Types of Medicare managed care plans include:

- Health Maintenance Organization (HMO). An HMO is a very common health plan type that works with a network. ...

- Preferred Provider Organization (PPO). A PPO also works with a network. ...

- Health Maintenance Organization Point of Service (HMO-POS). An HMO-POS plan works with a network, like all HMO plans. ...

- Private Fee-for-Service (PFFS). ...

- Special Needs Plan (SNP). ...

Full Answer

How do I select a Medicare HMO?

Health Maintenance Organization (HMO) | Medicare Health Maintenance Organization (HMO) In HMO Plans, you generally must get your care and services from providers in the plan's network, except: Emergency care Out-of-area urgent care Out-of-area dialysis In some plans, you may be able to go out-of-network for certain services.

What does "HMO" mean in health insurance?

Jul 16, 2021 · Medicare managed care plans are an alternative option to Original Medicare. Otherwise known as Medicare Advantage plans, most are either HMOs or PPOs. However, there are other less common plan types available. Managed care plans provide additional benefits to Medicare Part A and Part B coverage.

What is the difference between HMO and EPO health insurance?

Sep 09, 2020 · You can choose from among a few kinds of Medicare managed care plans. The plan types are similar to what you might’ve had in the past from your employer or the Health Insurance Marketplace. Types...

Does HMO have a deductible?

Aug 12, 2019 · A HMO, or Health Maintenance Organization, is a type of Medicare Advantage (MA or Part C) plan. HMO plans always offer the same benefits as any other Medicare plan, but they are also able to provide additional benefits, many plans include vision, dental, and …

Is Medicare Part A and B an HMO?

A Medicare Advantage HMO plan delivers all your Medicare Part A and Part B benefits, except hospice care – but that's still covered for you directly under Part A, instead of through the plan. Medicare Advantage plans are offered by private, Medicare-approved insurance companies.

Is Medicare considered an HMO?

A Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that provides health care coverage from doctors, other health care providers, or hospitals in the plan's network for certain services.

What is an example of an HMO?

The medical-care foundation reimburses the physicians from the prepaid fees of subscribers. Examples of this type of HMO are the San Joaquin Foundation in California and the Physician Association of Clackamas County in Oregon.

What does HMO mean in Medicare?

Health Maintenance OrganizationHealth Maintenance Organization (HMO) | Medicare.

What is the relationship between Medicare and HMOs?

Like all Medicare Advantage Plans, HMOs must provide you with the same benefits, rights, and protections as Original Medicare, but they may do so with different rules, restrictions, and costs. Some HMOs offer additional benefits, such as vision and hearing care. You must have both Parts A and B to join a Medicare HMO.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is HMO in US healthcare?

A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage.

How is an HMO organized?

A health maintenance organization (HMO) is a network or organization that provides health insurance coverage for a monthly or annual fee. An HMO is made up of a group of medical insurance providers that limit coverage to medical care provided through doctors and other providers who are under contract with the HMO.

What are the different types of HMOs?

There are four basic models of HMOs: group model, individual practice association (IPA), network model, and staff model.

What is an EPO plan vs HMO?

An exclusive provider organization, or EPO, is like an HMO in that they both consist of a network of healthcare providers and facilities. Although you must choose a primary care physician with most EPOs, you don't need a referral to have access to a specialist—unlike an HMO.Jun 1, 2020

What is the difference between a PPO and an HMO Medicare plan?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.Sep 19, 2017

What is managed care plan?

Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan. MA plans decide on rate amounts, making prices different from plan to plan. Processing payments are done through the private plan, not Medicare.

What is Medicare Advantage 2021?

Updated on March 19, 2021. Medicare managed care plans are an alternative to Original Medicare. Otherwise known as Medicare Advantage plans with many plan types, most are either HMOs or PPOs. Managed-care plans provide benefits for gaps in Parts A and B coverage. These alternative health-care plans make up Part C of Medicare.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

Can seniors travel internationally?

Coverage is not available when traveling internationally. Seniors often live in northern states for the summer and come winter, they head south. The better known as snow-birds may find they’re out-of-network for half of the year. Enrolling in a Medicare Supplement plan may be a better option for these individuals.

Is Medicare Supplement the same as Managed Care?

Managed-care plans and Medicare Supplement plans are not the same. This misconception is common. Both provide additional benefits to Original Medicare. However, they serve two totally different purposes. Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan.

What is indemnity health insurance?

Before HMOs, PPOs, and others, Indemnity plans were the main plans to choose from. Indemnity plans pre-determine the percentage of what they consider a reasonable and customary charge for certain services. Carriers pay a percentage of charges for a service and the member pays the remainder.

Is Medicare managed care affordable?

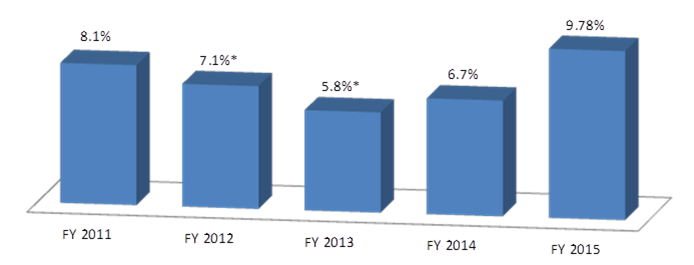

Medicare managed care plans can provide some relief . Enrolling in the right plan for you is key to making health-care more affordable. The number of Medicare beneficiaries enrolling in managed care plans is on the rise. Instead of working alongside Medicare-like Medigap insurance, Advantage plans replace Original Medicare.

What is Medicare managed care?

Medicare care managed care plans are an optional coverage choice for people with Medicare. Managed care plans take the place of your original Medicare coverage. Original Medicare is made up of Part A (hospital insurance) and Part B (medical insurance). Plans are offered by private companies overseen by Medicare.

What is the difference between HMO and POS?

The difference is that an HMO-POS plan allows you to get certain services from out-of-network providers — but you’ll likely pay a higher cost for these services than if you see an in-network provider. Private Fee-for-Service (PFFS). A PFFS is a less common type of managed care plan. PFFS plans don’t have networks.

How much does Medicare cost in 2021?

Most people receive Part A without paying a premium, but the standard Part B premium in 2021 is $148.50. The cost of your managed care plan will be on top of that $148.50.

What is Medicare Advantage?

Sometimes referred to as Medicare Part C or Medicare Advantage, Medicare managed care plans are offered by private companies. These companies have a contract with Medicare and need to follow set rules and regulations. For example, plans must cover all the same services as original Medicare.

Do you have to be enrolled in Medicare Part A and Part B?

You’ll need to be enrolled in both Medicare Part A and Part B to be eligible for a managed care plan. You can become eligible for parts A and B in a few ways:

What is PFFS in medical?

Private Fee-for-Service (PFFS). A PFFS is a less common type of managed care plan. PFFS plans don’t have networks. Instead, for a present price, you can see any doctor who contracts with Medicare. However, not all providers accept PFFS plans. Special Needs Plan (SNP).

What is a Medigap plan?

A Medigap plan, also known as Medicare supplement insurance, is optional coverage you can add to original Medicare to help cover out-of-pocket costs. Medigap plans can help you pay for things like: coinsurance costs. copayments. deductibles. These aren’t a type of managed care plan.

What is an HMO plan?

Reviewed and Updated by Anastasia Iliou, Medicare Advantage. A HMO, or Health Maintenance Organization, is a type of Medicare Advantage (MA or Part C ) plan. HMO plans always offer the same benefits as any other Medicare plan, but they are also able to provide additional benefits, many plans include vision, dental, and hearing coverage.

What is Medicare Advantage?

Medicare Advantage plans can add anything from extra medical coverage to additional benefits like home healthcare, telemedicine, and full dental coverage. Many MA plans can offer coverage for whole health benefits.

How many stars does Medicare Advantage have?

The Centers for Medicare and Medicaid (CMS) issues a quality rating for Medicare Advantage plans. CMS awards between one and five stars based on the quality of patient care the plan provides.

Is Medicare Advantage available in every zip code?

Medicare Advantage HMO plans are not available in every zip code. However, we have highly-trained, licensed agents in 38 states who can help you discover the options available in your neighborhood. To get started, send us a message or give us a call at 833-438-3676.

Can a PPO plan cover HMO?

Where an HMO requires a very specific network, a PPO, or Preferred Provider Organization, can cover services outside of your network. With a PPO plan, you’ll be able to see any provider without needing a referral from your primary physician.

Does HMO accept Medicare?

The only exceptions are that not every county has HMO plans available, and most HMO plans do not accept Medicare beneficiaries with ESRD (End-Stage Renal Disease). Just like your Original Medicare coverage, you will receive a card in the mail when you enroll in a HMO plan.

What is the HMO/CMP liability?

If a noncontracted physician provides a service to one of the cost-based HMO/CMP’s enrollees, and the physician is not a Medicare participating physician, the limit of the HMO/CMP’s liability is the lower of the actual charge or the limiting charge permitted under the statute for FFS Medicare. The HMO/CMP is responsible for beneficiary coinsurance and deductible payments.

When did Medicare start paying for inpatient hospital?

The Social Security Amendments of 1983 (P.L. 98-21) provided that, effective with cost reporting periods beginning on or after October 1, 1983, most Medicare payments for Part A hospital inpatient operating costs are to be made prospectively on a per discharge basis. Part A Inpatient Hospital operating costs include costs (including malpractice insurance cost) for general routine services, ancillary services, and intensive care type unit services. However, they exclude capital-related costs incurred prior to October1, 1991, when capital-related costs began to be paid based on a separate prospective payment rate and direct medical education costs (which are paid using a different method). Part B inpatient ancillary and outpatient service will continue to be paid retrospectively on a reasonable cost basis.

What is CMS 2552?

Providers using cost reports other than Form CMS-2552 will utilize the principles outlined for Form CMS-2552. That is, separate apportionment and settlement schedules will be prepared by the provider for each Medicare HMO/CMP processing the provider’s bills and for non-HMO/CMP beneficiaries. Each set of schedules will apportion the appropriate cost centers between the applicable groups of Medicare patients and all other provider patients.

Is Medicare a primary payer?

The Medicare program is usually the primary payer for covered Medicare services provided to Medicare members of a Medicare cost-based HMO/CMP; however, there are six categories of services for which Medicare is the secondary payer if a timely filed claim was submitted to the primary payer. These are:

What are limitations on cost provisions?

The limitations on cost provisions contain special rules for evaluating allowable provider costs that apply in addition to certain Medicare reimbursement principles. Specifically, these rules deal with the cost limits that apply to hospitals exempt from PPS. The rules do not apply to hospitals, SNFs, and HHAs paid under PPS.

Does Medicare have recovery rights?

Also, Medicare has the right to recover its benefits from any entity, including a State Medicaid Agency that has been paid by the responsible third party. In other words, Medicare’s recovery rights when another third party is primary payer take precedence over the rights of any other entity. The superiority of Medicare’s recovery right over those of other entities, including Medicaid, derives from the preceding cited statute.

What is CMS claim?

CMS’s claim is the amount that is determined to be owed to the Medicare program. This is the amount that was paid out by Medicare, less any prorated procurement costs (see 42 CFR 411.37) if the claim is in dispute.