What does Medicare Part a cover exactly?

- Medicare Part A provides basic hospitalization coverage.

- Medicare part B covers outpatient care like doctor’s visits and diagnostic tests.

- Medicare Part C (Medicare Advantage) is a private option that combines Part A and Part B coverage and offers additional benefits.

- Medicare Part D is prescription drug coverage.

What part of Medicare covers nursing homes?

Your Part A nursing home benefit usually covers:

- A semi-private room

- Meals

- Prescription medications to treat your health condition

- Skilled nursing care

- Physical, occupational, and/or speech language therapy.

Is Medicare Part a cover hospital?

Medicare Part A will pay for most of the costs of your hospital stay, after you pay the Part A deductible. Medicare Part A is also called "hospital insurance," and it covers most of the cost of care when you are at a hospital or skilled nursing facility as an inpatient. Medicare Part A also covers hospice services.

How long will Medicare pay for a hospital stay?

Once the deductible is paid fully, Medicare will cover the remainder of hospital care costs for up to 60 days after being admitted. If you need to stay longer than 60 days within the same benefit period, you’ll be required to pay a daily coinsurance.

Which type of Medicare covers most hospital visits?

Medicare Part A covers hospital or inpatient care. A person usually visits the ER at a hospital. However, there is a difference between emergency care at a hospital and being a hospital inpatient. Medicare Part A specifically covers care when a person stays as an inpatient at the hospital.

Does Medicare Part B cover hospitalizations?

It also includes inpatient care you get as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor's services you get while you're in a hospital.

Which Medicare plan covers hospitalization for patients over the age of 65?

Medicare Part A covers hospitalization, post-hospital extended care, and home health care of patients 65 years and older.

Does Medicare pay for hospital stay?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

Does Medicare pay 100 of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Which insurance covers a patient who has been hospitalized up to 90 days for each benefit period?

MedicareMedicare covers Medicare provides 60 lifetime reserve days of inpatient hospital coverage following a 90-day stay in the hospital.

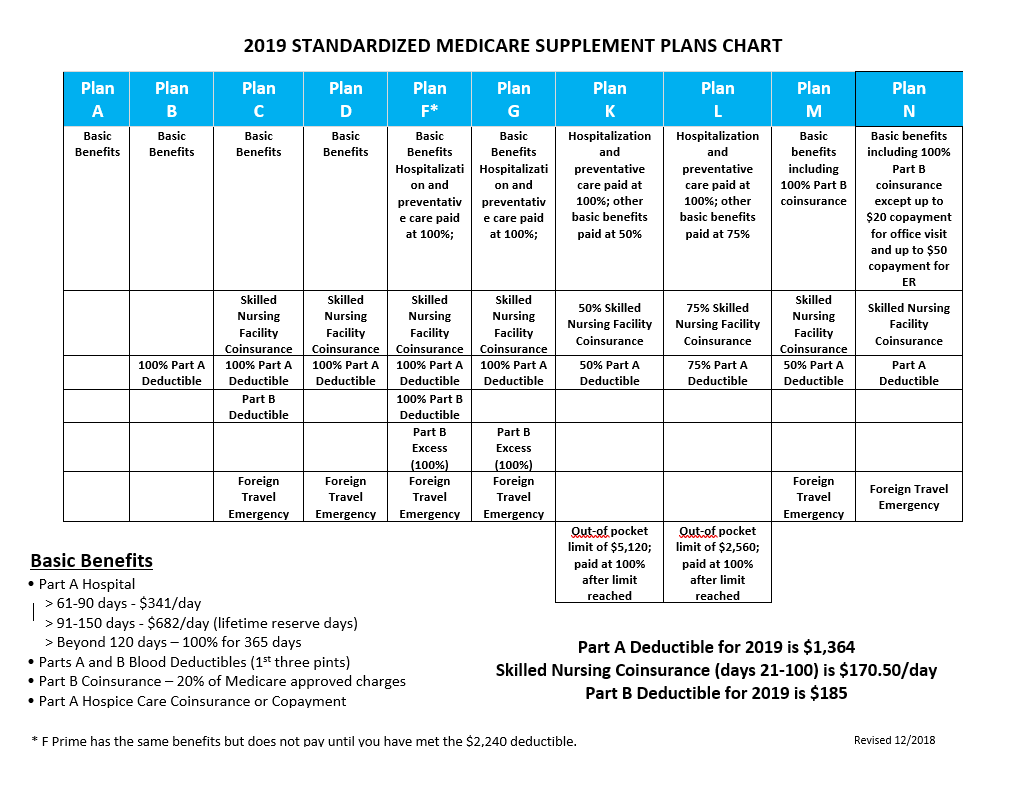

What is Medicare Plan G?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What is the difference between Part C and Part D Medicare?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the maximum out of pocket for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

What does Medicare A and B not cover?

Medicare Part A and Part B, also known as Original Medicare, does not cover all medical services, including hearing, dental or vision.

Medicare Part A is often called hospital insurance because it covers inpatient care

Medicare hospitalization coverage is under Part A, which covers inpatient services received in a hospital or skilled nursing facility (SNF) as well as hospice care. Typically, Medicare covers inpatient services when they're deemed medically necessary by a qualified healthcare provider.

What Does Medicare Part A Cover?

Original Medicare includes two parts, A and B. Medicare Part A, also known as hospital insurance, helps pay for inpatient care received in a:

What Does Medicare Part B Cover?

The second half of Original Medicare is Part B, also known as medical insurance. Medicare Part B helps pay for outpatient services, such as doctor appointments, lab work, durable medical equipment (DME), and mental health care.

Hospitalization Coverage Under Medicare Advantage

Medicare Part C, better known as Medicare Advantage, provides health insurance plans managed by private companies. These plans must provide the same coverage you get with Original Medicare (except for hospice care, which is still covered by Original Medicare).

Medicare Coverage for Inpatient Hospital Care

Medicare Part A will help pay for inpatient hospital care when all of the following apply:

How Much Will You Pay for Inpatient Hospital Care?

The Medicare program uses a cost-sharing model to help control costs and utilization. Your out-of-pocket costs may include monthly premiums, deductibles, and coinsurance or copayments.

Medicare Coverage for Skilled Nursing Facility Care

Medicare covers short-term SNF care if you meet the following conditions:

What is a Medigap policy?

Medigap policies are available to help fill the gap between what original Medicare pays and what you pay for medical treatment.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N coverage is one of 10 federally standardized options to help fill “gaps” in original Medicare coverage. It’s an option for people who want broad coverage but, to lower their premiums, are willing to pay for some copays and a small annual deductible.

What percentage of hospice care is coinsurance?

100 percent of Part A hospice care coinsurance or copayment.

Is Medigap standardized?

Standardization. Medigap plans are standardized the same way in 47 of the 50 states. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies (including Medicare Supplement Plan N coverage) are standardized differently.

Does Medigap cover spouse?

Your Medigap plan only covers you. Your spouse, if eligible for Medicare, would need to purchase a separate policy.

Can you have both Medicare and Medigap?

If you want coverage for these services, consider a Medicare Advantage plan. You can have either a Medicare Advantage plan or a Medigap Plan; you can’t have both.

Does Medicare pay its share of the Medicare approved amount?

Medicare pays its share of the Medicare-approved amount.

What is hospital insurance?

Hospitalization insurance, also sometimes called Hospital Insurance or Hospital Indemnity, can help you prepare your budget for unexpected medical costs resulting from a hospital stay. That’s why UnitedHealthcare offers Hospital SafeGuard, underwritten by Golden Rule Insurance Company. View plans by state. Enter your ZIP code to see available plans ...

Why buy hospital insurance bundles?

Why buy insurance bundles? Hospitalization insurance. The cost of medical care, especially hospital stays, can quickly add up. Hospitalization insurance, also sometimes called Hospital Insurance or Hospital Indemnity, can help you prepare your budget for unexpected medical costs resulting from a hospital stay.

How to get a check 2 for a health insurance claim?

Simply complete a claim form and submit it with attached copies of your receipts for any covered items (see the plan you choose for details). You are then issued a check 2 you can use as you see fit. Benefits are paid in a lump sum directly to you, and amounts are fixed and determined by your policy, regardless of the amount of expenses incurred.

Does hospital insurance have a deductible?

On top of helping you prepare your budget for the expenses surrounding hospital stays, Hospital Indemnity Insurance has the following benefits: You don’t have to meet a deductible to receive your benefits. No networks - payment amounts are the same regardless of whether you are in-network1 or out-of-network.

Do you have to have a health insurance plan in DC?

In DC, IL, and SD you must already have a health plan that is considered minimum essential health coverage by the ACA to qualify for Hospital SafeGuard.

Does Hospital Safeguard have network limitations?

3. Share. Footnotes. There are no network limitations for Hospital SafeGuard plans, but you may be bound to certain networks and providers with your major medical plan .

What does Medicare cover inpatient?

What Inpatient Hospital Costs Does Medicare Cover? As an inpatient at a hospital, your Medicare Part A coverage includes the following: Semi-private rooms. Meals. General nursing. Inpatient treatment drugs. Care as part of a qualifying clinical research study. Other hospital services and supplies.

What is Medicare Part A?

Medicare Part A covers inpatient hospital stays, as well as skilled nursing care, hospice care and limited home health services. Medicare beneficiaries can expect to meet a deductible before Part A starts paying its share of benefits. A Medicare Supplement (Medigap) plan can help pay for your hospital stays, including costs such as Medicare ...

What is Medicare Supplement?

A Medicare Supplement (Medigap) plan can help pay for your hospital stays, including costs such as Medicare deductibles, copays, coinsurance and more.

How much is Medicare Part A deductible?

Before Medicare Part A will pay its share of a hospital stay, you must first meet your Medicare Part A deductible — $1,484 per benefit period (in 2021).

When will Medicare plan F and C be available?

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020. Call today to speak with a licensed insurance agent who can help you compare Medigap plans that are available where you live.

Does Medicare Part A cover hospice?

Some Medigap plans may also include coverage for: Coinsurance for skilled nursing facility stay. Medicare Part A deductible. With 10 standardized Medigap plans to choose from in most states, you can find one that meets your needs.