Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Why the most popular Medicare Supplement is plan F?

Why Plan F Has Been the Most Popular Selling Plan for Decades. Before Plan F was changed in January 2020, it was the most popular plan among all seniors. This made sense because it offered the most coverage among supplement plans. With this comprehensive coverage comes the most peace of mind available to Medicare recipients.

Should you get Medicare supplement plan F?

You must be enrolled in both Part A and Part B first, then you are eligible to enroll in Medicare Supplement Plan F. When you add a Medicare Supplement Plan F or G to your Original Medicare benefits, your coverage will be quite comprehensive.

What is happening to Medicare supplement plan F?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Is Medigap plan F the best supplement?

- Eight plans offered in many areas: F, G, A, B, C, K, L and N

- You can apply to join AARP at the same time you apply for a Medigap supplement plan

- More flexibility to change to another Medigap plan if you qualify

- Enrollment discount in many states of up to 30 percent starting at age 65 and decreasing 3 percent thereafter

What is the deductible for Medicare Supplement Plan F?

II: SERVICE BENEFITS The High Deductible Plan F includes a $2,180 Calendar Year Deductible. You must pay for the first $2,180 (excluding Dues) for the Medicare- covered costs in a Calendar Year before Benefits are provided for covered Services.

Is United Healthcare Plan F good?

A UHC Plan F will provide great benefits, but ALL Medicare supplement Plan F policies give you the exact same benefits and doctor access. Do your research before you enroll and later find out you are paying $300 more per year than you needed to. You can start by reading our Medicare Supplement Plan F Reviews here.

What is the deductible for Plan F in 2022?

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490.

Why is Medicare Supplement Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Who is the best Medicare supplement provider?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

How much does AARP Plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

What is the premium for plan F?

Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more. Factors that determine your cost include your ZIP Code, gender, age, tobacco use, and more.

What is the difference between high deductible Plan F and high deductible plan G?

The only difference between Plan F and Plan G is the fact that Plan G does not pay the Part B deductible ($233 in 2022), while Plan F does. Overall, this won't hurt your pocket. Many seniors find they still find a substantial amount of savings with Plan G, even though they have to pay the Part B deductible.

What is the difference between plan F and high deductible Plan F?

The only difference in plan details is that High Deductible Plan F requires you to meet a deductible before it begins covering you ($2,490 in 2022), whereas Plan F provides coverage immediately.

Is plan F still available in 2022?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Will plan F premiums rise after 2020?

This is good for the long-term rate picture, because insurance companies will still compete for your Plan F business. However, over time we can probably expect Plan F premiums to slowly rise, since the total number of people enrolled will be shrinking annually.

Is there a Medicare supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

How much is the average premium for a high deductible plan?

In 2019, the average premium for high-deductible Plan F was $57.16 per month. In 2019, the average premium for standard Plan F was $169.14 per month. 1. If you are interested in enrolling in a high-deductible Medigap Plan F, you should consider a few things. You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will ...

What is a high deductible plan?

High deductible Plan F provides the same level of coverage as the standard Plan F with potentially lower monthly premiums. The tradeoff for these lower monthly premiums is a high deductible.

What happens if you meet your deductible on Medigap?

Once you meet your deductible, your Medigap insurance company will begin paying the benefits offered in the plan. Before you choose the high-deductible Plan F, you should consider how likely you are to use enough medical services to meet the yearly deductible. Then evaluate how much coverage you would need after the deductible is met.

How much will Medicare cover in 2021?

You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will kick in. For example, if you need a blood transfusion, a traditional Medigap plan will cover the cost of the first three pints, and Medicare will cover the cost of pints four and beyond.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F (also called Medigap Plan F) is a popular choice because it generally features the most benefits. Some insurance companies may also offer a high-deductible version of Plan F. As the name implies, Medicare Supplement insurance like Plan F “supplements” your Original Medicare coverage by paying for some ...

What is a high deductible plan?

You can also choose a high-deductible Plan F offered by select insurance companies in some states. The high-deductible Plan F offers the same benefits as the standard plan; the only difference is you’d need to pay all costs for Medicare-covered services until a deductible amount is reached.

When is the best time to enroll in Medicare Supplement?

A good time to enroll is during the Medicare Supplement Open Enrollment Period, which is a six-month period that starts automatically when you are 65 or older and have Part B. During this period, Medigap insurance companies can’t turn you down for coverage – even if you have pre-existing conditions or health problems.

Which Medicare plan gives the most help?

But if you see your doctor frequently, need many health-care services, or face high out-of-pocket costs, Plan F generally gives you the most help with Original Medicare costs.

Does Medicare leave out of pocket?

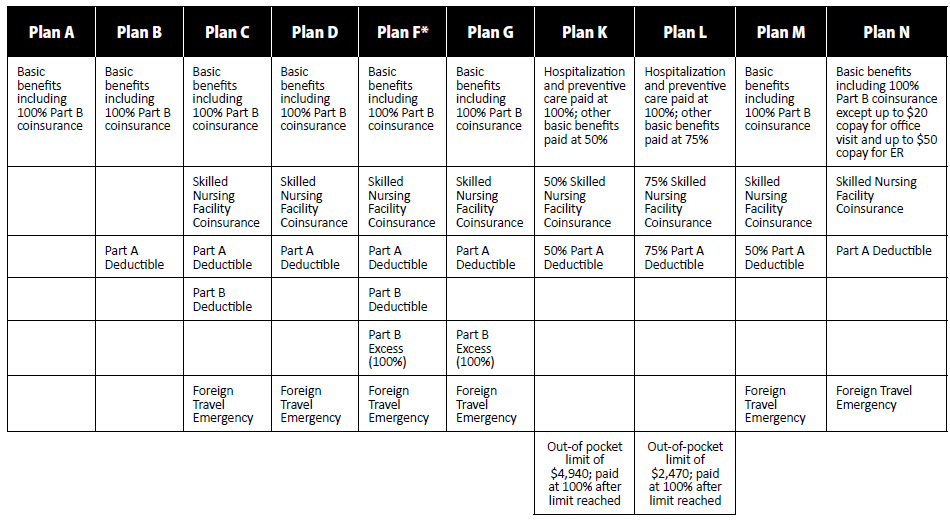

As you may know , Original Medicare (Part A and Part B) may leave you with out-of-pocket hospital and medical costs, like copayments, coinsurance, and deductibles. To help cover these “gaps,” you can consider purchasing one of the 10 standardized Medicare Supplement (Medigap) plan options available in 47 states (Massachusetts, Minnesota, ...

Is Medicare Supplement F deductible?

Here is an overview of the differences between Medicare Supplement F and the high-deductible Plan F, including covered benefits and costs. But there have been changes effective 2020 for Medicare Supplement. As of January 1, 2020, Medicare Supplement Plans F and C won’t be sold to anyone who’s not already eligible for Medicare before that date.

What is the deductible for Plan F 2021?

What is the Deductible for High Deductible Plan F in 2021? In 2021, the deductible is $2,370. Therefore, you would have to pay $2,370 out-of-pocket on this plan. Once you reach this deductible, the plan will cover 100% of the costs.

What is a standard plan F?

Standard Plan F is the Medigap plan offering the most comprehensive benefits. Yet, with more coverage comes higher monthly premiums. Thus, this plan, with its lower monthly premiums, could be a good choice for cost-conscious beneficiaries who find standard Plan F’s benefits attractive.

How to get a medical insurance plan?

This Plan is Perfect For Those Who: 1 Need a lower monthly premium 2 Are comfortable with paying a higher deductible before receiving full coverage 3 See the doctor or visit the hospital semi-frequently 4 Live in states that allow excess charges 5 Like to travel outside the United States

What is the highest level of Medicare Supplement?

You’ll pay the 20% that Medicare doesn’t for all expenses that would normally be paid under plan F for Medicare Part A and B expenses until you hit $2,300. Then you’re covered at 100%. It’s a cost effective way to have the best coverage if you’re willing to pay a little along the way.

Is high deductible F better than Medicare Advantage?

The High Deductible F plan can also be a better option for people who are considering a Medicare Advantage plan. Some Medicare Advantage plans cost $50 to $100 per month plus you still have copays, deductibles and cost sharing up to $6,000 or $10,000 for out of pocket expenses.

When is the best time to buy Medicare Supplement Plan F?

Note that the best time to buy Medicare Supplement Plan F or Plan G is usually during your Medicare Supplement Open Enrollment Period (OEP). This 6-month timeframe starts the first month you’re both at least 65 years old and enrolled in Medicare Part B.

How much is the Medicare Supplement deductible in 2021?

As noted above, annual deductible for high-deductible plans is $2,370 in 2021. Each year Medicare might adjust the deductible amount.

What does a high deductible mean?

So, if you have a high deductible, that means you pay more before plan benefits kick in.

How long after Medicare benefits are used up can you get a blood transfusion?

Up to 365 additional hospital days after your Medicare benefits are used up. Medicare Part B coinsurance and copayments. The first 3 pints of blood if you need a transfusion. Some Medicare Supplement insurance plan types, such as the high-deductible plans, provide additional coverage beyond the benefits listed above.

What is Medicare Supplement?

Summary: Medicare Supplement insurance plans are designed to work alongside Medicare Part A and Part B to help pay medical costs not paid by Medicare. Two of these Medicare Supplement plans, Plan F and Plan G, have high-deductible options – often with lower premiums. A deductible is an amount you have to pay toward your covered medical costs ...

What is the difference between a F and G plan?

Here’s what to know about Plan F and Plan G: Each has a regular version, meaning you generally don’t have to wait for plan benefits to start. Each has a high-deductible version. The basic plan benefits are the same – for example, if you have Plan G, it generally pays your Medicare Part B coinsurance.

Does Medicare Supplement Plan G have the same benefits?

Each Medicare Supplement insurance plan of the same name offers the same basic benefits. For example, Medicare Supplement Plan G will have the same basic benefits no matter which insurance company sells you the plan. Premiums for the same plan may vary. Having standard plans may make it easy for you to compare Medicare Supplement plans.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

When will Medicare Supplement Plan F be available?

Note: Medicare Supplement Plan F and Plan C will no longer be offered to new Medicare beneficiaries who became eligible for Medicare after January 1, 2020. If you were eligible for Medicare before Jan. 1, 2020, you may still be able to enroll in Plan F if it’s available where you live.

What is a plan F?

For example, Plan F is one of only two standardized Medigap plans to cover the Medicare Part B annual deductible and also one of only two plans to cover Part B excess charges in full. Plan F gives beneficiaries the peace of mind of having cost certainty and protection against surprise out-of-pocket medical bills.

How much does Medicare cost per month?

The average Medicare Plan F premiums cost $169 per month in 2018, which is among the more expensive Medigap plan premiums and higher than the overall plan average of $152 per month. 1. However, it’s important to review the cost of a Medigap plan not only by its price tag but by its overall value.

What is the most popular Medicare plan in 2021?

2021 Medicare Plan F benefits reviewed. Medicare Plan F is the most popular Medigap plan partly because it covers more out-of-pocket Medicare costs (such as deductibles, copays and coinsurance) than any other standardized Medigap plan. Click here to view enlarged chart.

Does Medicare Plan F cover out of pocket costs?

Medicare Plan F Cons. You pay no out-of-pocket costs for health care that’s covered by Medicare (other than your monthly premiums) Average premiums are among the more expensive average Medigap plan premiums. Covers more out-of-pocket Medicare costs than any other Medigap plan.

Does Plan F cover Part B?

And because it covers Part B excess charges, Plan F also allows beneficiaries some increased freedom to visit non-participating health care providers (providers who don’t accept Medicare reimbursement as payment in full for their services). Plan F can also cover up to 80% of the cost for foreign travel emergency care.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.