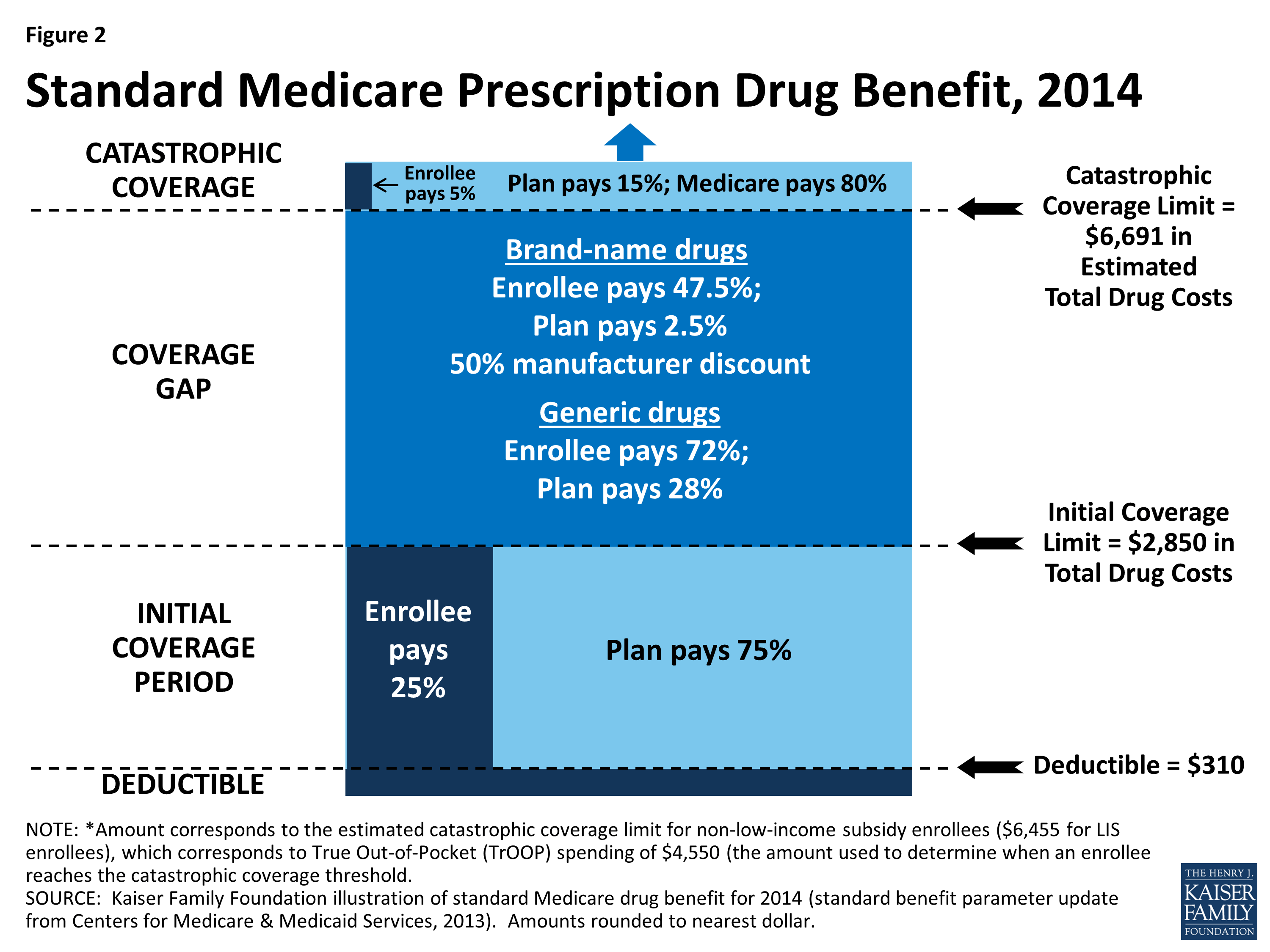

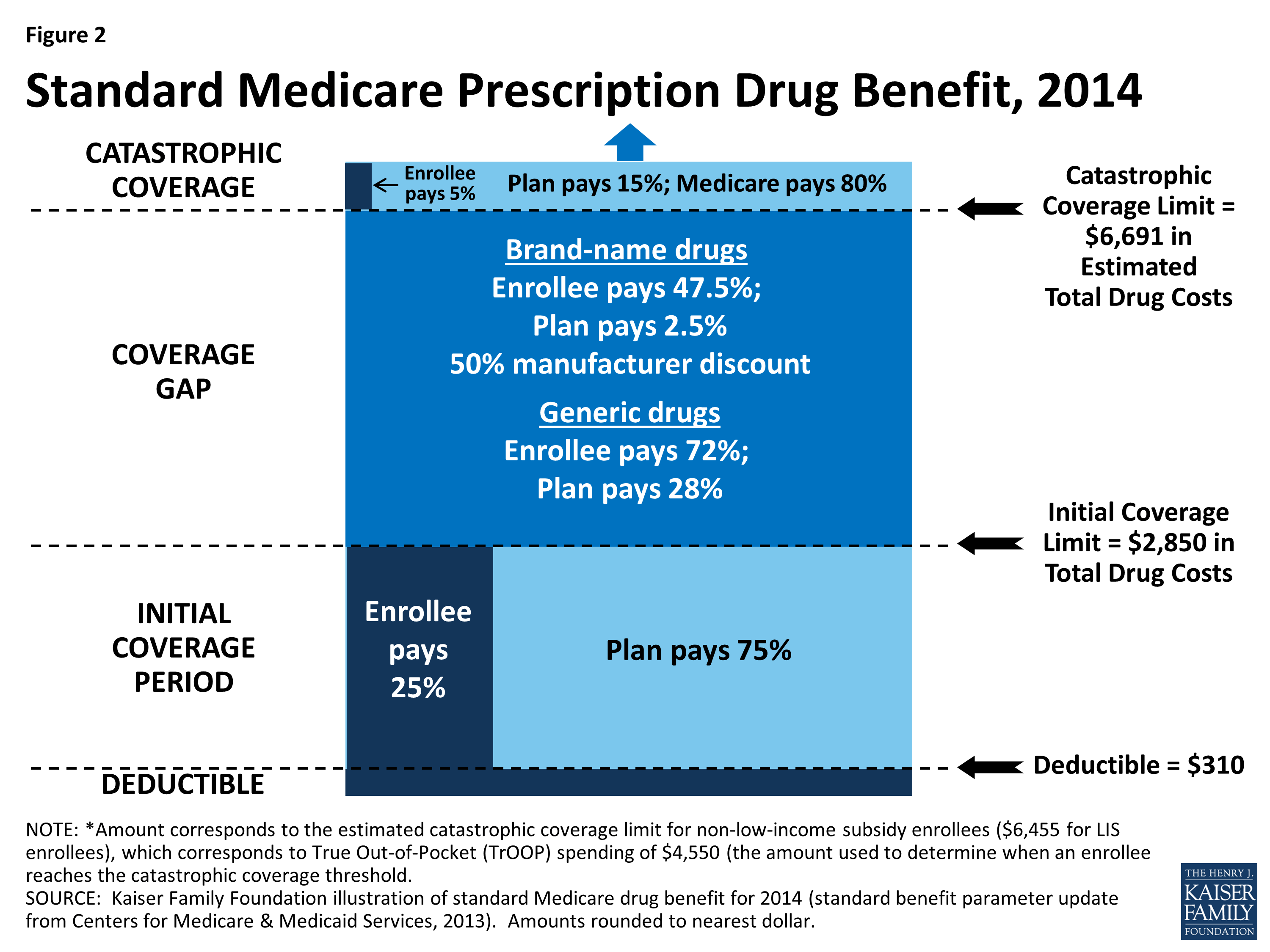

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

Is Medicaid part of Medicare?

Medicare and Medicaid (called Medical Assistance in Minnesota) are different programs. Medicaid is not part of Medicare. Here’s how Medicaid works for people who are age 65 and older: It’s a federal and state program that helps pay for health care for people with limited income and assets.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover colonoscopy?

If you had a different screening for colorectal cancer called a flexible sigmoidoscopy, Medicare covers a screening colonoscopy if it is 48 months or longer after that test. Eye exams. Medicare doesn’t cover routine eye exams to check your vision if you wear eyeglasses or contacts.

Does Medicare cover hearing aids?

Hearing aids. Medicare doesn’t cover hearing aids or pay for exams to fit hearing aids. Some Medicare Advantage plans have benefits that help pay for hearing aids and fitting exams.

Does Medicare cover acupuncture?

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesn’t cover costs to live in an assisted living facility or a nursing home.

How many parts are there in Medicare?

There are four different parts of Medicare: Part A, Part B, Part C, and Part D — each part covering different services. Understanding how these parts and services work (together and separately) is the key to determining which ones fit your unique health care needs and budget. There are two main paths for Medicare coverage — enrolling in Original ...

What is Medicare Advantage?

Medicare Advantage (Part C) is an alternative to Original Medicare. It allows you to receive Part A and Part B benefits — and in many cases, other benefits — from a private health insurance plan. At the very least, your Medicare Advantage plan must offer the same benefits as Original Medicare. The only exception is hospice care, which is still ...

Does Medicare Advantage include Part D?

Many Medicare Advantage plans also include Part D coverage. If you're looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan. You can compare Part D plans available where you live and enroll in a Medicare ...

What are the benefits of Medicare Advantage Plan?

Additional benefits that many Medicare Advantage plans include are: Vision coverage. Hearing coverage. Dental coverage. Medicare Part D prescription drug coverage. If you’re eligible for Medicare Part A and Part B, and do not have ESRD, you can join a Medicare Advantage Plan. Medicare beneficiaries have the option of receiving health care benefits ...

How long do you have to be on Medicare if you are 65?

For those younger than 65, you are only eligible to receive Medicare benefits if you: Have received Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Components

- Original Medicare consists of two parts: Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Medicare Part A covers Medicare inpatient care, including care received while in a hospital, a skilled nursing facility, and, in limited circumstances, at home.

Qualification

- Most people are automatically eligible for Medicare Part A at age 65 if theyre already collecting retirement benefits from the Social Security Administration or the Railroad Retirement Board. You may qualify for Medicare Part A before 65 if you have a disability, end-stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS). You must be either a United States citizen or a legal perm…

Benefits

- *Please note that some of the above benefits are only covered in limited situations and if certain conditions are met. As a Medicare Part A beneficiary, you will receive coverage for hospital expenses that are critical to your inpatient care, such as a semi-private room, meals, nursing services, medications that are part of your inpatient treatment, and any other services and suppli…

Cost

- Please note that Medicare Part A hospital insurance does not cover the costs for a private room (unless medically necessary), private-duty nursing, personal care items like shampoo or razors, or other extraneous charges like telephone and television. Medicare Part A also does not cover the cost of blood. You do not need to pay anything if the hospital gets it from a blood bank at no cha…

Scope

- Medicare Part A does not cover 24-hour home care, meals, or homemaker services if they are unrelated to your treatment. It also does not cover personal care services, such as help with bathing and dressing, if this is the only care that you need.

Health

- The home health care must be provided by a Medicare-certified home health agency, and a doctor must certify that you are home-bound. According to Medicare, you are homebound if both of the following are true:

Healthcare

- The skilled nursing care must be provided at a Medicare-certified facility. Medicare-covered skilled nursing care includes, but is not limited to:

Treatment

- If your doctor has certified that you have a terminal illness with an estimated six months or less to live, you may be eligible for hospice care coverage. In hospice care, the focus is on palliative care, not curing your disease. The goal is to relieve pain and make the patient as comfortable as possible.

Prevention

- Although you must give up any curative treatments for your terminal illness to receive Medicare coverage, you have the right to stop hospice care at any time. If you are thinking about going back to curative treatments, talk to your doctor.

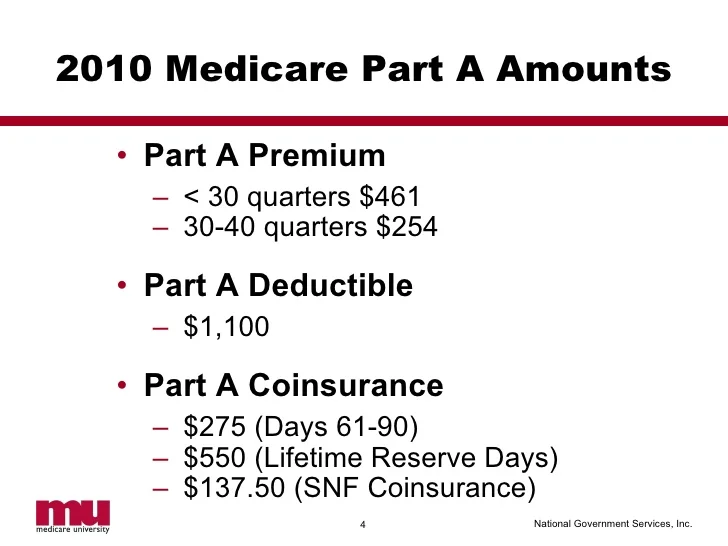

Risks

- Most beneficiaries do not pay a premium for Medicare Part A if they have worked at least 10 years (or 40 quarters) and paid Medicare taxes during that time. Individuals who arent eligible for premium-free Medicare Part A can still enroll in Part A and pay a premium. Beneficiaries who delay enrollment after they first become eligible for Medicare Part A may be subject to a late enr…

Access

- If you do not qualify for Social Security retirement benefits or benefits from the Railroad Retirement Board (RRB) then you must enroll in Medicare Part A manually during your Initial Enrollment Period(IEP). You can do so through the Social Security website, by visiting a local Social Security office, or by calling 1-800-772-1213 (TTY users 1-800-0778), Monday through Fri…

Schedule

- The seven-month IEP begins three months before your 65th birthday, includes the month you turn 65, and ends three months later. The start of your coverage depends on which month you enroll during your IEP. Be careful not to wait until the last minute to enroll. If you do not enroll during your seven-month IEP, you will be required to wait until the next general enrollment period (Janu…

Results

- If you are disabled, enrollment in Medicare Part A hospital insurance (and Medicare Part B medical insurance) will begin after you have been receiving Social Security disability benefits for 24 months. Your coverage will begin in the 25th month. Your Medicare card will arrive about three months before your coverage begins.

Example

- If you have ALS (also known as Lou Gehrigs disease), your Medicare Part A hospital insurance (and Medicare Part B medical insurance) will automatically begin the same month that your Social Security disability benefits begin. Your Medicare card will arrive about one month after you sign up for Social Security disability benefits.