Full Answer

What does Medicare pay for leukemia?

Oct 29, 2020 · Summary. There are benefits included in Medicare plans that can help with treatment costs relating to leukemia. Out-of-pocket expenses may apply, but there may be additional support available ...

Which Medicare plan is right for You?

If you or a loved one has been diagnosed with leukemia or lymphoma, you may be worried about which cancer treatment, services, supplies, and medications Medicare will cover. Treatment for Leukemia It depends on the severity. The primary form is chemotherapy — a drug treatment that uses chemicals to destroy leukemia cells.

Does Medicare cover Keytruda?

Medicare is an insurance program run by the United States government. Medicare is for people who. 65 years or older. Under 65 but have received Social Security Disability Insurance (SSDI) for 24 months. Have end-stage renal disease or Amyotrophic Lateral Sclerosis (ALS) Medicare has 4 types of possible coverage.

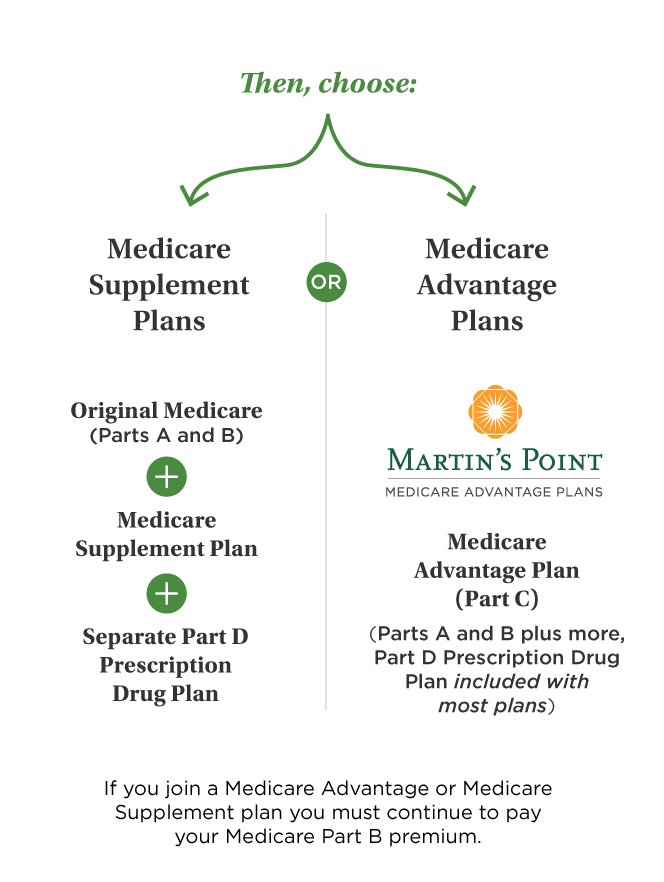

What are the alternatives to Original Medicare?

Making decisions regarding which Medicare plan is right for you can be complicated and confusing. Cancer patients often find that original Medicare is their best option for covering treatment costs. However, there are resources available to help you decide, such as: The Official US government website or call 1-800-MEDICARE (800-633-4227). This ...

Does Medicare pay for leukemia?

Medicare pays for many of the expenses needed to diagnose and treat the disease. There is currently no preventive screening for leukemia, and often, routine blood tests provide a diagnosis. A person may be required to pay out-of-pocket expenses, but they may enroll in a Medigap policy to help cover these costs.Oct 29, 2020

Do any Medicare Advantage plans cover chemotherapy?

Because chemotherapy is covered under Medicare Part D, a Medicare Advantage plan with Part D included will cover chemotherapy treatments. “When chemo and radiation are administered, the most a Medicare Advantage plan can charge in coinsurance is 20 percent.

Can you get a Medicare supplement if you have cancer?

The good news is that Medicare does cover cancer treatment. If you have a Part D prescription drug plan and a comprehensive Medigap plan, most of your treatment has 100% coverage. Here are the facts on Medicare coverage for cancer treatments.Feb 1, 2022

Do any Medicare Part D plans cover chemotherapy drugs?

Part D covers most prescription medications and some chemotherapy treatments and drugs. If you have Original Medicare with a Medicare drug plan, and Part B doesn't cover a cancer drug, your drug plan may cover it.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the Medicare approved amount for chemotherapy?

Medicare Part B usually covers 80% of outpatient cancer-related services, such as radiation therapy and chemotherapy, after a $203 deductible. The insured person is responsible for paying the remaining 20% of the costs.

Which Medigap plan is best for cancer patients?

We have conducted extensive research on the best Medigap providers for seniors with cancer....Prescription Drug Plans for Cancer PatientsMutual of Omaha: Best Overall. Overview. ... AARP Medigap Plans from UnitedHealthcare: Best Coverage Options. Overview. ... Humana: Best Online Experience. Overview.Aug 16, 2021

Does Medicare cover chemotherapy?

Medicare covers chemotherapy if you have cancer. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. covers it if you're a hospital inpatient. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Does Medicare Part B cover oral cancer drugs?

Part B coverage includes certain oral and intravenous drugs along with anti-nausea drugs to offset the symptoms of chemotherapy. In fact, chemotherapy and other cancer-treating drugs account for the majority of units of Medicare-covered drugs that are thrown away or otherwise discarded by health care providers.Jan 11, 2022

Is wellcare a good Part D plan?

Wellcare's Medicare Part D Plans have an overall average quality rating of 4 stars from the Centers for Medicare & Medicaid Services (CMS).

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Is Gleevec covered by Medicare Part D?

Yes. 100% of Medicare prescription drug plans cover this drug.

Treatment for Leukemia

It depends on the severity. The primary form is chemotherapy — a drug treatment that uses chemicals to destroy leukemia cells. Depending on the kind of leukemia you have, you may get a single prescription or a mix of drugs. The medications may be injected into a vein or come in a pill form.

Treatment for Lymphoma

It depends on the stage. Lymphoma treatment can include chemotherapy, immunotherapy, radiation therapy, medication, and occasionally stem-cell transplant.

Original Medicare and Chemotherapy

Original Medicare has two parts: Part A (hospital insurance) and Part B (medical insurance).

Medicare Coverage Other Than Original Medicare

Medicare offers prescription drug coverage to all users, but it isn’t automatic. You must be enrolled in a Medicare drug plan ( Part D) or be enrolled in a Medicare Advantage plan with Part D coverage.

Changing Medicare Coverage

After getting leukemia or lymphoma diagnosis, it’s a good idea to review your current Medicare coverage. Each year, you can change your health and prescription drug coverage for the next year — during the Medicare Open Enrollment Period — October 15 to December 7.

How much is Medicare Part A deductible?

For Medicare Part A, the inpatient deductible for hospital admissions will be $1,364 in 2019. Once your total payments equal this amount, you will not have to pay if you are hospitalized again. For Part B, patients must first pay an annual deductible of $185. After that, Medicare pays for 80% of all costs of any outpatient care you receive ...

Why do Medicare Advantage plans deny care?

It may be that prior authorization rules are a reason that sicker Medicare Advantage patients are more likely to dis-enroll in their plans than healthier people.

How much does Medicare pay for outpatient care?

After that, Medicare pays for 80% of all costs of any outpatient care you receive and you must pay the remaining 20%. (Many people with Medicare buy supplemental insurance, also called Medigap insurance, to cover their out-of-pocket costs under Part B.)

How much does Medicare pay for cancer treatment?

You will pay this until you reach the plan’s out-of-pocket maximum. That maximum can be as high as $6,700 per calendar year within the network and even higher out-of-network.

Why is it important to understand Medicare landscape?

Because costs are so high, it’s especially important for people with cancer to understand how plans cover care and treatment. The Medicare Landscape. Original Medicare. Medicare coverage, provided by the government, includes Parts A and B, which pay a large portion of the costs of inpatient care (visits that require hospital admission) ...

What happens if you spend $5,100 on Medicare?

Once you spend $5,100 out of your own pocket, you’re considered to have catastrophic coverage, and the amount you pay for your drugs will decrease. If you meet certain income qualifications, there are programs that can help pay your Medicare premiums.

When do you change your Medicare Advantage plan?

After the initial 3 months, you must stay enrolled in the plan for the rest of the calendar year. The Annual Election Period in the fall is the most common time to change your Medicare Advantage plan. This period runs from October 15th to December 7th each year.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

What are the preferred pharmacies for Choice Plan?

For those with the Choice plan, there are fewer options. For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores. Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Does Cigna have a pharmacy network?

As far as in-network, Cigna has contracts with over 63,000 pharmacies nationwide. Preferred pharmacies include Kroger, Rite Aid, Walmart, Sam’s Club, Walgreens, and MANY more. For the most savings, consider enrolling in their mail-order pharmacy program.

Does Humana Part D have a deductible?

Humana Part D Reviews. Many generics with Humana have a $0 deductible. Further, they have a variety of plan options, something for everyone. The high deductible on brand name medications isn’t that great, and you have to go to Walmart to get the best savings.

What is the difference between Essential and Extra?

Secure-Extra. The “Essential” policy is the lowest premium option, and the “Extra” has a higher premium than the other two. Like all insurance, the best plan for your neighbor might not be the most suitable for you. To find the most suitable coverage, comparing all available options is necessary.

What is the limit on the amount a health insurance company requires a patient to pay in deductible and co-

The limit on the total amount a health insurance company requires a patient to pay in deductible and co-insurance per year. After reaching an out-of-pocket maximum, the patient no longer pays co-insurance because the plan begins to pay 100 percent of covered medical expenses.

How long do you have to notify HMO of emergency care?

Patients receiving emergency care may be required to notify their HMO within 24 hours of service. Preferred Provider Organizations. Preferred provider organizations (PPOs) provide plan members with additional choices in providers, hospitals, and other healthcare professionals at a reduced fee.

What is a deductible amount?

Deductibles: a fixed amount of money that you must first pay out of your own pocket each year, before the insurance plan will start to pay for your medical expenses. Co-payments/Co-pays: a fixed amount that you must pay at the time you receive medical care or prescription drugs.

What is an in network provider?

An in-network provider is contracted with an individual’s health insurance company to provide services to plan members at a predetermined rate. The amount paid for an in-network provider is usually much less than the amount that you would pay for an out-of-network provider. Out-of-Network Provider.

What is co-insurance/cost share?

Co-insurance/Cost share: the percentage of medical expenses shared by you and the health plan.

What is health insurance?

Insurance Coverage. Health insurance helps pay for costly medical treatment and can protect you and your family from financial hardship. Some people have private health insurance coverage either through an employer (often called a group plan) or through an individual policy they've purchased. Even if you have coverage, however, certain treatments ...

Do you see a PCP first?

Members usually see their chosen PCP first for any medical issues . If necessary the member is referred to a specialist. A POS plan member may need a referral to see a specialist. Members may visit a licensed provider outside the network and still receive coverage, although this would usually cost more.

What is part B insurance?

Part B covers cancer screenings and treatments at a doctor’s office or clinic. These preventive care benefits pay the full cost of some cancer screenings. Also, Part B pays 80% of the price of chemotherapy, radiation, and tests done on an outpatient basis or at a doctor’s office.

What is the T cell in cancer?

Trump and Secretary Azar finalized the decision to cover the FDA-approved Chimeric Antigen Receptor T-Cell or “CAR T-Cell” Therapy, which is a form of treatment for cancer that uses the patient’s own genetically-modified immune cells to fight cancer.

What is covered by Part D?

Part D covers cancer drugs that are not covered by Part B, including anti-nausea medications that are only available in pill form, injections that you give yourself, and medicines designed to prevent cancer from recurring. Your Part D prescription coverage offsets the high cost of cancer drugs.

Is Medicare Advantage good for cancer patients?

Medicare Advantage plans give you Part A and B benefits through private insurance coverage. Although Advantage plans usually aren’t the best choice for cancer patients. This is because most plans’ benefits aren’t as good as Medicare plus a Medigap policy.

Does Medicare cover cancer?

Medicare does cover cancer treatments. Your cancer coverage will work differently depending on if you’re in the hospital or an outpatient facility. Also, depending on your policy, you may need prior authorization for treatment. In most cases, preventive services are available for people at risk for cancer.

Does Medicare pay for breast cancer screening?

Medicare pays 100% of the cost of an annual breast cancer screening. Part A pays for inpatient breast cancer surgery or breast implant surgery after a mastectomy. Breast surgeries done at a doctor’s office or outpatient center are covered by Part B. Part B also covers breast prostheses after a mastectomy.

Does Cancer Treatment Center of America work with Medicare?

Most Cancer Treatment Centers of America will work with Medicare or Part C Advantage plans. Since insurance is a challenge, it’s best to contact one of the Oncology Information Specialist to find out how your policy will work at the Cancer Treatment Center of America.

What is prior authorization for Medicare?

Most Medicare prescription drug plans have prior authorization rules that will require your prescriber to contact your plan before you can get your medication. This is to show that the drug is medically necessary.

What is the cost of a copay after deductible?

Copay Range. $4 – $174. In the Donut Hole (also called the Coverage Gap) stage, there is a temporary limit to what Medicare will cover for your drug.

How much does Medicare cover in the donut hole?

Therefore, you may pay more for your drug. Copay Range. $3 – $15. In the Post-Donut Hole (also called Catastrophic Coverage) stage, Medicare should cover most of the cost of your drug.

What tier is imatinib?

Tier 5. Medicare prescription drug plans typically list imatinib on Tier 5 of their formulary. Generally, the higher the tier, the more you have to pay for the medication. Most plans have 5 tiers.

What is prior authorization for Medicare?

Most Medicare prescription drug plans have prior authorization rules that will require your prescriber to contact your plan before you can get your medication. This is to show that the drug is medically necessary.

What is the donut hole in Medicare?

In the Donut Hole (also called the Coverage Gap) stage, there is a temporary limit to what Medicare will cover for your drug. Therefore, you may pay more for your drug. In the Post-Donut Hole (also called Catastrophic Coverage) stage, Medicare should cover most of the cost of your drug.

What is the post deductible stage of a drug?

After your deductible has been satisfied, you will enter the Post-Deductible (also called Initial Coverage) stage, where you pay your copay and your plan covers the rest of the drug cost.

What tier is Imbruvica?

Tier 5. Medicare prescription drug plans typically list Imbruvica on Tier 5 of their formulary. Generally, the higher the tier, the more you have to pay for the medication. Most plans have 5 tiers.