Best overall Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What are the top 5 Medicare supplement plans?

May 06, 2022 · Mutual of Omaha. AM Best 2021 rating: A+. Medigap plans offered: A, F, HD-F, G and N. Also offers Medicare Part D for prescription drug coverage. In business for over 100 years, Mutual of Omaha ...

How to choose the best Medicare supplement plans?

10 rows · Feb 26, 2020 · Medicare Supplement Plan G is the best overall plan that provides the most coverage for ...

Who has the best Medicare supplement plans?

3 rows · Mar 24, 2022 · Plan A is the standard Medicare Supplement plan. All other plans build upon the benefits ...

What is the best and cheapest Medicare supplement insurance?

8 rows · Jan 19, 2021 · We submitted a quote for a 68-year-old female living in Tulsa, Oklahoma, and received quotes ranging ...

What are the top 3 Medicare supplement plans?

Which Medicare supplement plan has the highest level of coverage?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the highest rated supplemental insurance?

- Best Overall: Mutual of Omaha.

- Best User Experience: Humana.

- Best Set Pricing: AARP.

- Best Medigap Coverage Information: Aetna.

- Best Discounts for Multiple Policyholders: Cigna.

Which Medicare plan offers the best coverage?

Standout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers. UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the difference between Plan G and high deductible plan G?

Does Plan N cover Medicare Part B deductible?

What is the difference between a Medicare Advantage plan and a Medicare supplement plan?

What is the average cost of supplemental insurance for Medicare?

Are all Plan G Medicare supplements the same?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What are the negatives of a Medicare Advantage plan?

What is the difference between Medicare Part C and Part D?

Which Medicare Supplement plan is the best?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give yo...

How much do Medicare Supplement plans usually cost?

A Medicare Supplement plan costs about $163 per month for 2022. However, the range of costs is especially wide because of the variety of plans avai...

What's the most popular Medicare Supplement plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of...

What's the least expensive Medicare Supplement plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves aga...

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

Is Medicare Supplement Insurance the only alternative?

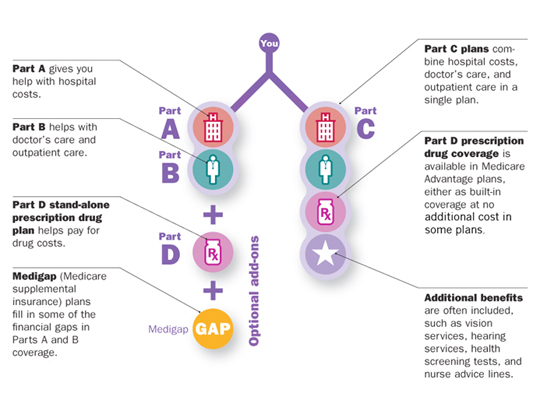

Medicare Supplement Insurance isn’t the only alternative available for beneficiaries who are worried about covering those out-of-pocket costs remaining after Medicare pays its share. Medicare Advantage plans, also known as Medicare Part C, are health plans issued by a private insurer that cover your Medicare Part A and Part B benefits.

Does Massachusetts have Medicare Supplement?

Medicare Supplement Plans in Massachusetts. Like we mentioned above, Medicare Supplement Insurance plans are structured differently in Massachusetts. Residents of the Bay State only have two plans to choose from: the Core Plan and the Supplement 1 Plan. Both plans cover basic benefits:

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare have a penalty for enrolling in Medicare?

In order to encourage people to enroll in Medicare, the federal government imposes a penalty on people who enroll in Medicare after their Initial Enrollment Period has passed and if they don’t qualify for any of the Special Enrollment Periods described above.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

Is United Medicare Advisors a good company?

United Medicare Advisors has an excellent reputation. The company enjoys accreditation and an "A+" rating from the Better Business Bureau. Also, we found more than 20,000 5-star ratings from customers who appreciate their quality service and significant savings over other brokers. Clients said that the information they received was thorough and genuinely focused on their individual circumstances, not on pushing a particular service or plan. People also praised the friendly, helpful reps and describe their experiences as being quick, easy, and a perfect match for their insurance needs.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Does United Medicare Advisors offer online quotes?

So, while United Medicare Advisors does not show you an online quote, they absolutely deliver the goods with the lowest priced Medicare Supplement Plans we found. This is because of their vast access to both the bigger names in the industry as well as smaller, reputable companies you might not have heard of before.

Is Aetna a good provider of Medicare Supplement?

Strong choice. While it's up to you to determine if you want to purchase your Medicare Supplement Plan directly from Aetna or through a broker that offers additional services, you can be assured that Aetna is likely to give you one of the lowest premiums. Aetna is a trustworthy provider of Medigap plans. See Plans.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

What is Medicare Select?

Medicare SELECT is a type of Medigap policy that requires policyholders to use hospitals and doctors within its network to get coverage. The premiums are typically lower than those offered by other Medigap providers, which don’t enforce network restrictions. Medicare SELECT can provide the same Plan A through N coverage as other Medigap policies, just with added network and geographical restrictions.

Is Plan C still available for new Medicare recipients?

As of Jan. 1, 2020, Plan C is no longer available for new Medicare recipients.

Does Medicare cover Plan F?

Plan F covers everything covered by Plan C and also covers any excess charge by a doctor or hospital that Medicare does not cover. Due to the changes regarding the Part B deductible, newly eligible consumers can no longer enroll in Plan F.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

How much is the deductible for a 2021 plan F?

This version of Plan F has the same coverage as the standard Plan F, but individuals must pay a high deductible — $2,370 in 2021 — before the policy pays anything.

What is Plan M?

Plan M covers additional days in the hospital after Medicare benefits are exceeded, Part B copayments and coinsurance, hospice care coinsurance and copayments, skilled nursing facility care coinsurance and up to three pints of blood. It also covers 50% of the Part A deductible and 80% of charges for care abroad.

How Medicare Supplement Insurance Works

Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to supplement your benefits and help pay out-of-pocket costs left by coverage gaps. If you choose to supplement your benefits with a Medicare Supplement Insurance plan, Medicare will pay its share of the costs first, and then your Medigap policy pays its share.

Medigap Plan Types

In most states, there are 10 standardized plan types to choose from — Plan A, B, C, D, F, G, K, L, M and N. Basic benefits offered by each type of Medigap plan of the same letter are the same, although one carrier's Plan F and another carrier's Plan F may come at different prices.

Basic Benefits and Medicare Supplement Insurance Plans

Depending on which Medicare Supplement Insurance plan type you choose, a certain combination of Medicare-related expenses may be covered:

Plan Pricing Can Vary Widely

Prices for the same plan type can differ from one insurance company to the next. The monthly premiums can vary widely, depending on where you live and the carrier you choose. Insurance companies also determine their own pricing structures, which affects what you pay in premiums when you first buy the policy and in the future.

Get A Medicare Supplement Insurance Quote Today

For help paying your out-of-pocket medical expenses, consider extending your health care coverage with a Medicare Supplement Insurance plan. To speak with a licensed agent, call 1-800-995-4219. To learn more about Medicare Supplement Insurance, read through our Medigap comparison guide.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

Does Mutual of Omaha offer Medicare Supplement Plan G?

Mutual of Omaha offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available, and High-Deductible Plan G in all of those states except New York.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

Does Aetna give a discount on Medicare Supplement Plan G?

Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans. This includes a spouse, someone with whom you have a civil union partnership, or anyone who has lived with you for 12 months or more.

Does Medicare cover acupuncture?

Instead, they cover the left-over costs for Medicare-approved services that Part A or Part B did not pay in full. Original Medicare does cover acupuncture for chronic low back pain. If you meet the specific criteria for acupuncture services, Part G will cover the remaining costs.

Does BCBS offer dental insurance?

Not only does BCBS offer dental coverage, but it also offers vision and hearing aid benefits. To round out your healthcare needs, BCBS offers 4- to 5-Star Medicare Part D prescription drug plans, available for purchase with your Medicare Supplement Plan G. As a bonus, a nurse line is available 24/7.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.