Average Cost of Medicare Advantage Plans in Illinois

| Plan Name | Company | Annual Premium(approx.) | Drug Deductible | Star Rating (Out of 5 Stars) |

| Humana Gold Plus (HMO) | Humana | $1,735 | $0 | 4.5 |

| Cigna-HealthSpring Advantage (HMO) | Cigna | $1,735 | N/A | 3.5 |

| WellCare Essential (HMO-POS) | WellCare | $1,735 | $0 | 3 |

| AARP Medicare Advantage Choice (PPO) | UnitedHealthcare | $2,191 | $195 | 4.5 |

Full Answer

What is the best health insurance in Illinois?

What is the best Health Insurance Plan in Illinois?

- Bright Healthcare: Arrived to Illinois in 2021 with myriad of affordable plans and robust nework of providers and hospitals. ...

- Oscar: Start to offer health insurance plans in Illinois effective 2022. Oscar plans offer different health benefits are affrdable cost or even $0 cost. ...

- Cigna:

Which Medicare Prescription Plan is best?

- Medicare Advantage, also known as Part C is an alternative to Original Medicare.

- Medicare Advantage is run by private Medicare-approved insurance companies.

- Medicare Advantage is a bundle of Original Medicare, but provides more benefits than just Part A, Part B, and Part D (most plans), such as dental, hearing and vision, which ...

Who has the best Medicare Advantage plan?

- Best Medicare Advantage Plan Providers

- Compare Medicare Advantage Plans

- What is a Medicare Advantage Plan

- Medicare Law and Medicare Advantage Plans

- Best Medicare Insurance Providers 1. ...

- Pros + Cons of Medicare Advantage Plans Advantages of Medicare Part C Disadvantages of Medicare Part C

- How to Compare Medicare Advantage Plans

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

What is the most widely accepted Medicare plan?

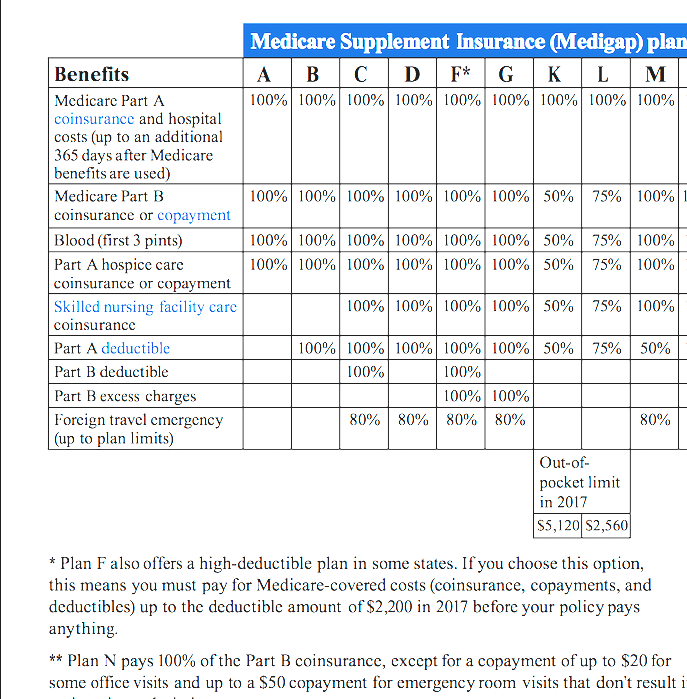

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is the number one Medicare plan?

Best for size of network: UnitedHealthcare UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties. UnitedHealthcare also partners with AARP, insuring the Medicare products that carry the AARP name.

Who has the best Medicare package?

Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states. Overall, Aetna Medicare ranks the best in the most (23) states. That said, there is no single “best plan.” Your needs and preferences will determine the best choice for you.

How Much Does Medicare Plan G cost in Illinois?

about $25 to $349 each monthExpect to pay about $25 to $349 each month for a Medigap plan A, G, or N in Illinois if you enroll during your open enrollment period. Premiums will vary depending on your insurer and how your premium is rated.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Are there disadvantages to a Medicare Advantage plan?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

What is the difference between Plan G and Plan G Plus?

Medigap G PLUS covers everything that a standard Plan G does, and more. Medigap G PLUS provides additional hearing, vision, and dental benefits.

What is the difference between Plan G and Plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

How many Medicare Advantage plans are there in Illinois?

There are 147 Medicare Advantage plans available in Illinois for 2021, compared to 126 plans in 2020. All Illinois residents with Medicare have access to buy a Medicare Advantage plan, including plans with $0 premiums. There are 31 stand-alone Medicare Part D plans available in Illinois for 2021, compared to 28 plans in 2020.

What is Medicare in Illinois?

Plan options. Enrollment. Resources. Takeaway. Medicare is a federal health insurance program that helps people age 65 and older pay for necessary medical care. You may also be eligible if you are younger than age 65 and living with certain disabilities.

How many people in Illinois are on Medicare in 2020?

The takeaway. Over 2.2 million people in Illinois were enrolled in Medicare in 2020. There are several private insurance companies offering many types of Medicare Advantage and Medigap plans in Illinois. Overall, Medicare Advantage plan monthly premium costs have decreased in Illinois for 2021.

How many Medicare plans are there in Illinois in 2021?

There are 31 stand-alone Medicare Part D plans available in Illinois for 2021, compared to 28 plans in 2020. All Illinois residents with a stand-alone Part D plan have access to a plan with a lower monthly premium than they paid in 2020. There are 12 different Medigap plans offered in Illinois for 2021.

What is the difference between Medicare Advantage and Original?

Original Medicare provides nationwide coverage, while Medicare Advantage plans serve more limited areas. If you plan to travel, you may prefer a Medicare plan that offers travel or visitor benefits. Ratings. Every year, the Centers for Medicare & Medicaid Services (CMS) rates plans from one to five stars.

What are the benefits of Medicare Advantage in Illinois?

Medicare Advantage plans in Illinois may offer many other benefits that aren’t included in original Medicare, such as: hearing, vision, and dental care. prescription drug coverage. wellness programs.

How long do you have to be on Medicare to receive SSDI?

If you’re eligible for Medicare due to a disability, you’ll be enrolled after you receive SSDI checks for 24 months. If you get Railroad Retirement benefits or Social Security retirement benefits, you’ll be enrolled when you turn 65 years old.

How does Medicare Advantage work in Illinois?

Each Illinois Medicare Advantage plan is required to include the same benefits you can get in Original Medicare (Part A and Part B), but they are allowed to add prescription drug coverage so that you don’t have to buy a separate Part D plan, and they can include additional benefits like fitness, dental, vision, hearing, and even non-emergency medical transportation.

What is Medicare Supplement Plan?

Similar to Medicare Advantage, Medicare Supplement plans are offered by private insurance companies and not by the federal government. Differently from Medicare Advantage, Medicare Supplements do not typically provide coverage for additional services. Instead, they help cover your Part A and B deductibles, co-payments, coinsurance, and premiums. They are often called “Medigap” plans because they “fill the gap” between what Medicare covers and what you have to pay out of pocket. Some Medigap plans do include prescription drug coverage or a fitness benefit, but generally, that is not what they are designed to do.

What is Medicare Part A?

Medicare Part A covers hospital visits, nursing home care, hospice services, and some home health services. Most people will get Part A for free. The exception is for those who have not worked and paid Medicare taxes throughout their lives. If you worked for a little less than ten years, your premium for Part A will most likely be $240 per month in 2019. If you worked for even less than that, your premium will most likely be $437 per month in 2019.

What is a Part D plan?

Part D plans are separate plans that provide prescription drug coverage. Each plan will have its own formulary or list of covered drugs. You can have a Part D plan as an addition to your Original Medicare coverage. If you do not select a form of prescription drug coverage during your Initial Enrollment Period, you will face a penalty later.

What is the best insurance in Illinois?

Aetna is one of the largest insurance options in Illinois due to its low monthly payment, deductible, and low out of pocket limits.#N#The plan offers a $0 copay for drugs so long as you go to a preferred seller. Aetna has out of pocket maximum of 3,450; prescription drugs plan deductible of $0. It offers varieties of plans, including:#N#Health Maintenance Organization (HMO) plans, you’re required to choose an in-network primary care physician (PCP). You’ll have access to a specified network of doctors and hospitals that includes specialists.#N#Preferred Provider Organization (PPO) Plans allow you to use any doctor, in and out of network, provided that they accept Medicare and Aetna ’s plan terms. Seeing an out-of-network provider will typically cost more.#N#Dual Eligible Special Needs Plan (D-SNPs) designed for people who are eligible for both Medicare and Medicaid.

What is Bright Health?

It provides lower copays and deductibles and makes it easier for seniors to centralize more care with one insurance company.#N#Unlike some Medicare Advantage Plans, Bright Health offers HMO-style plans to make buying supplemental insurance more affordable, particularly for seniors who are already receiving medical care from one of Bright Health’s provider partners.#N#It offers Health Maintenance Organizations (HMO) Plans, and Preferred Provider Organization (PPOs) Plans only. It has low average premiums of $0 and the Average highest premium of $54.

Is a PPO higher than an HMO?

Preferred Provider organizations (PPOs) which is a little bit higher than H MO because you don’t usually have to get a referral to see a specialist when you have a PPO. But you can save money by choosing in-network providers from the insurance company’s provider list. You may pay more if you choose an out-of-network provider.

Does an HMO plan have to go out of network?

You’ll need to go to doctors, hospitals, and other providers within the plan’s network to cover your services. However, if you have an emergency, the plan will likely pay even if you go out of network.

Supplemental Medicare Plans in Illinois

Even though Parts A&B are good for most people, there might come a time when you decide you require a supplemental Medicare plan to ensure you’re fully insured. Here are some of the different supplements available.

How to Sign Up for Supplemental Medicare in Illinois

A licensed agent can help you sort through all the different supplemental Medicare plans in the state of Illinois. As the customer, you have a wealth of options, and using a licensed agent will be a huge aid — especially considering the agent is free of charge!

How many Medicare Advantage Plans are there in Illinois?

Besides Original Medicare, there are 102 Medicare Advantage Plans available throughout the state, offering you the coverage that fits your needs and budget. Keep reading to learn more about Medicare plans in Illinois and find information on the resources available to help you find the right coverage.

What is Medicare fraud in Illinois?

Medicare fraud, which occurs when someone bills your health insurance for services you didn’t receive, is prevalent in Illinois. The state’s Senior Medicare Patrol program helps you recognize the signs of health care and Medicare fraud and learn how to protect yourself.

What is the Chicago Senior Services Division?

The City of Chicago Senior Services Division is one of the state’s 13 Area Agencies on Aging. This agency partners with the state’s Senior Health Insurance Program to provide one-on-one health insurance counseling for area residents aged 60 and over. SHIP counselors are unbiased and aren’t affiliated with a health insurance company or licensed to sell policies. They are trained to answer questions regarding Original Medicare coverage and Medigap and Medicare Advantage Plans. They can also help visitors organize and understand their medical bills and file disputes for denied coverage.

How to contact Medicare Advantage?

Contact Information: Website | 800-252-8966.

How many people are on Medicare in Texas?

In Texas, more than 2 million people are enrolled in Original Medicare, over half of the 3.7 million seniors in the state. Beneficiaries pay up to $471 monthly for Part A coverage, depending on how Across Illinois, about 1.6 million people rely on Medicare for their health insurance. How much you pay for coverage depends on many factors, ...

What is a ship for Medicare?

SHIP is a free statewide program that provides unbiased counseling services for Medicare beneficiaries. Through SHIP, you can receive one-on-one guidance from a volunteer counselor who can help you understand your medical bills, identify and compare Medicare Advantage Plans in your region, and address medical billing issues. Counselors can also help you determine your eligibility for need-based Medicare Savings Programs, which can reduce your out-of-pocket expenses.

Does Medicare pay for prescription drugs?

Original Medicare doesn’t pay for most prescription drugs, so you need to purchase a prescription drug plan if you want this coverage. Also called Part D, prescription drug coverage plans are optional and offered to all Medicare enrollees.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan: