Medicare prescription drug plans are also called Part D plans. They help you pay for prescription drugs. Medicare works with insurance companies and other private companies to offer many options for buying prescription medicines. Look at each plan to see how much it costs, what drugs it covers, and what pharmacies it works with.

Full Answer

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

How to find the best Medicare Part D plan?

How to shop for and compare Medicare Part D plans

- Know what you need. The first step in choosing a plan once you’ve set up your primary Medicare plan is to consider your needs.

- Start shopping early. These are a lot of questions to consider. ...

- Gather helpful information. ...

- Check your eligibility for assistance programs. ...

What drugs are covered under Medicare Part D?

which is as good or better than what Part D would provide. Medicare contracts with private plans to offer drug coverage under Part D. There are two ways to enroll in Part D. You can purchase a stand-alone Part D plan or enroll in a Medicare Advantage plan ...

What is the Best Part D drug plan?

Humana Medicare Part D Plans

- Walmart Value Rx Plan

- Basic Rx Plan

- Premier Rx Plan

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What are the two options for Medicare consumers to get Part D prescription drug coverage?

You may have the choice of two types of Medicare plans—a stand-alone Medicare Part D Prescription Drug Plan or a Medicare Advantage Prescription Drug plan. Your Part D coverage choices are generally: A stand-alone Medicare Part D Prescription Drug Plan, if you have Medicare Part A or Part B or both.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

How do I choose a Part D plan?

Before you enroll in a Part D prescription drug plan, find out which plans are available in your area and whether they cover your prescriptions. Compare their overall cost and look for a plan that: Features the lowest overall cost.

What is an enhanced Part D drug plan?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

Is SilverScript a good Part D plan?

All of Aetna's PDPs have a Medicare star quality rating of 3.5 out of five stars. CVS/Aetna's SilverScript Smart RX plan has the lowest average monthly premium in 2022, and CVS is one of four main providers of stand-alone Part D prescription drug plans in the United States.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Is wellcare a good Part D plan?

Wellcare's Medicare Part D Plans have an overall average quality rating of 3.7 stars from the Centers for Medicare & Medicaid Services.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the difference between SilverScript choice and SilverScript SmartRx?

SilverScript SmartRx: $0 deductible for tier 1 drugs and a $445 deductible for tiers 2 to 5. SilverScript Choice: $0 deductible for tier 1 and tier 2 drugs and a deductible from $205 to $445 for tiers 3 to 5. SilverScript Plus: $0 deductible on all covered drugs.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

Why does Medicare change its drug list?

Your plan may change its drug list during the year because drug therapies change, new drugs are released, or new medical information becomes available.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What are the tiers of Medicare?

Here's an example of a Medicare drug plan's tiers (your plan’s tiers may be different): Tier 1—lowest. copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

Which insurance company monitors drug plans?

Plans that have accurate price information are more likely to have higher ratings. Further, Medicare monitors plans for drug safety.

How many pharmacies does Cigna have?

As far as in-network, Cigna has contracts with over 63,000 pharmacies nationwide. Preferred pharmacies include Kroger, Rite Aid, Walmart, Sam’s Club, Walgreens, and MANY more.

What is Humana Pharmacy?

Humana Pharmacy is a mail-order program that saves you time and money.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

What are the two types of Part D plans?

Part D prescription drug plans vary considerably from one plan to another, but they fall into two basic categories: Basic and Enhanced. As implied by the names, Enhanced plans will provide more benefits, but also tend to have higher monthly premiums.

How to contact Part D insurance?

Call 1-844-309-3504 now to discuss your Part D coverage options with a licensed advisor. In addition, premiums can change from one year to the next, making a plan a better or worse value when compared with the other available options for the coming year.

How many Medicare Advantage plans are there?

According to a Kaiser Family Foundation analysis, the average Medicare beneficiary has access to 24 Medicare Advantage plans in 2019, and 20 of those plans include prescription drug coverage. If you want to use a Part D prescription drug plan to supplement Original Medicare, you can sign up for one when you become eligible for Medicare.

What is the maximum out of pocket limit for Medicare Advantage?

Other points to keep in mind: Medicare Advantage plans have maximum out-of-pocket limits that can’t exceed $6,700 in 2019, and that limit will continue to apply in 2020. But prescription costs don’t count towards the out-of-pocket cap, since it only applies to services that are covered under Medicare Parts A and B.

When does Medicare take effect?

If you join a PDP or Medicare Advantage plan between October 15 and December 7, your prescription drug coverage takes effect January 1.

Does Medicare cover outpatient drugs?

A: You have two general options for Medicare prescription drug coverage, and in both cases, they’re provided by private health insurance carriers, since most outpatient drugs are not covered under Medicare A or B.

Does Medicare offer drug assistance?

Prescription drug assistance for enrollees with low incomes. The federal government offers Extra Help to Medicare Part D enrollees with limited resources. And some states have State Pharmaceutical Assistance Programs (SPAPs) that provide prescription drug assistance to Medicare enrollees.

What is a Part D plan?

The best Medicare Part D plans not only help you manage the cost of prescription drugs, they also play a role in ensuring medicines stay affordable and they can protect against future price hikes. Roughly 70% of Americans signed up for Medicare supplement with a Part D plan, ...

What is the best Medicare Part D provider?

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

How much do the best Medicare Part D Plans cost?

According to MyMedicareMatters.org, the national average monthly premium for a Part D plan is $33.19. However, the cost varies depending on the plan you choose and the area where you live. In addition, to really determine the best plan for you, you need to consider the cost of the drugs you take plus the deductible and premium.

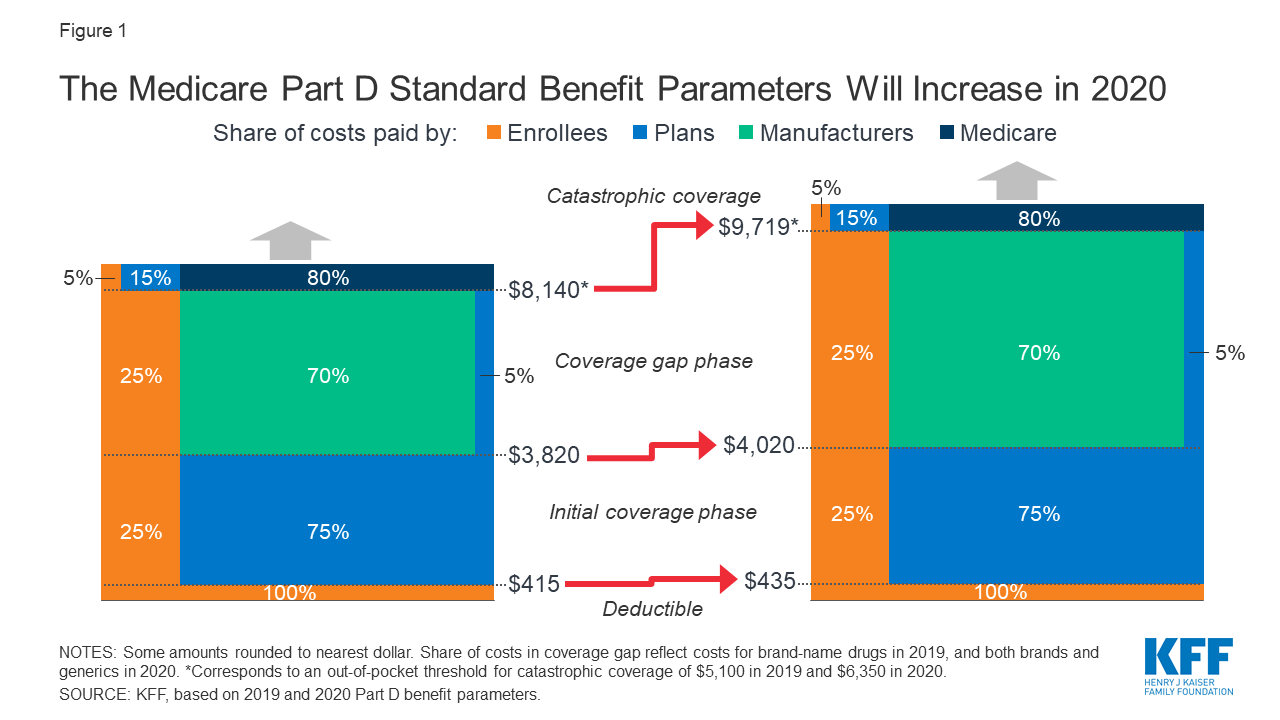

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

What is the deductible for Medicare Part D?

Annual deductible: The amount you pay before coverage begins. This amount is capped at $435 annually, but some Medicare Part D plans offer zero deductibles.

How much does AARP Medicare saver cost?

Plans range from the AARP Medicare Rx Saver Plus at $31.30 per month , the AARP Medicare Rx Walgreens at $39.40 and the AARP Medicare Rx Preferred plan as the most comprehensive for $81.80.

What is Medicare Part B?

Many Americans pay for Medicare Part B, as this covers doctor visits and similar outpatient medical services. Deductibles apply to services covered under Part A and B.

How long can you have opioids on Medicare?

First prescription fills for opioids. You may be limited to a 7-day supply or less if you haven’t recently taken opioids. Use of opioids and benzodiazepines at the same time.

What is the purpose of a prescription drug safety check?

When you fill a prescription at the pharmacy, Medicare drug plans and pharmacists routinely check to make sure the prescription is correct, that there are no interactions, and that the medication is appropriate for you. They also conduct safety reviews to monitor the safe use of opioids ...

Does Medicare cover opioid pain?

There also may be other pain treatment options available that Medicare doesn’t cover. Tell your doctor if you have a history of depression, substance abuse, childhood trauma or other health and/or personal issues that could make opioid use more dangerous for you. Never take more opioids than prescribed.

Does Medicare cover benzodiazepines?

Some Medicare drug plans have a drug management program in place to help you use these opioids and benzodiazepines safely. If your opioid use could be unsafe (for example, due to getting opioid prescriptions from multiple doctors or pharmacies), or if you had a recent overdose from opioids, your plan will contact the doctors who prescribed them for you to make sure they’re medically necessary and you’re using them appropriately.

Do you have to talk to your doctor before filling a prescription?

In some cases, the Medicare drug plan or pharmacist may need to first talk to your doctor before the prescription can be filled. Your drug plan or pharmacist may do a safety review when you fill a prescription if you: Take potentially unsafe opioid amounts as determined by the drug plan or pharmacist. Take opioids with benzodiazepines like Xanax®, ...

Does Medicare cover prescription drugs?

In most cases, the prescription drugs you get in a Hospital outpatient setting, like an emergency department or during observation services , aren't covered by Medicare Part B (Medical Insurance). These are sometimes called "self-administered drugs" that you would normally take on your own. Your Medicare drug plan may cover these drugs under certain circumstances.

Does Medicare require prior authorization?

Your Medicare drug plan may require prior authorization for certain drugs. . In most cases, you must first try a certain, less expensive drug on the plan’s. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

What is Medicare drug coverage?

You'll make these payments throughout the year in a Medicare drug plan: A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ).

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

What is formulary in insurance?

Your prescriptions and whether they’re on your plan’s list of covered drugs (. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

Why are my out-of-pocket drug costs less at a preferred pharmacy?

Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying your drug coverage costs.

Which Medicare Part D Plan is Best?

The best Part D drug plan depends on which medications you take. It’s best to look at the overall annual cost of each plan to identify the most financially sensible option for you.

Who Has The Cheapest Medicare Part D Plan?

Many people get hung up on the monthly costs, but as you’ll learn, there is more than premiums when it comes to insurance.

Which Plans Have High Ratings And Great Benefits?

Finding the right balance of cost and benefits can seem overwhelming. Medicare.gov gives you the option to see plans in your area based on their star ratings.

Which Part D Plans Have Enhanced Benefits?

Plans with higher premiums generally come with more benefits. For those that need specialty tier medication or take several brand-name medications, these high costing premium plans could be a money saver.

How to Find the Best Part D Prescription Drug Plan

Finding the best policy for yourself can feel overwhelming. Working with a licensed insurance agent can give you peace of mind because they will input your medication online to identify the options that save you the most money.

What is Medicare drug plan?

These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What do you give when you join a Medicare plan?

When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

How to compare Medicare Advantage plans?

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP).

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

How much does Medicare Part D cost?

As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How to find out if Medicare covers prescription drugs?

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent . You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

Why do we detail Part D costs?

We also detail Part D plan costs so that you can better understand your Medicare prescription drug coverage options.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.