Which of the following is not covered by Medicare Part A quizlet?

Medicare Part A covers 80% of the cost of durable medical equipment such as wheelchairs and hospital beds. The following are specifically excluded: private duty nursing, non-medical services, intermediate care, custodial care, and the first three pints of blood.

Which item is not covered by Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Which type of care is covered under Medicare Part A?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

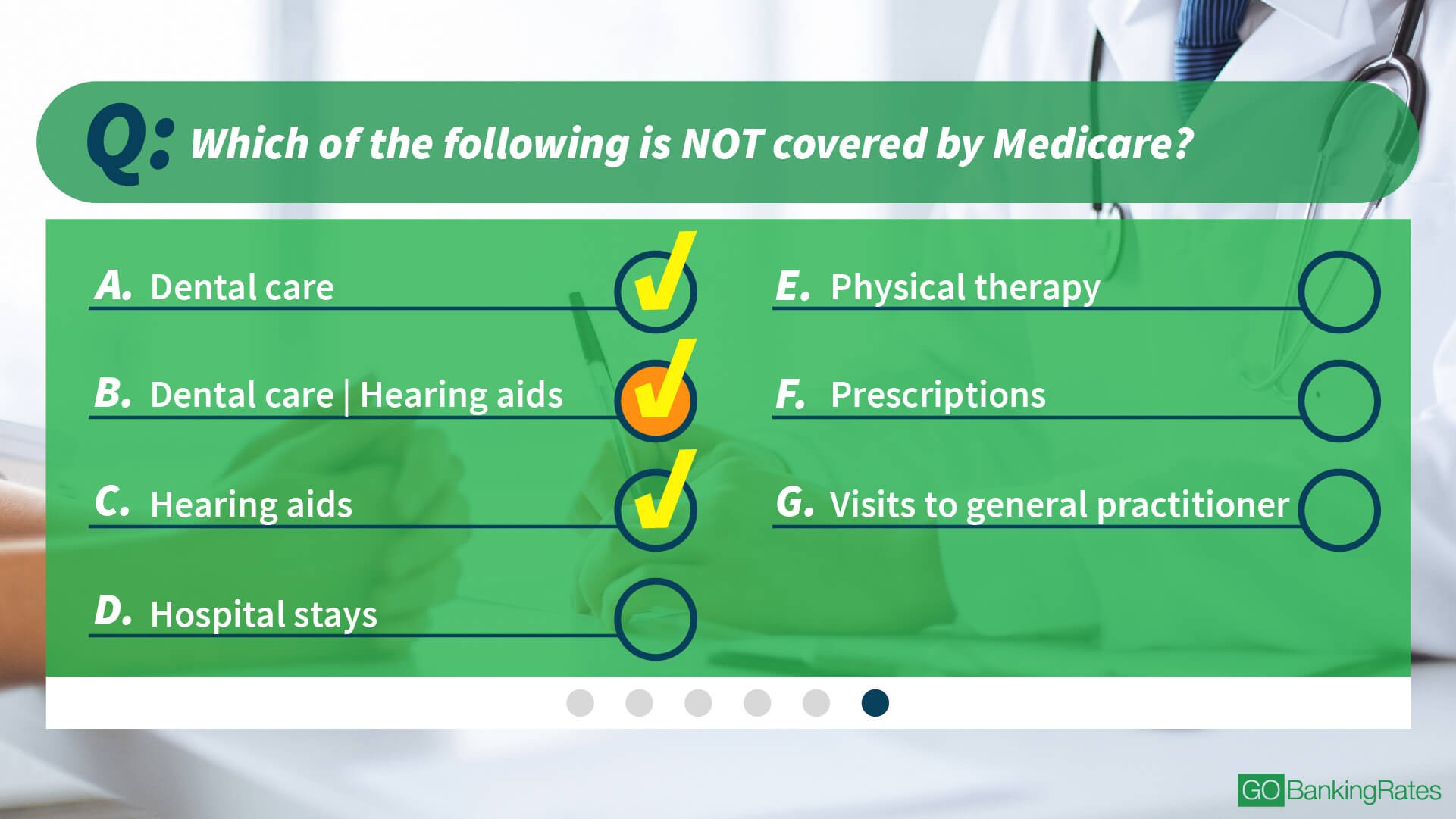

Which type of care is not covered by Medicare?

does not cover: Routine dental exams, most dental care or dentures. Routine eye exams, eyeglasses or contacts. Hearing aids or related exams or services.

What is Part A of Medicare?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

What does Medicare Part A cover quizlet?

Medicare Part A includes inpatient hospital coverage, skilled nursing care, nursing home care, and hospice care. It is the plan in which you're automatically enrolled when you apply for Medicare. The Part A plan is your hospital insurance plan.

Which of the following is excluded from coverage under Medicare Part B?

Such excluded items included physical examinations, drugs, hearing aids, dental services, and eyeglasses.

What does Medicare Parts A and B cover quizlet?

Medicare Part A covers hospitalization, post-hospital extended care, and home health care of patients 65 years and older. Medicare Part B provides coverage for outpatient services. Medicare Part C is a policy that permits private health insurance companies to provide Medicare benefits to patients.

Does Medicare Part A cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Which of the following is not true about Medicare?

Which of the following is not true about Medicare? Medicare is not the program that provides benefits for low income people _ that is Medicaid. The correct answer is: It provides coverage for people with limited incomes.

What is the difference between Medicare Part A and Part B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

What is Medicare Part A and B mean?

There are four parts of Medicare: Part A, Part B, Part C, and Part D. Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

What is the difference between Medicare Part A and Part B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

What is Medicare Part A and B mean?

There are four parts of Medicare: Part A, Part B, Part C, and Part D. Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

What Medicare Doesn’T Cover

Original Medicare, Part A and Part B, doesn’t generally cover the following services and supplies. This may not be a complete list.Alternative medi...

Can I Get Benefits That Pay For Services Medicare Does Not Cover?

Medicare Advantage plans may be an option to consider since they are required to have at least the same level of coverage as Original Medicare, but...

What Medicare Part D Doesn’T Cover

Medicare Part D is optional prescription drug coverage. You can enroll in this coverage through a stand-alone Medicare Part D Prescription Drug Pla...

What is Medicare Part A?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the U.S. without a break for at least five years. You’re eligible if you’re 65 and older or under age 65 with certain disabilities. You may also qualify at any age if you have end-stage renal disease or amyotrophic lateral sclerosis (also known as Lou Gehrig’s disease). Together with Medicare Part B, it makes up what is known as Original Medicare, the federally administered health-care program. Medicare Part A helps pay for the cost of inpatient hospital care, while Part B covers outpatient medical services.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

How old do you have to be to get Medicare?

You are 65 or older and meet the citizenship or residency requirements. You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

When do you enroll in Medicare Part A?

If you’re currently receiving retirement benefits from Social Security or the Railroad Retirement Board (RRB), you’re automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What is Medicare services?

Medicare considers services needed for the diagnosis, care, and treatment of a patient’s condition to be medically necessary. These supplies and services cannot be primarily for the convenience of the provider or beneficiary. Always ask your doctor to clarify if you’re not sure whether a specific service or item is covered by Medicare.

What is Medicare Part D?

Medicare Part D is optional prescription drug coverage. You can enroll in this coverage through a stand-alone Medicare Part D Prescription Drug Plan, or through a Medicare Advantage Prescription Drug plan.

Does Medicare Part D cover weight loss?

Not already covered under Medicare Part A or Part B. Based on these criteria, there are certain drugs that Medicare Part D does not generally cover: Weight loss or weight gain drugs.

Does Medicare have a formulary?

Each Medicare Prescription Drug Plan has a formulary. The formulary may change at any time. You will receive notice from your plan when necessary.

Is hospice covered by Medicare?

Medicare Advantage plans may be an option to consider since they are required to have at least the same level of coverage as Original Medicare, but may have other benefits, such as routine vision, dental, and prescription drug coverage. Hospice services are covered directly under Medicare Part A instead of through a Medicare Advantage plan. You need to keep paying your Part B premium (as well as any premium the plan charges, if any).

Does Medicare cover personal comfort items?

Personal comfort items : Medicare does not cover personal comfort items used during an inpatient hospital stay, such as shampoo, toothbrushes, or razors. It doesn’t cover the cost of a radio, television, or phone in your hospital room if there’s an extra charge for those items.

Does Medicare cover short term nursing?

However, Medicare does cover short-term skilled nursing care when it follows a qualifying inpatient hospital stay. Medicare Part A may cover nursing care in a skilled nursing facility (SNF) for a limited time if it’s medically necessary for you to receive skilled care.

How many parts are there in Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D .

What is the difference between Medicare Advantage and Original?

For instance, in Original Medicare, you are covered to go to nearly all doctors and hospitals in the country. On the other hand, Medicare Advantage Plans typically have network restrictions, meaning that you will likely be more limited in your choice of doctors and hospitals. However, Medicare Advantage Plans can also provide additional benefits that Original Medicare does not cover, such as routine vision or dental care.

Does Medicare Advantage Plan cover Part A?

Each Medicare Advantage Plan must provide all Part A and Part B services covered by Original Medicare, but they can do so with different rules, costs, and restrictions that can affect how and when you receive care. It is important to understand your Medicare coverage choices and to pick your coverage carefully.

Do you have to pay coinsurance for Medicare?

You typically pay a coinsurance for each service you receive. There are limits on the amounts that doctors and hospitals can charge for your care. If you want prescription drug coverage with Original Medicare, in most cases you will need to actively choose and join a stand-alone Medicare private drug plan (PDP).

Does Medicare pay for health care?

Under Original Medicare, the government pays directly for the health care services you receive . You can see any doctor and hospital that takes Medicare (and most do) anywhere in the country. In Original Medicare: You go directly to the doctor or hospital when you need care.

Does Medicare Advantage have network restrictions?

On the other hand, Medicare Advantage Plans typically have network restrictions, meaning that you will likely be more limited in your choice of doctors and hospitals.

What is Medicare Part A?

Tap card to see definition 👆. Coverage of Medicare Part A-eligible hospital expenses to the extent not covered by Medicare from the 61st through the 90th day in any Medicare benefit period. Explanation. The benefits in Plan A, which is known as the core plan, must be contained in all other plans sold.

Which Medicare supplement plan has the least coverage?

Explanation. In the 12 standardized Medicare supplement plans, Plan A provides the least coverage and is referred to as the core plan. Plan J has the most comprehensive coverage. Plans K and L provide basic benefits similar to plans A through J, but cost sharing is at different levels.

Why do insurance companies offer Medicare supplement policies?

Because of the significant gaps in coverage provided by Medicare, many insurers offer Medicare supplement policies that supplement Medicare, paying much of what Medicare does not. To protect consumers, the law narrowly defines what must be included in a Medicare supplement policy. These minimum standards apply to both individual and group policies.

Can a Medicare supplement agent be sued?

A) Yes, if her agent does not offer to sell her a Medicare supplement policy, the agent could be sued under her Errors and Omissions policy.

Does Medicare cover nursing home care?

They do not cover the cost of extended nursing home care.

What is the difference between Medicare and Medicaid?

Medicaid provides funds to states to assist their medical public assistance programs. Medicare provides health benefits for the aged and disabled.

Does Medicare cover coinsurance?

All Medicare supplement policies must cover the core basic benefits that Plan A covers. This includes covering 100% of the Part A hospital coinsurance amount for each day used from the 61st through the 90th day in any Medicare benefit period and 100% of the Part A hospital coinsurance amount for each Medicare lifetime inpatient reserve day used from the 91st through the 150th day in any Medicare benefit period.

What chapter is Medicare Part A?

Start studying Chapter Ten : Medicare Part A. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

How long does Medicare cover hospitalization?

After an initial deductible is met, Medicare pays for all covered hospital charges for the first 60 days of hospitalization. The next 30 days are also covered, but the patient will be required to contribute a certain daily amount. If, after these first 90 days the patient is still hospitalized, they can tap into a lifetime reserve of an additional 60 days, paying a higher level of daily co-payments. Consequently, a patient who has not yet tapped into the lifetime reserve days could have up to 150 days of Medicare coverage for 1 hospital stay.

How many pints of beer is Medicare Part A?

3 pints annually under Medicare Part A or Part B

When will Jamie be enrolled in Medicare?

Jamie will be automatically enrolled in Medicare Part A on the first day of the month in which she reaches age 65, unless she declines coverage .

Do you have to pay monthly premiums for Medicare Part A and Part B?

People who purchase Medicare Part A coverage are usually required to also purchase Medicare Part B coverage and pay monthly premiums for both Part A and Part B.

Does Medicare pay deductibles after they are met?

After the deductible has been met, Medicare Part A will pay all approved charges for:

What is Medicare Part A?

Medicare Part A is automatically available to persons who have turned 65 and have applied for Social Security benefits. Medicare Part B is voluntary and may be elected or rejected as the recipient wishes. Which of the following is not covered by ...

How much does Medicare pay after deductible?

Medicare pays the remaining 80% of covered Medicare Part B charges after: The annual deductible is met. Medicare pays the remaining 80% of covered charges after the deductible is met.

What is Medicare approved charge?

The Medicare approved charge/amount is the dollar amount that Medicare considers to be the reasonable charge for a particular medical service. Payment of each medical service covered by Medicare is based on its Medicare approved charge. Click again to see term 👆. Tap again to see term 👆.