Does Medicare Part A and B cover 100% of cost sharing?

1. Inpatient care in a hospital. Part A pays for inpatient care in a hospital that accepts Medicare if your physician certifies that you need this care for treatment of an injury or illness. While you are in the hospital, your coverage includes: • A semi-private room …

What are the core benefits of Medicare Part a hospital insurance?

Dec 10, 2019 · Part A typically covers only inpatient care. If you receive dialysis while you’re an inpatient at a Medicare-approved hospital, Part A will cover it. If you receive dialysis as an outpatient—or certain kinds of training and support for self-dialysis—you’ll need to enroll in Medicare Part B to get coverage.

What are Medicare Part A and b plans?

Which of the following medical expenses is covered. 37. Which of the following medical expenses is covered under Part B of Medicare? A. Diagnostic tests B. Custodial nursing care C. Hearing examinations and hearing aids D. Drugs that can be self-administered. 38.

What can I expect when Medicare Part A coverage begins?

For which policy type is the threshold for deductibility lower after one reaches the age of 65? A. Medical expense insurance, long-term care insurance, and disability income insurance. B. Medical expense insurance and long-term care insurance. C. Long-term care insurance only. D. Medical expense insurance only.

What is covered under Part A of Medicare?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

What is covered by Medicare Part A quizlet?

What does Medicare part A cover? Covers inpatient hospital care, skilled nursing facility care, home health care and hospice care.

What does Medicare Part A reimburse for?

Medicare Part A covers hospital services, hospice care, and limited home healthcare and skilled nursing care. All your Part A–related expenses are covered by Medicare if you receive them through a participating provider who accepts Medicare assignment.

What is not covered under Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

What are the 4 parts of Medicare quizlet?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What expenses will Medicare Part B pay quizlet?

Part B helps cover medically-necessary services like doctors' services, outpatient care, durable medical equipment, home health services, and other medical services. Part B also covers some preventive services. If you have Part B, you pay a Part B premium each month.

Which of the following services are covered by Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services.Sep 11, 2014

What is covered by Medicare Part C?

What Does Medicare Part C Cover?Routine dental care including X-rays, exams, and dentures.Vision care including glasses and contacts.Hearing care including testing and hearing aids.Wellness programs and fitness center memberships.

Does Medicare reimburse for travel expenses?

Does Medicare Cover Travel Expenses? Generally, Medicare doesn't cover any type of travel expenses, even if they're necessary to receive medical care. Gasoline, airfare, bus fare and other expenses are your responsibility, as are the costs of food and accommodations.Oct 12, 2021

Which of the following is not covered by Medicare Part B?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

Which of the following items is not covered by Medicare Part B?

Medicare will not pay for medical care that it does not consider medically necessary. This includes some elective and most cosmetic surgery, plus virtually all alternative forms of medical care such as acupuncture, acupressure, and homeopathy—with the one exception of the limited use of chiropractors.

Which of the following is excluded under Medicare?

Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services. Certain preventive services, including routine foot care.

What is Medicare Part A?

December 10, 2019. Medicare Part A is part of Original (traditional) Medicare and constitutes the federal government’s “hospital insurance.”. In short, Part A covers costs for inpatient services in the following situations: While that sounds pretty straightforward, this part of the Medicare program causes plenty of confusion.

How many midnights are covered by Medicare?

Part A covers much of your care if you’re admitted to a hospital for at least "two midnights." In other words, you're covered if your hospital stay runs for at least two nights in a row.

What is the home health advance notice?

Alternatively, the agency should give you a notice called the “ Home Health Advance Beneficiary Notice of Noncoverage ” before providing noncovered services or supplies.

What does Part A pay for?

What Part A pays for hospital care. You’ll have to meet your deductible and pay any coinsurance or copayments before coverage kicks in. Once it does, Part A covers 100% of approved hospital services. 1.

How long does a hospice patient live?

Your hospice doctor and regular doctor certify you have a terminal illness with a life expectancy of six months or less. You accept care for comfort purposes instead of a cure for your illness. You sign a statement saying you choose hospice care instead of other Medicare-covered treatments for your illness.

How long do you have to stay in the hospital for skilled nursing?

For Part A to cover your skilled nursing costs, you must spend a minimum of three days as an inpatient (not under “observation”) in the hospital first. While you’re there, your doctor must determine that you require follow-up care that you cannot receive at home.

What are the requirements for home health insurance?

Coverage requirements for home health services. To get coverage for home health care expenses, you must be homebound and a Medicare-certified home health agency must provide all covered services. Additionally, your doctor must care for you regularly and certify that you need one or more of the following services: Intermittent skilled nursing care. ...

What is a coverage gap in Medicare?

The coverage gap refers to. A) the large, up-front deductible that must be satisfied if the patient has a prescription for a covered brand-name drug.

How many credits do you need to be insured for Social Security?

One insured status under Social Security requires you to have earned at least six credits duing the last 13 calendar quarters ending with the quarter of death, disability, or entitlement to retirement benefits. This insured status is. A) disability insured. B) temporarily insured.

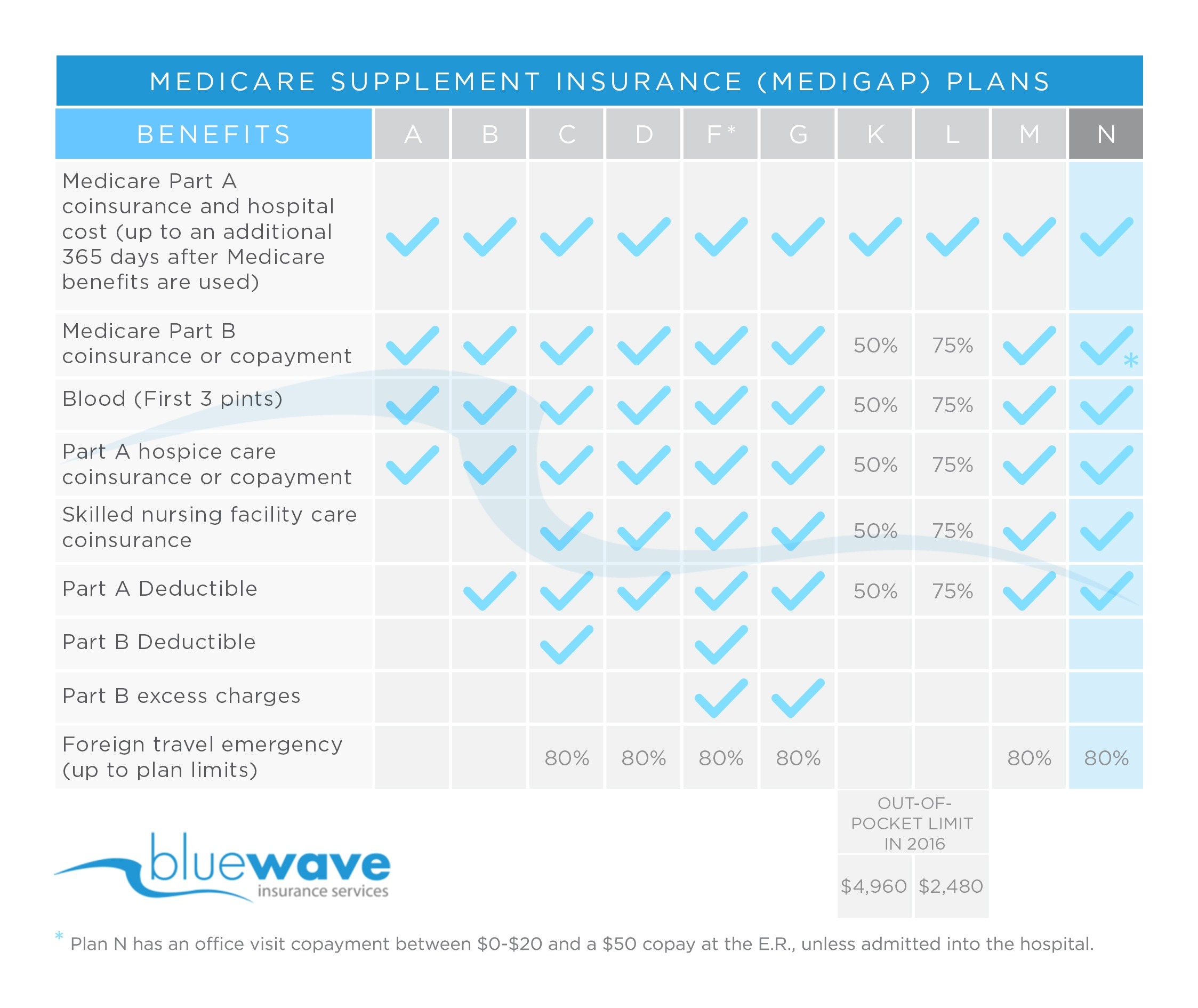

How old was Dale when he bought Medicare?

Dale, age 65 , was dismayed to learn about all of the deductibles, co-pays, limits, and exclusions in the Medicare program. Dale bought a type of health insurance specifically designed to supplement Medicare, and selected his coverage from among 10 standard policies that private insurers offer.

Can you enroll in private health insurance?

As an alternative to the Original Medicare Plan, beneficiaries can elect to enroll in private health insurance plans that cover all services that the Original Medicare Plan covers except hospice care. These private health insurance plans that are an alternative to the Original Medicare Plan are called.

Can employers self-insure workers compensation in Washington?

When Marco asked about methods of providing workers compensation, the answer surprised him. In Washington, employers can self-insure the risk or obtain coverage through a state fund. Private insurers do not market workers compensation insurance in Washington. Washington uses a. A) competitive state fund.

Can you see a doctor on Medicare Advantage?

Under one type of Medicare Advantage Plan, members of the plan can see any doctor or health services provider that accepts Medicare patients. If members receive care outside the network of member physicians and care facilities, they must pay higher out-of-pocket costs. This type of Medicare Advantage Plan is a.

What is Medicare Part A?

Tap card to see definition 👆. Coverage of Medicare Part A-eligible hospital expenses to the extent not covered by Medicare from the 61st through the 90th day in any Medicare benefit period. Explanation. The benefits in Plan A, which is known as the core plan, must be contained in all other plans sold.

What is the core plan of Medicare?

Among the core benefits is coverage of Medicare Part A-eligible expenses for hospitalization, to the extent not covered by Medicare, from the 61st day through the 90th day in any Medicare benefit period.

What happens after Tom pays the deductible?

After Tom pays the deductible, Medicare Part A will pay 100% of all covered charges. Explanation. Medicare Part A pays 100% of covered services for the first 60 days of hospitalization after the deductible is paid.

What is Medicare Supplement Insurance?

Medicare supplement insurance fills the gaps in coverage left by Medicare, which provides hospital and medical expense benefits for persons aged 65 and older. All Medicare supplement policies must cover 100% of the Part A hospital coinsurance amount for each day used from.

How long does Medicare cover skilled nursing?

Medicare will cover treatment in a skilled nursing facility in full for the first 20 days. From the 21st to the 100th day, the patient must pay a daily co-payment. There are no Medicare benefits provided for treatment in a skilled nursing facility beyond 100 days. Medicare Part A covers.

What is Medicaid in the US?

Medicaid is a federal and state program designed to help provide needy persons, regardless of age, with medical coverage. A contract designed primarily to supplement reimbursement under Medicare for hospital, medical or surgical expenses is known as. A) an alternative benefits plan. B) a home health care plan.

Which Medicare supplement plan has the least coverage?

Explanation. In the 12 standardized Medicare supplement plans, Plan A provides the least coverage and is referred to as the core plan. Plan J has the most comprehensive coverage. Plans K and L provide basic benefits similar to plans A through J, but cost sharing is at different levels.