not present

| Original Medicare | Medicare Advantage |

| For Part B-covered services, you usually ... | Out-of-pocket costs vary —plans may have ... |

| You pay a premium (monthly payment) for ... | You may pay the plan’s premium in additi ... |

| There’s no yearly limit on what you pay ... | Plans have a yearly limit on what you pa ... |

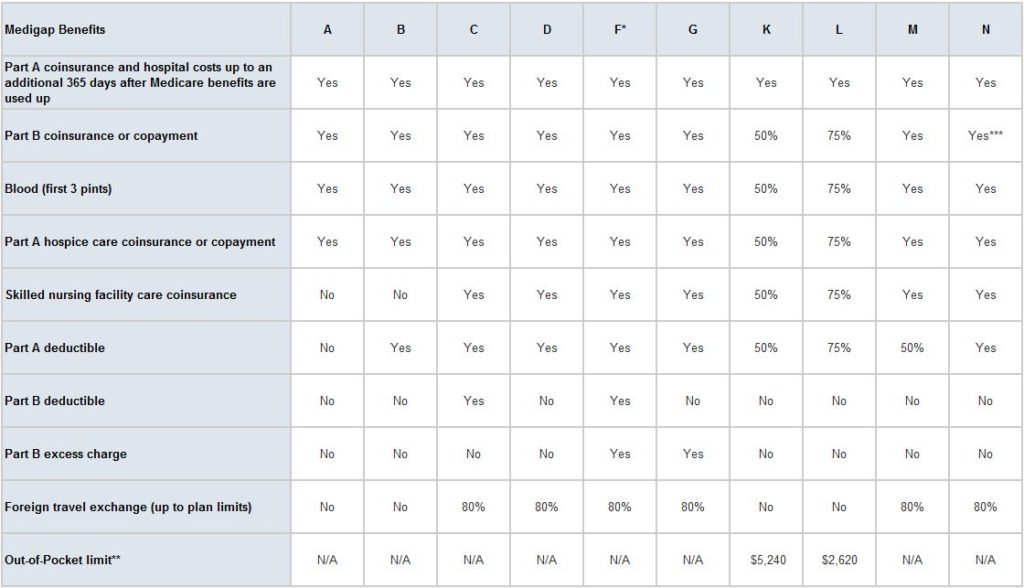

| You can get Medigap to help pay your rem ... | You can’t buy and don’t need Medigap. |

Full Answer

What do you pay in a Medicare Advantage plan?

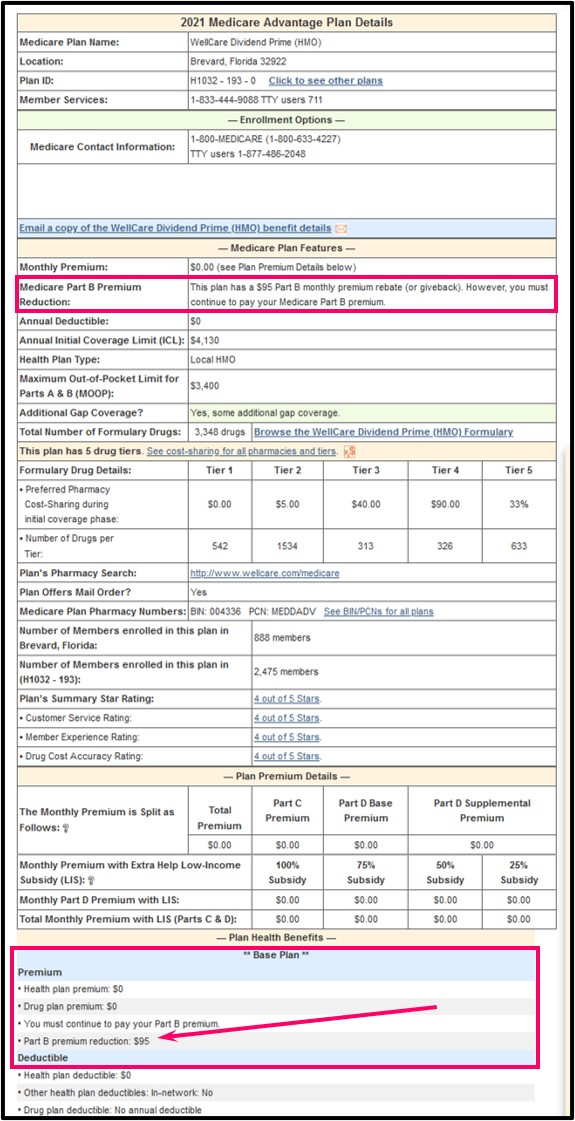

Sep 21, 2021 · iQuanti: If you have Medicare, you probably pay a monthly premium of $148.50 (in 2021) in order to receive Medicare Part B benefits and coverage. However, there is a program called the Medicare giveback benefit, or Part B premium reduction plan, that is offered by some Medicare Advantage plans and covers some or all of your Part B monthly premium.

How much does Medicare pay Advantage plans?

5 rows · You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug ...

How to purchase Medicare Advantage plans?

Jan 15, 2020 · The standard Medicare Part B premium for 2020 is $144.60. While most Medicare beneficiaries will pay the standard premium amount, the premium you will pay is dependent on your income. If your income falls below the federal standards, help is available for Medicare beneficiaries through Medicare Savings Programs (MSP).

How do I pay my monthly Medicare Part B premium?

Nov 18, 2021 · Part B premiums Part B comes with a monthly premium. Many people pay the standard premium amount of $148.50 per month in 2021. You may pay higher or lower premiums than the standard premium based on how you pay your premium or your yearly income. Part B deductibles, copayments and coinsurance Part B also comes with a $203 annual deductible in …

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

How much is Medicare Part B premium 2020?

The standard Medicare Part B premium for 2020 is $144.60. While most Medicare beneficiaries will pay the standard premium amount, the premium you will pay is dependent on your income. If your income falls below the federal standards, help is available for Medicare beneficiaries through Medicare Savings Programs (MSP).

Is Medicare Part A free?

Medicare Part A, which covers hospitalization, is free for anyone eligible for Social Security, even if they have not claimed benefits yet. If enrolled in Part B but not yet collecting Social Security benefits, you’ll be billed quarterly by Medicare. As a Medicare beneficiary, you have many options when it comes to how you receive your Medicare ...

What is Medicare Part B 2021?

March 8, 2021. Reviewed by John Krahnert. Medicare Part B, one part of Original Medicare, provides medical insurance coverage. It covers many different services such as doctor visits and outpatient medical care. 3 things to know about Medicare Part B:

How much is Part B insurance in 2021?

Part B comes with a monthly premium. Many people pay the standard premium amount of $148.50 per month in 2021. You may pay higher or lower premiums than the standard premium based on how you pay your premium or your yearly income.

How much is the 2021 Medicare premium?

You have to pay a monthly premium for it. The standard monthly premium is $148.50 in 2021, but you may pay more or less than that.

Is Medicare Part B optional?

Medicare Part B provides medical insurance coverage. It covers many different services such as doctor visits and medical services. Part B is optional. If you are automatically enrolled in Medicare Parts A and B, you can opt out of Medicare Part B.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio