Scroll for more

| Medicare Supplement Benefits | K 2 | L 3 |

| Part A coinsurance and hospital coverage | ||

| Part B coinsurance or copayment | 50 % | 75 % |

| Part A hospice care coinsurance or copay ... | 50 % | 75 % |

| First 3 pints of blood | 50 % | 75 % |

Full Answer

What is Medicare supplement plan F?

Oct 29, 2021 · Founded in 1961, Humana started as a nursing home company and began selling health insurance in the 1990s. It offers Plan F in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan F …

Which states do not offer Medicare supplement plan F?

Nov 07, 2019 · As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings (Plans A-N; Plans E, H, I, and J are no longer sold). Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers

What are the best Medicare supplement insurance companies?

Sep 07, 2021 · What is a Medigap Plan F? Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs. Medigap Plan F covers copayments, coinsurance and deductible costs. Medicare Supplement Plan F doesn’t cover services not covered by Original Medicare, such as eye care, ...

What is the difference between Medicare supplement plans F&G?

8 rows · Dec 06, 2021 · Eight Medicare Supplement Insurance plans offer at least some coverage for skilled nursing ...

Can you still purchase a Medicare Plan F?

Is AARP plan f still available?

What Plan F offers?

What is Plan F supplemental insurance?

Is Plan F still available in 2022?

What is the difference between AARP Plan F and Plan G?

Who qualifies for Medicare Plan F?

How much does AARP Plan F Cost?

Can I get Medicare Plan F in 2020?

Does Medicare F cover prescriptions?

Does AARP Medicare Supplement Plan F cover dental?

What is the most comprehensive Medicare supplement plan?

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

How long does Medicare Supplement last?

This is the six-month period that starts the first month when you’re enrolled in Part B and age 65 or older; during this period, you typically have a guaranteed right to enroll in any Medicare Supplement plan of your choice without medical underwriting.

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

Does Medicare cover Part A coinsurance?

Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. * May be covered if your foreign travel emergency care starts during the first 60 days after leaving the United States and Medicare doesn’t otherwise cover the care.

Can you keep your existing plan F?

You can typically keep your existing Plan F or Plan C.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

When did Medicare Plan F end?

However, Medicare Plan F was discontinued as of Jan. 1, 2020. People who had purchased Plan F before Jan. 1 were grandfathered in and new plans were eliminated from that point on.

What is the best alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesn’t cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so that’s a good alternative to Plan F.

What is deductible insurance?

As a reminder, your deductible is the out-of-pocket cost you must pay toward covered health services before your insurance company starts paying for care. Both insurance plans have identical coverage.

When is the best time to buy Medicare Supplement?

Although Plan F has been eliminated for new enrollees, Decker explains that the best time to purchase any Medicare supplement is during the initial enrollment period when you first become eligible for Medicare. That begins three months before your 65th birthday and ends three months after. Otherwise, pre-existing health conditions could prohibit you from purchasing a plan later during the annual open enrollment period.

Is Medicare Plan F still available?

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Is Medicare Supplement Plan F available?

Medicare Supplement Plan F is a Medigap policy that’s no longer available to new Medicare members, but Original Medicare beneficiaries who were eligible before 2020 may be able to get a plan.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans can offer coverage for varying combinations of up to nine defined areas. Medigap Plan F is the only Medigap plan to offer coverage for each potential Medigap benefit.

What percent of Medicare beneficiaries are enrolled in Medicare Supplement Insurance Plan F?

In fact, 53 percent of all Medigap beneficiaries are enrolled in Medicare Supplement Insurance Plan F. 1. Let’s take a closer look at the benefits offered by Medigap Plan F, how it compares to other Medicare Supplement Insurance plans and how you can apply for Plan F. To get help finding a Medicare Supplement Insurance Plan F ...

How much is coinsurance for skilled nursing?

Coinsurance for skilled nursing facilities. While staying at a skilled nursing facility, you will be required to make coinsurance payments of $185.50 per day in 2021 for days 21-100 of your stay, and you will be responsible for all costs thereafter. Eight Medicare Supplement Insurance plans offer at least some coverage for skilled nursing facility ...

How much is Part A coinsurance for 2021?

Once you meet the Part A deductible in 2021, you will be responsible for a Part A coinsurance payment of $372 per day for days 61-90 of a hospital stay in each benefit period, and $742 per day beyond that. Every Medicare Supplement Insurance plan, including Plan F, covers the Part A coinsurance in full.

How much is deductible for Medicare 2021?

Part A of Medicare requires a deductible of $1,484 for each benefit period in 2021. You can potentially face more than one benefit period in a calendar year.

What is the plan F for Medicare?

Six Medicare Supplement Insurance plans, including Plan F, offer 80 percent coverage of qualified foreign travel emergency care. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ...

What is the deductible for Plan L in 2021?

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

What is the best Medicare supplement plan?

The best Medicare Supplement plan is one you can afford, has the coverage you’re most likely to utilize, and that your insurance company of choice offers. Prior to changes in Medicare regulations, Medicare Part F was the most popular supplement plan.

Which Medicare supplement plan was the most popular?

Before changes in Medicare regulations, Medicare Part F was the most popular supplement plan. An estimated 60% of subscribers held the plan. 1 While this doesn’t necessarily mean Plan F was the best plan, many Medicare beneficiaries chose it because it offered the most coverage and predictability for their Medicare costs.

How much is the deductible for Medicare Plan F?

The average monthly deductible for Plan F with a traditional plan is about $185. 1 Yours could be different if you are older, smoke, or have chronic health conditions. Your cost and deductible for Medicare Plan F will depend upon several factors, including how your insurance company determines your initial costs, your health, and your age. Another factor is choosing a high-deductible or traditional plan (a high-deductible plan will have a lower monthly premium).

How many states does Aetna have?

Only available in 21 states. Aetna is one of the largest Medicare insurance companies in the country and offers its plans in 21 states. When we shopped for Aetna plans, many offered a household discount in some areas.

What information do you need to get a Medicare quote?

Most other insurance companies only ask for information such as your age and dates for Medicare eligibility.

Why did Medicare choose Plan F?

1 While this doesn’t necessarily mean Plan F was the best plan, many Medicare beneficiaries chose it because it offered the most coverage and predictability when it came to their Medicare costs.

What is the difference between Plan F and Plan G?

The key difference between Plan F and Plan G is that Plan G does not pay for the Part B deductible, which is $198 in 2020.

Does Medicare pay for retirees?

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

Does Medicare Supplement Insurance cover health care?

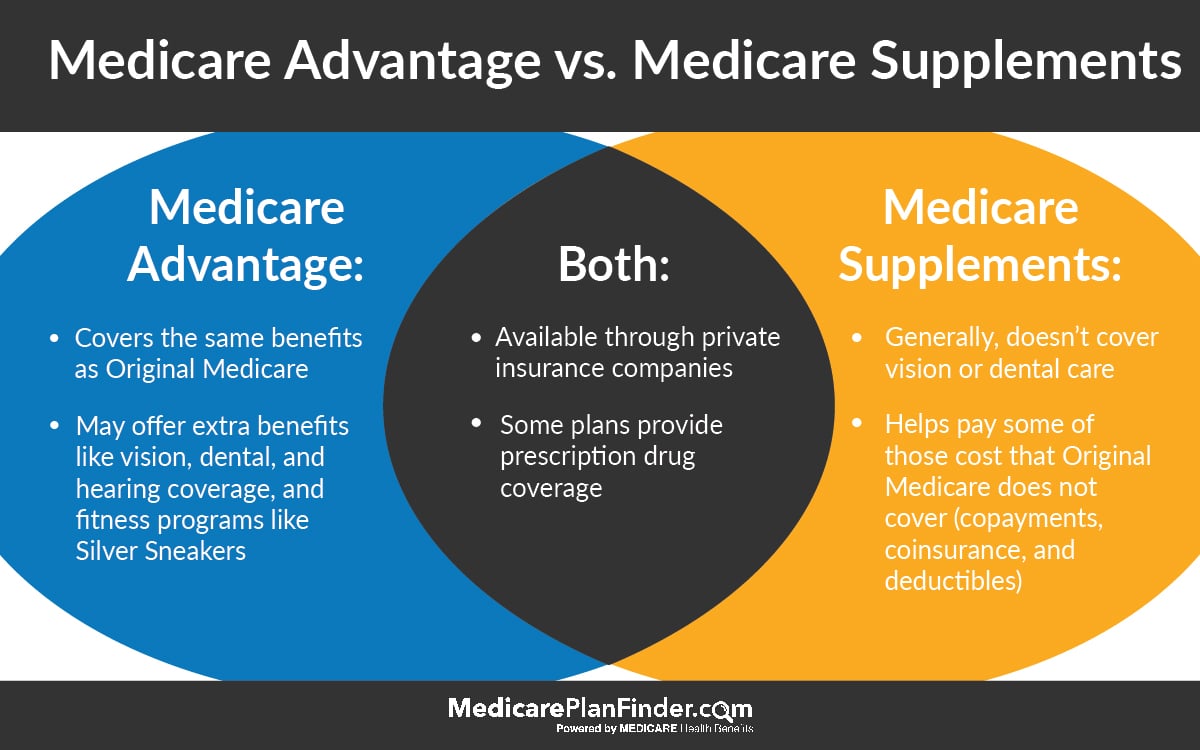

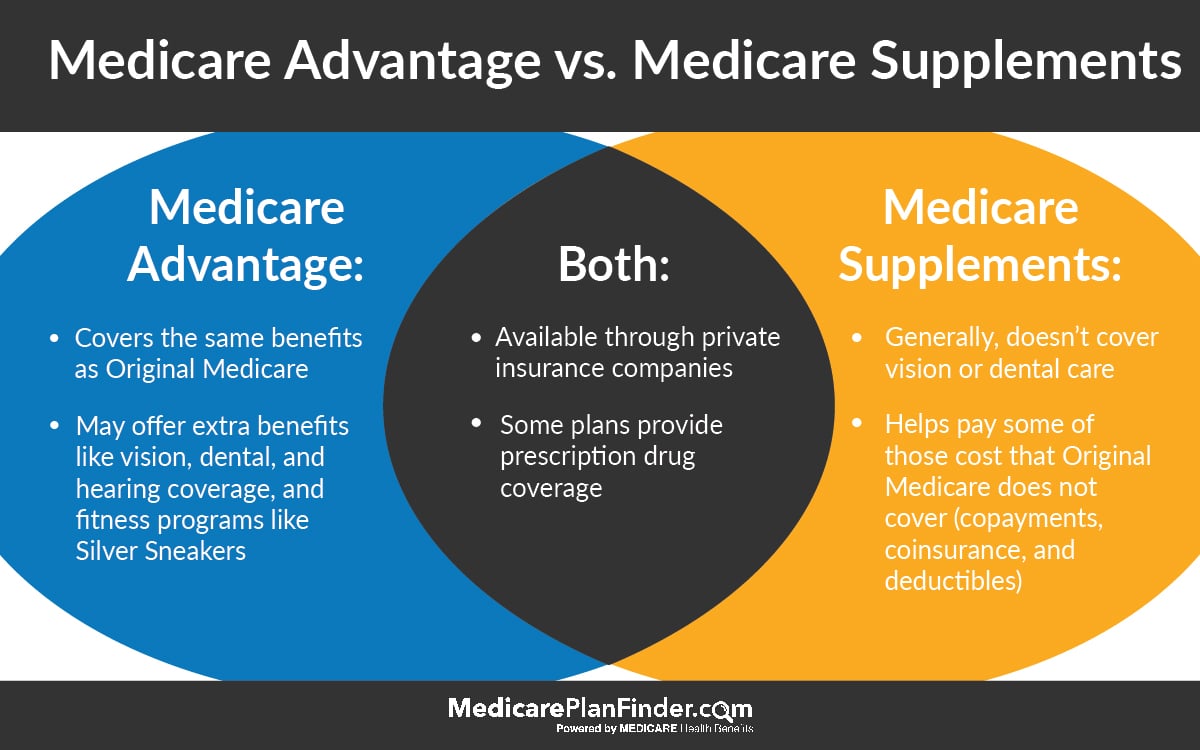

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When will Medicare plan F be available?

Medigap Plan F and Plan C are not available to anyone who became eligible for Medicare on or after January 1, 2020.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What are the factors to consider when shopping for Medicare Supplement Insurance?

Your unique health coverage needs and budget are important factors to consider as you shop for Medicare Supplement Insurance plans.

When will Medicare Supplement Plan F be available?

Medicare Supplement Plan F and Plan C are not available for sale to Medicare beneficiaries who became eligible for Medicare on or after Jan. 1, 2020.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

How long does Medicare cover hospital costs?

Hospital costs: Part A coinsurance and hospital costs for 365 additional days after Medicare benefits are used up as well as coinsurance or copayments for hospice care.

Why would someone choose Plan G?

However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost. Therefore, when you get a quote, compare the premium amount against the deductible to select the more cost-effective option.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

Who decides which Medigap policies to sell?

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Is Medigap standardized?

Medigap policies are standardized. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic.