Differences Between Medicare and Medigap

| Medicare Advantage | Medigap | |

| Enrollment | There are opportunities for enrollment e ... | You can only enroll when you are first e ... |

| Network | Have to use doctors in the plan’s networ ... | Can use any doctor or visit any hospital ... |

| Cost | Affordable (less than $30/month) | Nearly $200/month |

| Coverage | Covers Medicare Parts A and B and extra ... | You already have Medicare Parts A & B fo ... |

Full Answer

How to choose between Medicare Advantage, Medigap and Part D?

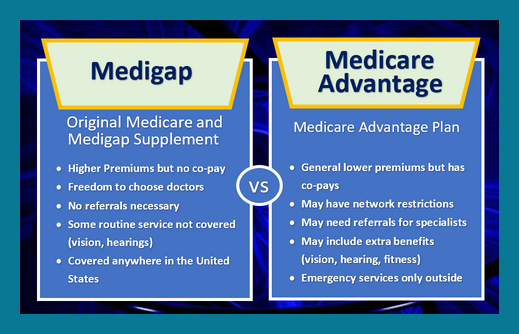

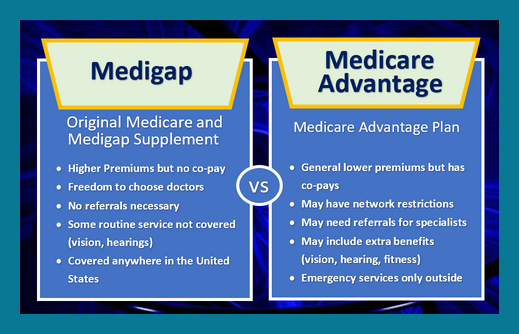

Jan 17, 2022 · While Medigap and Medicare Advantage plans are different, they both can be beneficial. The policy that is right for you depends on what’s important to you when it comes to your healthcare. The Benefit of a Medicare Supplement Medigap policies are great because they give you the freedom to see any doctor, anytime, without hassle.

How to switch from Medicare Advantage to Medigap?

Sep 15, 2021 · Medicare Advantage is an alternative to Medicare, bundling Medicare’s parts together. Medigap works as a wraparound to original Medicare, covering out-of-pocket costs for Parts A and B. Medicare allows enrollees to use only one of these two plans at a time, though.

Why Choose Medicare Advantage over Medicare?

Jan 20, 2022 · Medicare Advantage plans include out-of-pocket spending limits and generally have lower monthly premiums than Medigap plans. (Many Medicare Advantage plans actually have $0 premiums).

Is Medicare better than Advantage plans?

Mar 30, 2022 · Medicare Advantage is a money-saving choice if you are in good health with few medical expenses. Otherwise, Medigap is generally better for those with serious medical conditions. You cannot have Medicare Advantage and Medigap at the same time. But you are able to switch between the two plans should your health care costs change.

Is a Medigap plan better than an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include:Higher monthly premiums.Having to navigate the different types of plans.No prescription coverage (which you can purchase through Plan D)

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What is the difference between Medigap and Medicare Advantage plans?

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

What are the pros and cons of Medigap?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Sep 26, 2021

Why should I choose a Medigap plan?

A Medigap plan is a private insurance policy that can help you pay for some of the out-of-pocket costs associated with traditional Medicare and sometimes additional services. You must pay a premium for Medigap insurance in addition to your Medicare Part B premium and Medicare Part D prescription drug premium.

Can you switch from Medicare Advantage to Medigap?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

How do I choose a good Medigap plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.Feb 9, 2022

Can Medigap insurance be denied for pre-existing conditions?

Be aware that under federal law, Medigap policy insurers can refuse to cover your prior medical conditions for the first six months. A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What is the best Medicare Advantage plan?

Which Is Better: Medigap or Medicare Advantage? 1 One of the advantages of Medigap is that a plan can potentially help you greatly reduce or even eliminate many of your out-of-pocket Medicare costs. Surprise medical bills can be stressful and damaging to your household budget, and a Medigap plan can provide you with more predictable Medicare spending.#N#Medigap plans also have the luxury of being accepted all over the U.S. If you’re a frequent traveler, you can use your Medigap plan anywhere in America where Original Medicare is accepted. 2 On the other hand, Medicare Advantage plans include out-of-pocket spending limits and generally have lower monthly premiums than Medigap plans. (Many Medicare Advantage plans actually have $0 premiums).#N#Medicare Advantage plans may also cover things you don’t otherwise get through Original Medicare, which can allow you to bundle a variety of benefits under one plan without having to juggle multiple insurance policies for everything you need.#N#One type of Medicare Advantage plan called a Special Needs Plan (SNP) can even be customized to fit the needs of someone with a specific health condition or circumstance

What is a Medigap plan?

Medigap plans are also referred to as Medicare Supplement Insurance, and there are 10 different types of standardized Medigap plans that are available from private insurance companies in most states. Medigap plans pay for some of the out-of-pocket costs that are required by Original Medicare. The costs that Medigap plans can cover include things like Medicare deductibles, copayments, coinsurance and more.

Does Medigap accept Medicare?

Medigap plans are accepted by any health care provider who accepts Original Medicare. There are no network restrictions or participating providers to worry about. If a doctor accepts your Medicare insurance, they will accept your Medigap coverage as well.

Does Medicare Supplement pay out of pocket?

When you use a Medigap plan, it works alongside your Original Medicare coverage so that when you receive care that’s covered by Medicare, your Medicare Supplement plan will pay certain out-of-pocket costs that might be due when you receive that care.

Is Medigap Plan A standardized?

Medigap plans are standardized in terms of their benefits (except for Medigap plans in Massachusetts, Minnesota and Wisconsin, where plans are standardized differently). For example, Medigap Plan A purchased in California will include the same benefits as Medigap Plan A purchased in New York.

Does Medigap cover prescriptions?

Medigap plans do not cover prescription drug costs. Beneficiaries who have a Medigap plan must enroll in a Medicare Part D plan or other type of prescription drug insurance plan (such as an employer-provided drug plan) if they want drug coverage.

What is the difference between Medicare Advantage and Medigap?

Medicare Advantage and Medigap plans are both sold through private insurers, but there are major differences. Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What are the advantages of Medigap?

The biggest advantage of Medigap may be your choice of doctors. You have more doctors and hospitals to choose from since you can go to any provider that accepts Medicare. If your doctor is not in a Medicare Advantage plan you’re considering, and you don’t want to switch doctors, you may want to consider Medigap.

What is Medicare Advantage?

Medicare Advantage: Covers Medicare Parts A and B, but most provide extra benefits, including vision, dental, hearing and prescription drugs. Medigap: You still have Original Medicare Parts A and B, and the choice of eight different Medigap plans each providing different levels of coverage. Out-of-Pocket Limit.

How much is Medicare Advantage 2021?

Medicare Advantage: An average $21 a month premium (for 2021) on top of your Medicare Part B premium. Medigap: The average Medigap cost is $2,100 per year ($175 per month), and covers about $1,600 in out-of-pocket expenses per year, on average. Coverage.

What is the difference between Medicare Supplement and Medicare Advantage?

Licensed insurance advisor John Clark explains the main difference between Medicare Supplement plans and Medicare Advantage plans. You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

How much does Medicare cost out of pocket?

Medicare Advantage: Plans must cap annual out-of-pocket costs at $7,550 for in network services and $11,300 for in - and out-of-network services combined. Medigap: A Medigap policy can ease concerns about Medicare's lack of caps or limits. Each plan has specific benefits with specified out-of-pocket costs. Prescription Drug Coverage.

When can I switch to a different Medicare Advantage plan?

If you are in a Medicare Advantage plan, you can make a switch to a different Medicare Advantage plan during Medicare’s open enrollment period, which runs from October 15 through December 7 each year. You may also not be able to get a Medigap policy if you give up your Medicare Advantage plan.

Explaining Original Medicare

The Medicare program was signed into law in 1965 and began offering coverage in 1966 to those who qualified. For instance, to qualify for original Medicare, individuals must be 65 years of age or older, diagnosed with a disability, or have End-Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

Medigap (Medicare Supplemental Plans)

Medigap provides supplemental funds from private insurers to cover out-of-pocket costs. Likewise, Medicare Supplement Plans strive to meet individual needs regarding out-of-pocket costs associated with Medicare.

Which Plan Is Best for Me?

Finding the best Medigap plan for you is heavily dependent on your condition and the medical services you require. Licensed agents consider the health and needs of the Medicare recipient to provide adequate and cost-effective plan recommendations.

Medicare Advantage (Part C)

Medicare Advantage merges the forms of Medicare part A (Hospital Insurance) and Medicare part B (Medical Insurance). Also known as Part C of Medicare, Medicare Advantage plans utilize companies that are approved by Medicare to offer supplemental services.

Choosing A Plan

There are many benefits to both Medigap and Medicare Advantage plans. However, the reason for either plan is to eliminate out-of-pocket costs. Medicare Advantage includes out-of-pocket costs as it pertains to the advantages offered. With Medicare Advantage, preferences are irrelevant.

What is Medicare Advantage?

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

What is a Medigap policy?

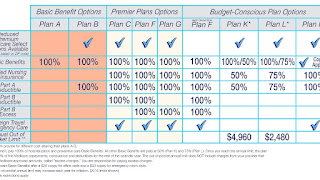

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov . They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. 12 Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal.

How long can you stay on medicare?

You generally won't have to pay a penalty if you later decide to enroll in a Medicare prescription drug plan and you haven't gone for longer than 63 continuous days without creditable coverage. 98.

What happens if you don't enroll in Medicare?

Once you’ve enrolled in Medicare, a key decision point is choosing coverage for Part D prescription drug insurance . If you don’t enroll in Part D insurance when you start Medicare and want to buy drug coverage later on, you may be permanently penalized for signing up late. 8

How to get started with Medicare?

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings. 10

Does Medigap cover Part B?

Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible.

Does Medicare Advantage cover doctors?

Medicare Advantage plans cover hospitals and doctors and often include prescription drug coverage and some services not covered by Medicare, too.

What is the difference between Medicare and Medigap?

A. There are very big differences between these two types of insurance, although both are options for people with Medicare. Technically, only medigap counts as "Medicare supplemental insurance" — in fact, that's its formal name — but Medicare Advantage plans may provide some extra benefits ...

How long do you have to buy Medicare if you turn 65?

But when you turn 65, you get federal protections—meaning you cannot be denied coverage or charged more due to health issues, wherever you live—provided that you buy a policy within six months of your 65th birthday. Medicare Advantage plans: Visit the Medicare Plan finder at the Medicare website.

Can you use Medigap for Medicare?

Medigap can be used only by people enrolled in traditional Medicare. It is not a government-run program, but private insurance you can purchase to cover some or most of your out-of-pocket expenses in traditional Medicare.

Does Medicare cover Part B?

Most charge a monthly premium in addition to the Part B premium, but some don't.

Can you use Medigap for out of network?

Note: If you enroll in a Medicare Advantage health plan you cannot use a medigap policy to cover your out-of-pocket expenses;

What is a Medigap plan?

Medigap refers to a group of supplemental insurance plans that work in conjunction with your regular Medicare benefits. They cover many expenses not covered under Original Medicare such as additional hospital days or international travel. Also Medigap plans often cover expensive deductibles or copayments that are charged to Medicare patients without Medigap. These cost can add up to hundreds of thousands of dollars should you have a major illness or accident.

Does Medicare Advantage replace Original Medicare?

In contrast, Medicare Advantage plans replaces Original Medicare. Medicare Advantage plans are run by private companies and must provide the same coverage as Medicare A and B, but vary beyond this minimum set of benefits. Medicare Advantage can still leave open the gaps that Original Medicare leaves in case of major medical issue. Some Medicare Advantage plans offer dental, vision or prescription coverage. Most Medicare Advantage plans are HMOs, therefore have a smaller network of doctors than those that accept Original Medicare.

Is Medicare Advantage more expensive than Medigap?

Medicare Advantage will almost always be less expensive in the short run because their monthly premiums are usually lower than Medigap. Out-of-pocket costs for many services such as hospital stays, however, are often much more expensive with Advantage plans than they are with Medigap plans. Seniors considering a Medicare Advantage plan should be aware that their annual out of pocket maximum could be as high as $6700. You should also contact your physicians to ensure you can keep seeing them if you go with Medicare Advantage.

What is the difference between Medicare Advantage and Medigap?

The main difference between the two is how they work alongside original Medicare. Medigap plans work alongside original Medicare’s Part A and Part B to help with out-of-pocket expenses, such as deductibles, coinsurance, and copayments.

How does Medicare Advantage work?

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicare’s find-a-plan tool. After deciding on a specific plan, a person can enroll by doing one of the following: enrolling through the company’s website.

How long does it take to switch from Medicare Advantage to Medigap?

Switching between plan types. There are three opportunities for a person to switch from Medicare Advantage to Medigap. During the initial enrollment period (IEP): This 7-month period begins the month before a person reaches 65 years of age.

What is a Medigap plan?

Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits. Once a person decides on a plan, Medicare will provide contact information for the company administering the plan.

How long do you have to switch back to Medicare after enrolling?

Shortly after enrolling: When a person first becomes eligible for Medicare and enrolls in a Medicare Advantage plan, they have 3 months in which they can switch back to original Medicare and enroll with Medigap.

What are the parts of Medicare Advantage?

Medicare Advantage plans combine original Medicare’s parts A and B, and the majority include coverage for prescription drugs . Advantage plans often also include other benefits not available with original Medicare, including vision, dental, or hearing coverage.

When does Medicare Advantage OEP end?

During the Medicare Advantage OEP: This OEP runs from January 1 to March 31 each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.