The short answer is that a Medicare Advantage plan “replaces” your Original Medicare (Medicare Parts A and B) coverage – hence the term “replacement plan” – while a Medicare supplement plan supplements your Original Medicare benefits.

Full Answer

Which is better humana or Medicare?

While both insurers are good options, Humana stands out for its Medicare Advantage Special Needs Plans for people with chronic illnesses or dual Medicare and Medicaid eligibility. Its prescription drug plans are remarkable for the Medication Therapy Management support program.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Which is the best Medicare supplement?

Medicare Supplement Plan G is identical to Plan F except you pay the Part B deductible once per year on Plan G. It’s definitely one of the best Medicare supplement Plans. Whereas Plan F pays that amount for you (with the extra money you give them in the higher monthly premium for Plan F).

Which Medicare supplement plan should I buy?

One of the most common types of supplemental insurance is Medigap, which is sold by private insurance companies to people enrolled in Original Medicare. (Medigap plans cannot be paired with Medicare Advantage plans).

What is the difference between Medicare and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Does a supplement replace Medicare?

There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement (or Medigap) insurance plans work alongside your Original Medicare coverage.

What are the advantages and disadvantages of Medicare Supplement plans?

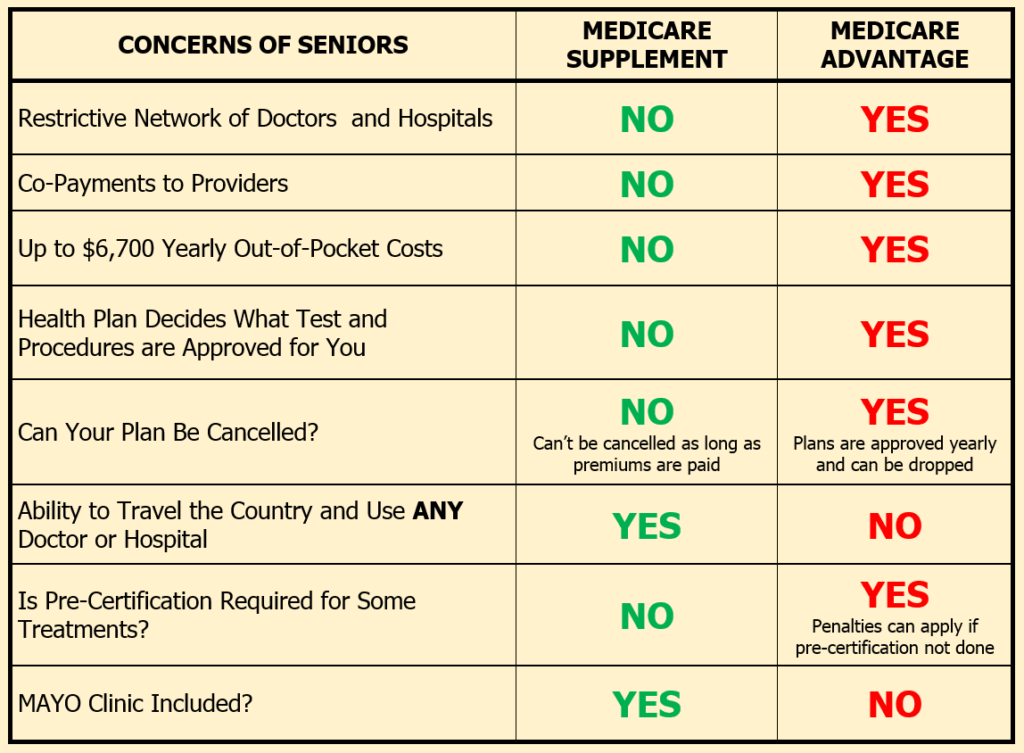

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

What is Medicare Advantage?

Medicare Advantage plans negotiate contracts with networks doctors, hospitals, and other healthcare providers. The agreements they reach can help to keep their costs lower. This means that you must adhere to their networks or face substantially higher out of pocket costs.

How are Medicare Advantage Plans structured?

How Medicare Advantage Plans Are Structured. Medicare Advantage replaces your Medicare Part A and Part B services. Most of the time it replaces your Part D as well. A Medicare Advantage plan combines them into one coverage with a private insurance company. This is what is known as Part C of Medicare.

How long does it take to get a Medigap plan?

This period starts six months before you enroll in Part B of Medicare and continues the six months after. Medicare Advantage and Part D allow a 3-month open enrollment before and after your date of first coverage under Part B. You will likely have to be underwritten to get a Medigap plan once you are out of your Open Enrollment period.

How long does Medicare lock you in?

If you enroll in a Medicare Advantage plan, Medicare locks you into that plan until December 31st. Medicare Advantage plans and Part D prescription drug plans have only one window of opportunity each year for you to enroll. It happens from October 15 through December 7 each year. During that time, you can change plans or go from MAPD to original Medicare with a Medicare Supplement plan (or vice versa). There are Special Enrollment periods such as if you move out of your network coverage area. You have an Initial Enrollment Period three months before and three months after you first enroll in Part B of Medicare. Other than that, you cannot change plans or move back to original Medicare.

What is a Medigap plan?

Under a Medigap plan, Medicare first pays its portion of the bill and then sends the remainder of the bills to your Medicare supplement company to pay their portion. This is done electronically through what is called the crossover system.

What are the different types of Medicare insurance?

There are two types of private plans that you can purchase that will help fill the gaps of Medicare – Medicare supplements (Medigap) or Medicare Advantage. These two plans are very different and it is imperative that you understand the differences.

How much does Medicare cover in 2021?

If you go with Medicare alone with no additional coverage, you will quickly learn that there are a lot of gaps that Medicare does not cover – a Part A deductible ($1,484 in 2021) that you must pay to the hospital to cover you for up to 60 days of hospital care.

What are the gaps in Medicare Supplement?

Here are the most common “gaps” that people turn to Medicare Supplement plans to cover: Part A coinsurance for hospitalization, hospice, or skilled nursing facilities. Part B coinsurance and copayments. Blood costs (up to 3 pints) Part A deductible. Part B deductible.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is a replacement for your traditional Medicare Parts A and B. It is new insurance provided by a private company. With a Medicare Supplement, on the other hand, you are keeping your Original Medicare Parts A and B and simply adding on additional coverage. What this means is that you cannot have both Medicare Advantage ...

How much is Medicare Part A deductible?

For example, the Medicare Part A deductible for inpatient hospital care is around $1400. This means that if you required inpatient services, you would have to pay the first $1400 in expenses before Medicare would start paying anything.

What is the premium for Medicare?

For example, the standard monthly premium to stay on Medicare Part B was $144.60 in 2020. Coinsurance: A percentage of medical costs that you are responsible for paying, even after you have met your deductible.

How to contact Medicare for one on one?

If you would like to have a one on one conversation, please call us at 844-528-8688 and we would be happy to discuss what plan is right for you.

Is Medigap better than Medicare?

So if you would like more freedom to choose your doctors, Medigap is a better choice for you. If you are interested in a Medicare Advantage plan but want to keep seeing your current providers, you should make sure they are in-network before adopting a plan.

Is Medicare Advantage the same as Original Medicare?

However, all Medicare Advantage providers are required to offer at least the same level of coverage as Original Medicare. A Medicare Advantage Plan is similar to shopping around for insurance before you had Medicare. You get to compare companies, plans, coverage, and costs and choose the best option for you.

What is Medicare Supplement?

Medicare Supplements. Medicare supplements are ideal for seniors who have Original Medicare and need help paying some of their out-of-pocket costs. Known as Medigap insurance, a Medicare supplement covers things like co-payments, coinsurance payments and deductibles.

What is Medicare Advantage?

Medicare Advantage plans combine the components of Original Medicare — Part A and Part B — into a single plan, while Medicare supplements help pay for costs that Medicare doesn’t cover. Seniors looking for lower costs or better coverage may want to explore their Medicare Advantage options.

Does Medicare Supplement cover Medicare Advantage?

It may also cover services that Original Medicare doesn’t cover. A Medicare supplement isn’t a replacement for Original Medicare or a Medicare Advantage plan; it simply supplements the coverage provided by Original Medicare.Medicare supplements are only available to seniors enrolled in Original Medicare. Seniors with Medicare Advantage plans may ...

Does Medicare Advantage have a co-payment?

Some Medicare Advantage plans have $0 premiums, which means a Medicare Advantage plan may help seniors save money every month. Medicare Advantage plans may also have lower co -payments or coinsurance requirements than Original Medicare, which can reduce a senior’s out-of-pocket medical costs.

Does Medicare Advantage have an annual maximum?

Original Medicare doesn’t have an annual maximum, which may make services received under a Medicare Advantage plan more affordable.Another advantage of choosing a Medicare Advantage plan over Original Medicare is that some plans include vision and dental coverage.

Can seniors with Medicare Advantage plan take Medicare supplements?

Seniors with Medicare Advantage plans may not purchase any Medicare supplements. Seniors may want to keep in mind that Medicare supplements sold after January 1, 2006, can’t include prescription coverage. Seniors in need of drug coverage may want to look into purchasing Medicare Part D, a type of Medicare that provides coverage for prescription ...

What is Medicare Advantage?

Medicare Advantage (MA) plans (also known as Medicare Part C) combine doctor, hospital and, in many cases, even drug coverage into one plan. Most MA plans also include coverage for routine dental, vision and hearing care, as well as other services. These plans are offered by private insurers who contract with the federal government.

How many people will choose Medicare Advantage in 2028?

Between 2008 and 2018, Medicare Advantage enrollment grew from 9.7 million, or 22% of all Medicare beneficiaries, to nearly 20.4 million, or 34% of Medicare beneficiaries. 1. By 2028, more than 41% of Medicare members are expected to choose Medicare Advantage plans. 2.

Will Medicare Advantage be available in 2028?

By 2028, more than 41% of Medicare members are expected to choose Medicare Advantage plans. 2. *Costs for Medicare Supplement plans vary by the state you live in and the plan you choose. Medicare Supplement plans can only be paired with Original Medicare.

Does Medicare cover dental?

How Original Medicare works. Original Medicare does not include coverage for prescription drugs or routine dental, vision and hearing care. If you choose Original Medicare, you can pay for those things out of pocket, or you can purchase a stand-alone prescription drug plan and a Medicare Supplement plan to beef up your coverage.

Does Medicare Part D cover prescription drugs?

Medicare Part D helps cover prescription drug costs. Costs for Part D depend on things like the plan you choose and what type of prescription drugs you require. Medicare Supplement (Medigap) plans can help pay out-of-pocket costs that Medicare doesn’t, including copays, deductibles and co-insurance.*.

Is it better to have Medicare Advantage or Medicare Supplement (Medigap)?

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

Can you have a Medicare Advantage plan and a Medicare Supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Can you change from a Medicare Advantage plan to a Medicare Supplement plan?

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period. 4