Do you have a Medicare plan?

If you’ve been working, then you probably have a plan through your employer. Most people do. But once you turn 65, you become eligible for Medicare, a government-backed program designed specifically for seniors.

What does each part of Medicare cover?

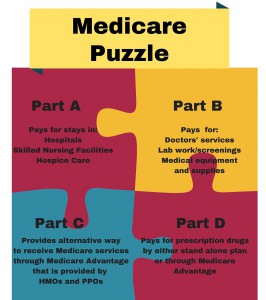

Medicare is broken out into four parts. What does each part of Medicare cover? Part A (hospital coverage) covers things like inpatient hospital stays, home health care and some skilled nursing facility care. Together, Medicare Parts A and B are called Original Medicare.

What is Medicare and who qualifies?

Medicare is the United States’ national health insurance program for citizens and some permanent legal residents. Generally, you qualify for Medicare when you turn 65, based on your employment record or that of your spouse. People under 65 with qualifying disabilities are also covered by Medicare.

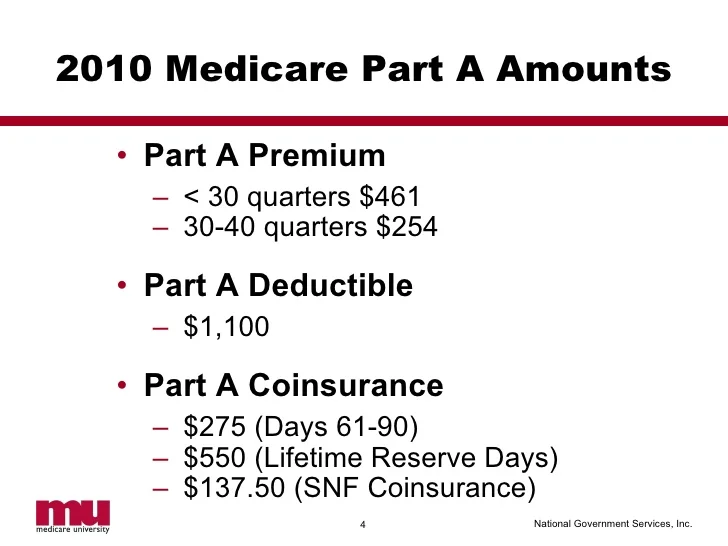

Do you have to pay for Medicare Part A?

Your Part A coverage is free if you or your spouse paid Medicare taxes while working for at least 40 quarters (10 years), or if you are eligible or receive retirement benefits from Social Security or the Railroad Retirement Board. When you use Medicare Part A, you have to pay a deductible before coverage kicks in.

What parts of Medicare are mandatory?

Part A is mandatory for those on Social Security. You'll need to take Part A unless you want to forfeit benefits. Is Part C Mandatory? Medicare Advantage coverage is entirely optional.

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What part of Medicare do you not pay for?

Medicare and most health insurance plans don't pay for long-term care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

Is Medicare Part B required?

Medicare Part B isn't a legal requirement, and you don't need it in some situations. In general, if you're eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

Can I opt out of Medicare Part A?

If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.

What's the difference between Medicare Part C and D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

Why do I need Medicare Part D?

If you're in the end stages of a life-threatening disease and under Medicare hospice care, Medicare Part A covers medications related to the terminal condition. If you need medications for anything not related to that condition, you will need to purchase Part D coverage.

What is the difference between Medicare Part A and Part B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Does Part A cover 100%?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What are the parts of Medicare?

There are four parts to Medicare: A, B, C , and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse. Part C, called Medicare Advantage, is a private-sector alternative to traditional Medicare.

How much does Medicare Part A cost?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1

How much is Part B insurance in 2021?

1 If you're on Social Security, this may be deducted from your monthly payment. 11 . The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021.

What is the coverage gap in insurance?

The coverage gap is often called the "doughnut hole," and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2020 the donut hole occurs once you and your insurer combined have spent $4,020 ($4,130 in 2021) on prescriptions. 24.

How many days do you have to pay deductible?

Additionally, if you're hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day's expenses. If you're admitted to the hospital multiple times during the year, you may need to pay a deductible each time. 8 .

What is Medicare Part C?

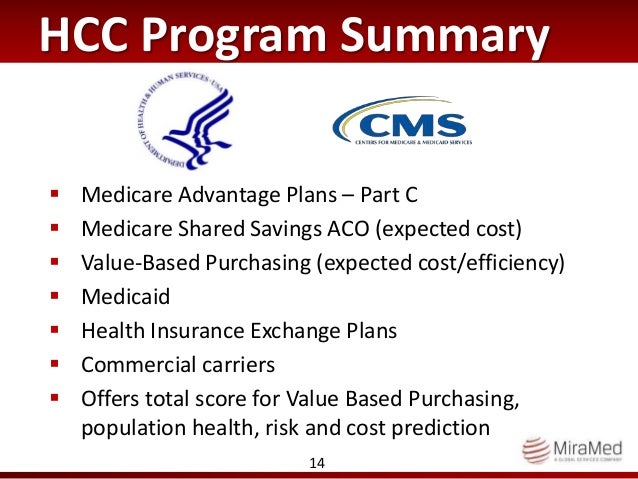

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

How often do you have to have a colonoscopy for Medicare?

Colonoscopies. Medicare covers screening colonoscopies. Test frequency depends on your risk for colorectal cancer: Once every 24 months if you have a high risk. Once every 10 years if you aren’t at high risk.

What is hospice care?

Medicare Part A covers hospice care for terminally ill patients who will live six months or less. Patients agree to receive services that focus on providing comfort and that replace the Medicare benefits to treat an illness.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover hearing aids?

Hearing aids. Medicare doesn’t cover hearing aids or pay for exams to fit hearing aids. Some Medicare Advantage plans have benefits that help pay for hearing aids and fitting exams.

Does Medicare cover acupuncture?

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesn’t cover costs to live in an assisted living facility or a nursing home.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

What are the parts of Medicare?

Each part covers different healthcare services you might need. Currently, the four parts of Medicare are: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term inpatient stays in hospitals and for services like hospice.

What does Medicare Part A cover?

Medicare Part A covers the care you receive when you’re admitted to a facility like a hospital or hospice center. Part A will pick up all the costs while you’re there, including costs normally covered by parts B or D.

How long do you have to sign up for Medicare if you have delayed enrollment?

Special enrollment period. If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment to sign up without penalty.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, the out-of-pocket maximum for plans is $7,550. Note.

How many people are on medicare in 2018?

Medicare is a widely used program. In 2018, nearly 60,000 Americans were enrolled in Medicare. This number is projected to continue growing each year. Despite its popularity, Medicare can be a source of confusion for many people. Each part of Medicare covers different services and has different costs.

What is Medicare for seniors?

Medicare is a health insurance program for people ages 65 and older, as well as those with certain health conditions and disabilities. Medicare is a federal program that’s funded by taxpayer contributions to the Social Security Administration.

How old do you have to be to get Medicare?

You can enroll in Medicare when you meet one of these conditions: you’re turning 65 years old. you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months at any age. you have a diagnosis of end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) at any age.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;

What are the parts of Medicare?

What are the four parts of Medicare? Medicare is divided into four parts: A, B, C, and D. The first two parts, A and B, are sometimes called “ Original Medicare .”. Part C, also known as “Medicare Advantage” is a private insurance plan that provides similar benefits as Original Medicare. The final piece of Medicare, Part D, ...

How long does Medicare coverage last?

Your Part A coverage is free if you or your spouse paid Medicare taxes while working for at least 40 quarters (10 years), or if you are eligible or receive retirement benefits from Social Security or the Railroad Retirement Board.

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible, which you have to pay once a year, is $203 in 2021. If you use Medicare Part B, you will also have to pay a 20% co-insurance for the cost of your care.

Does Medicare cover out of pocket costs?

Find Medicare Supplement Plans That Help Cover Your Medicare Costs. If you receive treatment that is covered by Medicare, you may likely face out-of-pocket Medicare costs such as deductibles, coinsurance and copayments. A Medicare Supplement Insurance (Medigap) plan can help cover some of these costs.

Does Medicare cover physical therapy?

All of the other parts are optional. The coverage for Part A spans from inpatient hospital care to at-home physical therapy. It also covers blood transfusions after the first 3 pints of blood and inpatient care at a religious, non-medical care facility.

Does Medicare Supplement Insurance cover outpatient treatment?

For example, each of the 10 standardized Medigap plans that are available in most states provide at least partial coverage for the Medicare Part B coinsurance or copayments you might face when you receive covered outpatient treatments.

Medicare Part A

Part A covers inpatient care at hospitals and skilled nursing facilities as well as hospice and some home health care. If you paid Medicare payroll taxes for at least 40 quarters, the Part A premium is free. For 2022, there is a deductible of $1,556. You also must pay coinsurance for hospital stays longer than 60 days.

Medicare Part B

Part B pays for doctor visits, outpatient care and some home health care. For 2022, the deductible is $233 and the base premium is $170.10 per month. After hitting the deductible, you pay 20% of expenses unless you have either Medicare Advantage or supplemental coverage.

Medicare Part C

Part C is commonly called Medicare Advantage. Beneficiaries are covered for Parts A and B through private insurers instead of traditional government-administered Medicare. Most Advantage plans include prescription drug coverage. For 2022, the average monthly premium is $19.

Medicare Part D

Part D refers to standalone prescription drug coverage through private insurers. If your Advantage plan includes prescription drugs, you don't need Part D. If you elect original Medicare and want medications covered, you will need a Part D plan or a medigap plan that includes prescription drugs, though both are optional.

Medigap

Supplemental coverage is commonly referred to as medigap. This is private insurance to supplement original Medicare coverage. The plans cover part or most of the cost sharing, such as coinsurance and co-payments, for Parts A and B, depending on which lettered medigap plan you choose.

How many parts are there in Medicare?

There are four parts to the program (A, B, C and D); Part C is a private portion known as Medicare Advantage, and Part D is drug coverage. Please note that throughout this article, we use Medicare as shorthand to refer to Parts A and B specifically.

How long do you have to be a US citizen to qualify for Medicare?

To receive Medicare benefits, you must first: Be a U.S. citizen or legal resident of at least five (5) continuous years, and. Be entitled to receive Social Security benefits.

How old do you have to be to get a Medigap policy?

In other words, you must be 65 and enrolled in Medicare to sign up for a Medigap policy. Once you’re 65 and enrolled in Part B, you have six months to enroll in Medigap without being subject to medical underwriting. During this initial eligibility window, you can: Buy any Medigap policy regardless of health history.

How long do you have to sign up for Medicare before you turn 65?

And coverage will start…. Don’t have a disability and won’t be receiving Social Security or Railroad Retirement Board benefits for at least four months before you turn 65. Must sign up for Medicare benefits during your 7-month IEP.

When do you sign up for Medicare if you turn 65?

You turn 65 in June, but you choose not to sign up for Medicare during your IEP (which would run from March to September). In October, you decide that you would like Medicare coverage after all. Unfortunately, the next general enrollment period doesn’t start until January. You sign up for Parts A and B in January.

How long does it take to enroll in Medicare?

If you don’t get automatic enrollment (discussed below), then you must sign up for Medicare yourself, and you have seven full months to enroll.

When does Medicare open enrollment start?

You can also switch to Medicare Advantage (from original) or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. Eligibility for Medicare Advantage depends on enrollment in original Medicare.