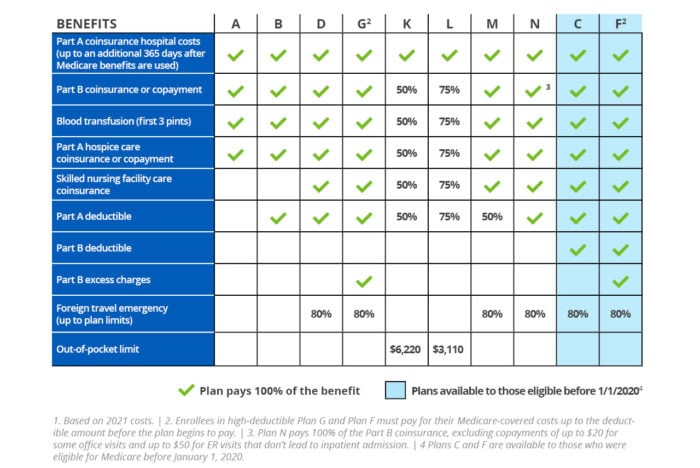

Medigap Benefits

| Plan A | Plan C | Plan D | Plan F * | Plan K |

| Skilled nursing facility care coinsuranc ... | No | Yes | Yes | Yes |

| Part A deductible | Yes | Yes | Yes | Yes |

| Part B deductible | No | Yes | No | No |

| Part B excess charge If you have Origina ... | No | No | No | Yes |

Full Answer

What is the difference between Medicare supplement plan a and B?

Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care coinsurance. Where Plan B becomes advantageous is that it also covers the Part A deductible, which, in 2020, is projected to rise to $1,420.

What is the Medicare Part A and Part B deductible?

In 2019, the Part A inpatient hospital deductible is $1364 and the Part B deductible is $185. Medigap plans can help offset these costs, making your healthcare more affordable and giving you more access to services you might otherwise be unable to afford. Medicare Supplement plans can help pay for deductibles, coinsurance, and copayments.

Which Medicare supplement insurance (Medigap) plan provides full coverage for 2019 Part B?

Jan 21, 2022 · Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2022 Part B deductible. However, both plans are not be available to Medicare beneficiaries who become eligible for Medicare on or after Jan. 1, 2020. If you already have Medicare, you may be able to enroll in Plan C or F if either is available in your area.

Does Medigap plan F cover the 2022 Part B deductible?

2020 – $198 2022 – $233 Medicare Part B Deductible – What It Is Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B Most people pay the standard Part B premium amount.

Does my Medicare Supplement pay my Part B deductible?

Medicare Supplement insurance plans usually require a monthly premium. Starting January 1, 2020, Medicare Supplement insurance plans can't cover the Medicare Part B deductible. This eliminates Plan C and Plan F for new beneficiaries. However, if you already have one of these plans, you can keep it.Aug 6, 2021

Does AARP plan g cover Medicare Part B deductible?

Plan G's coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $233 in 2022. Even with paying the Part B deductible, many Medicare enrollees find Plan G more cost-effective than Plan F when considering their respective premiums.

Does Plan G Cover Part B deductible?

All Medigap plans, including Plan G, sold to new Medicare members don't cover the following: Part B deductible. (Since 2020, new Medicare members can't buy any plan that covers the Part B deductible, although existing members may own older plans that do.)

Does Plan G have a deductible?

Medigap Plan G is also available in some states as a high-deductible plan. The specific additional benefits Medigap Plan G offers include: Coverage for an additional 365 days of hospital care after Original Medicare benefits are exhausted, as well as coverage for hospital coinsurance and deductible.

Does Medigap cover Part A deductible?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

What is the difference between plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is the plan g deductible for 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How old do you have to be to get Medicare?

You must be enrolled in Original Medicare Part A and Part B, and most plans require you to be 65 years of age or older. If you are under 65 years old and receive Medicare benefits, you can check the Medigap plans sold in your state to see if any are available for you.

Can you cancel Medicare Supplement?

Medicare Supplement policies cannot be canceled by the providing company. This means that as long as you continue to pay your premiums, the insurance company is not able to cancel your insurance plan regardless of your current state of health or the usage of your plan. Related articles: What is Medicare Parts A & B.

Does Medicare Supplement cover travel?

Medicare Supplement plans can help pay for deductibles, coinsurance, and copayments. Some Medigap plans can also help cover the cost of medical care you receive while traveling abroad, so many Medicare recipients who spend time traveling outside of the United States find Medigap coverage appealing.

Does Medicare have a monthly premium?

While Original Medicare does offer coverage for an array of different medical services and supplies, the costs associated with them often include a monthly or annual premium and an annual deductible.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is Medicare Part B?

You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019. After you have paid $185 out of your own pocket, your Part B coverage will kick in. Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care.

What is the Part B premium?

The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What does it mean when a provider accepts Medicare?

When a health care provider accepts Medicare assignment, it means they have agreed to accept the Medicare-approved amount as full payment. When a provider does not accept assignment, it means they will still treat Medicare patients, but they do not accept the Medicare-approved amount as full payment .

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

What is Medicare Supplement Plan B?

Plan B offers coverage for the Part A deductible, Part A coinsurance, Part B coinsurance or copayment, and first 3 pints of blood. The coverage chart below lists all the benefits included in Plan B.

What is a Medigap Plan B?

Medigap Plan B is best suited for 1 Those in good health 2 Don’t travel outside the U.S. 3 Looking for lower premiums 4 Are not concerned about out of pocket costs if hospitalized

What is a plan B?

Plan B is a Medicare Supplement policy that helps beneficiaries with healthcare costs. You’ll use the word “plan” when referring to a Medigap plan.

Who is Lindsay Malzone?

Lindsay Malzone. Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Is Medigap standardized?

Medigap policies are standardized. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic.

What is Medicare Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, we can probably help you on premiums by looking ...

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Frank have a medicare plan?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year. The specialist bills Medicare, which pays 80% share of the bill except for the $203 outpatient deductible, which is billed to Frank.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...