What are the advantages of Medicare Part B?

Aug 25, 2016 · The Medicare program has several “parts,” and you may wish to understand them all when making your health-care coverage choices. Learning how Medicare works will help you choose the best plan for your needs. One part of the Medicare program is called Medicare Part B. What is Part B? Medicare Part A and Part B, together, are called Original ...

What is the best Medicare plan?

Get the basics. When you first enroll in Medicare and during certain times of the year, you can choose how you get your Medicare coverage. There are 2 main ways to get Medicare: Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare ...

What is the best health insurance for Medicare?

Apr 16, 2021 · The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

What Medicare plan to choose?

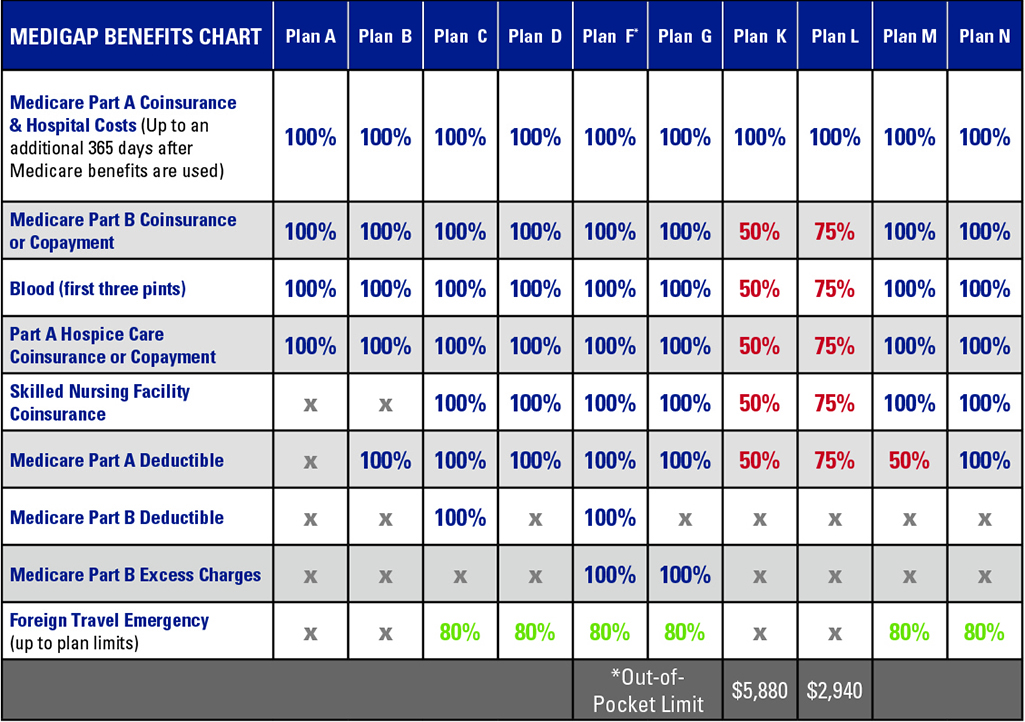

Mar 24, 2022 · Plans that cover the Medicare Part B deductible are being discontinued. Best for: People who want a high level of coverage and may face excess charges from their Medicare Part B services. Plan K and Plan L. Plan K and Plan L are similar in that they both cover Medicare Part A coinsurance and hospital costs at 100%.

What is the most popular Medicare supplement plan for 2021?

What is the most widely accepted Medicare plan?

Does Medicare Part B cost the same in every state?

What is the average deductible for Medicare Part B?

Is it better to have Medicare Advantage or Medigap?

What is the deductible for Plan G in 2022?

Why do doctors not like Medicare Advantage plans?

How do you qualify to get $144 back from Medicare?

- Are enrolled in Part A and Part B.

- Do not rely on government or other assistance for your Part B premium.

- Live in the zip code service area of a plan that offers this program.

- Enroll in an MA plan that provides a giveback benefit.

Can I get Medicare Part B for free?

What is the standard Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Does Medicare cover dental?

What is the Medicare Part B premium for 2022?

Do you pay a premium for Medicare Part B?

Part B premiums. You’ll typically pay a premium for Medicare Part B unless you qualify for financial assistance. Because of this, you have the option of turning it down, although you might pay a late-enrollment penalty if you decide to enroll in Medicare Part B later on.

What is Medicare Part A and Part B?

Medicare Part A and Part B, together, are called Original Medicare. Through the Center for Medicare &Medicaid Services, the United States government set up Original Medicare to cover a wide range of medical expenses for individuals 65 and older and individuals with certain disabilities. Part A is hospital insurance.

Does Medicare cover dental care?

Still, it doesn’t cover everything ; for example, routine dental care isn’t covered if you’re enrolled in Original Medicare, but some Medicare Advantage plans may offer this coverage. Whatever health-care coverage you choose, make sure you have a clear understanding of coverage options and costs.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800-MEDICARE (1-800-633-4227), TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

What are the risk factors for diabetes screening?

Diabetic screenings, if you have risk factors, such as high blood pressure, dyslipidemia, obesity, or high blood sugar; you’re also covered if two or more of the following factors apply: You’re 65 or older. You’re overweight. You have a family history of diabetes.

What is clinical trial?

Clinical trials, if the trial meets eligibility criteria for Medicare coverage. Ambulatory surgery center fees for approved surgical services. Emergency room services for severe injuries and illnesses that quickly worsen (note: emergency care is only rarely covered outside of the United States)

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What does Medicare Part B cover?

Routine vision care. Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. Hearing aids. 24-hour home health care. Long-term care, such as you might get in a nursing home.

What is not covered by Medicare Part B?

What doesn’t Medicare Part B cover? 1 Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. 2 Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services. 3 Routine dental care 4 Routine vision care 5 Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting. 6 Hearing aids 7 24-hour home health care 8 Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

How much is the 2021 Medicare premium?

The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

Does Medicare cover long term care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it .

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

What does Medicare Part B cover?

Both plans also cover Medicare Part B coinsurances and copays, the first three pints of blood, Part A hospice care coinsurances or copays, skilled nursing facility care coinsurances, and the Part A deductible, but not at 100% like other plans. Plan K covers these benefits at 50% and Plan L covers them at 75%.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare have a penalty for enrolling in Medicare?

In order to encourage people to enroll in Medicare, the federal government imposes a penalty on people who enroll in Medicare after their Initial Enrollment Period has passed and if they don’t qualify for any of the Special Enrollment Periods described above.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

How many different Medicare Supplement plans are there?

There are 10 different types of Medicare Supplement Insurance plans, each designated by a letter of the alphabet (you can find details about all 10 plans at Medicare.gov ). In most states, the benefits are the same no matter what insurance company you purchase the plan from, though each plan covers different things.

What is the Medicare program for retirees?

Your Medicare Coverage. Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.

Does Medicare Advantage include prescription drug coverage?

Most Medicare Advantage plans also include prescription drug coverage, which is an optional add-on called Part D for beneficiaries who keep Original Medicare. Some Medicare Advantage plans have a $0 monthly premium, while others come with a higher monthly premium.

When is Medicare open enrollment?

The Medicare Fall Open Enrollment runs from Oct. 15 to Dec. 7 of each year.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

Is United Medicare Advisors a good company?

United Medicare Advisors has an excellent reputation. The company enjoys accreditation and an "A+" rating from the Better Business Bureau. Also, we found more than 20,000 5-star ratings from customers who appreciate their quality service and significant savings over other brokers. Clients said that the information they received was thorough and genuinely focused on their individual circumstances, not on pushing a particular service or plan. People also praised the friendly, helpful reps and describe their experiences as being quick, easy, and a perfect match for their insurance needs.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Does United Medicare Advisors offer online quotes?

So, while United Medicare Advisors does not show you an online quote, they absolutely deliver the goods with the lowest priced Medicare Supplement Plans we found. This is because of their vast access to both the bigger names in the industry as well as smaller, reputable companies you might not have heard of before.

Is Aetna a good provider of Medicare Supplement?

Strong choice. While it's up to you to determine if you want to purchase your Medicare Supplement Plan directly from Aetna or through a broker that offers additional services, you can be assured that Aetna is likely to give you one of the lowest premiums. Aetna is a trustworthy provider of Medigap plans. See Plans.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is the Part B premium for 2021?

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

What is Medicare Advantage?

Medicare covers medical services and supplies in hospitals, doctors’ offices, and other health care settings. Services are either covered under Part A or Part B. Coverage in Medicare Advantage. Plans must cover all of the services that Original Medicare covers.

Does Medicare Advantage include prescription drugs?

Most Medicare Advantage Plans include drug coverage. If yours doesn't, you may be able to join a separate Part D plan. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Doctor and hospital choice.

Does Medicare cover hearing?

Some plans offer benefits that Original Medicare doesn’t cover like vision, hearing, or dental. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Your other coverage.