Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays.

Full Answer

Is Medicare always your primary insurance?

Medicare is always primary if it’s your only form of coverage. When you introduce another form of coverage into the picture, there’s predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

When does Medicare become primary?

There are a number of situations when Medicare is primary. Learning about them ahead of time will help you avoid costly enrollment deadlines. You are 65 or Older and Your Employer is a Small Business. Medicare is primary when your employer has less than 20 employees. Medicare will pay first and then your group insurance will pay second.

Who is primary over Medicare?

• If you have Medicare because you’re 65 or over or because you have a disability other than End-Stage Renal Disease (ESRD), Medicare pays first . • If you have Medicare due to ESRD, COBRA pays first and Medicare pays second

When Medicare is primary and secondary?

Medicare is often the primary payer when working with other insurance plans. A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments.

Is Medicare or Medigap primary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.

Is Medigap primary or secondary?

secondary insuranceMedigap policies are secondary insurance for Medicare. Because Medicare pays first, it is primary. But, Medicare doesn't pay for everything. So, a Supplemental policy is beneficial to have in place to protect you from unexpected medical costs.

Is Medicare Part D always primary?

Usually Medicare Part D coverage pays first. For example: Are you retired and have prescription drug coverage through your or your spouse's former employer's or union's retiree Group Health Plan and Medicare Part D coverage? If so, your Medicare Part D coverage is primary and the Group Health Plan is secondary.

Can you have 2 primary insurances?

BY Anna Porretta Updated on January 21, 2022. Yes, you can have two health insurance plans. Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances.

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.

Is supplemental insurance secondary?

It helps cover you for care and services that your primary medical plan may not. This secondary insurance could be a vision plan, dental plan, or an accidental injury plan, to name a few. These are also called voluntary or supplemental insurance plans. Some secondary insurance plans may pay you cash.

How does Medicare coordinate with Medigap?

With Medicare as primary, the Medigap plan backs it up as a secondary payer. Medicare pays, in most cases, 80% of the Medicare-approved costs (after the Medicare deductibles), and the Medigap plan pays, with most plans, the other 20% and some combination of the deductibles.

What is the difference between Medicare secondary and supplemental insurance?

Secondary health insurance provides the coverage of a full health care policy while supplemental insurance is intended only to augment an existing primary care plan. Choosing one of these health care routes may come down to finances and the coverage extended through your primary health insurance.

How does primary and secondary insurance work with prescriptions?

The pharmacy will first process your prescription through the primary plan. Once that is done, they will then process the prescription again, this time using the secondary coverage. Depending on which employer the secondary coverage is through, your copay could be as low as $0.

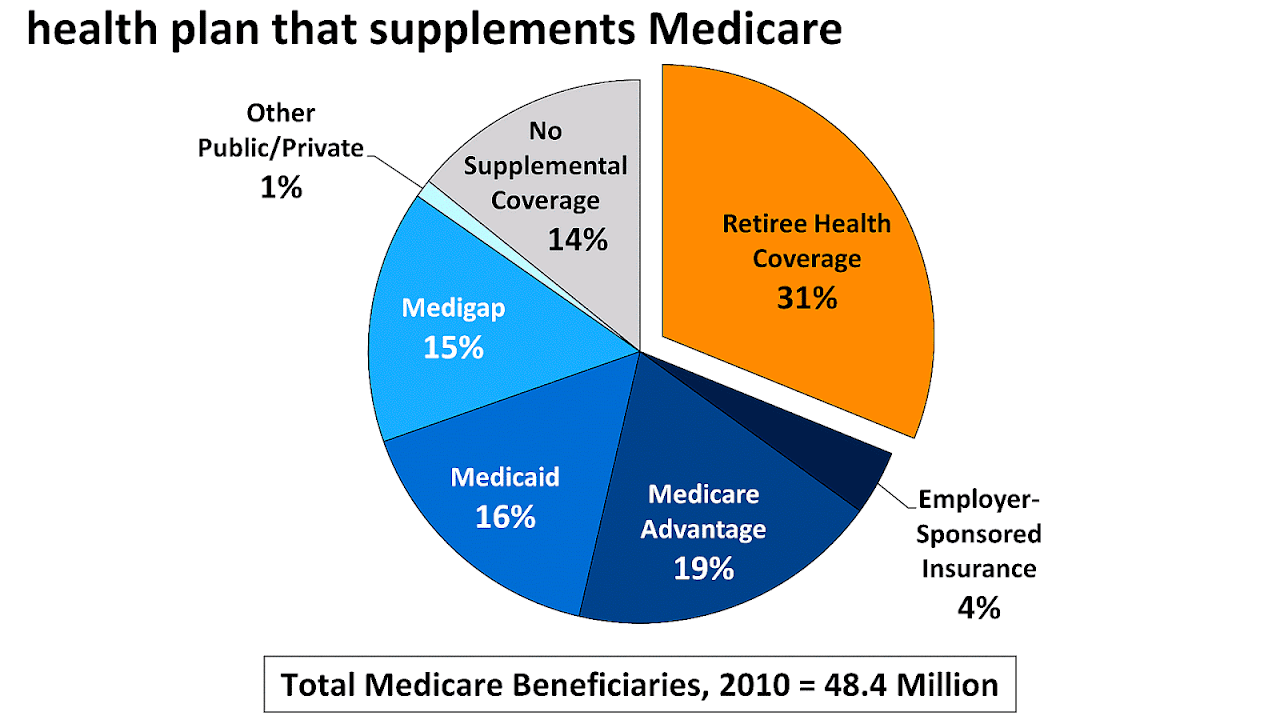

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

Which insurance pays first, Medicare or No Fault?

No-fault insurance or liability insurance pays first and Medicare pays second.

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Does Medicare cover prescription drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

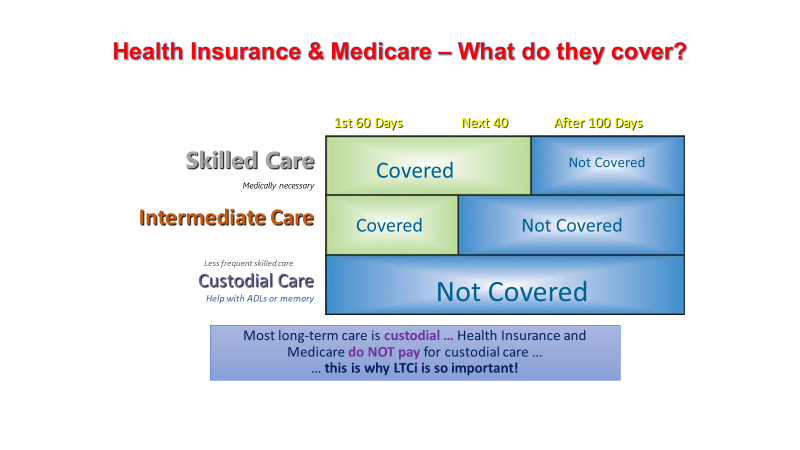

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

If you have Medicare and do not Work

You are covered by Medicare and Medicaid. Medicaid is secondary insurance, but only after the other coverage (such as employer group health plans) has paid.

If you have Medicare and still Working

If you are still working, Medicare can sometimes be primary and sometimes be secondary, depending on the situation.

Please give us your feedback!

What do you think about When Medicare is primary insurance? Write your comments.

Contact Us

For help finding the best Medicare or Individual Health Plan for you, please contact Liberty Medicare or call us at 877-657-7477.

What are special circumstances in Medicare?

In addition to the rules addressing Medicare participants who are covered by other health insurance coverage, additional rules apply to special medical circumstances.

Is Medicare a primary or secondary payer?

In some cases, Medicare is the primary payer, which means it is responsible for paying for covered charges before any other plans, which are called secondary payers because they're responsible only for covered charges left unpaid by the primary payer. In other cases, the other plan is primary and Medicare is secondary.

Is Medicare Advantage a primary plan?

Medicare Advantage plans, on the other hand, replace Medicare. For participants who elect coverage by a Medicare Advantage plan, the MA plan is primary, and Medicare isn’t a payer at all.

Is Medicare Supplements the same as Medicare Advantage?

Medicare supplements, also referred to as Medigap policies, are designed to cover the deductibles and co-insurance required by Medicare; thus, Medicare is always primary relative to Medicare supplements. Medicare Advantage plans, on the other hand, replace Medicare .

Can you use Medicare and VA as a secondary payer?

Generally speaking, neither program can be used as a secondary payer relative to the other. One exception is if the VA authorizes services in a non-VA hospital and you receive other services as well, Medicare may pay for covered services not authorized by the VA.

Is Medicare the primary insurance?

In some cases, Medicare is the primary payer, which means it is responsible for paying for covered charges before any other plans, which are called secondary payers ...

Can you make Medicare primary?

Making Medicare Primary. If you’re in a situation where you have Medicare and some other health coverage, you can make Medicare primary by dropping the other coverage. Short of this, though, there’s no action you can take to change Medicare from secondary to primary payer.

What is the difference between Medicare and Medicaid?

Eligible for Medicare. Medicare. Medicaid ( payer of last resort) 1 Liability insurance only pays on liability-related medical claims. 2 VA benefits and Medicare do not work together. Medicare does not pay for any care provided at a VA facility, and VA benefits typically do not work outside VA facilities.

Is Medicare a secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions.

How does Medicare know if I have other coverage?

Medicare doesn’t automatically know if you have other coverage. But your insurers must report to Medicare when they’re the primary payer on your medical claims.

What does the secondary payer pay for?

The secondary payer only pays if there are costs the first payer didn’t cover.

What is the difference between primary and secondary health insurance?

When a member has double insurance, his or her individual circumstances determine which insurance is primary and which is secondary. Following are some examples of how this might work:

What does secondary insurance cover?

The secondary health insurance payer covers bills that the primary insurance payer didn’t cover.

What is the most common example of carrying two health insurance plans?

The most common example of carrying two health insurance plans is Medicare recipients, who also have a supplemental health insurance policy, says David Mordo, former national legislative chair and current regional vice president for the National Association of Health Underwriters.

What are some examples of two insurance plans?

Other examples of when you might have two insurance plans include: An injured worker who qualifies for worker's compensation but also has his or her own insurance coverage. A military veteran who is covered by both Veterans Administration benefits and his or her own health plan. An active member of the military who is covered both by military ...

What does it mean to have two health insurance plans?

Having two health plans can help cover normally out-of-pocket medical expenses, but also means you'll likely have to pay two premiums and face two deductibles.

What is the process of coordinating health insurance?

That way, both health plans pay their fair share without paying more than 100% of the medical costs. This process is called coordination of benefits.

Who pays the medical bill?

The primary insurance payer is the insurance company responsible for paying the claim first. When you receive health care services, the primary payer pays your medical bills up to the coverage limits. The secondary payer then reviews the remaining bill and picks up its portion.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

What extra benefits does Medicare not cover?

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services )

How to get free health insurance counseling?

Contact your local State Health Insurance Assistance Program (SHIP) to get free personalized health insurance counseling. SHIPs aren’t connected to any insurance company or health plan.

Do you pay monthly premiums for Part B?

Most plans have a monthly premium that you pay in addition to your Part B premium. You’ll also pay other costs when you get prescriptions.