Which is Better Medicare Supplement Plan F vs Plan G? When it comes to coverage, Plan F will give you the most coverage since it’s a first-dollar coverage plan and leaves you with zero out of pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Plan G may be better for you.

Which is better Medicare supplement plan F vs Plan G?

Nov 18, 2021 · Plan F has long been the most popular Medigap plan. However, Medicare Supplement Plan F is no longer available for new Medicare beneficiaries. As a result, Plan G is quickly becoming the next most popular Medigap plan. Let's explore the differences between Plan F …

Is Plan G the most popular Medicare plan?

However, once the Part B deductible for Plan G is paid for, you essentially have Plan F. Why would someone choose Plan G? Plan G monthly premiums are typically much less expensive than the Plan F premiums – sometimes half the cost. Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F.

What is the high-deductible for Medicare Plan F?

Dec 07, 2020 · Why is Medicare Plan F popular? There are a couple reasons why an agent or insurance company might recommend Plan F over Plan G. Plan F typically has a higher premium than Plan G. T he higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F.

What is covered under Medigap plan F?

Feb 18, 2021 · Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

Is Plan G cheaper than Plan F?

What's the difference between Plan F and Plan G?

Should I switch from F to G?

Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What does Plan F cover that Plan G does not?

Is Plan G the best?

Why was Plan F discontinued?

Can you switch from Plan F to Plan G in 2021?

Can I switch from Plan F to Plan G without underwriting?

Does Plan G have a deductible?

What is the deductible for Plan G in 2021?

What is the deductible for Plan G?

which is better medicare plan f vs plan g?

The better plan will depend on your coverage goals and budget. Plan F makes sense if you want to simply pay a monthly premium and all of your Medic...

should i switch from plan f to plan g?

This will be a personal decision and will depend on your coverage goals. If you want to save some money each year, then a Plan G is a great option....

can i switch from medicare plan f to plan g?

Yes you can switch from Medicare Plan F to Plan G. However, you may be subjected to medical underwriting. This will be determined by the Medicare S...

What’S Covered on Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dol...

What’S Covered Under Medigap Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductibl...

What’S Covered Under Medigap Plan N?

This is another fast-selling plan because it offers a good balance between protection against catastrophic out-of-pocket expenses and affordable pr...

When Comparing Medicare Plan F vs Plan G vs Plan N

Be sure to give some thought to the type of coverage you think you’ll want over the long term. Here’s why:In most cases, you do not have a guarante...

What does Medicare Supplement Plans F and G cover?

Medicare Supplement Plans F and G are the only Medigap insurance plans that cover 100% of Medicare Part B “excess charges,” which are the costs a doctor can charge for a service or procedure, if they don’t accept assignment.

What is the difference between Medicare Supplement Plans F & G?

Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible (the Part B deductible for 2018 is $183). This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for Plan G is paid for, you essentially have Plan F.

Should I buy Medicare Supplement Plan F or G?

Your unique health insurance needs, budget, and individual quote will help you determine if Plan F, G – or a different Medigap plan – is right for you. Each Medigap insurance company has different rates, which are often based on gender, age, zip code, and tobacco status.

What else do I need to know about Medigap?

All Medigap policies of the same letter offer the same basic benefits, but some offer additional benefits and different rates. Medicare beneficiaries must be enrolled in Original Medicare (Part A and Part B) to qualify and cannot purchase a Medigap policy in addition to their Medicare Advantage Plan (Part C).

Which is better, Plan F or Plan G?

Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between the plans, but it can save you hundreds of dollars now and potentially thousands over time.

Is Plan G the same as Plan F?

After the deductible is met , Plan G benefits are exactly the same as Plan F . Plan F benefits include coverage for all copays, deductibles and coinsurance. This type of coverage has made Plan F extremely popular among seniors on Medicare.

Which Medicare supplement is the most expensive?

Plan F is the most popular plan, however it can also be the most expensive. Plan F is the most comprehensive Medicare supplement plan. But as it’s been explained, Plan F is not necessarily the best value for your premium dollar. As always, our goal is to show you how to save significant amounts of money by choosing the best plan for your premium ...

Is Medicare Plan G better than Plan F?

Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Is Plan F still available?

Plan F is still available to those who were eligible for Medicare before 2020. Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs.

Does Medigap Plan N cover Part B?

Under Medigap Plan N, you have all the same coverage as Plan F except: No coverage for Part B deductible. No coverage for Part B excess charges. You may have a copay of up to $20 for doctor visits and $50 for hospital visits that don’t result in admission. This is one of the newer plans, rolled out in 2010.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

Is Plan F the best Medicare Supplement?

So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage . Medicare changes eliminated all first-dollar coverage plans to newly eligible beneficiaries. Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F?

Does Medicare cover Plan G?

This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out of pocket is the Part B deductible. After you’ve met the deductible, Plan G will cover the rest, just like Plan F.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Medicare Supplement Plan F available?

Medicare Supplement Plan F is the only Medigap plan that offers more coverage than Plan G. However, Plan F is no longer available to new Medicare beneficiaries who became eligible for Medicare after January 1, 2020.

What is Medicare Plan G?

Medicare Plan G can help give you greater cost certainty and protection from high out-of-pocket costs. Medicare Plan G value review: Medicare Plan G provides tremendous value as one of the more affordable Medigap plans offering among the most comprehensive coverage. We rate the value of Medicare Plan G as an “A+.”.

What is the deductible for Medicare Part B in 2021?

As previously mentioned, the only benefit area that is not covered by Plan G is the Medicare Part B deductible. However, the Part B deductible is only $203 per year in 2021. When you consider all of the out-of-pocket Medicare costs that are covered by Plan G, you may begin to appreciate the plan’s value.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period, and you could potentially face multiple benefit periods within the same calendar year.

Is Plan F available for 2020?

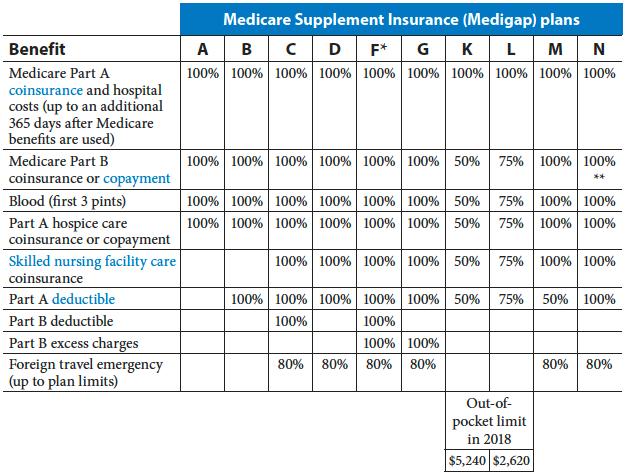

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

What is the deductible for 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is not only the most comprehensive plan for lowering out-of-pocket costs, it is also the most popular.

Is Plan F still available?

Starting on January 1, 2020, Plan F is not available to people newly enrolled in Medicare. Plan F is still an option if you were eligible for Medicare before that date, whether based on age (65 years or older) or qualifying disability (regardless of age).

How long is the open enrollment period for Medicare?

Although Medicare has an annual Open Enrollment Period, there is only one Medigap Open Enrollment Period. This six-month period starts when you enroll in Medicare Part B. Signing up after that time will allow companies to increase your rates or deny you coverage based on preexisting conditions.

When did Humana start selling health insurance?

Founded in 1961, Humana started out as a nursing home company and began selling health insurance in the 1980s. It offers Plan F in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan F is available in all of those states except Georgia and Kentucky.

Is Aetna a subsidiary of CVS?

Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 41 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, Minnesota, New York, Washington, and Wisconsin.

What is the difference between regular and high deductible insurance?

Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away. High-Deductible Plan F, on the other hand, offers lower monthly premiums but requires you to pay an annual deductible, set at $2,370 for 2021, before it will pay toward out-of-pocket costs. 4

What is Mutual of Omaha?

Founded in 1909, Mutual of Omaha offers a wide range of products from accident and life insurance to financial planning. As one of the first carriers to service Medicare in 1966, it has also built a solid reputation for high-quality Medicare products, offering Plan F in all 47 states where traditional Medicare Supplement Plans are available. If you are looking for High-Deductible Plan F, this company offers it in the majority of states with the exception of Georgia, Hawaii, Maine, Mississippi, New Mexico, New York, Ohio, Tennessee, Texas, Virginia, Wyoming.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

Does Aetna give a discount on Medicare Supplement Plan G?

Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans. This includes a spouse, someone with whom you have a civil union partnership, or anyone who has lived with you for 12 months or more.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

Does Mutual of Omaha offer Medicare Supplement Plan G?

Mutual of Omaha offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available, and High-Deductible Plan G in all of those states except New York.

Does Medicare cover acupuncture?

Instead, they cover the left-over costs for Medicare-approved services that Part A or Part B did not pay in full. Original Medicare does cover acupuncture for chronic low back pain. If you meet the specific criteria for acupuncture services, Part G will cover the remaining costs.

Does BCBS offer dental insurance?

Not only does BCBS offer dental coverage, but it also offers vision and hearing aid benefits. To round out your healthcare needs, BCBS offers 4- to 5-Star Medicare Part D prescription drug plans, available for purchase with your Medicare Supplement Plan G. As a bonus, a nurse line is available 24/7.