Medicare’s IRMAA defines income as: “Adjusted gross income plus any tax-exempt interest” or “Everything on lines 2b and 11 of the 2020 IRS tax form 1040”.

What is the Medicare irmaa and how does it work?

Nov 13, 2021 · IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you’re married), but as discussed below, there’s an …

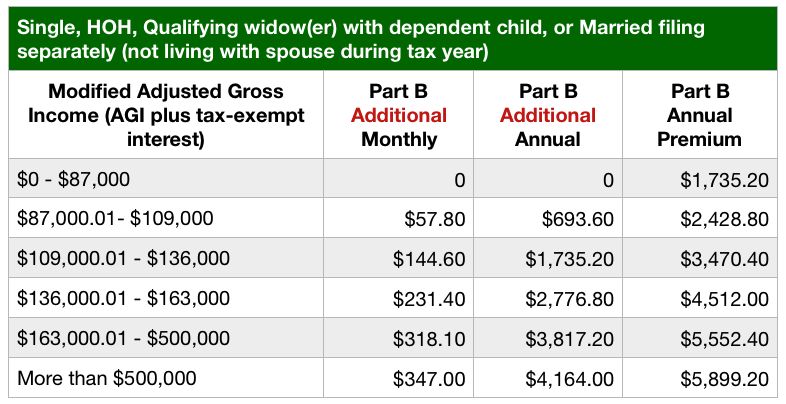

What are the income brackets for irmaa for Medicare Part B?

Nov 16, 2021 · The takeaway. IRMAA is an additional surcharge that can be added to your monthly Medicare premiums based on your yearly income. It applies only to Medicare parts B and D. The SSA uses your income ...

What types of income does irmaa collect from 1040?

Understanding Medicare and IRMAA - Income Related Monthly Adjustment Amount Your Modified Adjusted Gross Income (MAGI), is used to determine if you have to pay an IRMAA. MAGI is not found on your tax return; to calculate you will take your Adjusted Gross Income (AGI) typically line 11 on your 2019 tax return and add any tax-exempt interest income and certain deductions.

How does irmaa affect Part C and Part D insurance plans?

Next >. Your "most recent" Federal income tax return is usually used by the Social Security Administration (SSA) to determine whether you are subject to an income-related monthly adjustment amount or IRMAA for your Medicare Part B and Medicare Part D coverage. This means the SSA bases your IRMAA on reported modified adjusted gross income (MAGI) from …

What line on 1040 is used for Irmaa?

Is Irmaa based on AGI or taxable income?

Are Irmaa premiums tax deductible?

How is Medicare Irmaa billed?

Do both spouse's pay Irmaa?

Does Social Security count towards Irmaa?

Are Medicare premiums included in taxable income?

Can I deduct Medicare supplemental insurance premiums?

What is the Irmaa for 2021?

Is Part D Irmaa is paid directly to Medicare?

What is Irmaa reimbursement?

Is Irmaa In addition to Medicare?

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

What happens if you appeal Medicare Part B?

If you have a successful appeal, Social Security will automatically correct your Medicare Part B premium amount. If you’re denied, they will provide instructions on how to appeal the denial to an Administrative Law Judge. While you are in the process of the appeal, you will continue to pay the higher Medicare Part B premium.

What is modified adjusted gross income?

Your Modified Adjusted Gross Income amount is made up of your total adjusted gross income in addition to any tax-exempt interest income. On your IRS Form 1040, these are line items 37 and 8b; if you are unsure of your MAGI, you can quickly figure it out by looking at your tax return records. Income examples that you may have reported on your tax return would include wages, dividends, alimony received, rental income, investment income, capital gains, farm income, and SSA benefits.

Does the IRS refund excess money?

Yes, the IRS will refund any excess amounts.

Does income related monthly adjustment affect Part D?

The Income-Related Monthly Adjustment Amount also affects your Part D premium. You will pay the premium for your chosen plan, and then the adjustment will be added to that premium. Your prescription drug insurance company will collect the amount on behalf of Social Security.

What happens if IRMAA is applied to my Medicare?

If the SSA decides that an IRMAA applies to your Medicare premiums, you’ll receive a predetermination notice in the mail. This will inform you about your specific IRMAA and will also include information such as:

Who does IRMAA apply to?

IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

What line is modified adjusted gross income?

MAGI is not found on your tax return; to calculate you will take your Adjusted Gross Income (AGI) typically line 11 on your 2019 tax return and add any tax-exempt interest income and certain deductions.

Does IRMAA apply to Medicare Part D?

IRMAA applies to Medicare Part D as well. If you are enrolled in a Medicare Advantage plan (Part C) which includes prescription drug coverage you will still be charged the Medicare Part D IRMAA. Please see the chart below for the 2021 IRMAA amount on top of your Medicare Part D premium.

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an acronym for Medicare’s income-related monthly adjustment amount (IRMAA). This is a higher premium charged by Medicare Part B and Medicare Part D to individuals with higher incomes.

How much does IRMAA affect Medicare?

IRMAA affects less than 5% of people with Medicare, but those it does affect are often surprised or unclear about how it works. For the part of the population that does not pay the higher premium amounts, Medicare pays approximately 75% of the cost of the Medicare Part B premium. The beneficiary is left with approximately 25% ...

What is the IRMAA determination for Social Security?

This means that the IRMAA determination ends up being based on a tax return from a couple of years ago. For example, the 2020 IRMAA determination is based on 2018 tax return.

What is the Medicare monthly adjustment number?

If you want information about this, have questions about the Medicare income-related monthly adjustment amount, or anything else related to your transition to Medicare, feel free to contact us here or call 877.506.3378.

How much is Medicare premium 2020?

The beneficiary is left with approximately 25% of the premium – $144.60/month in 2020. For people with higher incomes, you pay a higher percentage of the total – 35, 50, 65 or 80 percent – based on where you fall on Medicare’s income-related monthly adjustment amount scale (see below).

What is the magi for married filing jointly?

The number used is the Modified Adjusted Gross Income (MAGI) and there is a sliding scale used. The sliding scale currently starts at $85,000 for individual income and $170,000 for married filing jointly income.

Does IRMAA work for Part D?

For Part D, the IRMAA amounts work similarly and are added on top of whatever your Part D premium is. Here is the chart that shows how IRMAA works for Part D:

How to avoid IRMAA?

The easiest answer to avoid IRMAA is to just not generate the wrong type of income while in Medicare. Granted, this may be easier said than done, especially for those who heed financial advice, but it can be done.

What age do you have to make a RMD?

With your Traditional 401 (k)’s or Traditional IRA’s there is a required minimum distribution (RMD) that you must make at age 72.5.

Is primary residency a good way to tap assets in retirement?

Your primary residency is also a great way to tap assets in retirement too . Like Life Insurance, the equity drawn from them is in a form of a loan. The equity can be from a conventional loan or a Reverse Mortgage. Keep in mind, with the sale of your primary residency any gain past certain limits may count towards IRMAA.

Is HSA tax deductible?

Health Savings Accounts (HSA’s), for those who have access to them, are fantastic too. With HSA’s contributions are tax-deductible, the assets grow tax-free and if the distribution pays for the health expenses of you, your spouse or any dependent they are tax-free too. Added bonus, if your employer contributes to them too they also get a tax-break.

Does Social Security pay IRMAA?

Your Social Security benefit pays automatically any IRMAA surcharges you may have as well as the bulk of your Medicare premiums.

How is Medicare Part B Premium Figure?

Most people have a $0 premium for their Medicare Part A hospital insurance. But as you probably know there is a monthly premium assigned for your Medicare Part B . The standard Medicare Part B premium in 2021 is $148.50 per month. That is for individuals making less than $88,000 a year and joint earners making less than $176,000 a year.

What Is Medicare IRMAA?

Here is a web page from Medicare’s website on IRMAA. You can see here under the “What Is It Heading.” It states, You’ll get this notice if you have Medicare Part B and/or Medicare Part D and social security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you.

What Aspects of Medicare are Affected by IRMAA?

Medicare is an essential public service for the elderly here in America, which helps cover medical expenses in various terms. Some people will be more affected by these changes than others due to their specific needs when it comes down to coverage.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago.

Important YouTube Channel Details

I appreciate you looking through my article. If it is interesting to you, please subscribe to my YouTube channel.

What is IRMAA in Medicare?

What is IRMAA? The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

How often is IRMAA calculated?

Unlike late enrollment penalties, which can last as long as you have Medicare coverage, the IRMAA is calculated every year. You may have to pay the adjustment one year, but not the next if your income falls below the threshold.

What is Part B IRMAA?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month. If you are not currently receiving retirement benefits each month, ...

What does SSA look at in 2021?

For example, in 2021, the SSA looks at the 2019 income data you filed with your tax return.

Is Medicare a premium?

Medicare considers it a premium. From the official Medicare site the amount is added to your premium. Your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount. If so, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Is IRMAA included in 1099?

Also, If you were on social security, the IRMAA deductions are included on the 1099-SSA and when entered will transfer to the medical section.

Is IRMAA based on income?

My rationale is the IRMAA is indeed a tax based on income, whereas the Medicare cost is not.